.Finance

Leverage your yield-bearing tokens (LP, RWA) or achieve high returns on stablecoins with hedged volatile risks

.Finance

Created At

Winner of

Arbitrum - Pool Prize

Prize Pool

Scroll - Deploy on Scroll

Prize Pool

XDC Network - Best Use or Extension of Fathom Protocol 2nd Place

Polygon - Polygon zkEVM DeFi Challenge

Project Description

Today, liquidity stands as a critical component in the web3 market, particularly within the realm of decentralized finance (DeFi). Projects aspire to attract as much liquidity as possible, while investors seek ways to maximize the efficient use of their capital, minimizing operational and volatility risks. A bottleneck arises from the restriction on the reuse of already invested capital, specifically the locking of liquidity that generates income for its owners. This significantly hinders the development of existing and new blockchain ecosystems due to a lack of available capital.

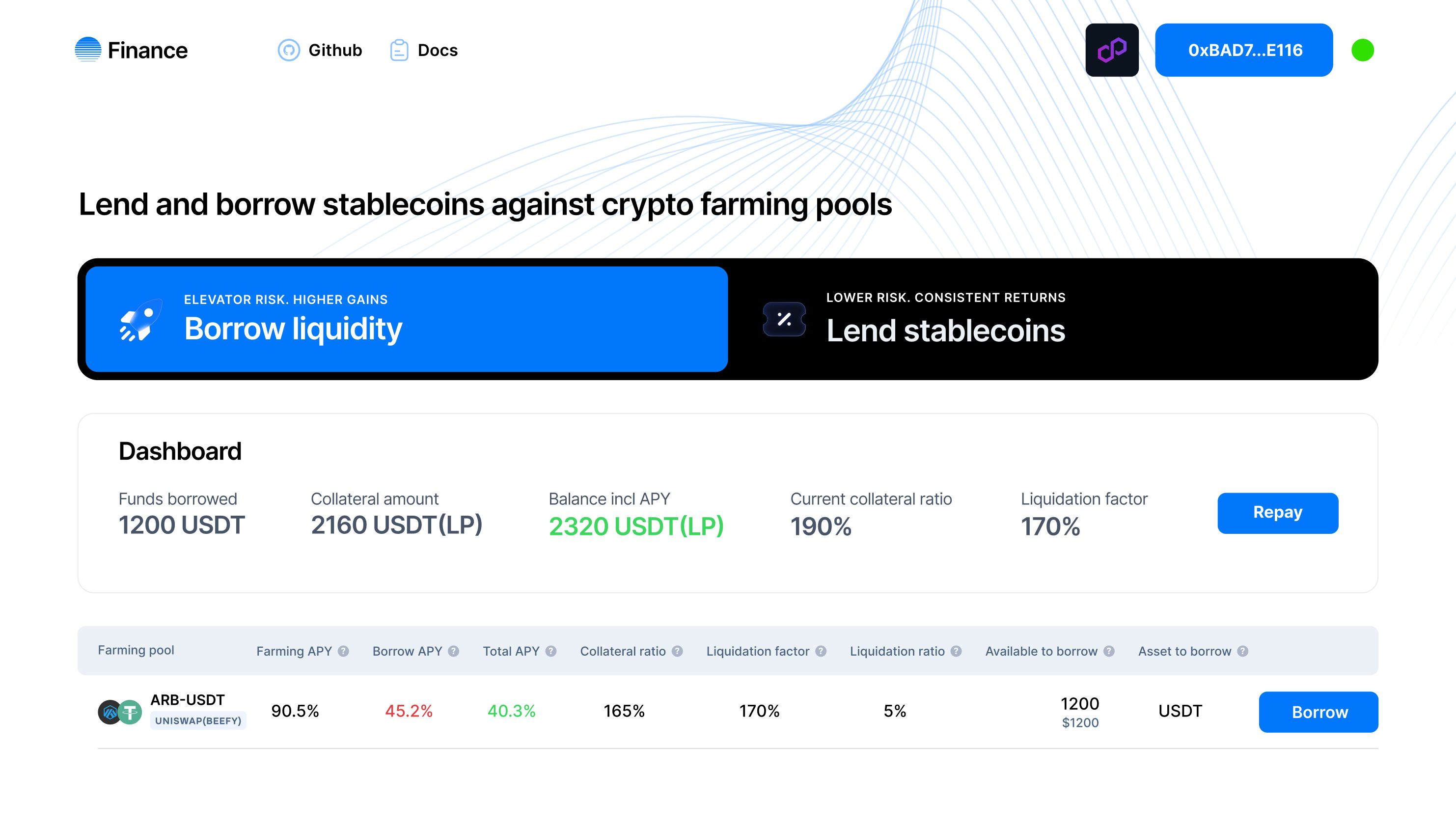

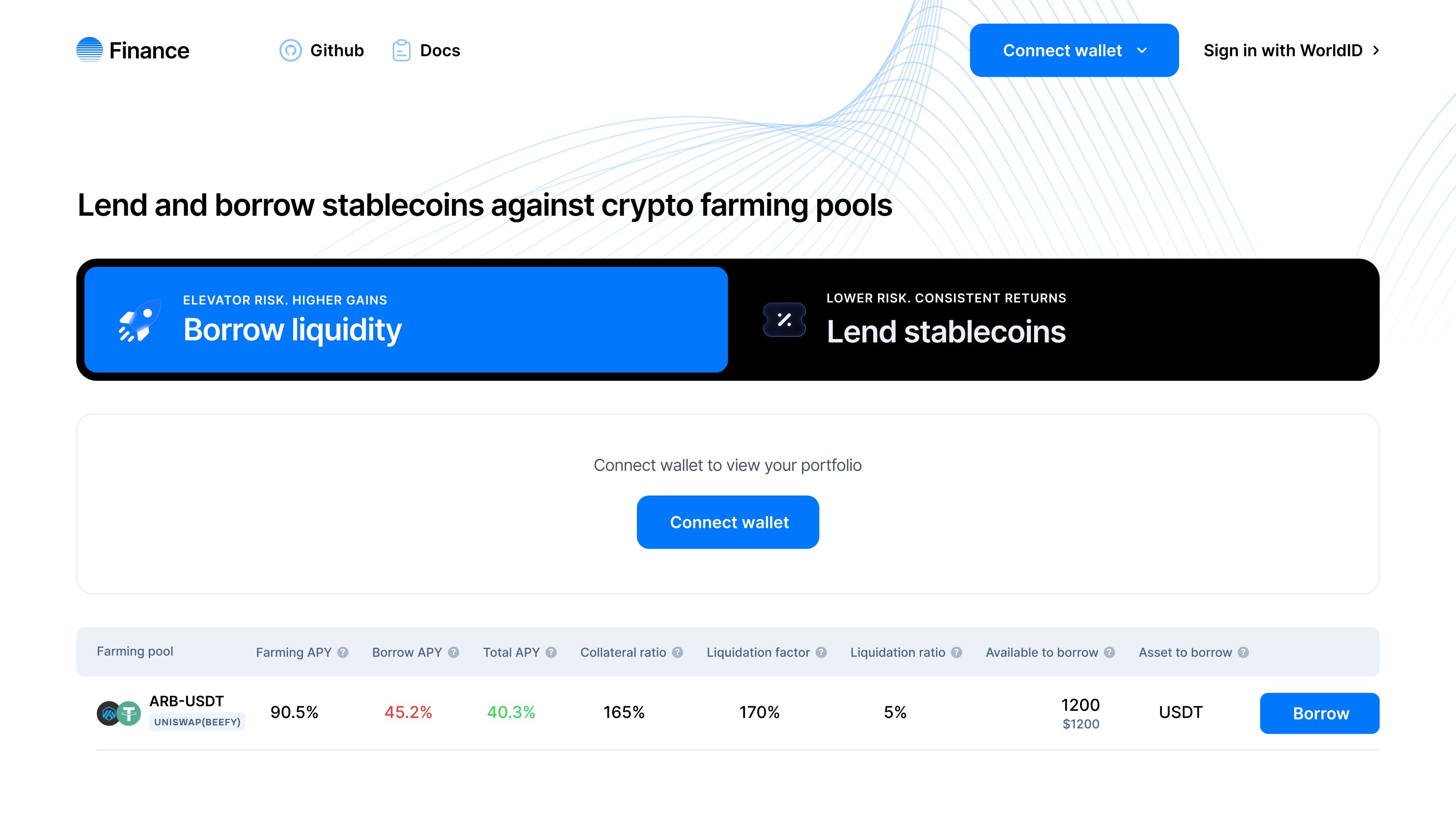

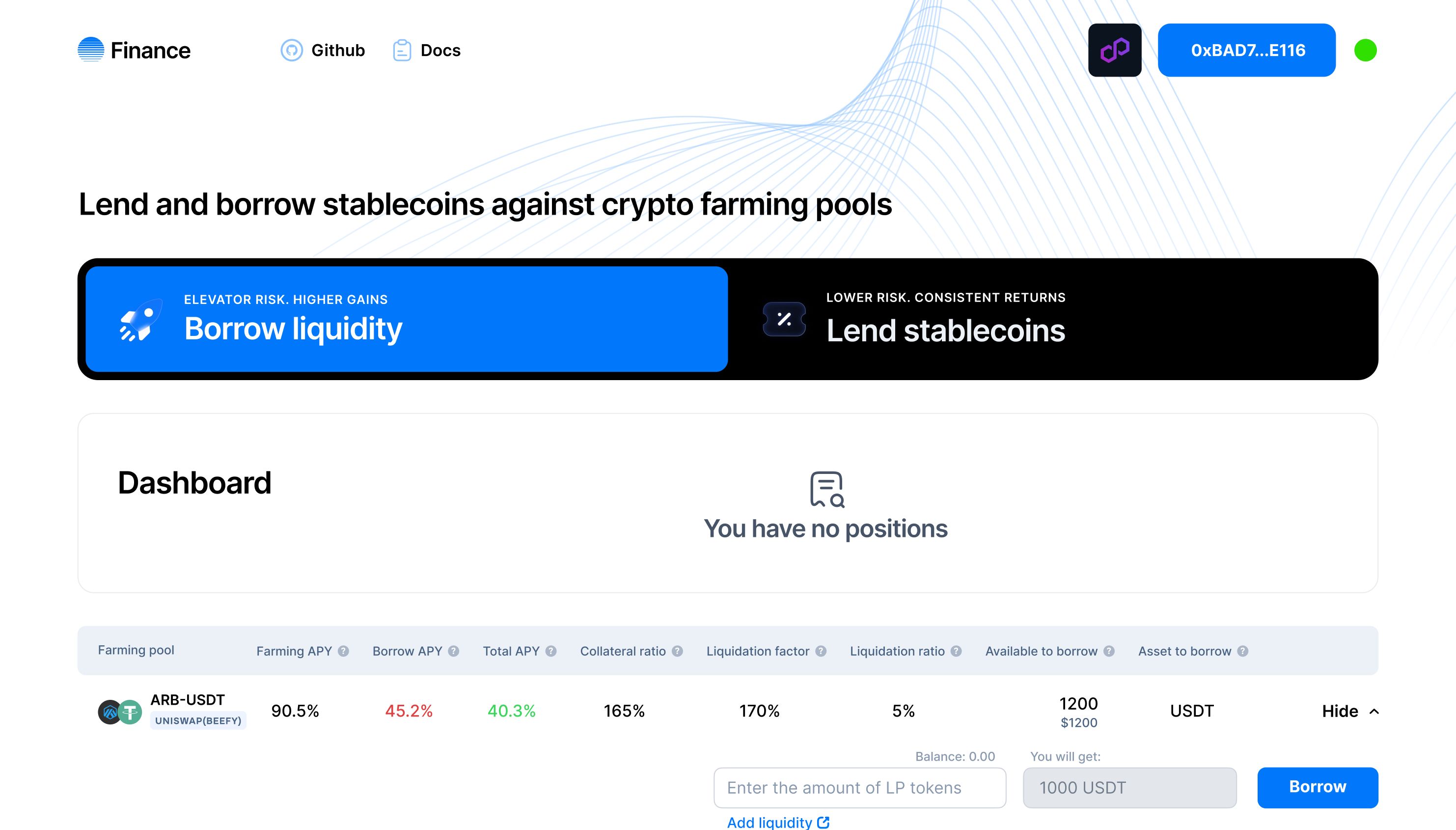

.Finance is designed to maximize the efficiency of capital utilization in DeFi with the support of RWA markets. It aids DeFi traders and liquidity providers in unlocking their yield-bearing tokens with the least possible loss of yield, enabling them to be utilized for purposes such as yield maximization, loan refinancing, temporary cash out, or any other relevant objective. This approach addresses the capital reuse issue, opening up new investment opportunities for liquidity owners and contributing to the development of both existing and new blockchain ecosystems.

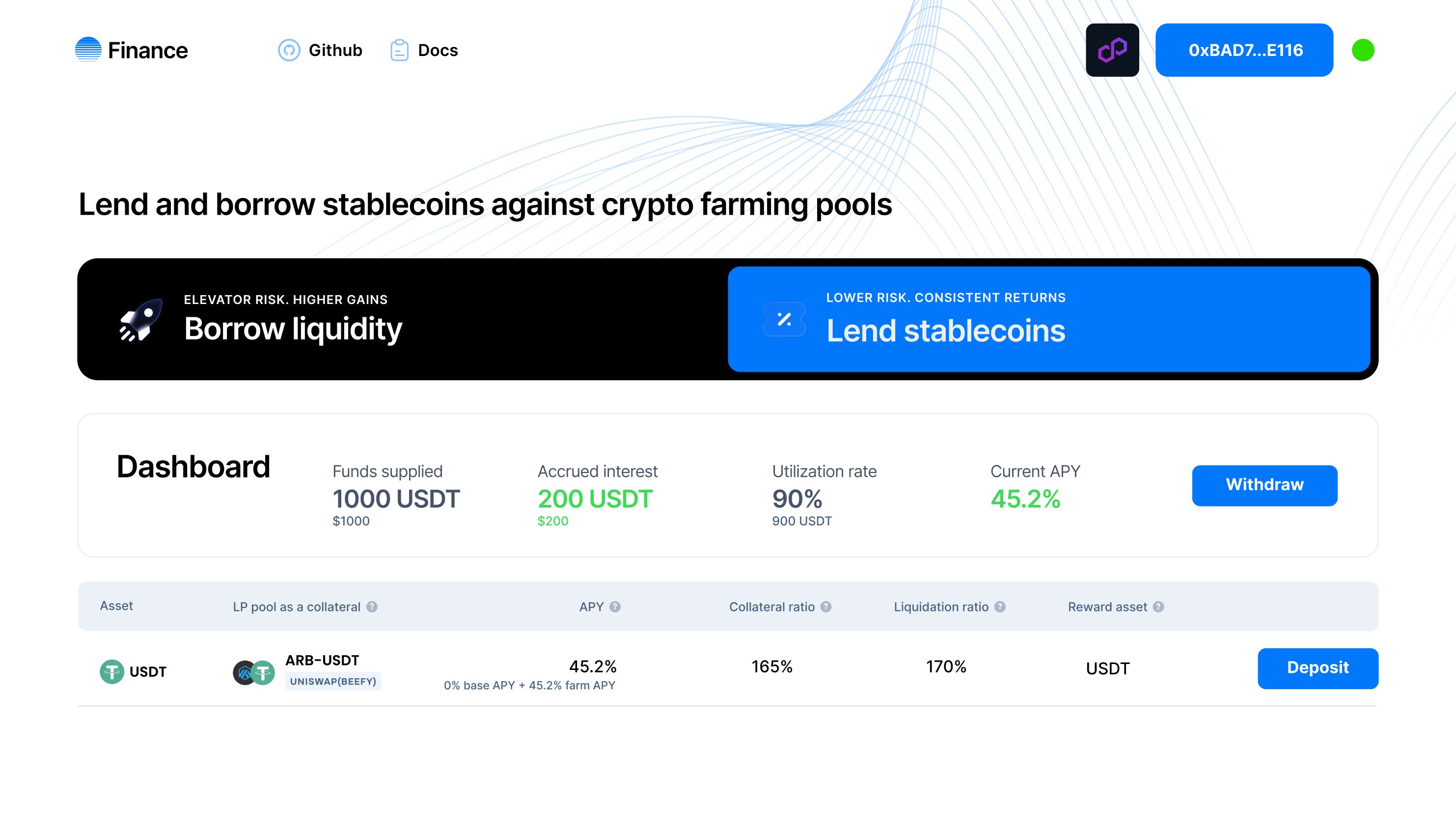

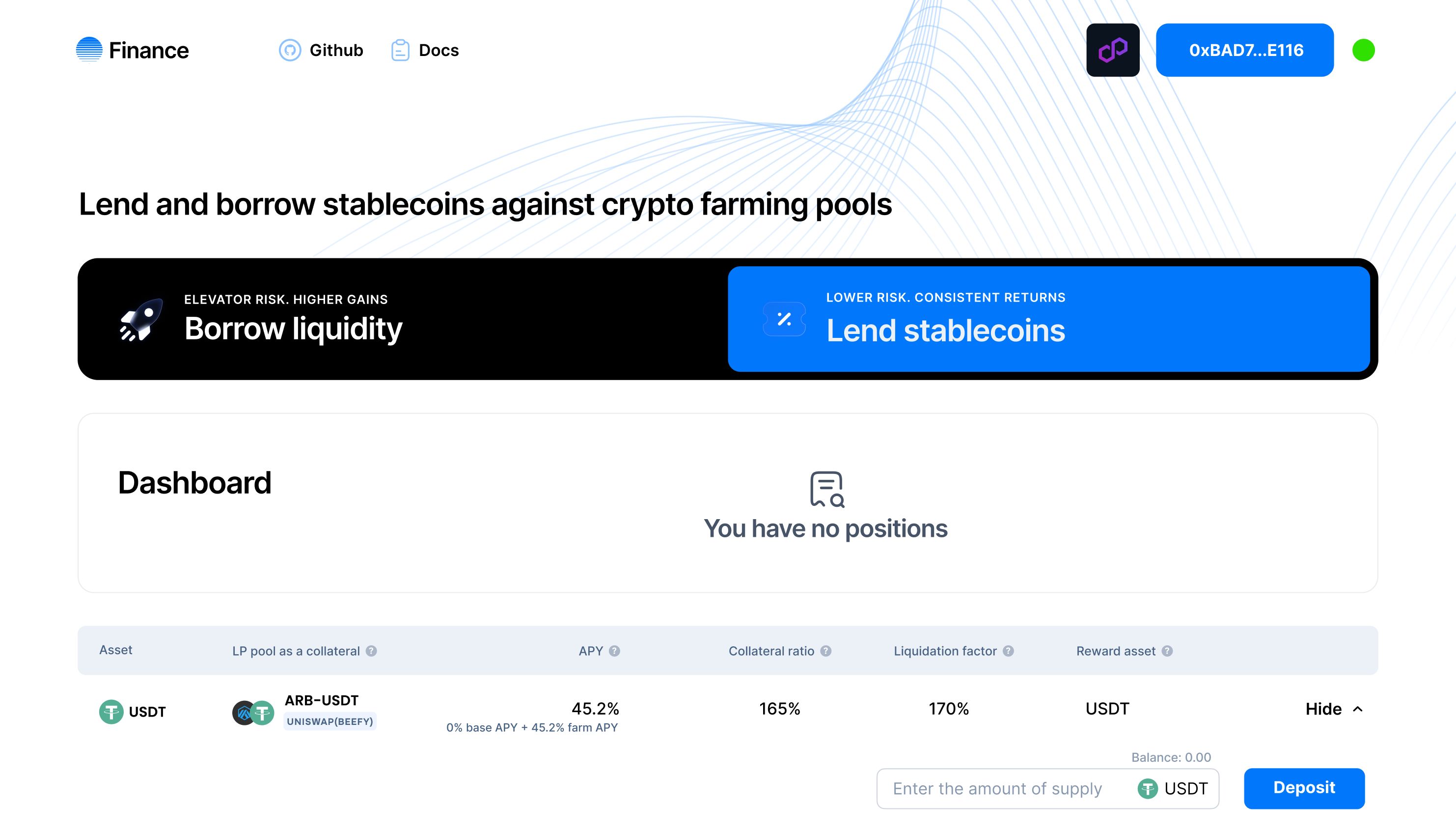

Lenders provide liquidity to borrowers, gaining the opportunity to earn an above-market return on their base asset (stablecoins) with hedged volatility risk. Borrowers, in order to reuse their capital, offer their LP or other yield-bearing tokens as collateral, receiving stablecoin credit in return. The deposit rate for the lender depends on the yield of the yield-bearing tokens, allowing them to have exposure to high-yield farming pools or other yield-bearing tokens with hedged volatility risk. The interest rate for the borrower is effectively always negative, generating income on the collateral asset and covering with excess the cost of the loan, except when the yield of collateral tokens drops below 4%.

Key features of the project:

- Lender returns directly depend on the yield of the yield-bearing tokens pledged as collateral,

- Lenders have the option to choose which specific yield-bearing token they use as collateral for the loan (for example, choosing a specific pool whose LP tokens will be pledged),

- Borrowers repay the loan with the yield of the yield-bearing token while continuing to receive a portion of the yield.

This is only the MVP, showcasing the business logic and value for both borrowers looking to make the most of their liquidity and lenders gaining the opportunity to earn high returns with volatility risk hedging. In the future, .Finance will allow the use of stablecoins with yields from US bonds and certain types of RWA assets as collateral, and stUSDT will be added as a credit instrument.

How it's Made

In its current form, the project includes the following components:

- A staking pool with yield-bearing tokens,

- A pool containing assets from lenders, utilized for issuing loans,

- A connector to the Beefy farming aggregation protocol, enabling the use of Beefy LP as collateral for obtaining a loan,

- A connector to the 1Inch protocol for executing exchanges, facilitating the accrual of rewards to lenders in the base asset (stablecoins like USDT, FXD),

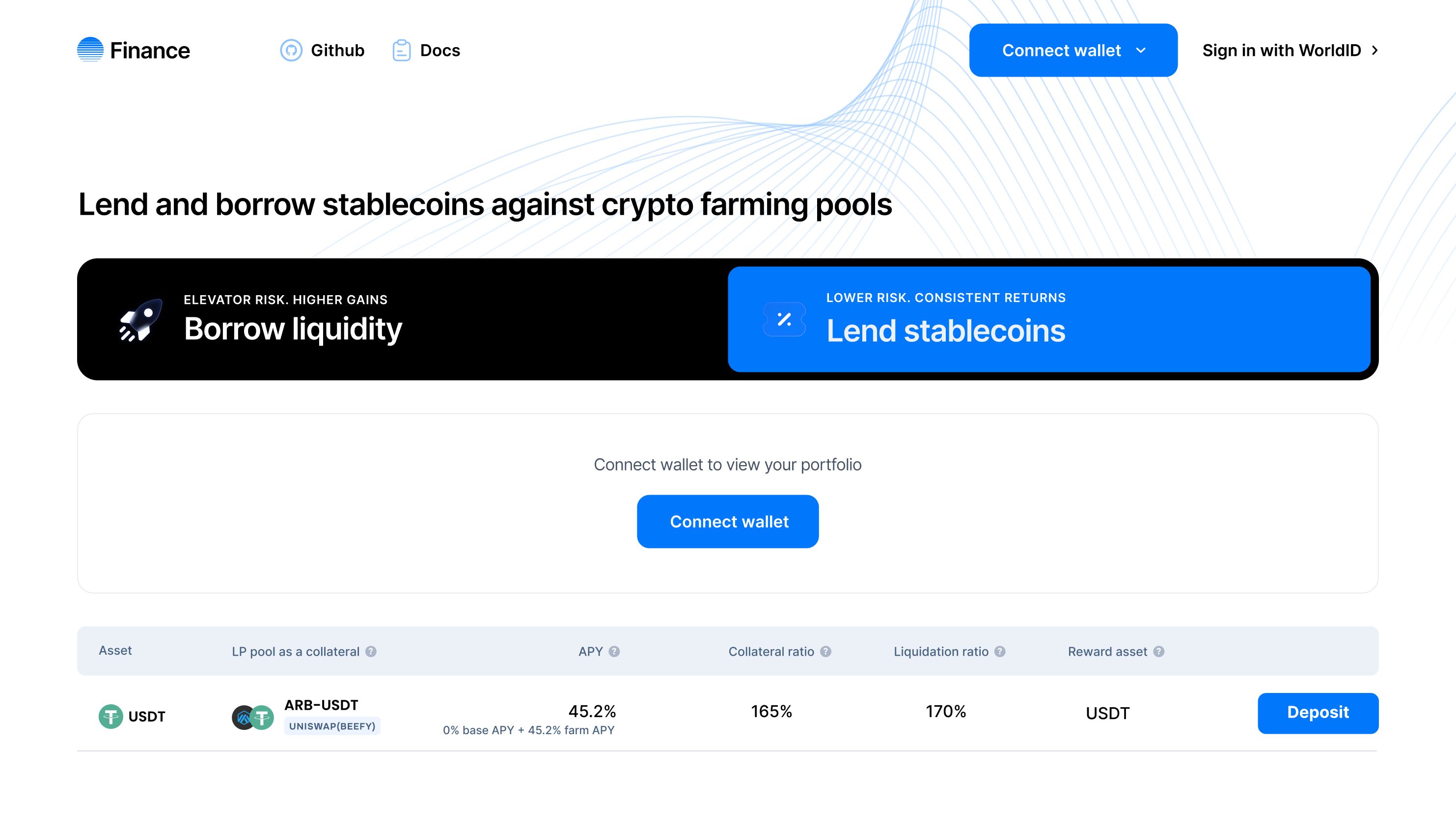

- Integrated front-end wallets MetaMask and WalletConnect for protocol interaction,

- A governance contract performing functions such as determining deposit and loan rates, as well as initiating reward accruals to lenders using the connectors mentioned above.

The underlying financial model of the .Finance protocol is as follows: To calculate lender returns, an approach similar to profit and loss accounting is employed. It is similar to fixed-income instrument models like bonds, with adjustments for the assets used (LP tokens).

An accrued coupon income model is used to determine the final balance for each lender and borrower, accounting for yield-bearing token (LP) income. The system is built on a registry model with temporal snapshots. The registry is based on borrowers who have deposited yield-bearing tokens (LPs) as collateral. The smart contract's registry is tasked with evaluating the position in stablecoins (LP tokens) that the borrower has contributed when taking out a loan.

Upon completing a transaction (obtaining a loan), initial position data is recorded in the registry. Subsequently, every n blocks involve a position recalculation, determining its change over time. This change is central to lender returns, with 65% allocated to the lender pool and 35% retained by the borrower. Afterwards, data on the new position evaluation and block snapshot number are recorded in the registry. The baseline yield rate is determined by the yield of the yield-bearing token (farming LP).

The registry ensures accurate calculation of the borrower's position evaluation and protects the lender from risks associated with the yield-bearing token's (LP) market value decline, thanks to a liquidation mechanism and periodic yield withdrawal.

Our dApp utilizes the following technologies and partner products:

- 1Inch protocol for exchanging lender profits into the underlying asset,

- Beefy protocol for using yield-bearing tokens as collateral and managing the borrower's income position,

- Metamask for front-end interaction with protocol contracts,

- WalletConnect for front-end interaction with protocol contracts.

The .Finance product is multi-chain, currently supporting the following chains:

- CELO

- PolygonZKEVM

- Base

- Linea

- Arbitrum

- XDC Network

- Gnosis Chain

- Mantle

- Scroll