GHOsafe Credit (GSC)

Lending platform dependent on the Credit score on the platform

Project Description

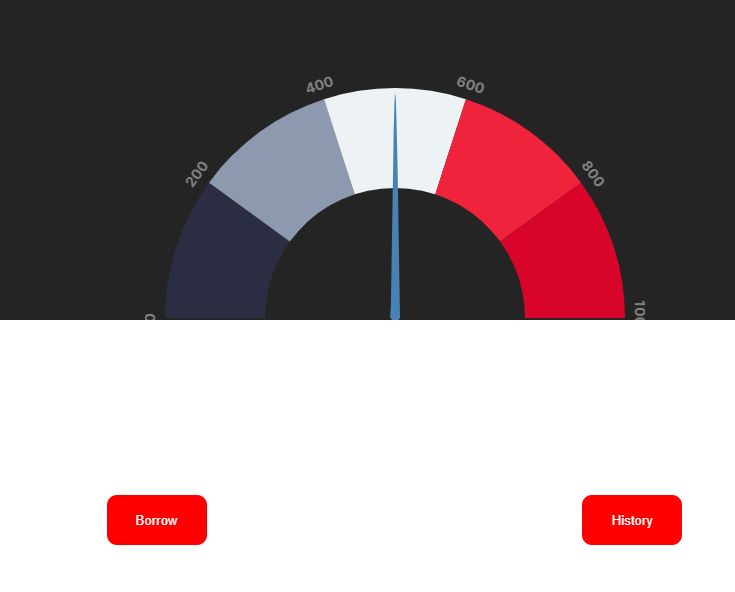

The GHOsafe Credit (GSC) is a digital version of a small lending library, but instead of books, it deals in money. Imagine it as an online banking service where the boss (admin) can give users a rating based on how trustworthy they are with money (credit score). Users with better ratings can borrow money at cheaper rates.

When someone wants to borrow money, they can tell the system how much they need. If the system has enough money to lend, it gives them the cash, noting down the details like when they have to pay back and the extra fees (interest).

Borrowers have a set time to give the money back (about a month). If they do this on time, the system gives them a better trust rating for next time. If they're late or don't pay at all, their rating goes down, making future borrowing costlier or harder.

And just like people put money in a bank, anyone can send money to this system to help it lend out more. It keeps a tally of all the money it has and uses this pool to lend out to others. This digital helper is like a mini online bank that keeps an eye on who borrows money, making sure they pay back on time and that the books balance in the end.

How it's Made

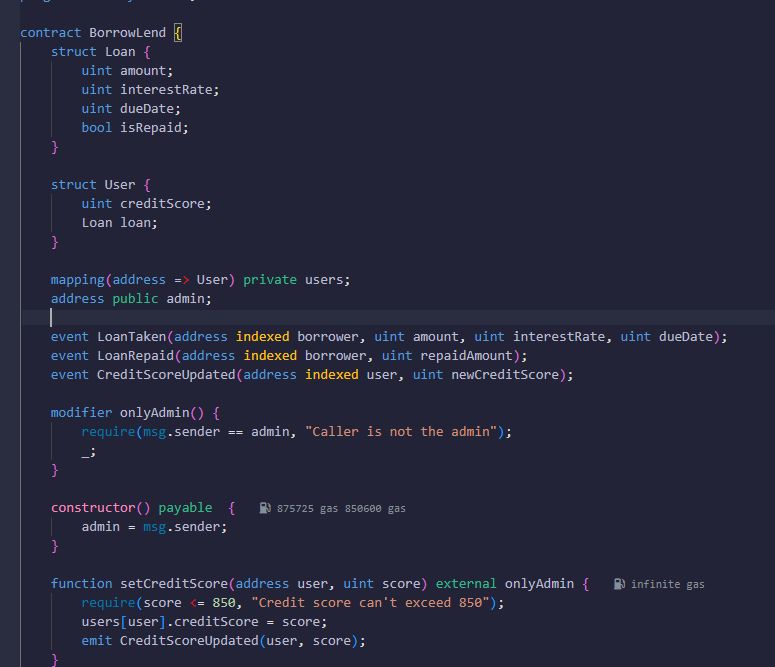

The smart contract sets up a simplified lending system on the Ethereum blockchain, where users can take out loans and repay them with interest. The admin of the contract, typically the deployer, has the exclusive right to assign credit scores to users. Credit scores affect the interest rate applied to loans. When a user borrows funds, the event LoanTaken is emitted, and the loan amount is transferred to them from the contract's balance if sufficient funds are present.

Repayment of the loans must occur within 30 days, including the calculated interest, which influences the user's future credit score. Timely repayments increase the credit score, while delays or defaults lead to deductions, as managed by internal functions. The contract accepts deposits to fund its operations through the fallback receive function. In essence, the contract tracks and administrates loans, rewards punctual repayments, penalizes defaults, and records significant financial interactions.