GHODiversiTech

A truly chain-independent🔗 stablecoin that integrates a diverse collateral framework, a robust stability mechanism, risk bonds and risk evaluation models! 💰

Project Description

Cross-chain protocols like CCIP enable interoperability between different blockchain networks, allowing assets to be transferred seamlessly between them. We have thought of the following components for the project:

-

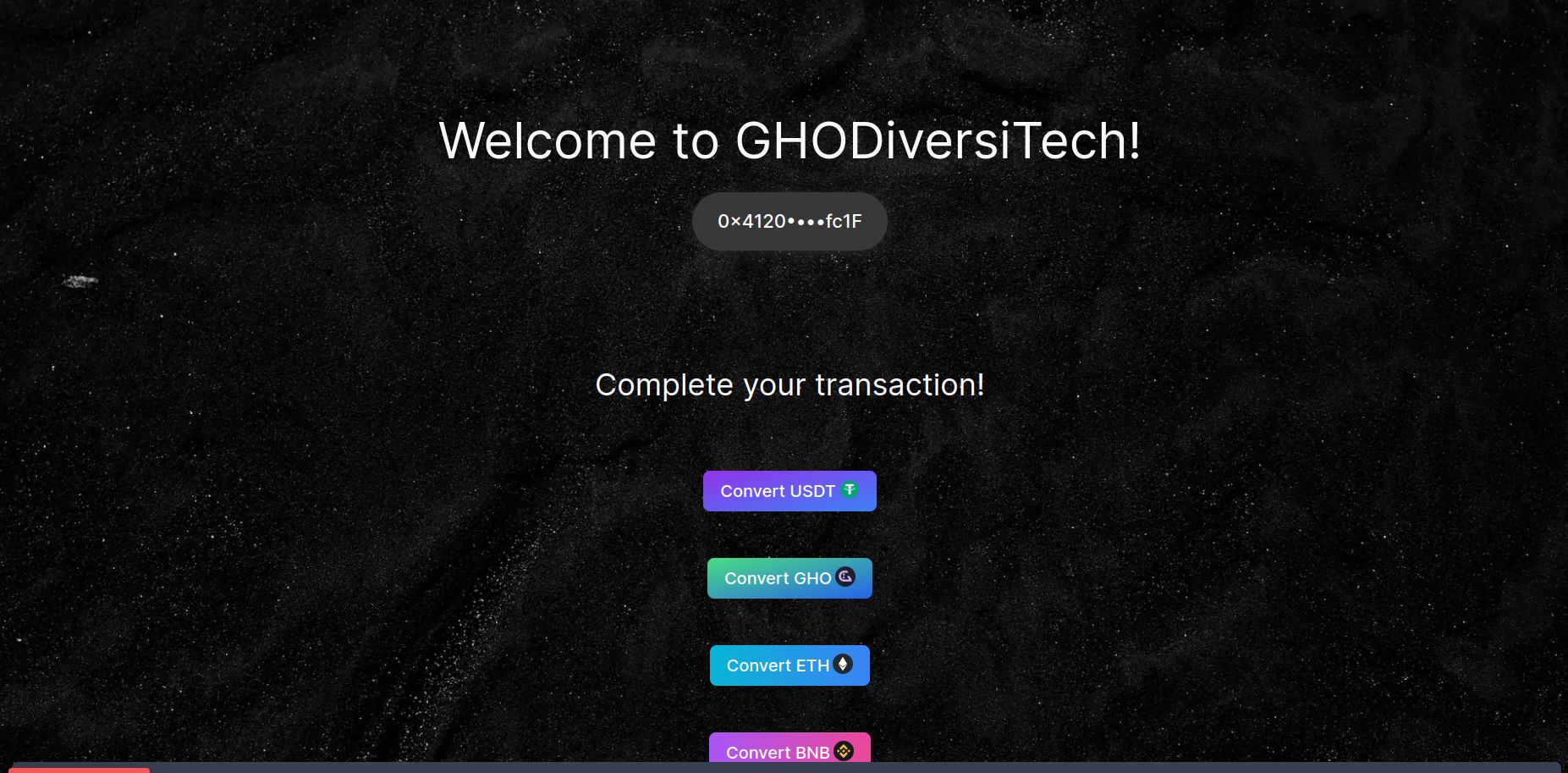

Diversified Collateral Framework The system will be designed with a diversified collateral framework. This implies that various types of assets may be used as collateral to back the stablecoin, providing stability and reducing risks associated with relying on a single type of collateral. We plan to include 4 types of assets currently available on CCIP Sepolia and BNB Testnets (ETH, BNB, USDT, & GHO).

-

Stability Mechanism The stablecoin system will incorporate a stability mechanism. Stability mechanisms are crucial for maintaining the value of the stablecoin close to its peg, typically to a fiat currency like the US Dollar.

-

Clearing System: A clearing system indicates a mechanism for settling transactions and ensuring the integrity of the financial transactions within the system. The clearing system will consist of multiple levels based on certain risk factors (evaluated from the below mentioned risk assessment techniques adopted by us).

-

Introduction of Risk Bonds: We aim to introduce the concept of risk bonds, which could be a novel financial instrument used to manage and mitigate risks within the stablecoin system. Risk bonds will be employed as a tool to absorb and distribute risks among participants.

-

Market Maker: This will provide liquidity for the lending and asset synthesis market, improving on-chain financial mechanisms, and expanding to relevant third-party applications outside the system. When more liquidity is added to the Market Maker pool, more number of resultant stable tokens can be borrowed from the pool.

-

Risk Evaluation Models: The stablecoin system incorporates risk evaluation models similar to those in traditional finance. This implies quantification of the risk levels due to market fluctuations of one/many of the supporting collaterals

How it's Made

Cross-chain protocols like CCIP enable interoperability between different blockchain networks, allowing assets to be transferred seamlessly between them. We have thought of the following components for the project:

-

Diversified Collateral Framework The system will be designed with a diversified collateral framework. This implies that various types of assets may be used as collateral to back the stablecoin, providing stability and reducing risks associated with relying on a single type of collateral. We plan to include 4 types of assets currently available on CCIP Sepolia and BNB Testnets (ETH, BNB, USDT, & GHO).

-

Stability Mechanism The stablecoin system will incorporate a stability mechanism. Stability mechanisms are crucial for maintaining the value of the stablecoin close to its peg, typically to a fiat currency like the US Dollar.

-

Clearing System: A clearing system indicates a mechanism for settling transactions and ensuring the integrity of the financial transactions within the system. The clearing system will consist of multiple levels based on certain risk factors (evaluated from the below mentioned risk assessment techniques adopted by us).

-

Introduction of Risk Bonds: We aim to introduce the concept of risk bonds, which could be a novel financial instrument used to manage and mitigate risks within the stablecoin system. Risk bonds will be employed as a tool to absorb and distribute risks among participants.

-

Market Maker: This will provide liquidity for the lending and asset synthesis market, improving on-chain financial mechanisms, and expanding to relevant third-party applications outside the system. When more liquidity is added to the Market Maker pool, more number of resultant stable tokens can be borrowed from the pool.

-

Risk Evaluation Models: The stablecoin system incorporates risk evaluation models similar to those in traditional finance. This implies quantification of the risk levels due to market fluctuations of one/many of the supporting collaterals