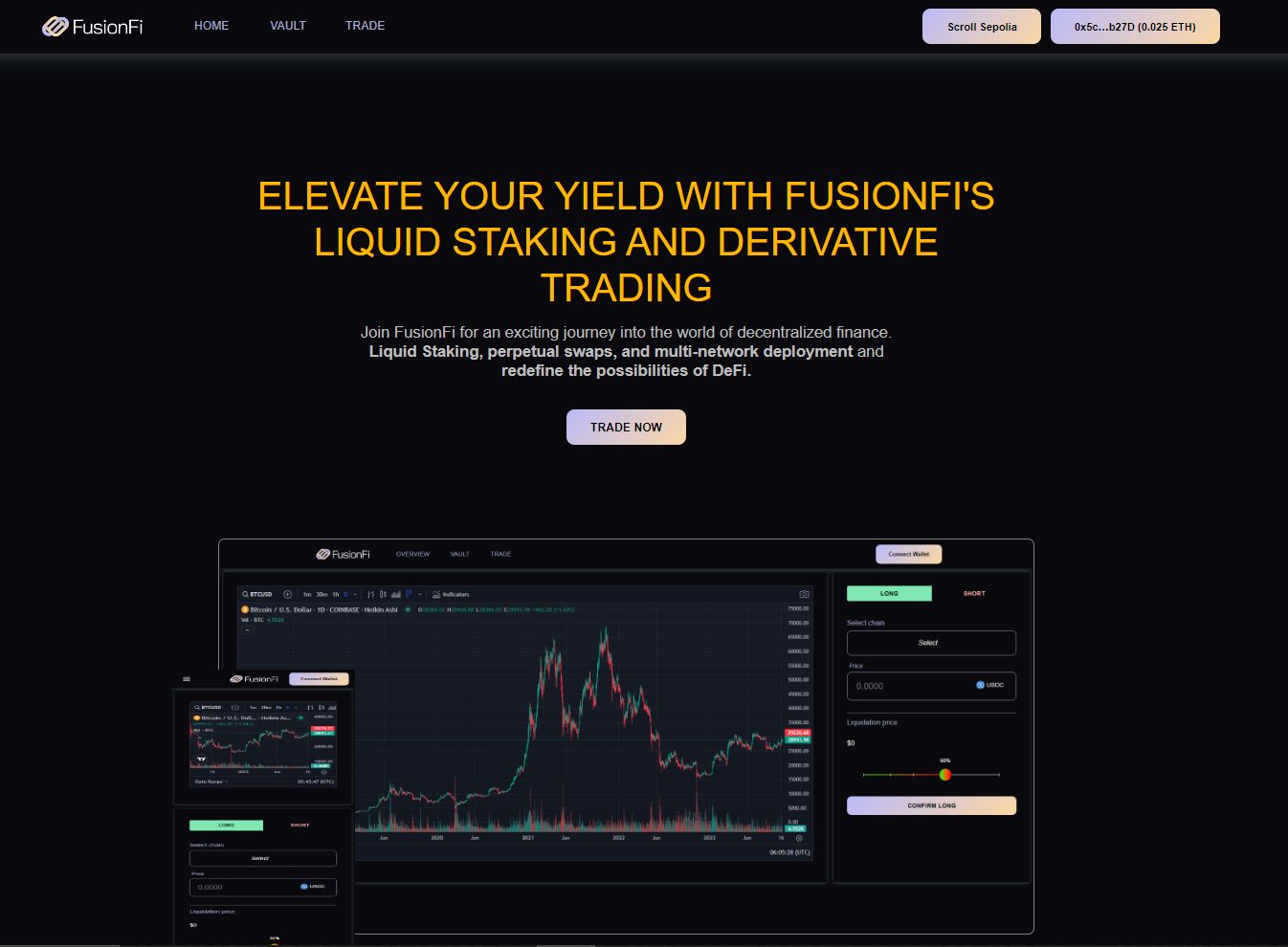

FusionFi

FusionFi is a cutting-edge DeFi derivative project that utilizes Liquid Staking to offer users more than a 5% Annual Percentage Rate (APR) over your LST tokens.

Project Description

FusionFi is an innovative decentralized finance (DeFi) project that leverages Liquid Staking to provide users with opportunities beyond the traditional 5% APR. Liquid Staking allows users to maximize their returns by staking sDAI with ETH, enabling them to earn and access additional benefits. Here's a more detailed look at how FusionFi operates:

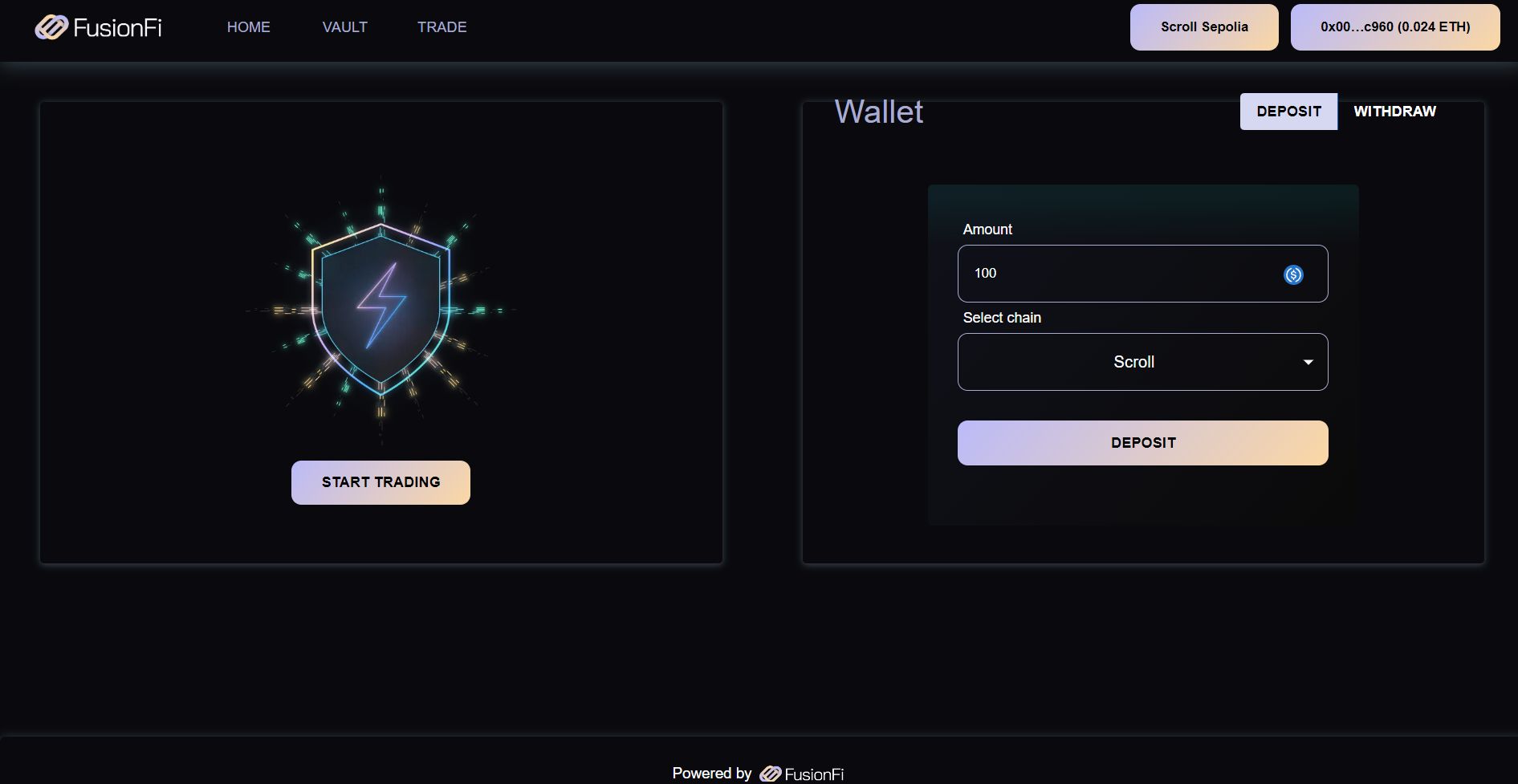

Liquid Staking: Users begin by staking their sDAI using ETH as collateral. In return, they receive an equivalent amount of sDAI. This process unlocks the potential for users to generate higher yields on their assets, going beyond the typical staking or lending returns seen in DeFi.

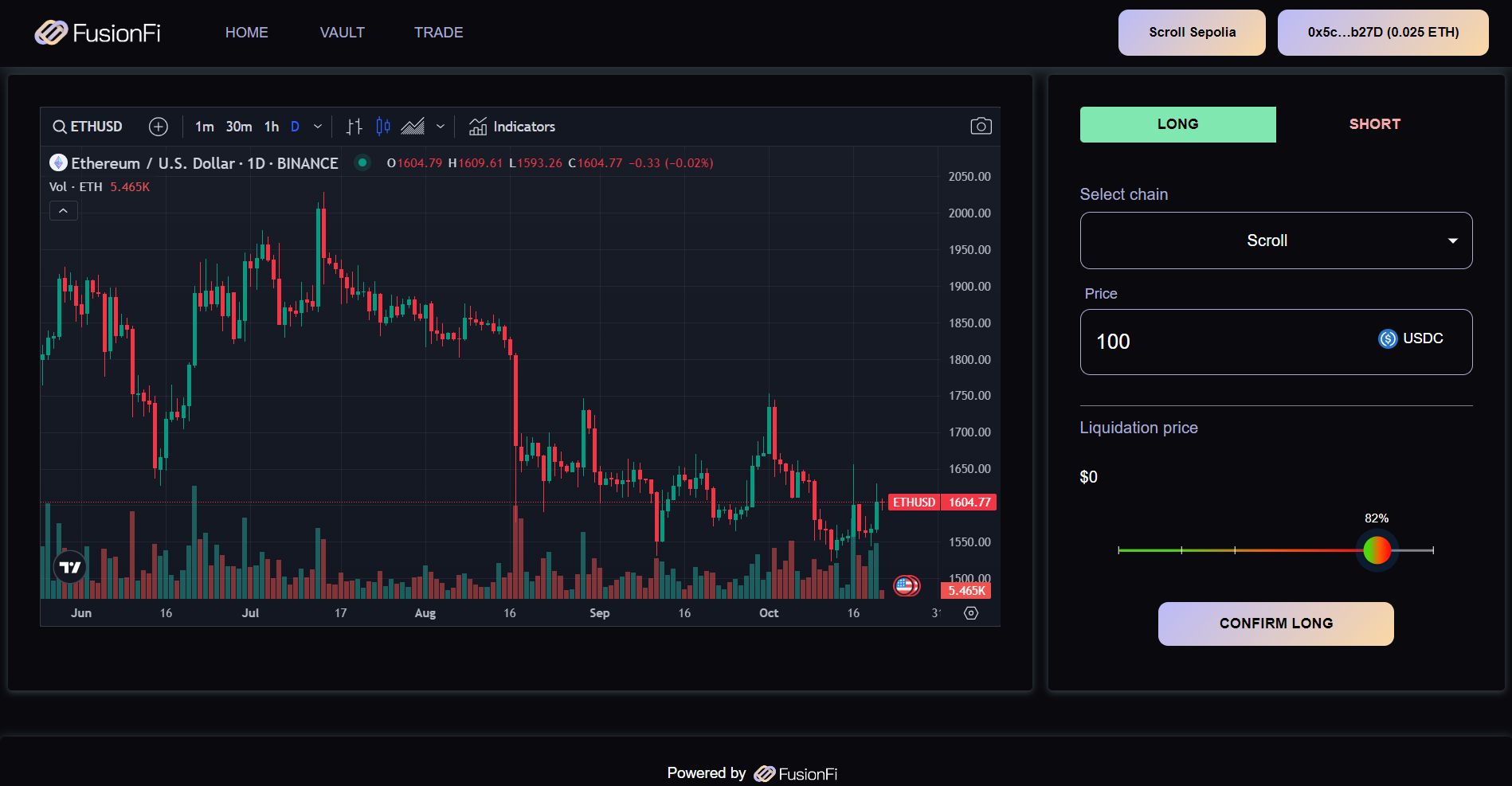

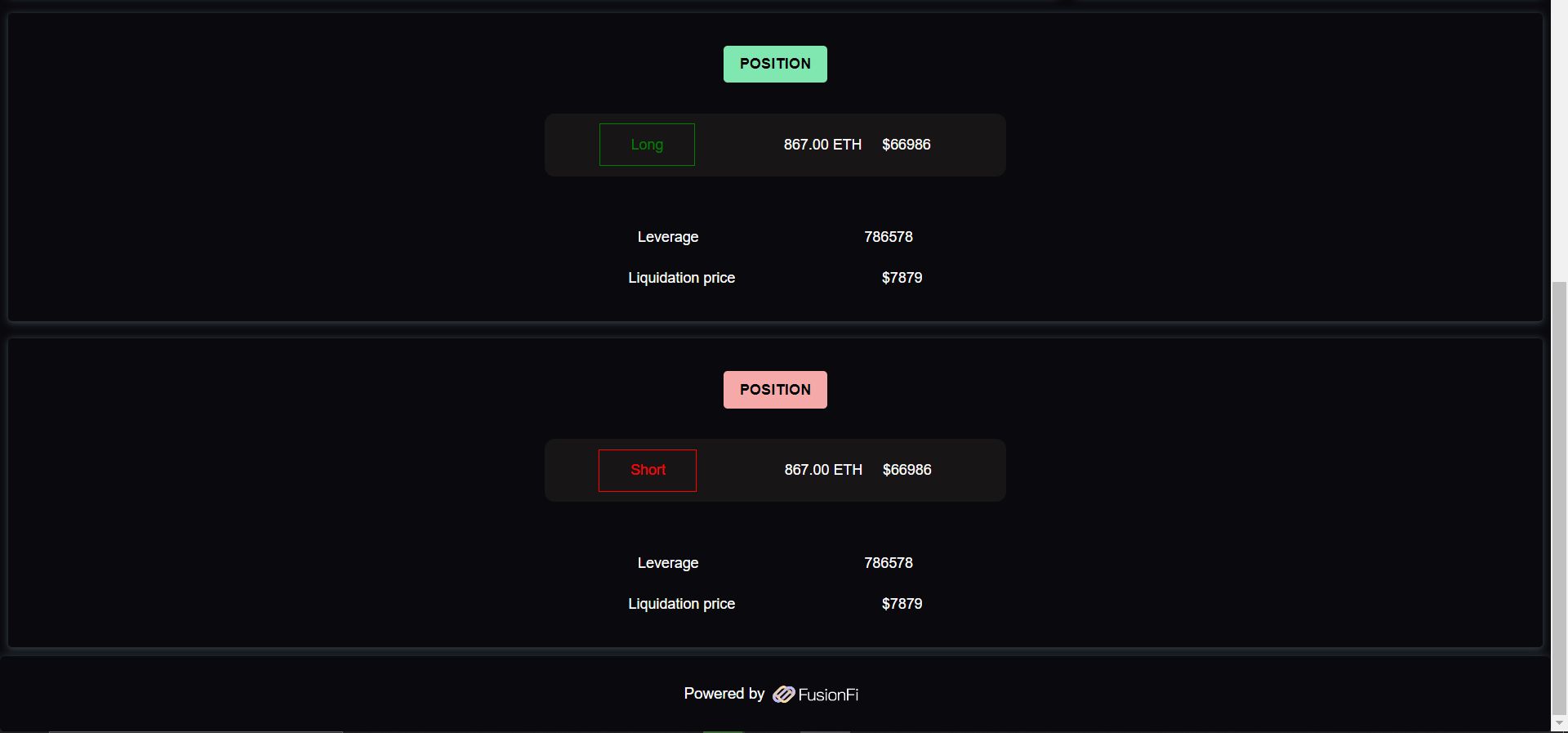

Perpetual Swap Derivative Trading: Once users have their sDAI, they can delve into the exciting world of perpetual swap derivative trading. This type of trading enables users to speculate on the future price movements of various assets, including cryptocurrencies, commodities, and more. Users can open positions by either going "long" (betting that the asset's price will rise) or "short" (betting that the price will fall).

Trading Against the Vault: What setsFusionFi apart is that all derivative trades are executed against the vault itself. If a user decides to take a long position, the vault will automatically take a short position to match it. This mechanism ensures that there is always an opposing position in place, maintaining the integrity of the trading system.

How it's Made

Technologies Used:

Smart Contracts (Solidity): The core of the project is built on Ethereum using Solidity. Smart contracts handle staking, trading, and various other functionalities.

Web Frontend (React.js): React.js is used to create a user-friendly web application for users to access and interact with the platform.

Scroll/Mantle/Polygon zkEVM: These technologies are employed for smart contract deployment and execution. They enhance scalability and reduce transaction costs through layer-2 solutions.

Spark: Spark is used to leverage the sDAI Vault and Conduits, enabling connections to various protocols to provide liquidity and support seamless trading.

UMA/ChainLink (To Be Determined - TBD): UMA or ChainLink could be integrated for price oracle services, ensuring accurate and reliable price feeds for assets within the platform.

Development Process:

Smart Contract Development (Solidity):

A team of blockchain developers writes and deploys smart contracts that manage Liquid Staking, trading, and other aspects of the platform. The smart contracts interact with the Spark platform to access the sDAI Vault and Conduits for liquidity management.

User Interface (React.js):

A frontend application is developed using React.js, providing a user-friendly experience for account management, trading, and monitoring. Layer-2 Deployment (Scroll/Mantle/Polygon zkEVM):

The project uses a Layer-2 scaling solution, such as Scroll, Mantle, or Polygon zkEVM, to deploy smart contracts on the Ethereum network. This reduces transaction costs and enhances scalability.

Utilizing Spark and Conduits:

The platform leverages the Spark platform to interact with the sDAI Vault and Conduits, which facilitate liquidity management by connecting to other DeFi protocols. Price Oracle Integration (UMA/ChainLink - TBD):

The project plans to integrate UMA or ChainLink for price oracles to ensure that accurate asset prices are available for trading and margin calculations.

Benefits of Partner Technologies:

Scroll, Mantle, or Polygon zkEVM layer-2 solutions reduce Ethereum gas fees and improve transaction speeds, making the platform more cost-effective for users. Leveraging Spark and Conduits enhances liquidity and expands the available trading options. Integrating UMA or ChainLink price oracles guarantees the accuracy of asset prices, essential for trading and margin calculations. Notable Considerations:

Layer-2 solutions can significantly improve the scalability and cost-effectiveness of the platform, but they require thorough testing and security measures to ensure user funds' safety. Integrating various external technologies, such as Spark and Conduits, involves careful coordination to ensure the seamless operation of the platform. Price oracle integration is crucial for accurate trading in which we choose Chainlink to get accurate data feed.