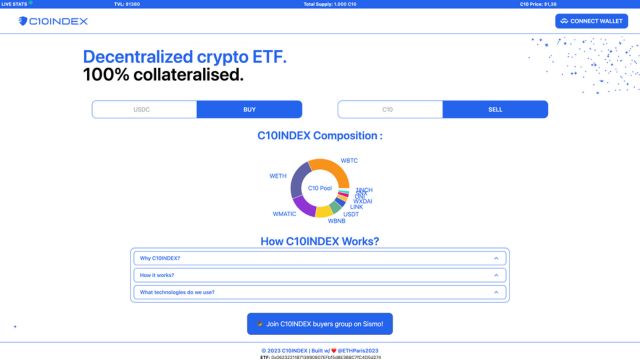

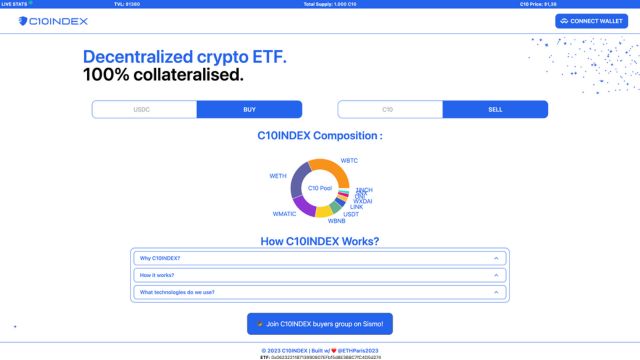

C10INDEX

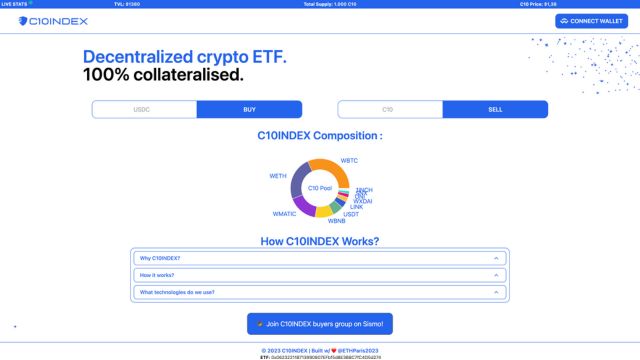

An ERC-20 token representing a pool of several assets, like an ETF in traditional finance.

Project Description

When a customer purchases C10Index, it's equivalent to buying a basket of ten market-cap crypto-currencies in one go. This is made possible by exchanges between the USDC and each of the selected crypto-currencies, weighted by proportions that together make up the value of the C10Index purchase. The proportions are established on the basis of individual market capitalizations relative to the total market capitalization of the largest crypto-currencies at that time. This means that the C10Index is 100% guaranteed, and its value depends solely on the value of the underlying assets. Buying and selling the C10Index does not alter its value, as our protocol mints and burns the ERC-20 token accordingly, reaching equilibrium. In fact, the price of the C10Index is equivalent to the total value locked in (TVL) divided by its bid, and the protocol strikes and burns according to the amount bought/sold divided by its price.

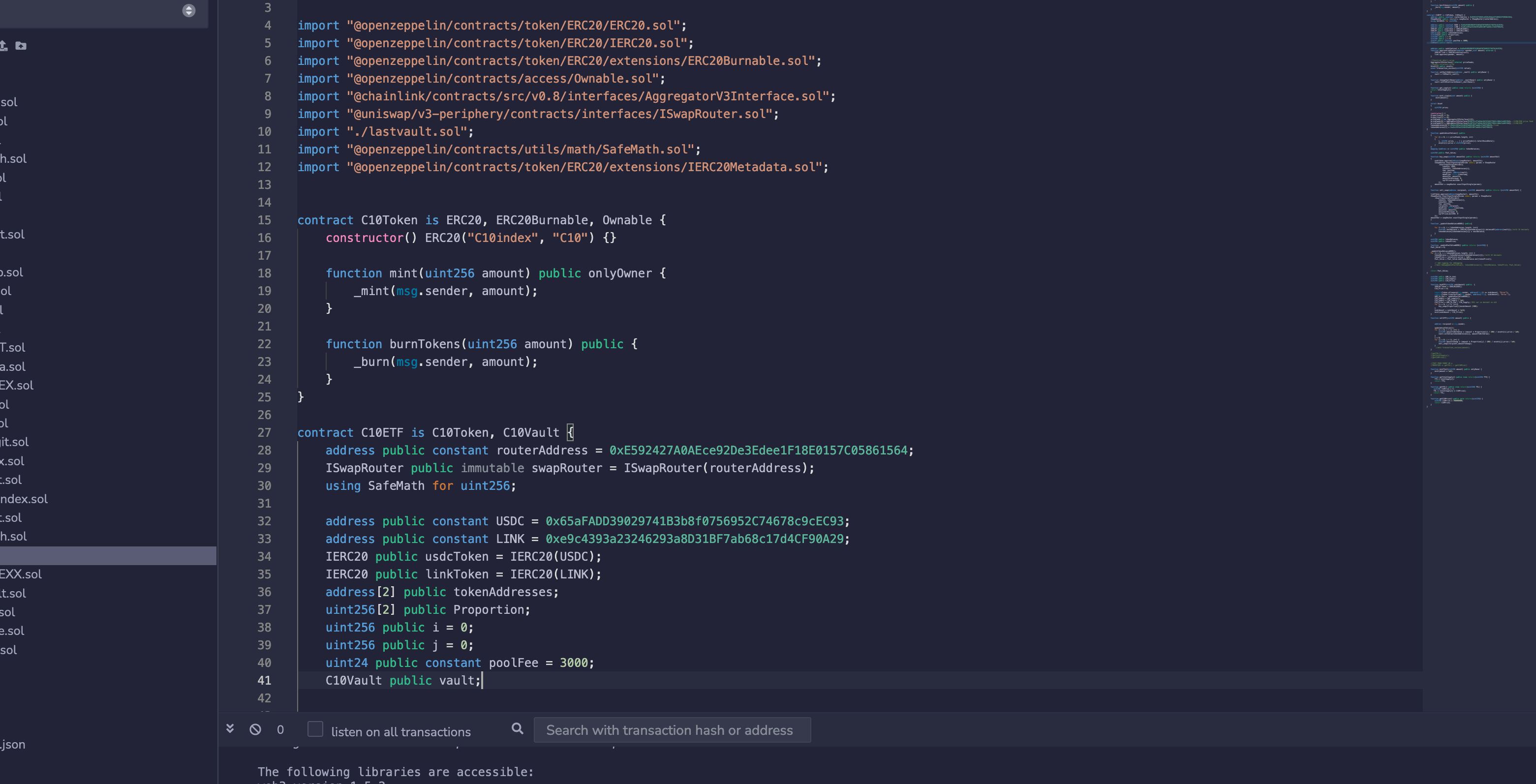

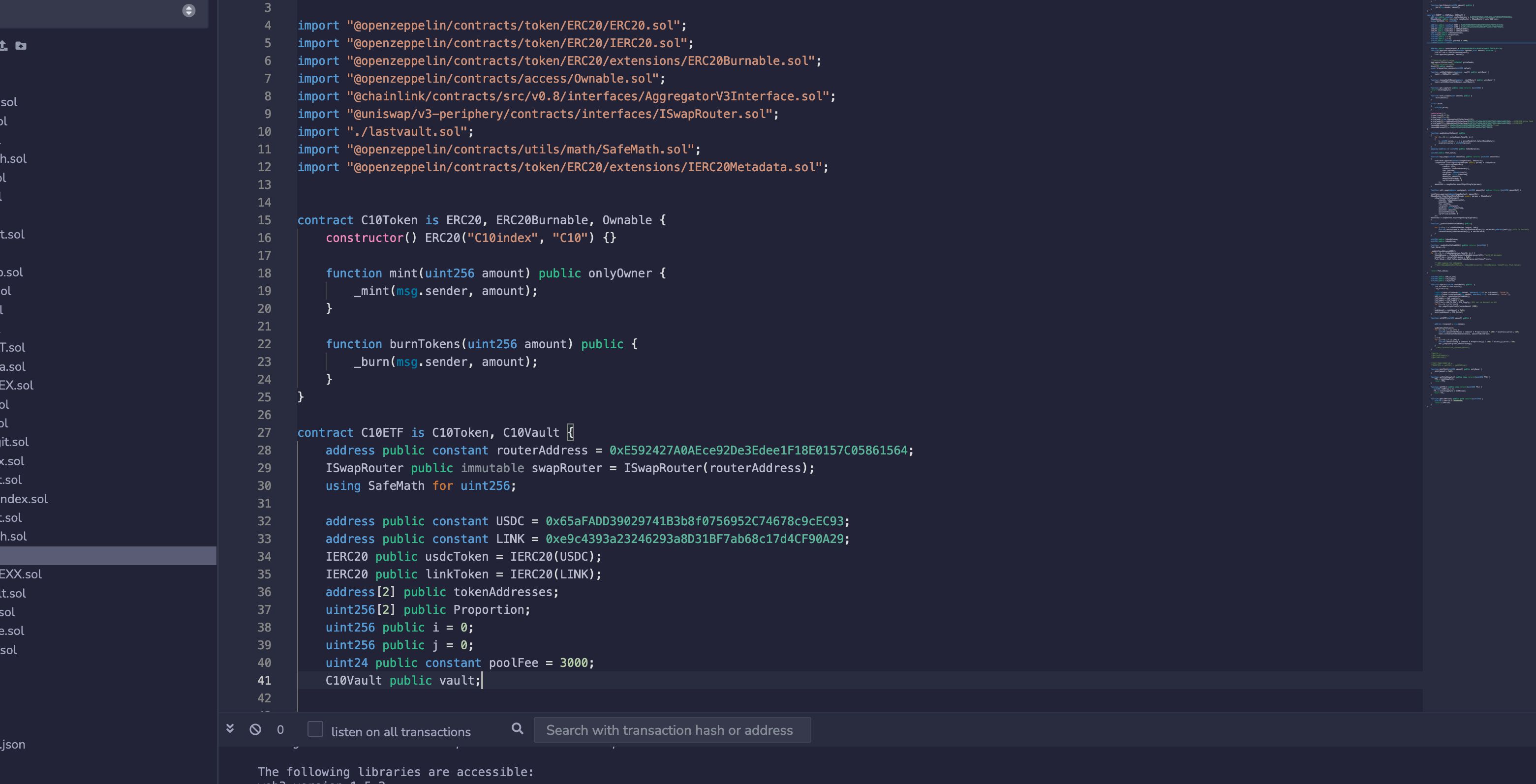

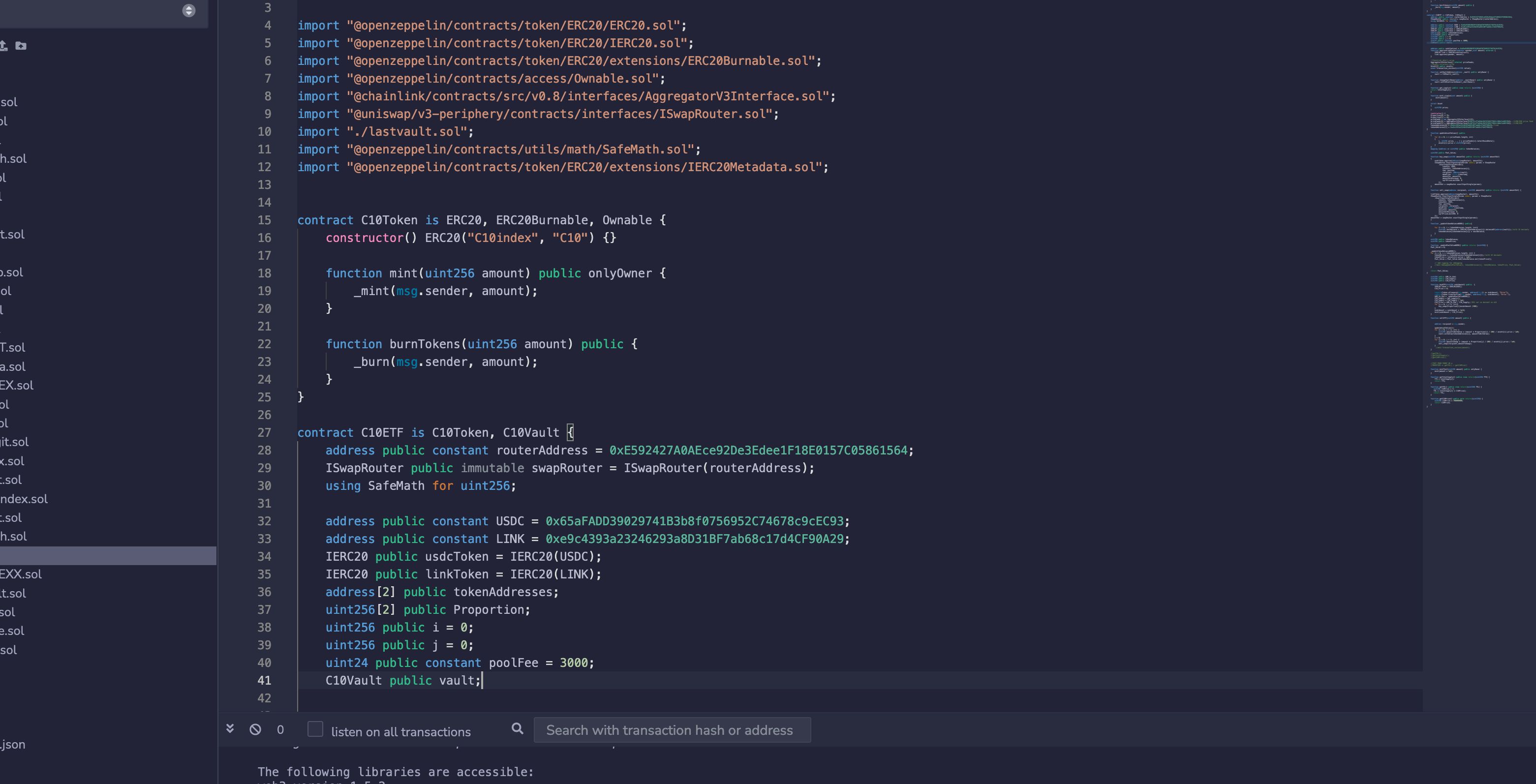

How it's Made

C10Index is deployed on Polygon Blockchain. We use solidity smarts contracts for our backend and NextJs for frontend. The initial idea was to deploy C10Index on Gnosis and use Hyperlane to get data feed from chainlink. Due to lack of time, we didn't finish this idea and decided to deploy it on polygon. We use EAS to mint attestation when users join the pool and use it to build a group of buyers using Sismo. We also use QuickNode as RPC and WalletModal as connect button.