DeInsurance

A zk based insurance protocol on Web3, where all the startup workers in the world can collectively use a global and fair insurance standard for employment insurance.

Project Description

The project is a zk based insurance protocol and mechanism for web3, focused on employment insurance.

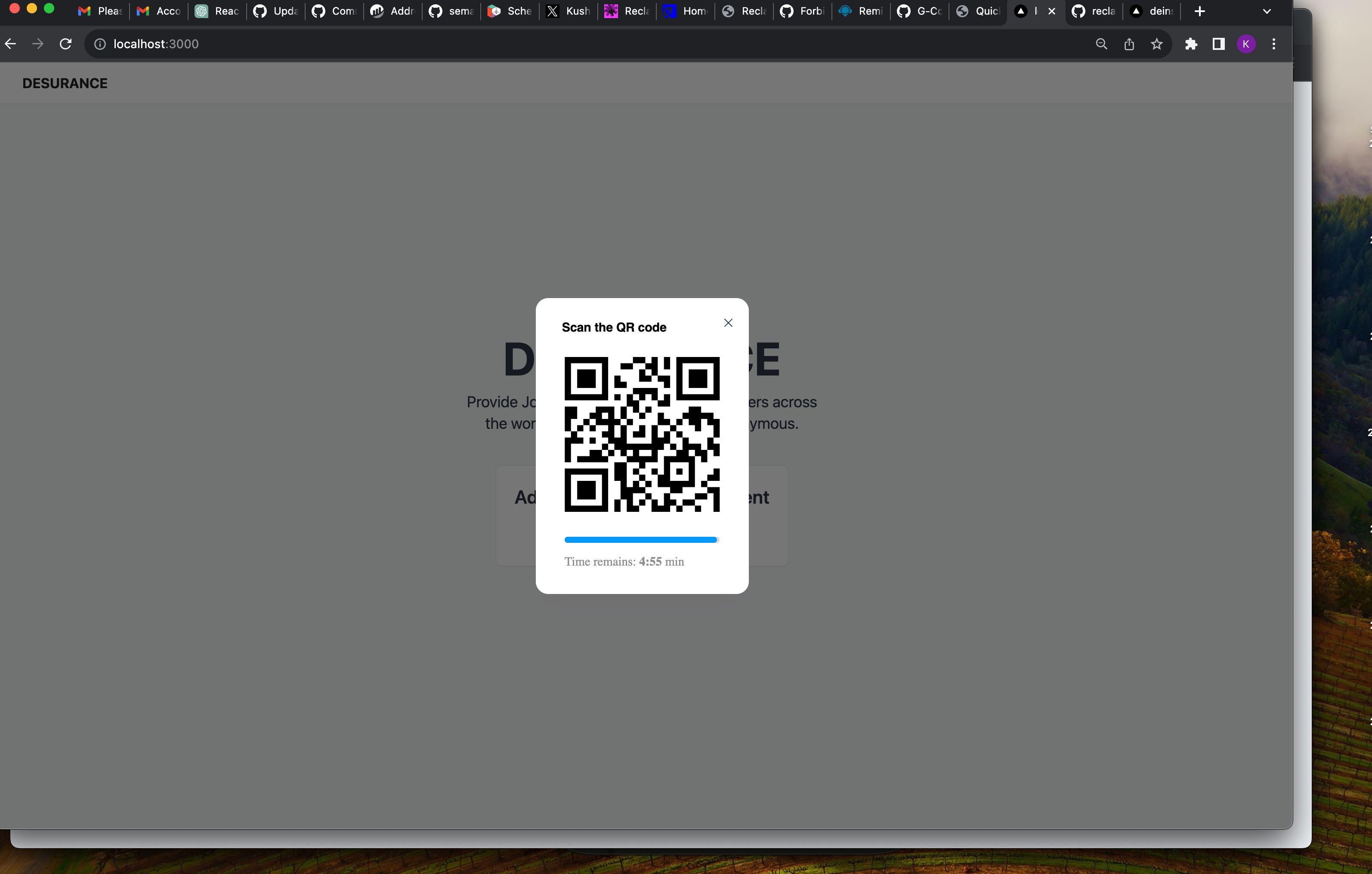

Using Zk proofs via Reclaim Protocol, we get the employment details (Salary and Company) of the user, without requiring their name, email, or any other private identifier details. Reclaim Protocol helps generate proofs of this information through Employee payment portals, in this case, we used India's Razorpay (a startup portal for employees).

Based on the salary of the employee, a quote for the insurance premium is decided upon, usually a fixed percentage of their salary ranging from 1-5%. Once the user confirms and pays, the smart contract asks and reminds the user to make payments monthly.

The user can claim their insurance instantly, by verifying in this case if their company had closed down, information which is attested through the crunchbase API. No wait times, hold times, they are all instant.

The platform itself makes money by staking 70% of the premiums received through Cowswap and earning a regular APY. 90% of the earnings will be distributed to public goods funding through Questbook platform.

How it's Made

Using Reclaim protocol for zk proofs, UMA for the insurance contract, and push protocol fo rnotifications, we enabled a zk based insurnace mechanism.

We built it on top of react.

Using Zk proofs via Reclaim Protocol, we get the employment details (Salary and Company) of the user, without requiring their name, email, or any other private identifier details. Reclaim Protocol helps generate proofs of this information through Employee payment portals, in this case, we used India's Razorpay (a startup portal for employees).

Based on the salary of the employee, a quote for the insurance premium is decided upon, usually a fixed percentage of their salary ranging from 1-5%. Once the user confirms and pays, the smart contract asks and reminds the user to make payments monthly.

The user can claim their insurance instantly, by verifying in this case if their company had closed down, information which is attested through the crunchbase API. No wait times, hold times, they are all instant.

The platform itself makes money by staking 70% of the premiums received through Cowswap and earning a regular APY. 90% of the earnings will be distributed to public goods funding through Questbook platform.