Kindred

A platform for 0% interest loans amongst trusted peers that generates compound interest in large group sums

Project Description

The Kindred Protocol utilizes the base concept of a rotating savings and credit association. This is a system utilized throughout Latin America, Africa and South and Southeast Asia. It goes by over 200 names some of which are a tanda in Mexico, a pandero in Peru and Brazil, arisan in Indonesia, hui in Vietnam and China, chama and susu in Western Africa and the Caribbean. The concept revolves around an informal loan club amongst a group of peers that trust one another. This could be family, friends and coworkers. They get together and decide to put a portion of their paychecks into a pool which they then take turns giving to one of the paying members. For example, let's say Alice, Bob, Caleb and David form a pool at $100 paid in among the members each month to be distributed in order by name of the person. The first month Alice would be paid $400, Bob would be paid $400 on the next and so on until David receives $400 and the loan club would be complete. At the front end of this, it's effectively a 0% interest loan and on the back end it's a socially incentivized way to save. As you could probably infer, the person at the back end of the circle doesn't receive much benefit outside of a socially compelled mechanism that forces them to save money. We think it could be better.

Our protocol takes this concept and modifies it slightly so that it solves a couple problems with the above. One, we ensure that no matter what, 1 more payment is received from an untrustworthy person than would otherwise be acquired. Two, we ensure that the pool of funds accumulate compound interest throughout the life of the loan club and are distributed according to member needs. Three, we make it so that it's available globally to any willing participants. This would help with family members or friends who have emigrated to another country and still want to participate in family finances. An ideal solution for blockchain.

Our solution to the first two problems are accomplished by modifying the structure of the loan so that the first payment is made and immediately begins investing into a yield aggregator. The first draw from the pool only happens when the second set of payments is made from members of the group and therefore incurs compound interest on the yield acquired at the group pool amount throughout the life of the loan club. At the end of the loan club cycle, the yield is distributed according to members' desires and amongst those who made their payments on time. It is our belief that members should choose to allocate it on an ascending scale towards the members at the back of the loan club with the participant at the front receiving a smaller reward because of the gain from the 0% interest loan. From this system of payments and keeping a record in the blockchain, and utilizing tools like a proof of humanity and unique identity, we can use this to generate a credit score on specific accounts and create a social graph of trust. This would enable a network of micro credit unions where members could apply into loan clubs where a person is unknown, or be used to offer undercollateralized loans by friend of a friend of a friend relationships within the circles at significantly reduced rates from credit card companies.

How it's Made

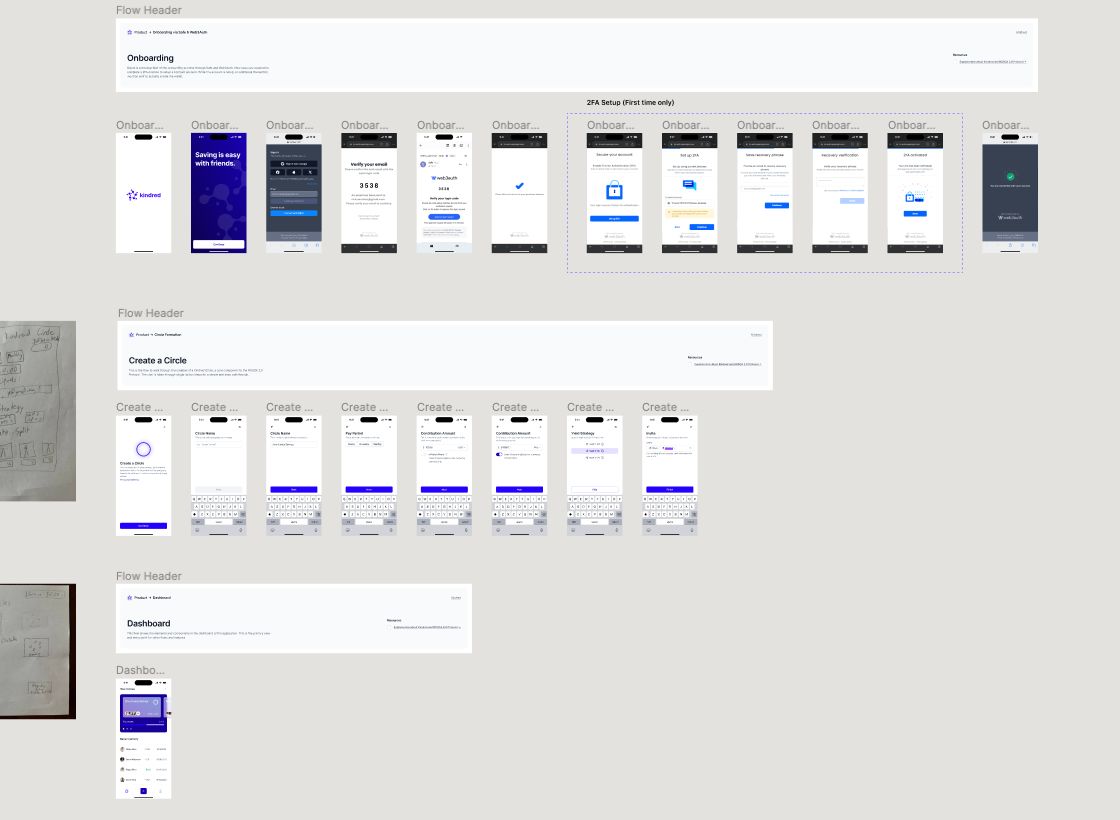

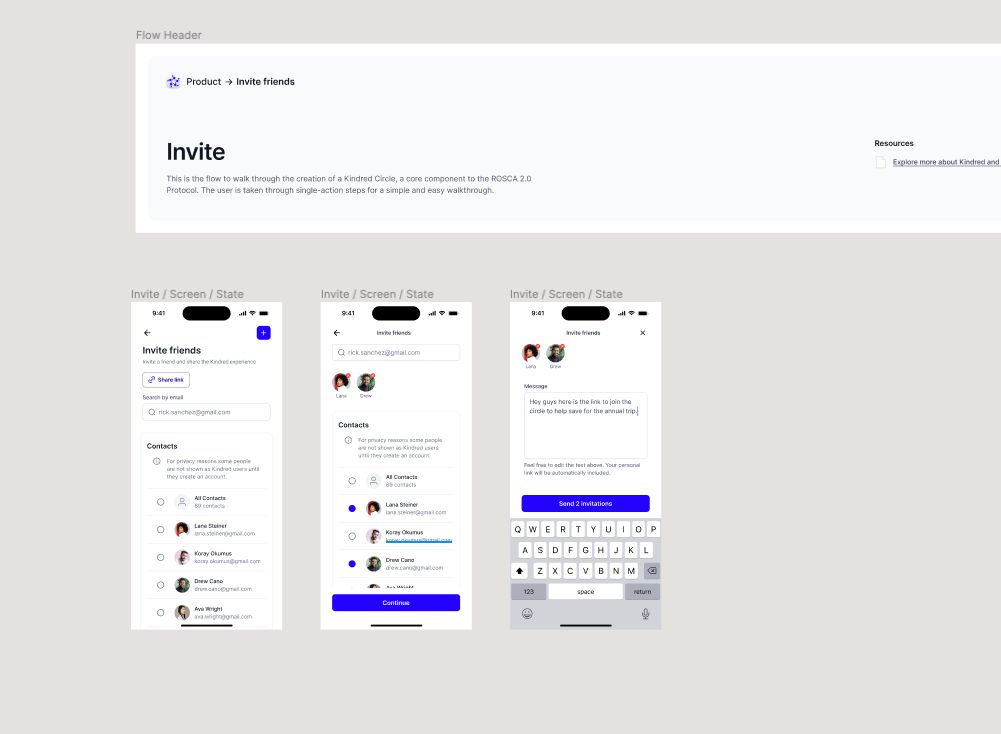

We use a combination of Lit Protocol to integrate into Whatsapp accounts and Zerodev headless wallets to create and preregister a group of users to account abstraction enabled wallets created directly off of their Whatsapp public key and create gasless transactions.

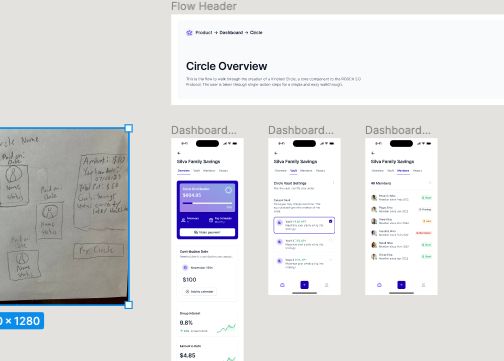

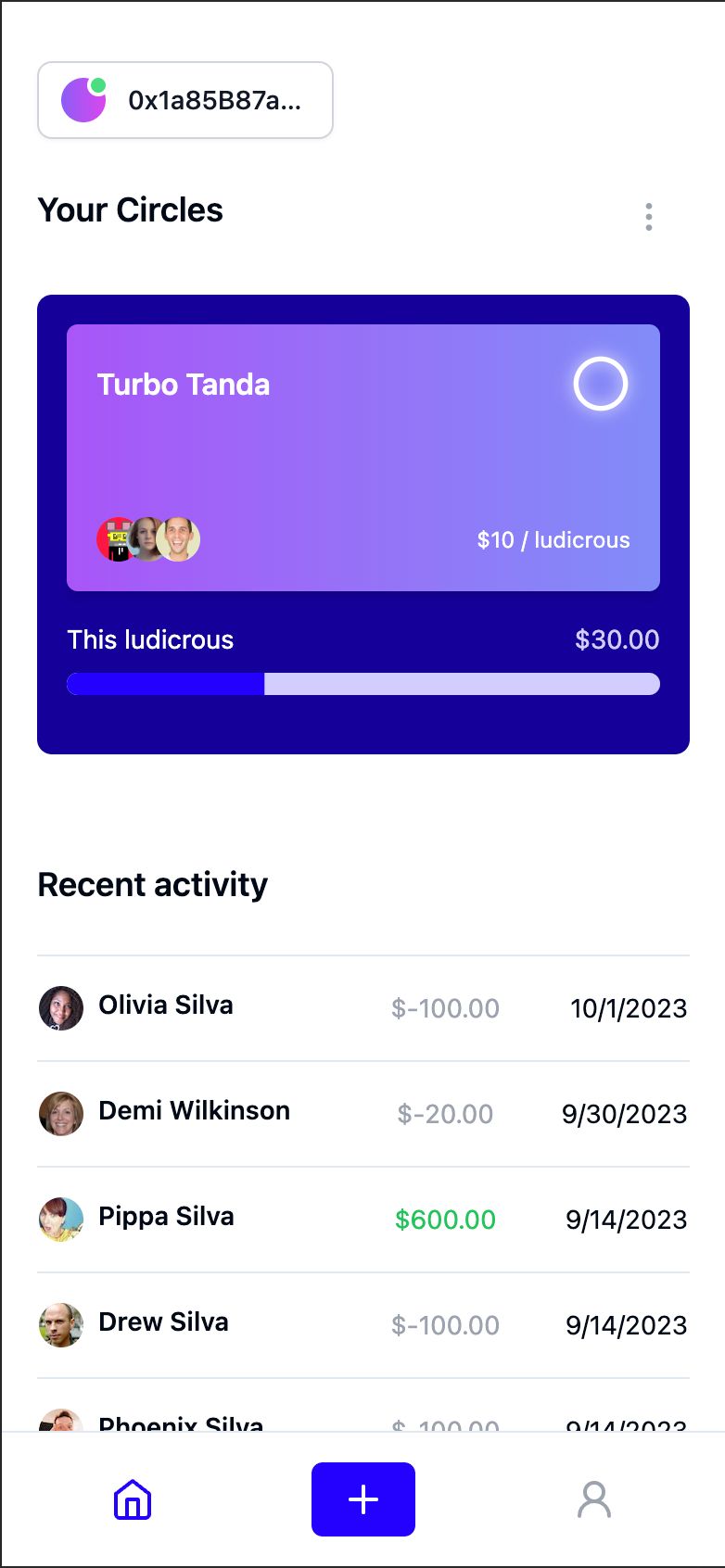

Once registered, you are entered into a dashboard where you can view your circles via queries on the Graph, set to search on the Mumbai network while tracking supply changes from compound finance.

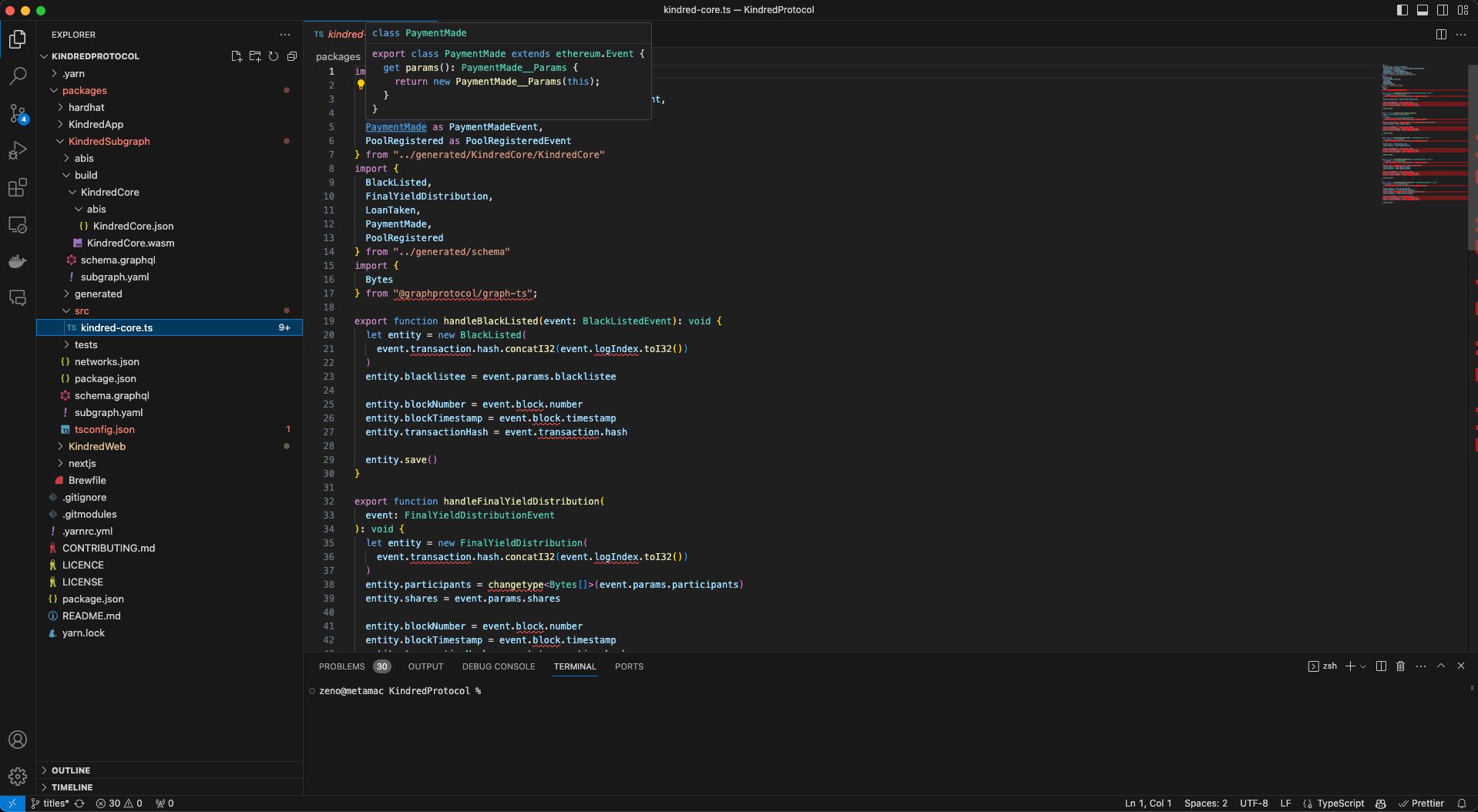

We're using Hardhat and NextJs through scaffold-eth to build out initial prototype. Contracts are written in Solidity. Funds are currently aggregating interest through Compound. The backend is run through subgraphs running on the Graph and will eventually be used to model out the social graph of trusted peers and gather payment and blacklisting history of individuals.