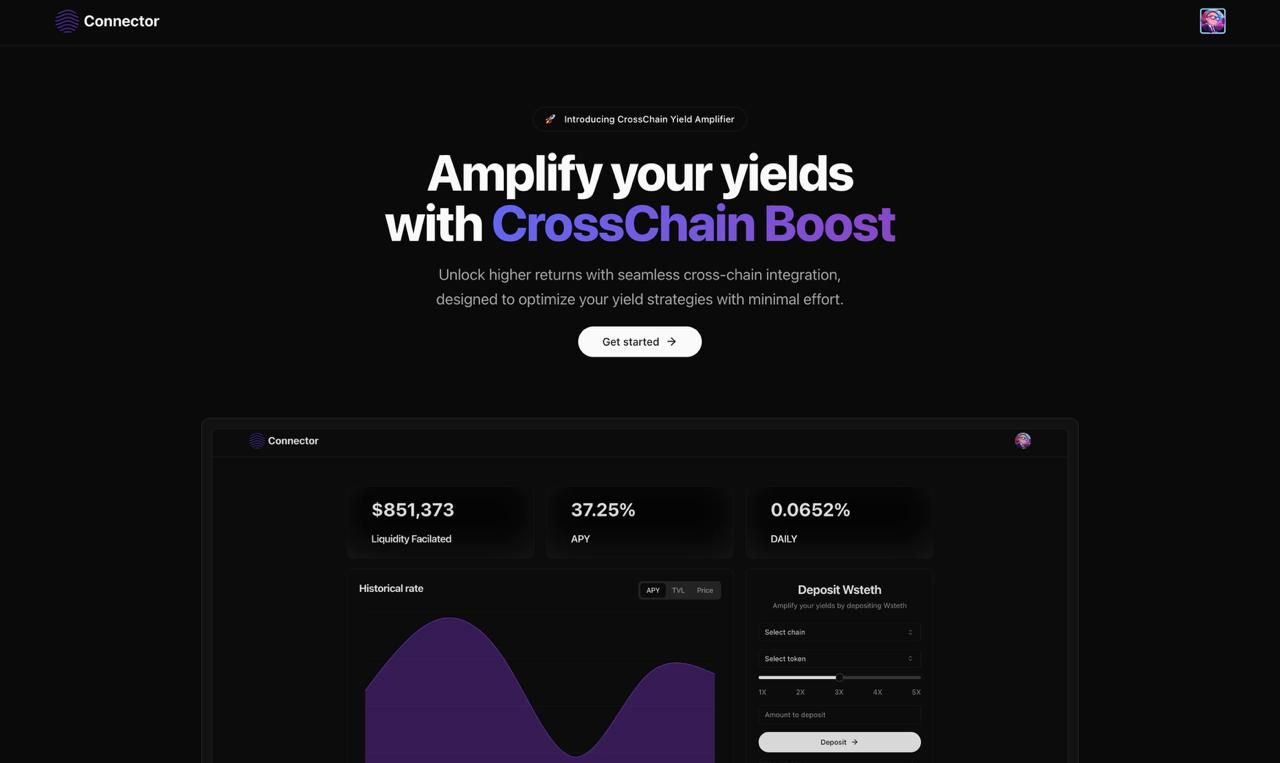

Connector

cross-chain liquidity movement and looping strategies in a single click using CCIP, LayerZero, and top DeFi protocols.

Project Description

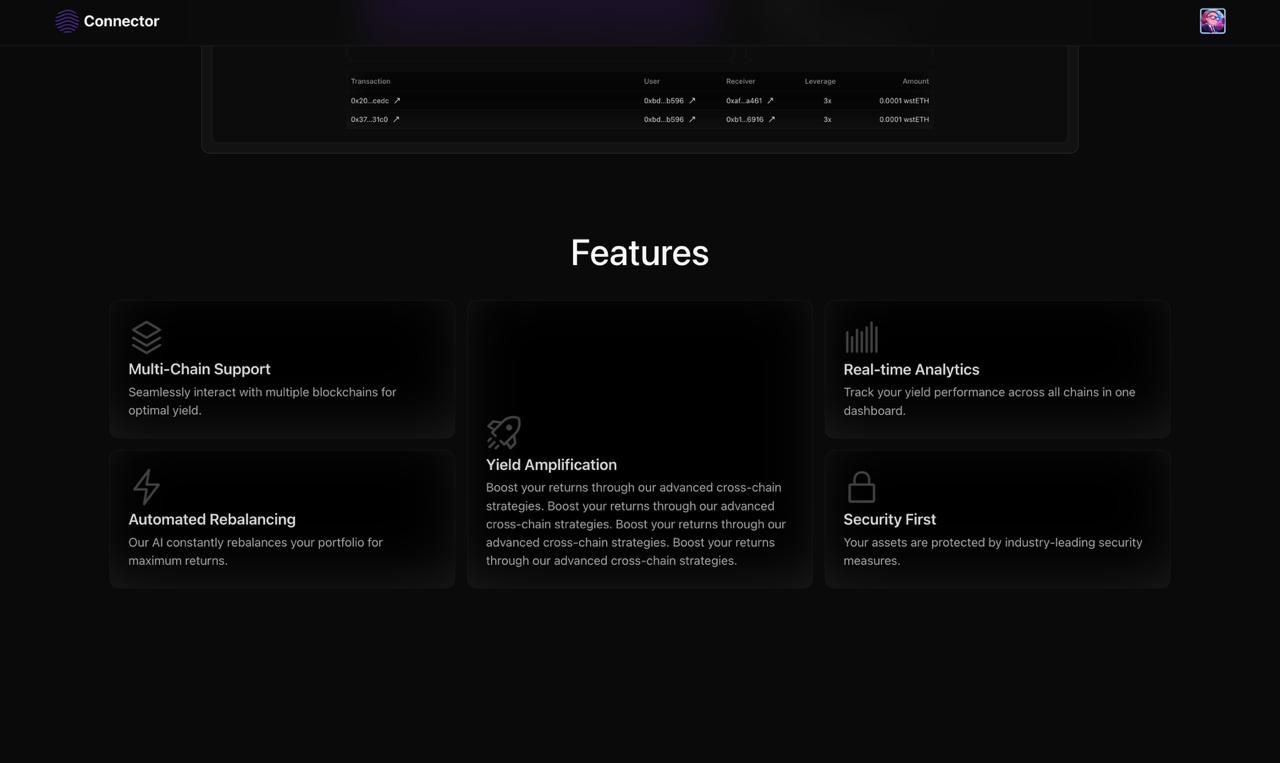

We are building a hackathon project that enables seamless cross-chain liquidity movement and advanced DeFi strategies in a single click. Our solution integrates two cutting-edge cross-chain messaging protocols, CCIP (Chainlink Cross-Chain Interoperability Protocol) and LayerZero, to move liquidity across multiple blockchains, offering users a smooth and efficient experience.

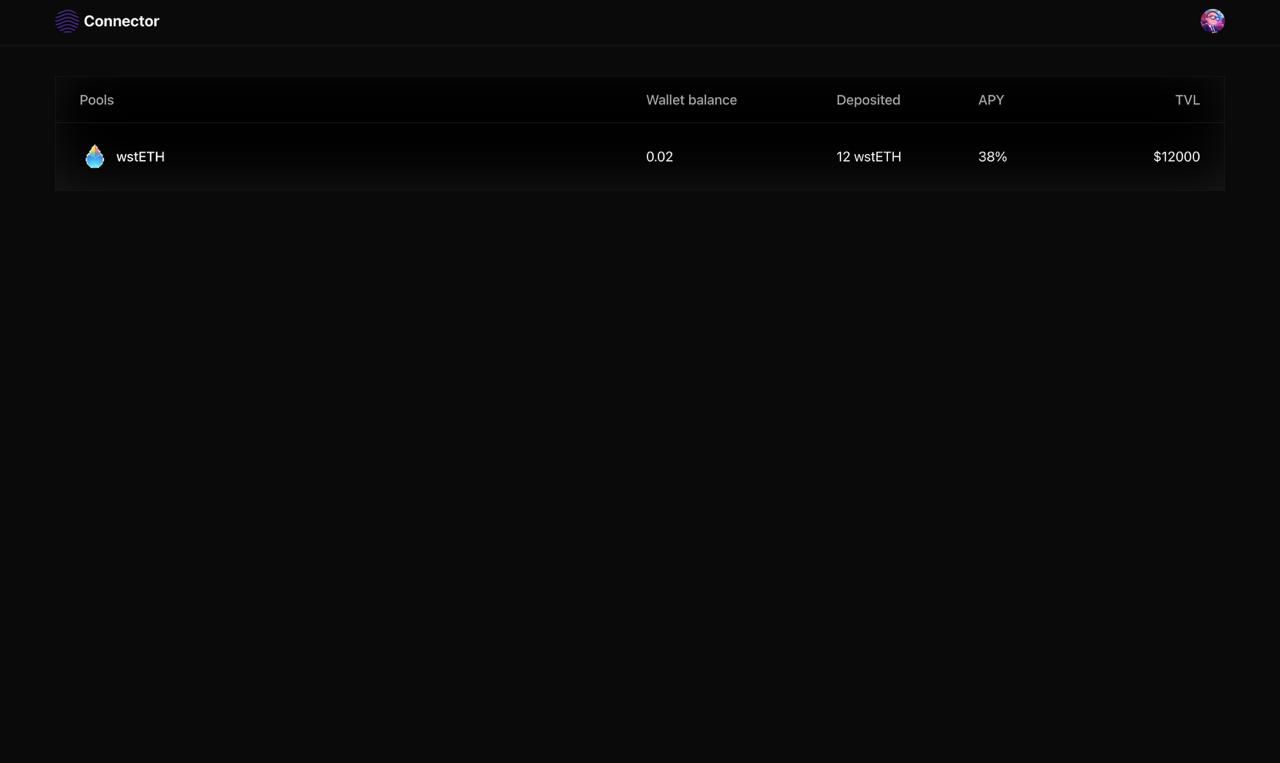

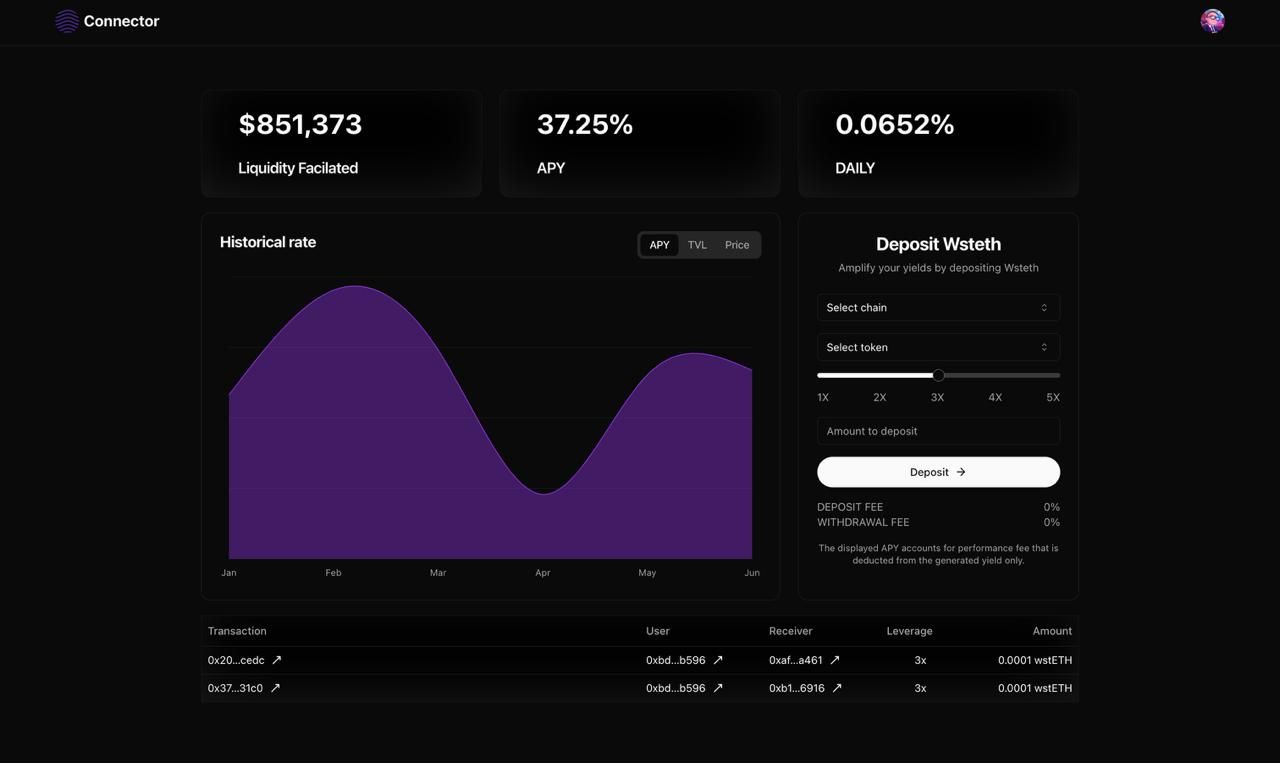

The project allows users to transfer liquidity between networks, such as Base, Arbitrum, and Linea, without needing to manually bridge assets. Once liquidity is moved cross-chain, users can perform looping strategies on Liquid Staking Tokens (LST) and Liquid Representation Tokens (LRT) like wstETH using DeFi protocols such as AAVE and Zerolend. Looping strategies maximize capital efficiency by automatically borrowing, staking, and repeating the process in a single transaction, optimizing yields for users.

We have integrated Reown's app kit for essential dApp functionalities such as wallet connection, social login, swapping, and onramping, making the platform accessible for both seasoned DeFi users and newcomers. The user interface also displays the ENS (Ethereum Name Service) of users for enhanced user identification and experience.

For real-time and accurate price feeds, we rely on Pyth Network, ensuring precise data for liquidity and collateral management. The use of Pyth’s price feeds allows us to offer robust pricing solutions for DeFi strategies within the platform.

In summary, this project brings together cross-chain liquidity transfer, advanced DeFi strategies, and a user-friendly interface powered by Reown's app kit, allowing users to perform complex financial operations in a simplified and cost-efficient manner.

How it's Made

Here’s a detailed explanation for How it’s made:

Our project is built on a combination of cross-chain messaging protocols, DeFi integration, and user experience enhancements, all carefully pieced together to offer a streamlined and efficient liquidity movement system with advanced financial strategies. Here's a breakdown of the technologies and how we combined them:

1. Cross-Chain Messaging and Token Transfer:

- We used CCIP (Chainlink Cross-Chain Interoperability Protocol) and LayerZero for cross-chain messaging and token transfer. These protocols allow secure and decentralized communication between different blockchain networks. CCIP and LayerZero manage the messaging, while we handle the liquidity and transaction flow seamlessly across Base, Arbitrum, and Linea.

2. Advanced DeFi Strategies:

- We implemented advanced looping strategies on Liquid Staking Tokens (LSTs) and Liquid Representation Tokens (LRTs) like wstETH. These strategies allow users to stake tokens, borrow against them, and loop the process to maximize capital efficiency. The strategies are deployed on top DeFi protocols like AAVE and Zerolend, which were chosen for their liquidity and strong smart contract infrastructure.

3. Reown's App Kit:

- For a smooth user experience, we integrated Reown's app kit, which provides key functionalities like:

- Wallet connection: Easy wallet management for users.

- Social login: Offering easy login methods for new users through social accounts.

- Swap: Allowing token swaps within the platform.

- Onramp: Making it easy for users to bring fiat into the system.

- These components saved development time and ensured a robust and user-friendly interface, allowing us to focus on core functionality rather than re-inventing the wheel for essential features.

4. Price Feeds and Pool Data:

- For real-time, reliable pricing data, we used Pyth’s price feeds. This ensured accurate token prices for our liquidity and borrowing positions. The integration of Pyth’s feed into our contracts allows us to offer users the most up-to-date prices when they perform DeFi strategies like looping and leveraging.

5. Smart Contract Deployment:

- We deployed smart contracts across Base, Arbitrum, and Linea. The contracts handle cross-chain messaging and DeFi strategies, leveraging both CCIP and LayerZero for smooth and secure cross-chain functionality. Our contracts were built with Solidity and optimized for cost and performance.

6. ENS Integration:

- To enhance user interaction, we display users' ENS (Ethereum Name Service) names in the dApp interface. This improves recognition and ease of use, especially for users who have already set up their ENS identities.

7. Notable Hacky Solutions:

- We did some creative workarounds in integrating the cross-chain messaging protocols with our advanced DeFi strategies. By chaining together actions from cross-chain messaging to staking, borrowing, and looping within a single user transaction, we were able to drastically reduce the number of manual interactions required by the user. This approach creates a user-friendly, "one-click" experience, even though the underlying logic is complex and spans multiple blockchains.

- Another notable hack involved optimizing gas fees by batching multiple DeFi strategy operations into a single contract call, allowing users to execute looping strategies without excessive cost.

Docs of the protocol is super Amazing and whenever we are struck on the Docs, their team help us. shoutout to the amazing team