ArbX

ArbX is the first cross-chain arbitrage protocol to optimize price rates across more than 40 decentralized exchanges on seven EVM chains. By leveraging robust on-chain interoperability networks, ArbX provides a trustless, decentralized, and permissionless solution.

Project Description

We are standing on the cusp of a future defined by multi-chain modalities, with modular architectures evolving to accommodate enhanced bandwidth and throughput capabilities for cryptocurrencies. The Ethereum modular architecture presents a diverse yet interconnected array of components such as the beacon chain, execution chain, Layer 2s, and imminent shards. Viewed collectively, they represent a tightly knit ecosystem of separate blockchains called 'domains' or 'chains.' ArbX effectively establishes the first framework of Extractable and Maximal Extractable Value for cross-chain arbitrage and trade opportunities.

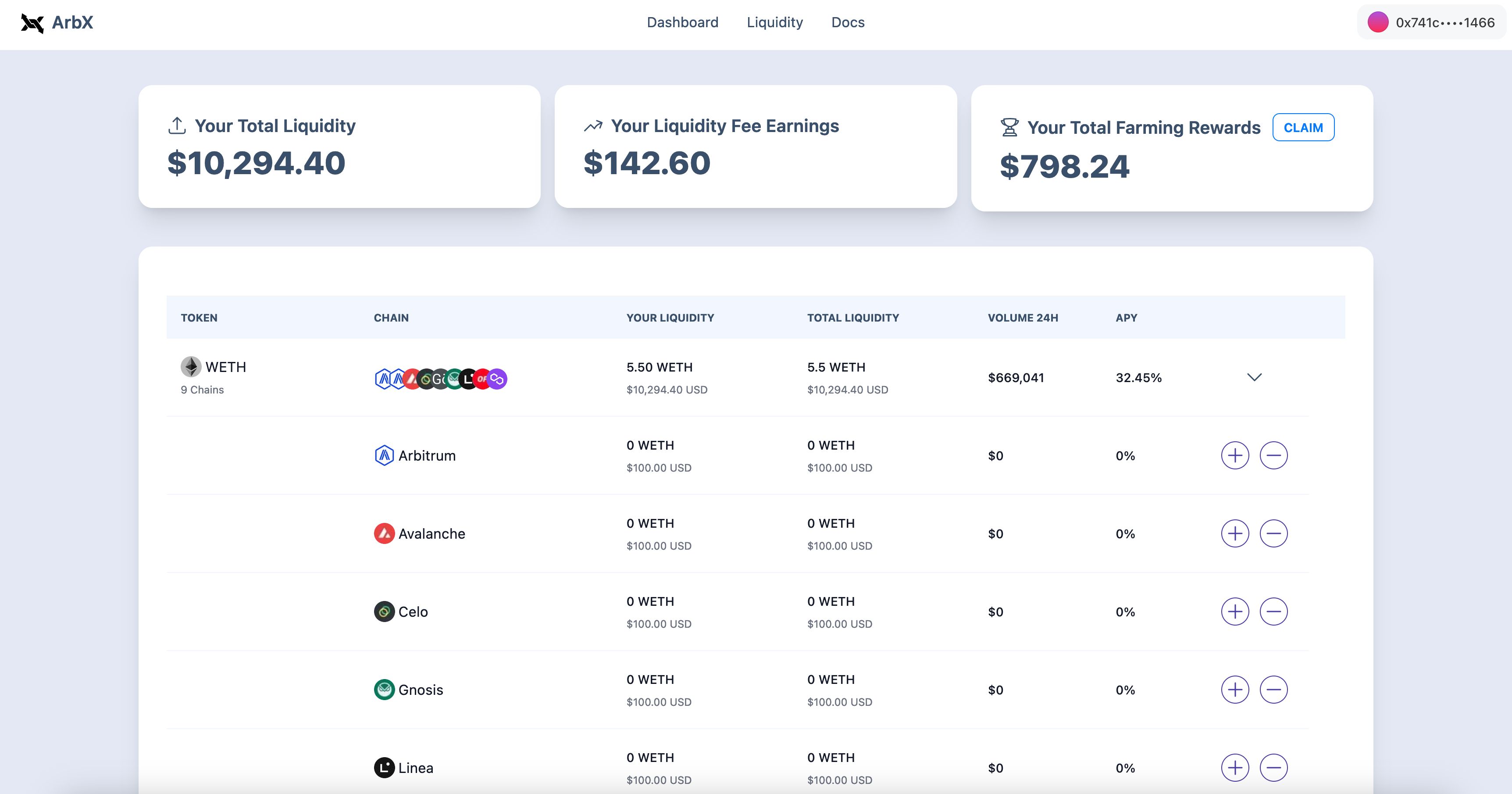

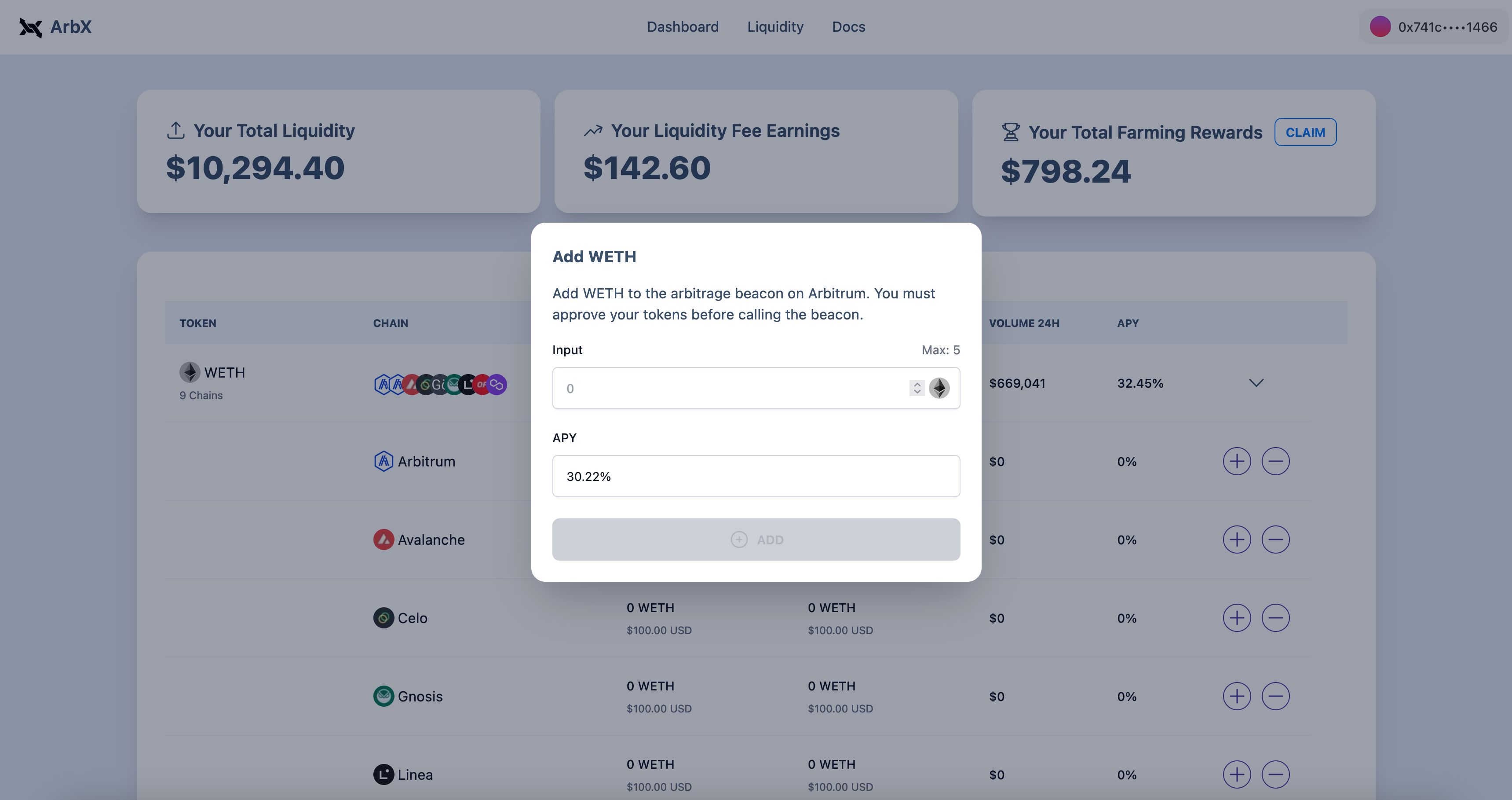

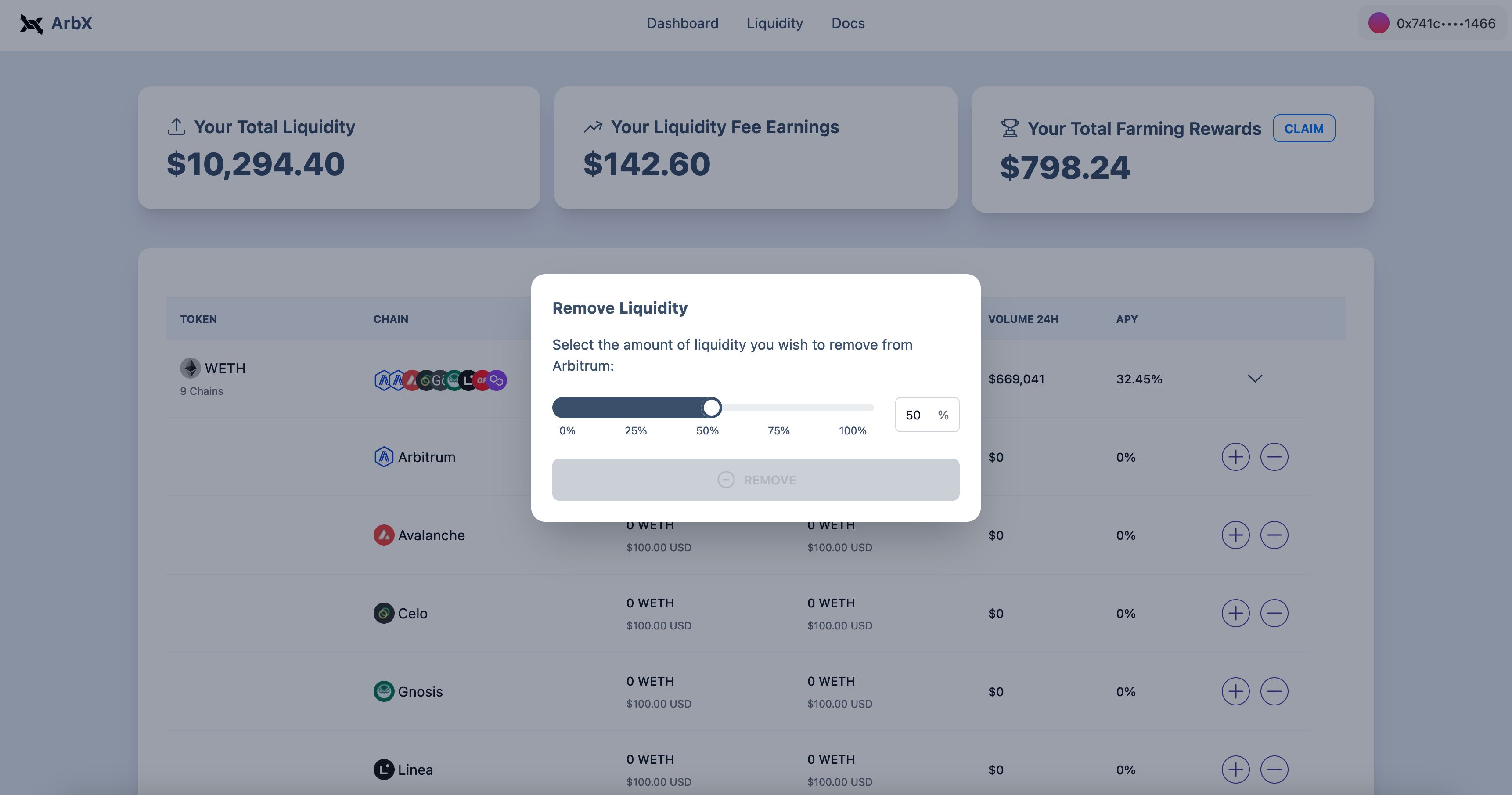

Many liquidity pools represent the same asset pairs across chains with different volumes, depths, and activity. Therefore, there will be a point in time when pools in different chains for the same asset pairs will be relatively imbalanced, creating an arbitrage opportunity. However, it's only possible to seize this opportunity in a semi-simultaneous set of transactions across chains. This requires pools of assets distributed throughout the different domains, as current bridges or communication protocols are not quick enough to transfer tokens in seconds. Essentially, ArbX allows users to deposit liquidity to specific assets on different chains, which are used to execute these arbitrage opportunities, distributing the profit back to the LPs. The trades are executed by arbitrageurs, which run custom off-chain software to detect price discrepancies across any type of decentralized exchange of price rate (leveraging new tools like MEV-share) in order to win a percentage of the arbitrage profit as a prize to incentive this role.

Similar to market makers and bridges, ArbX performs frequent inventory management, consisting of keeping assets scattered across the chains in a balanced way, managing risks associated with this, and determining relative pricing.

Thanks to this protocol, users on seven chains can enjoy more efficient and precise prices across more than 40 decentralized exchanges, which can be viewed as good "MEV."

Inspired on: Obadia, Alexandre, et al. “Unity Is Strength: A Formalization of Cross-Domain Maximal Extractable Value.” arXiv.Org, 5 Dec. 2021, arxiv.org/abs/2112.01472.

How it's Made

To achieve this, ArbX combines three interoperability protocols and a series of pool-like mechanisms to manage liquidity deposits and withdrawals. The interoperability protocols currently supported are Axelar, Chainlink, and Hyperlane, with each one having different benefits that the arbitrageur can decide from. Axelar presents a good example is the trade-off between extremely quick cross-communication and fees.

ArbX is mainly composed of a contract called Beacon, with the main role of managing user liquidity and trades. On the liquidity side, the Beacon contract contains pool logic that allows users to deposit and withdraw liquidity for an asset in the chain at any given moment in a fully permissionless and decentralized way. On the trades side, the Beacon contract is the entry point for arbitrageurs to send a list of cross or single trades to execute and is also able to accept cross-chain messages from other Beacons that have started another trade sequence. The contracts are fully modular, built on the latest 0.8.21 Solidity version, and with the latest smart contract design approaches.

Arbitrageurs run off-chain software to detect any price discrepancies across any type of market throughout the supported chains. When detecting such differences, it builds the series of trades that are sent as a payload to the Beacon contract from the first leg of the trade, which will execute the rest legs in a semi-simultaneous way through the given interoperability protocol. As a proof-of-concept for arbitrageurs, ArbX provides a bot that checks the arbitrage opportunities on https://odos.xyz/arbitrage and builds the appropriate payloads, simulating them before sending them on-chain.

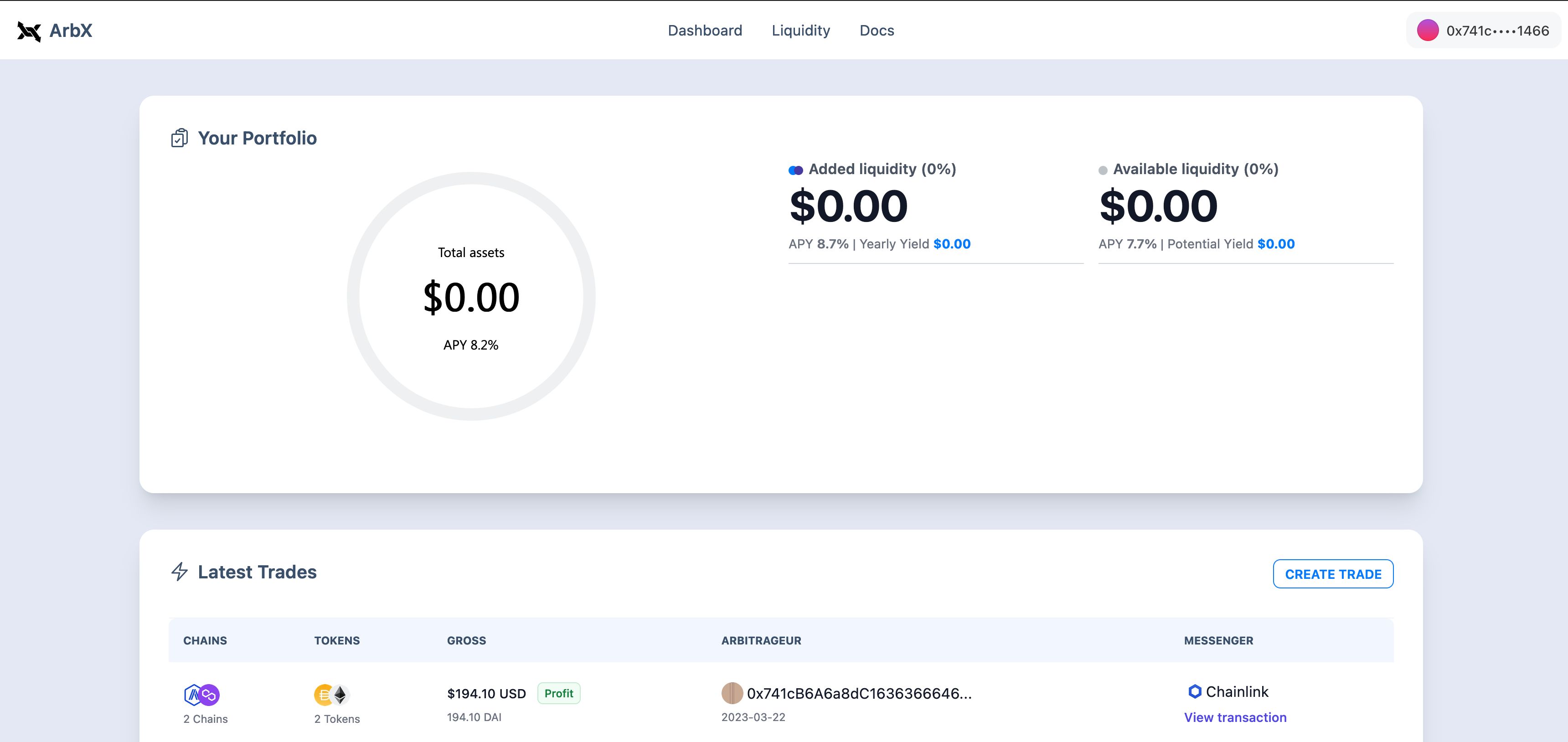

Users can easily access ArbX to provide liquidity through the dApp, which presents useful portfolio information, recent trades from arbitrageurs, and liquidity tables. The dApp is currently hosted on Vercel and runs with Next.js and TailwindCSS.