DumpNotFun

Dump is not fun, but at least you can short memecoin now! Built on Mode Network.

Project Description

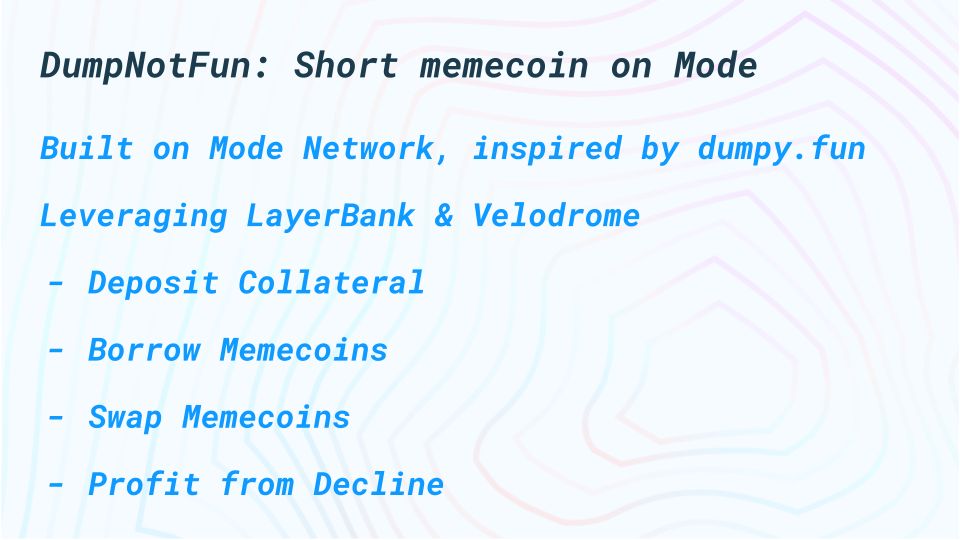

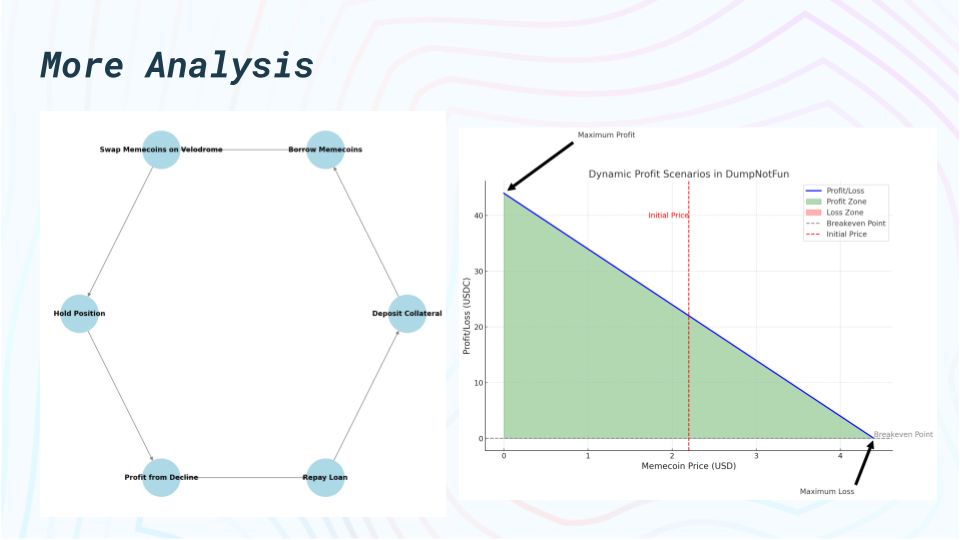

DumpNotFun is a protocol to short memecoin, inspired by dumpy.fun. This project allows you to short memecoins, introducing a new dimension to memecoin and DeFi.

Just as you can "shill" a memecoin, now you can "shill" that you are shorting a memecoin. Everything is onchain, enabling the potential for short squeezes, adding another exciting layer to the memecoin market dynamic.

How it's Made

Technologies Used

Solidity: The core smart contract logic is implemented in Solidity, the programming language for writing smart contracts on Ethereum and EVM-compatible blockchains like the Mode Network.

Hardhat: We used Hardhat as our development environment for compiling, deploying, and testing our smart contracts. Hardhat's flexibility and wide plugin ecosystem made it easy to integrate various tools and libraries.

Mode Network: The project is deployed on the Mode Network, a DeFi-focused Ethereum L2 built on the Optimism OP Stack. Mode was chosen for its lower transaction costs and scalability, which are crucial for a high-volume, on-chain financial application.

LayerBank: For the lending and borrowing mechanisms, we integrated LayerBank, the largest lending protocol on Mode. LayerBank allowed us to implement the core functionality of shorting memecoins by enabling users to borrow memecoins against stablecoin collateral.

Velodrome: Velodrome, the leading decentralized exchange (DEX) on Mode, was used for swapping tokens. Its efficient swap mechanics ensured that users could execute their trades with minimal slippage, which is vital for the success of shorting strategies.

Benefits of Partner Technologies Mode Network: By deploying on Mode, we took advantage of lower transaction costs and faster finality, which are essential for a DeFi application that may involve frequent trading and liquidations.

LayerBank: LayerBank's well-established protocol provided a reliable foundation for the lending and borrowing mechanics, which are the backbone of the shorting functionality.

Velodrome: Velodrome's efficient and scalable DEX infrastructure ensured that token swaps were executed quickly and with minimal slippage, directly benefiting users by preserving the value of their trades.