BasedBank

Based Bank is a fully-fledged on-chain bank, powered by stablecoins.

Project Description

Based Bank functions as a fully-fledged on-chain bank, powered by stablecoins. With the openness of public blockchains at the heart of our product, we bring accountability to a traditionally closed-off industry, without sacrificing the financial privacy of our end-users. We offer two distinct products: a consumer-facing customer app and Based Bank’s admin application.

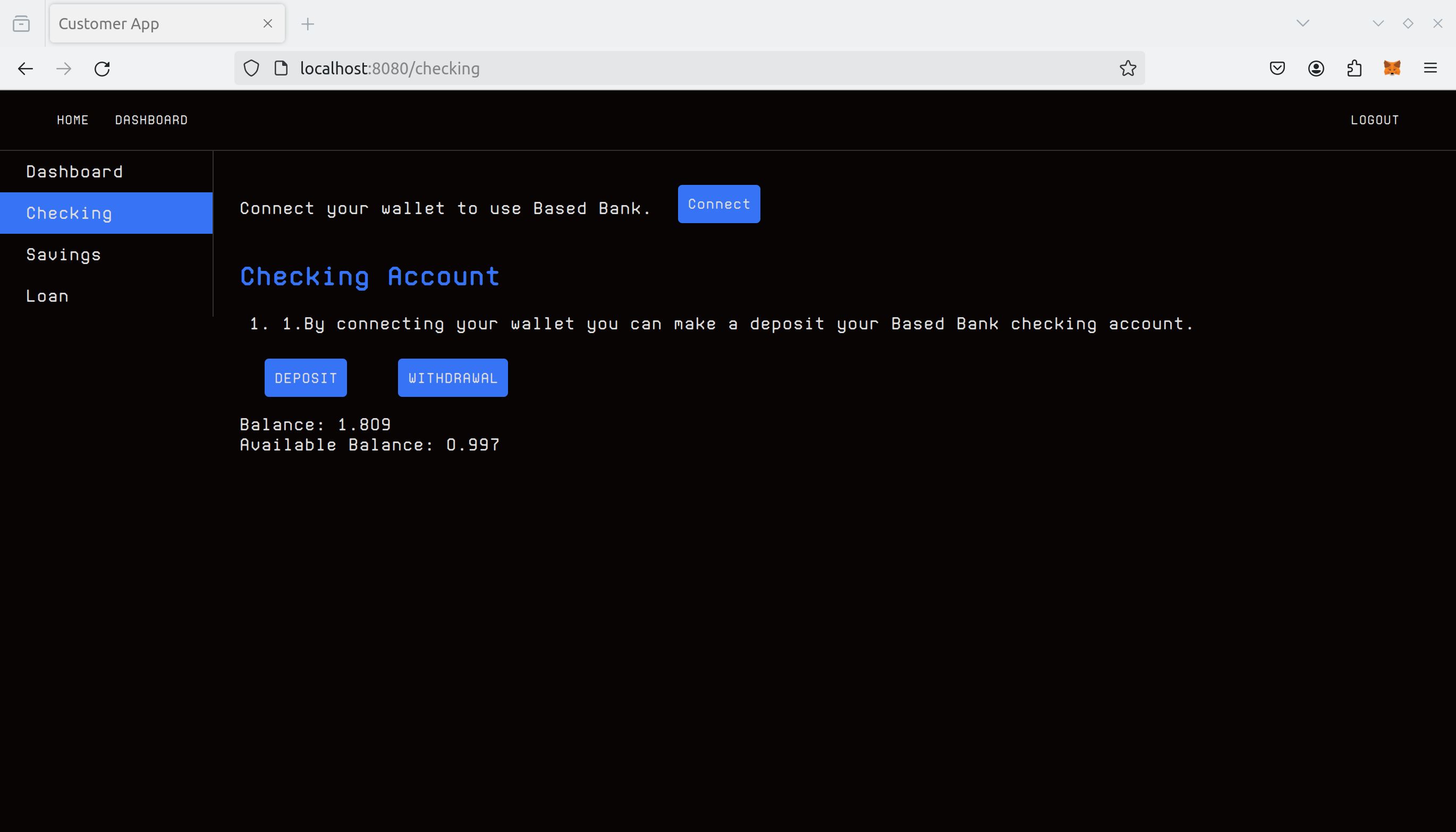

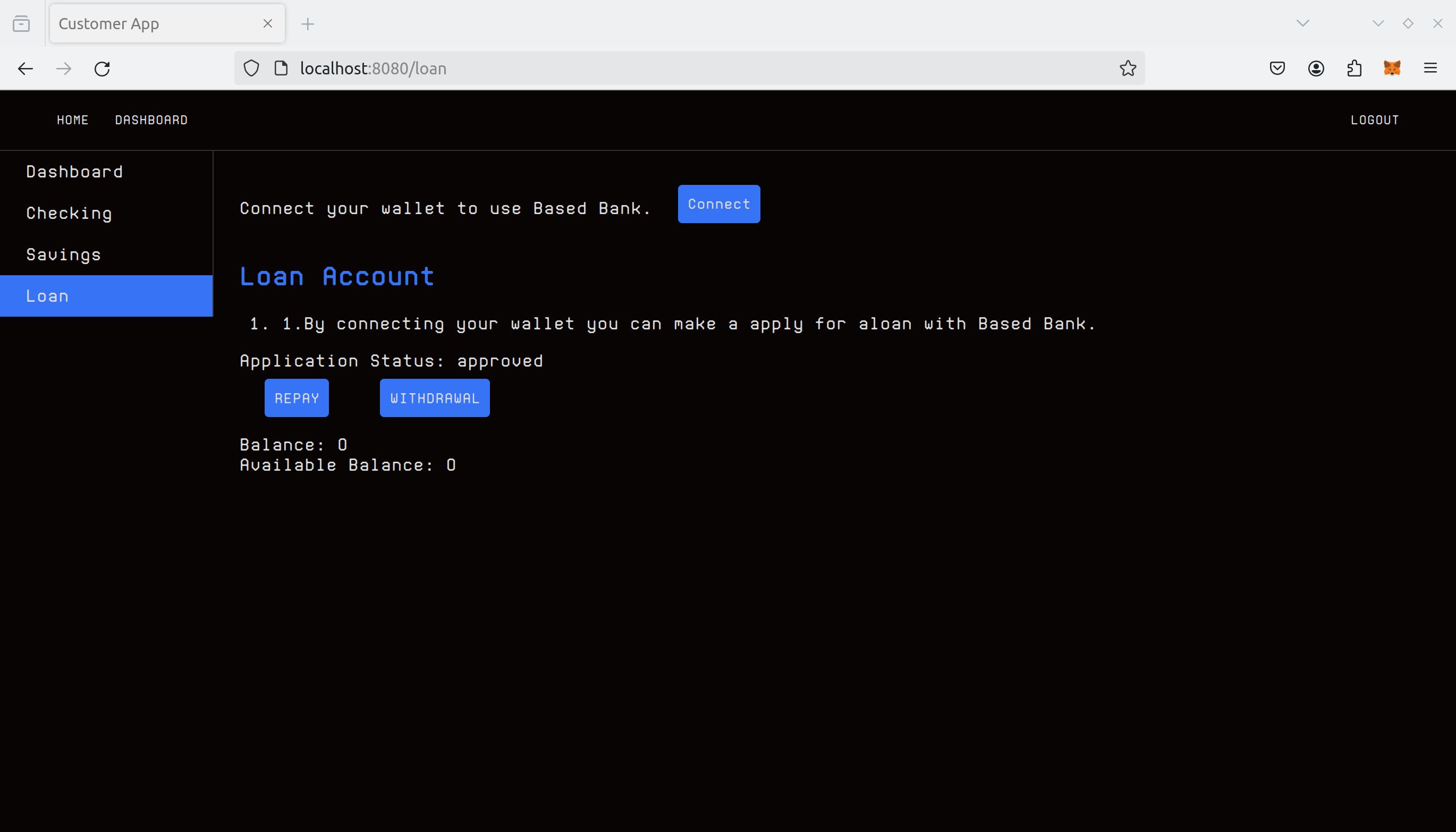

The customer app serves as the primary interface for our individual users. It is designed to feel indistinguishable from the familiar feel of a high-street bank. It allows users to deposit and withdraw stablecoins into checking and savings accounts just as you would with a traditional bank. Users can explore our innovative range of on-chain credit products, including loans and credit cards. With our innovative chain-agnostic, double-entry bookkeeping system powered by ERC20 tokens, we enable users to earn interest on their stored stablecoins. Based Bank breaks down the barriers that hold us back from a truly borderless banking experience.

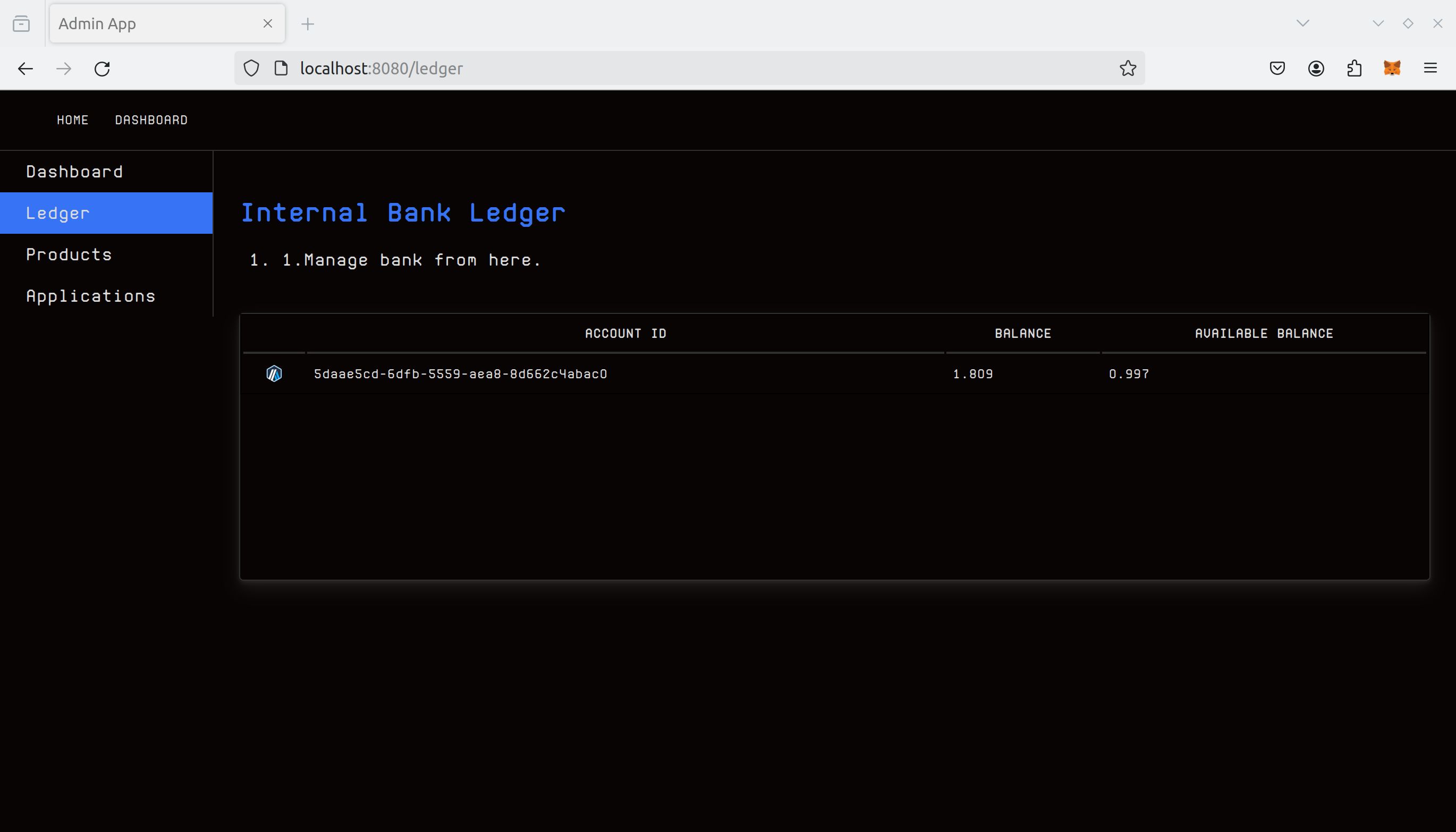

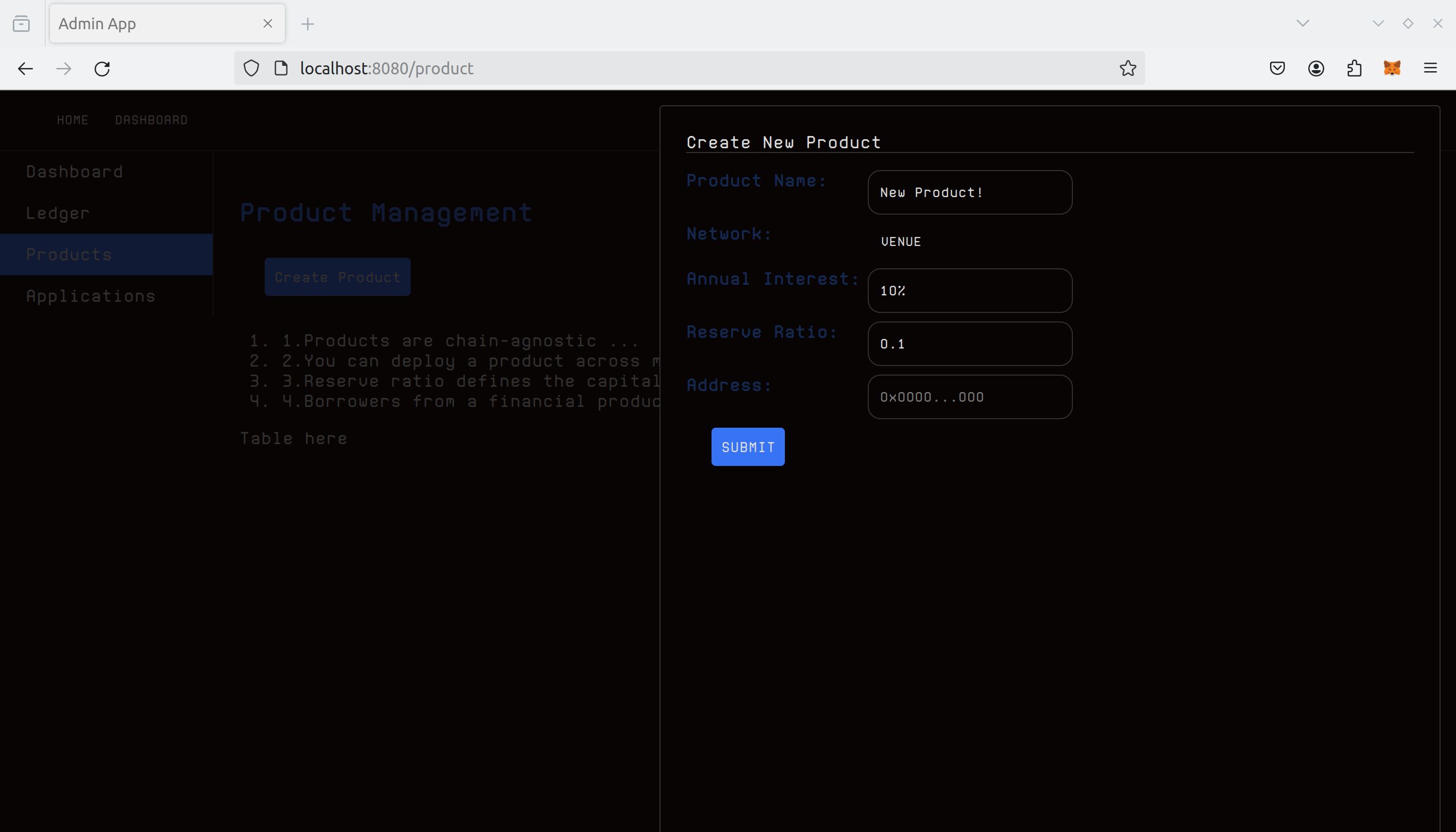

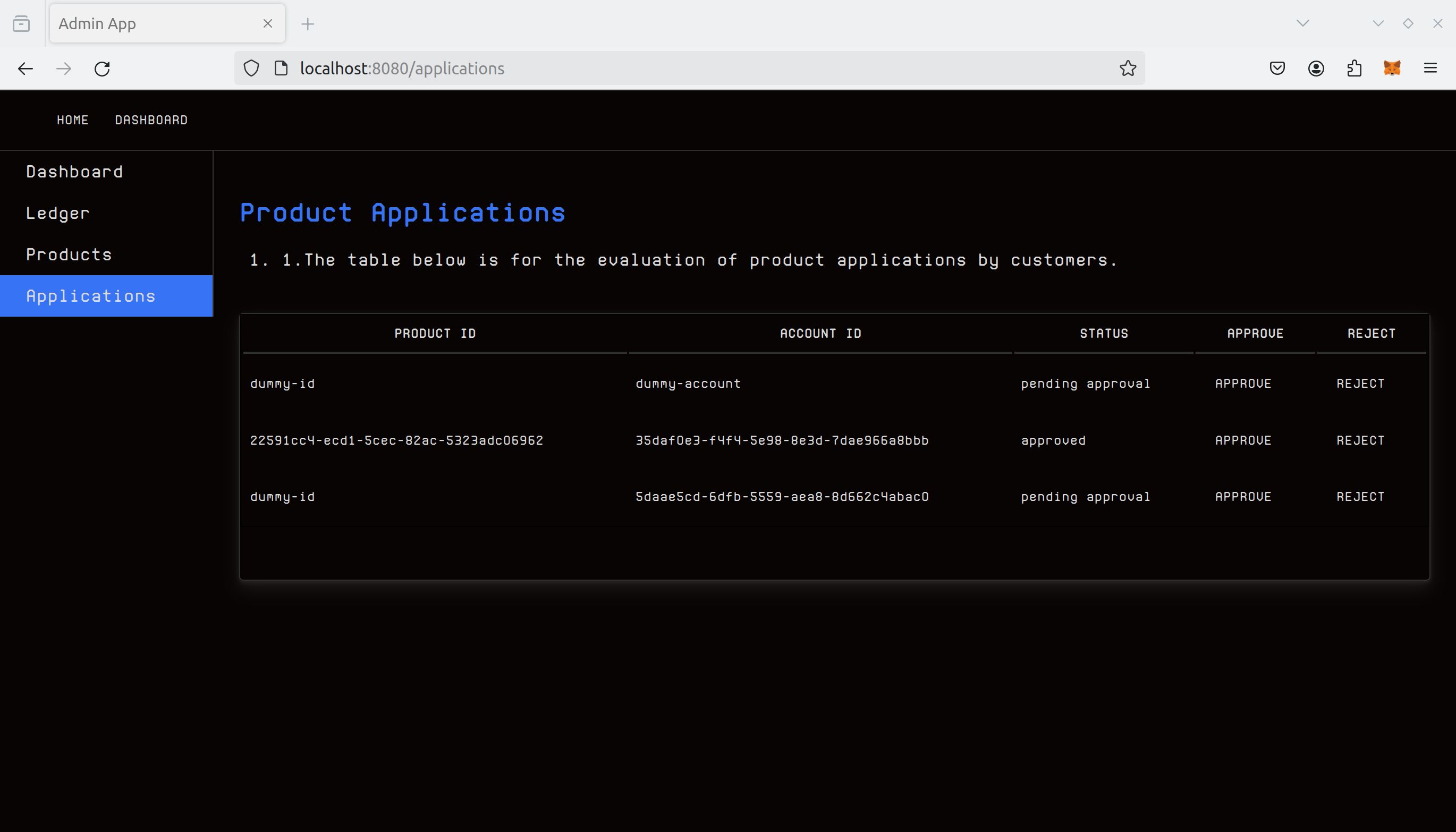

On the other hand, the admin application is designed for bank administrators, providing them with an interface into the mission-critical core banking system. The on-chain banking engine is the backbone of a bank’s operations. The admin application allows Based Bank’s administrators to manage the bank’s core processes, such as the general bank ledger insights, loan origination, credit processing and customer account management. This allows administrators to monitor the financial health Based Bank, manage risk and make informed decisions to guide our strategic direction.

Both applications are built upon chain-agnostic infrastructure, ensuring full compatibility with all EVM-compatible blockchains. This design choice underscores our commitment to interoperability and inclusivity, allowing users from different blockchain ecosystems to access and benefit from our banking services without the need for complex bridging solutions.

At its core, our project is built with the ethos of a TradFi bank but with the forward-thinking innovation of the DeFi space. It combines the reliability and familiarity of conventional banking practices with the transparency, security, and efficiency of blockchain technology. Our goal is to blend TradFi and DeFi, providing users with a robust, secure, and user-friendly platform for managing their digital assets and accessing innovative financial products.

How it's Made

Our project comprises two core components, both developed using React:

Consumer Application: This front-end application is designed for our end users. It incorporates MetaMask integration, enabling users to engage directly with our platform's smart contracts for various transactions.

Administrator Application: Aimed at bank administrators, this application is a multi-page browser application built with React. It offers detailed oversight of the bank's operations, including insights into customer balances, transaction histories, and the array of financial products offered.

DeFlux API Integration: A cornerstone of our project is our partnership with DeFlux API, an innovation from our startup. DeFlux delivers blockchain-based core banking functionalities, streamlining processes such as payment processing, creation of financial products, and the facilitation of uncollateralised loans. This integration is pivotal in simplifying the backend complexities of Based Bank’s banking operations, evidenced by our ability to establish a fully operational bank within a short span.

Innovative Accounting Mechanism: A distinctive feature of our system is the utilisation of wrapped ERC20 tokens, underpinned by stablecoins, for our bank's accounting framework. This setup allows the bank to define its own financial parameters like reserve ratios, interest rates, and capital requirements for various banking products such as checking and savings accounts. Our approach enables users to transact using these tokens, mirroring traditional banking operations but with the added benefits of blockchain's transparency and accountability. This novel application of blockchain technology brings an unprecedented level of openness and scrutiny to both retail and commercial banking sectors.