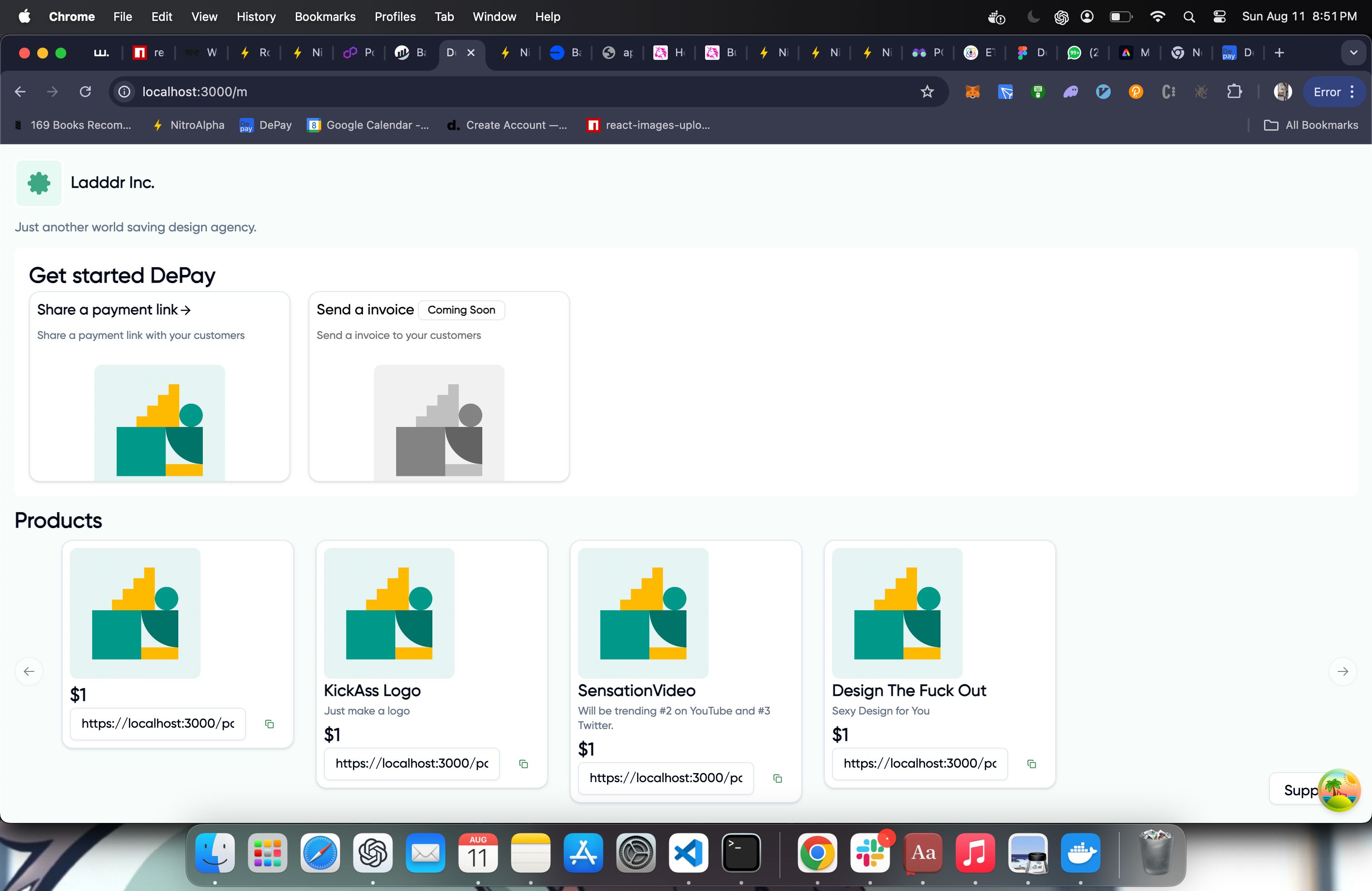

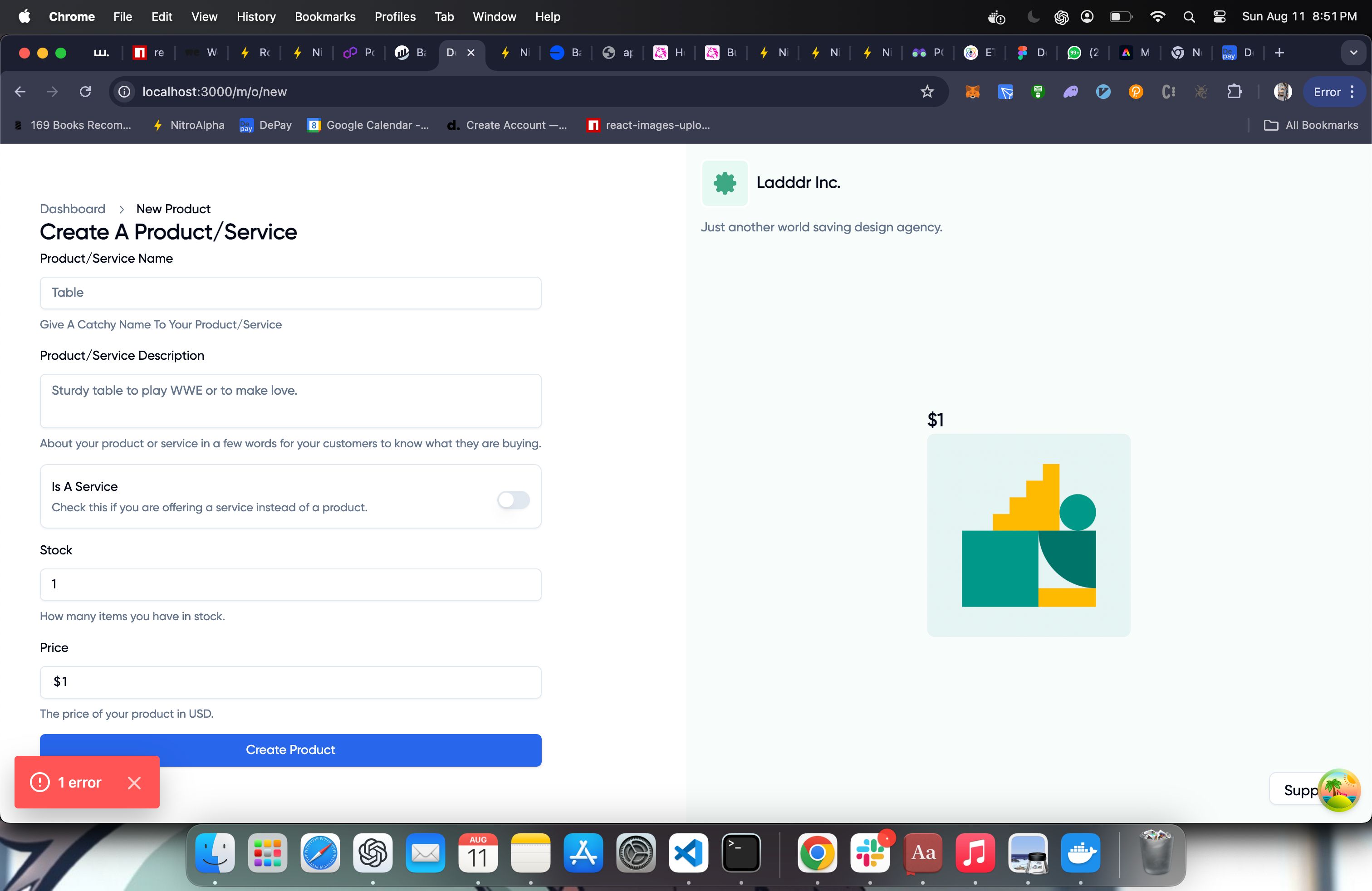

DePay

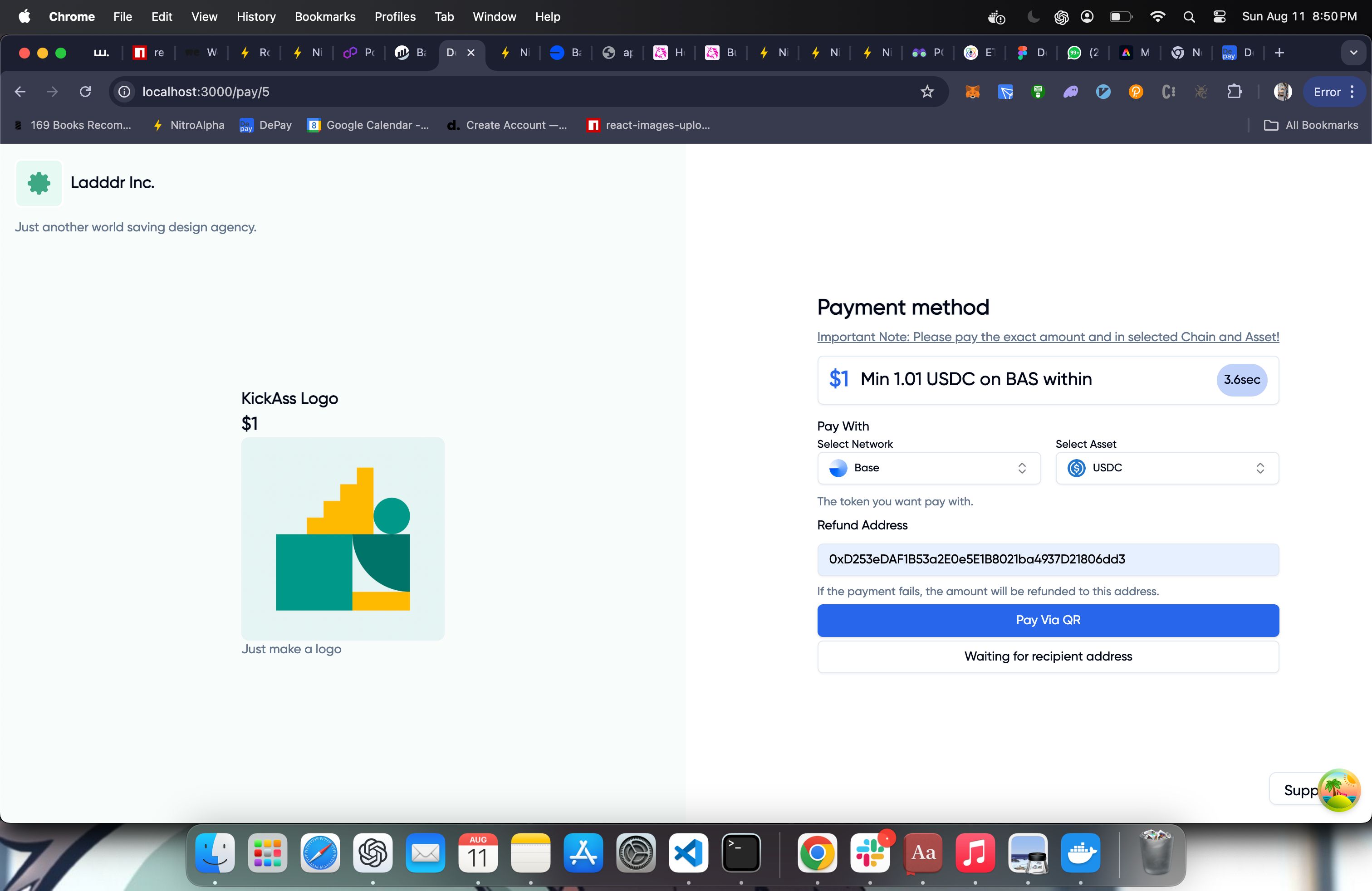

DePay is a cross-asset decentralised payment gateway designed to facilitate seamless and secure cryptocurrency transactions. Making it easier for businesses and individuals to accept and process crypto payments.

Project Description

DePay addresses several key issues:

- Security vulnerabilities in centralized custodian payment gateway.

- Limited acceptance of cryptocurrencies.

- Confusing User Experience, takes a learning curve.

- High transaction fees in traditional payment systems.

- Slow transaction processing.

How we improved Security vulnerabilities in centralized payment gateways? Devised non-custodian payment gateway for web2 merchants, with enhanced security with use of decentralized protocols like router protocol, layerzero, hyperlane.

Using how many assets can users pay? Supporting virtual any asset, DePay has power to accept payment through 25+ chains and 3000+ assets. As Bridges expands into chains so does DePay.

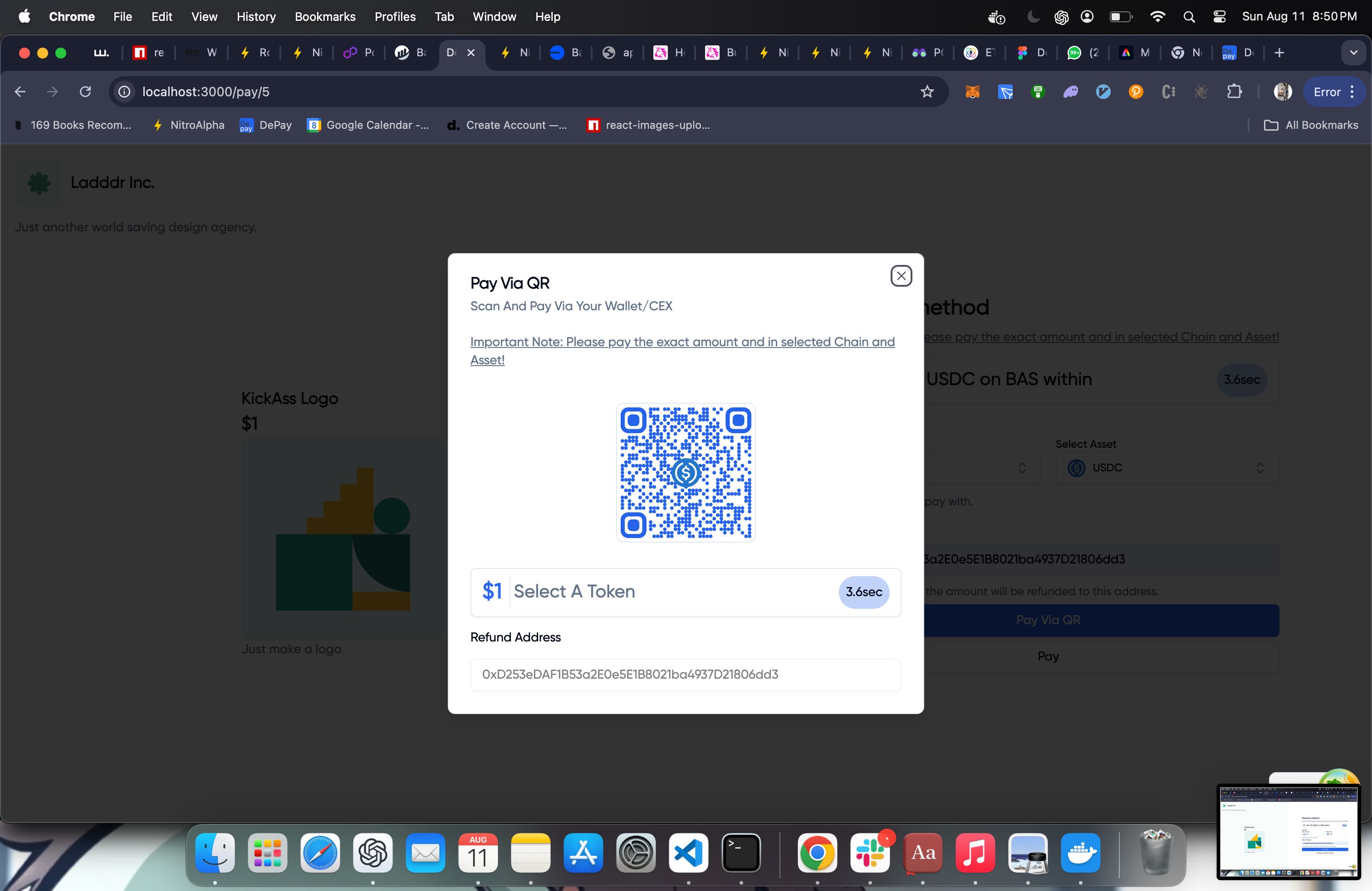

How easy is it to use DePay for CEX users? Get the payment link from vendor. Select the chain and asset you want to pay with. Scan the QR and pay.

How it's Made

How DePay Works: A High-Level Overview of the Core Decentralized Payment Gateway

-

Payment Request and Quote Generation: During the payment process, the payee requests a quote from DePay relayers. The relayers generate a quote along with a special address. This address isn’t linked to any existing externally owned account (EOA) or contract at this stage, and it has unique features that will be explained later. If the payee agrees to the quote, they send the funds to this designated address.

-

Fund Transfer and Relay: Once the relayers detect that the exact amount of funds has been sent, they relay the payment forward to the merchant. If there’s any issue causing the transaction to revert, the payee receives their funds back. This refund mechanism is a unique feature of the contract, ensuring that the payee's funds are protected during the process.

-

Security Against Malicious Relayers: If a malicious relayer attempts to redirect the funds for itself by altering the instructions, the address would automatically change. This ensures that any tampering with the transaction invalidates the original address, preventing the relayer from misappropriating the funds. This mechanism protects the integrity of the payment process, ensuring that funds reach the intended recipient or are safely returned to the payee.