Dextr

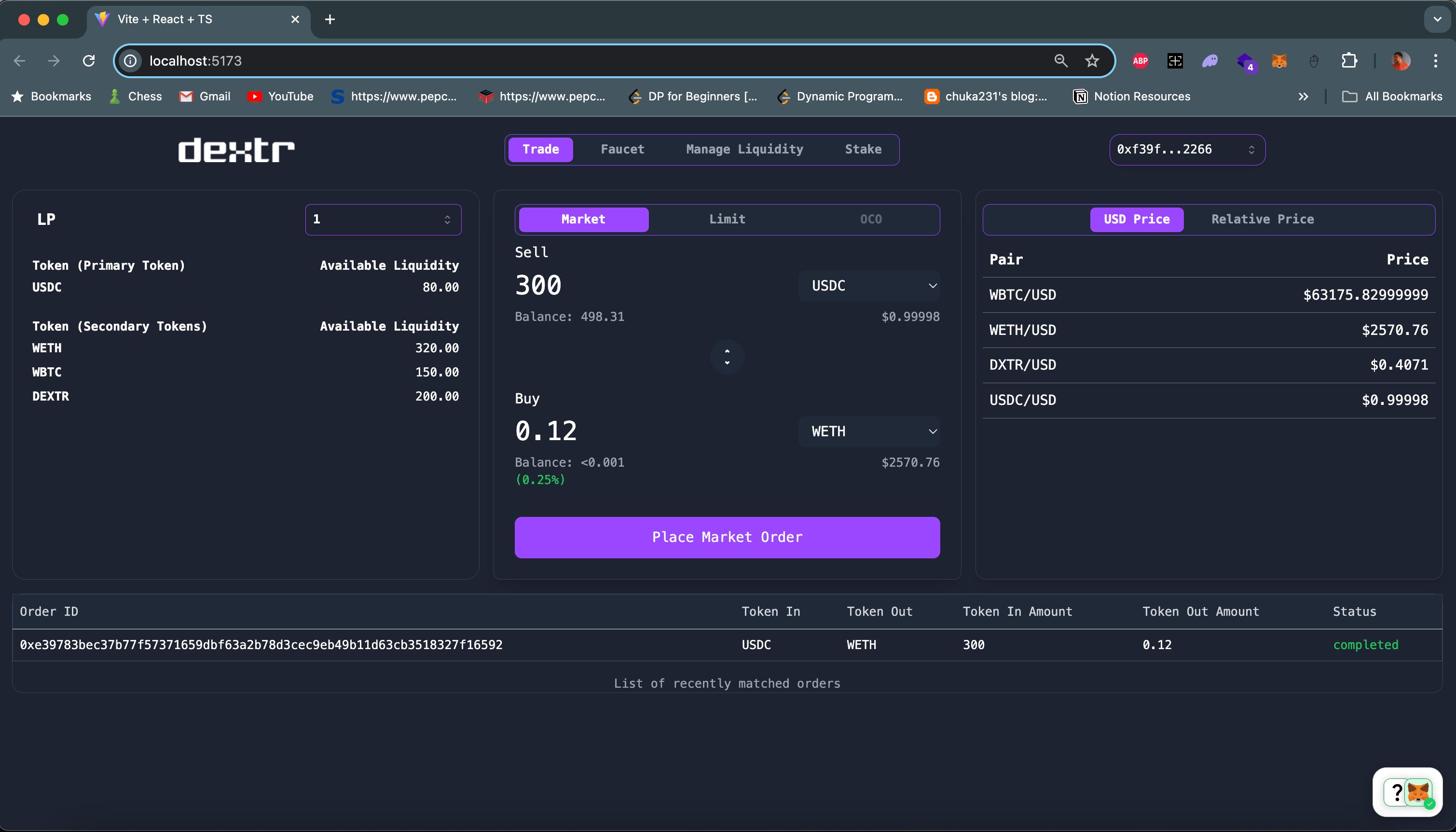

A hybrid exchange that minimizes LVR and enables Dynamic Liquidity Rotation which can be used to settle any selected pair order.

Project Description

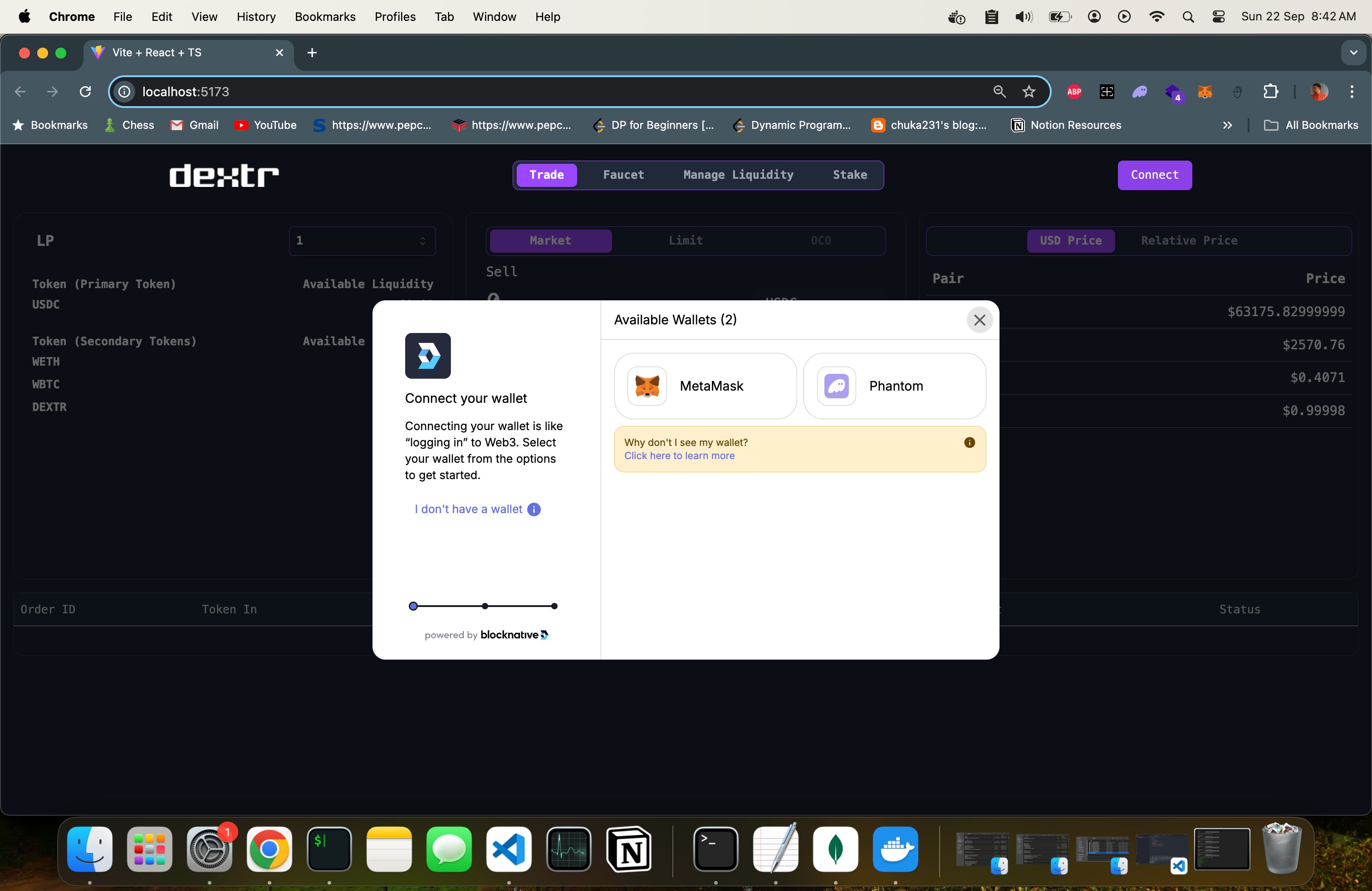

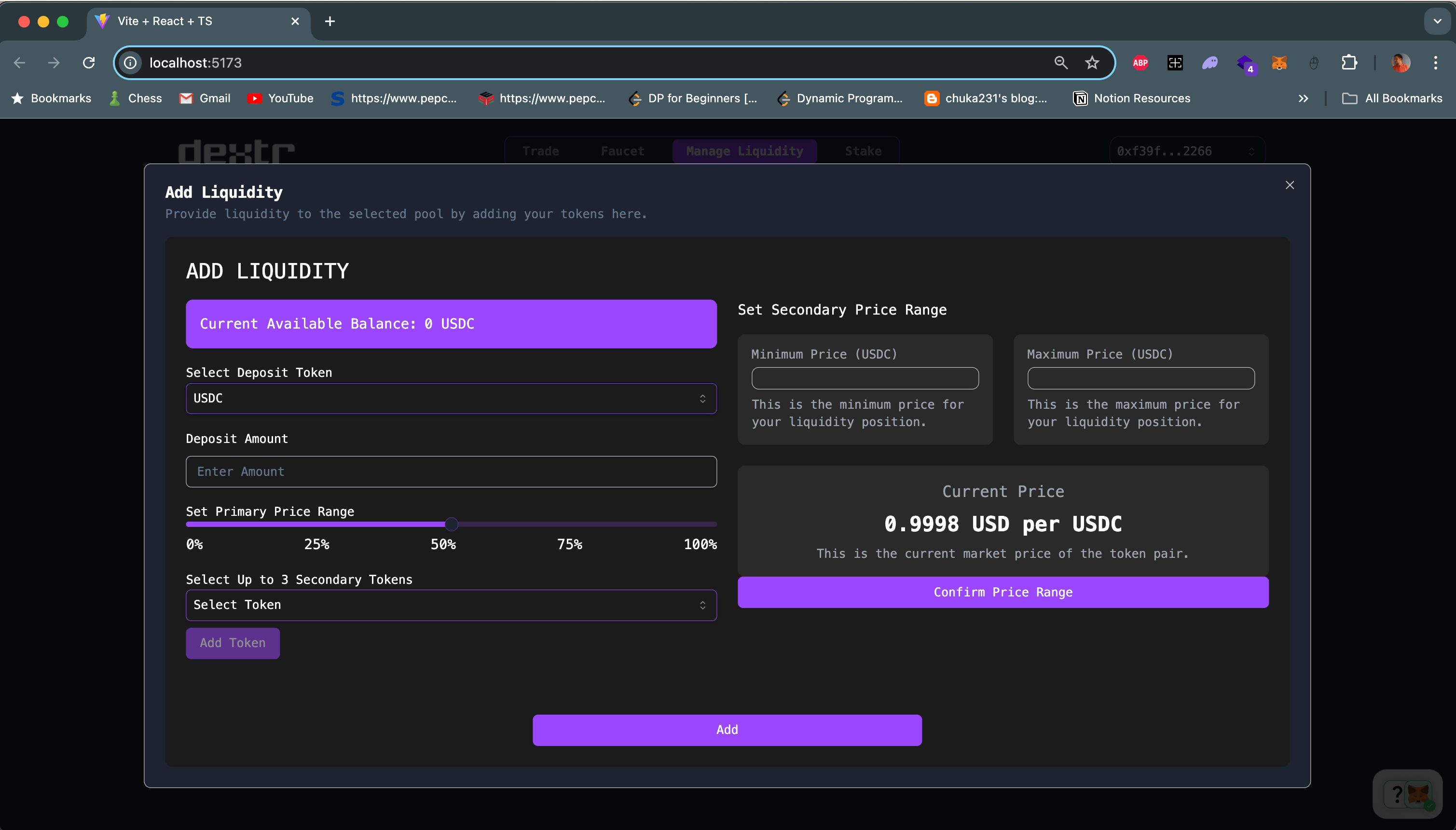

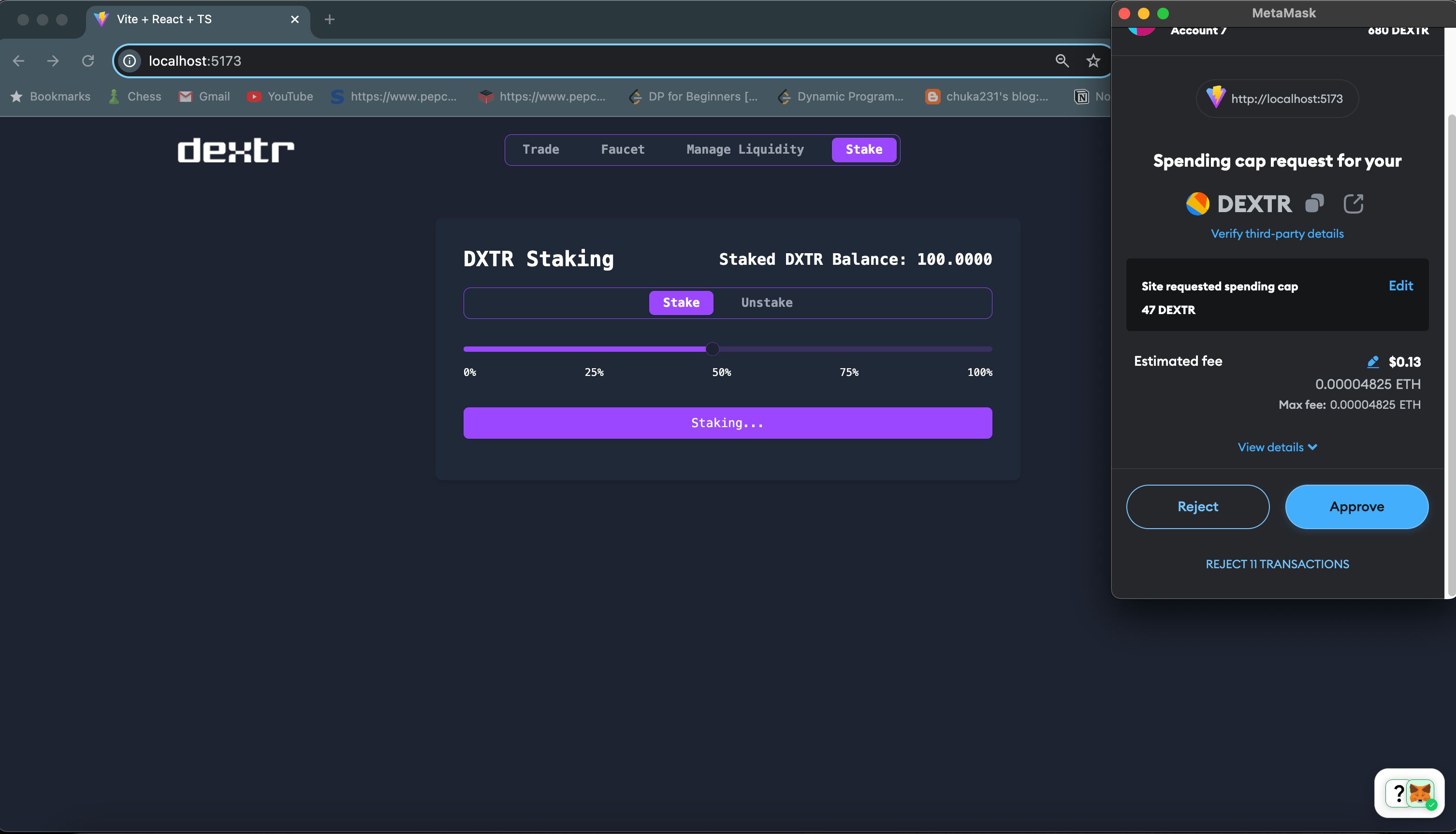

Two of the main challenges that LPs and DEXs are facing right now are LVR (Loss-versus-Rebalancing) and liquidity which is being locked in a pool. For example, one of my assets can be locked in a pool with low trading volume which can't be used to settle market sectors with high trading volume. Dextr solves both problems by simply trading on the Oracle Price and not the price decided by a curve (as expected with CF-AMMs). Also, using a Singleton Contract allows users to select the price range and the secondary tokens they wish to trade with the primary token. The order matching is happening off-chain by Eigen Layer AVS operators (Othentic) which Brevis Network's on-chain ZK Proof monitors. Any malicious activity by the operators (usually wrong order matching) will result in a slashing of their stake. The LPs are matched based on the REP SBT which is earned by either staking the Protocol Token - DXTR or any other general activity, thus creating a demand for DXTR.

How it's Made

I will divide the whole project into 3 parts -

-

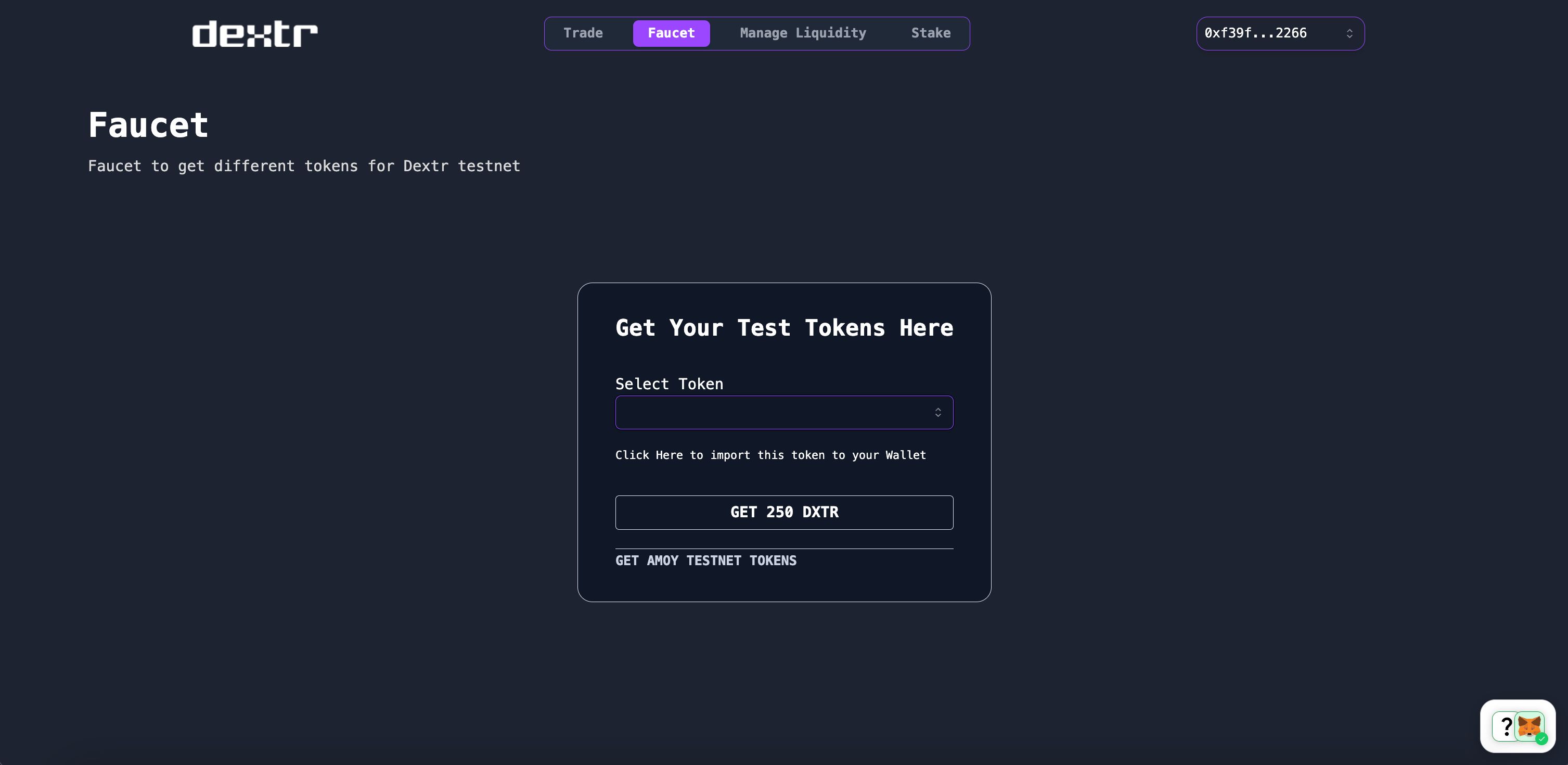

Smart Contract -> The smart contracts are built with the help of Foundry. There is a singleton contract that is in charge of all the tokens and liquidity positions of each LP. The Orderbook maintains all the order-related tasks. There are also a few tokens that can be airdropped via the faucet. Dextr REP is an SBT that determines the LP's eligibility to settle a trade. Oracle Client is basically a mock contract that mimics Supra Oracle Contracts.

-

Off-Chain Components -> There is a backend listener that listens to all the on-chain activity and saves that to the DB. The Oracle Cronjob regularly updates the token prices on the chain. Executioner Service is responsible for all the txs sent to the blockchain.

-

On-Chain Computing -> With the help of Othentic, we can rely on a host of operators that will stake their tokens to the Eigen Protocol and help us settle trades in a decentralized way. While one of the operators settles the trade, other operators can run their algorithm to keep the executioner in check. With Brevis Network, we can prove any historical data on-chain and thus have a tighter grip on the operators.