Kite

Kite is a BNPL integration with a GHO-backed ERC-4626 vault. Users can conveniently offset interests accrued on their installment payments with yields earned from the Aave marketplace.

Project Description

Kite offers an on-chain BNPL service that capitalizes on liquidation strategies on the Aave marketplace to benefit users returning payments over a fixed period of time.

The GHO-backed ERC-4626 vault allows depositors to earn yield on their GHO deposits. This yield can be used to offset portions of installment payments agreed with an enabled Merchant.

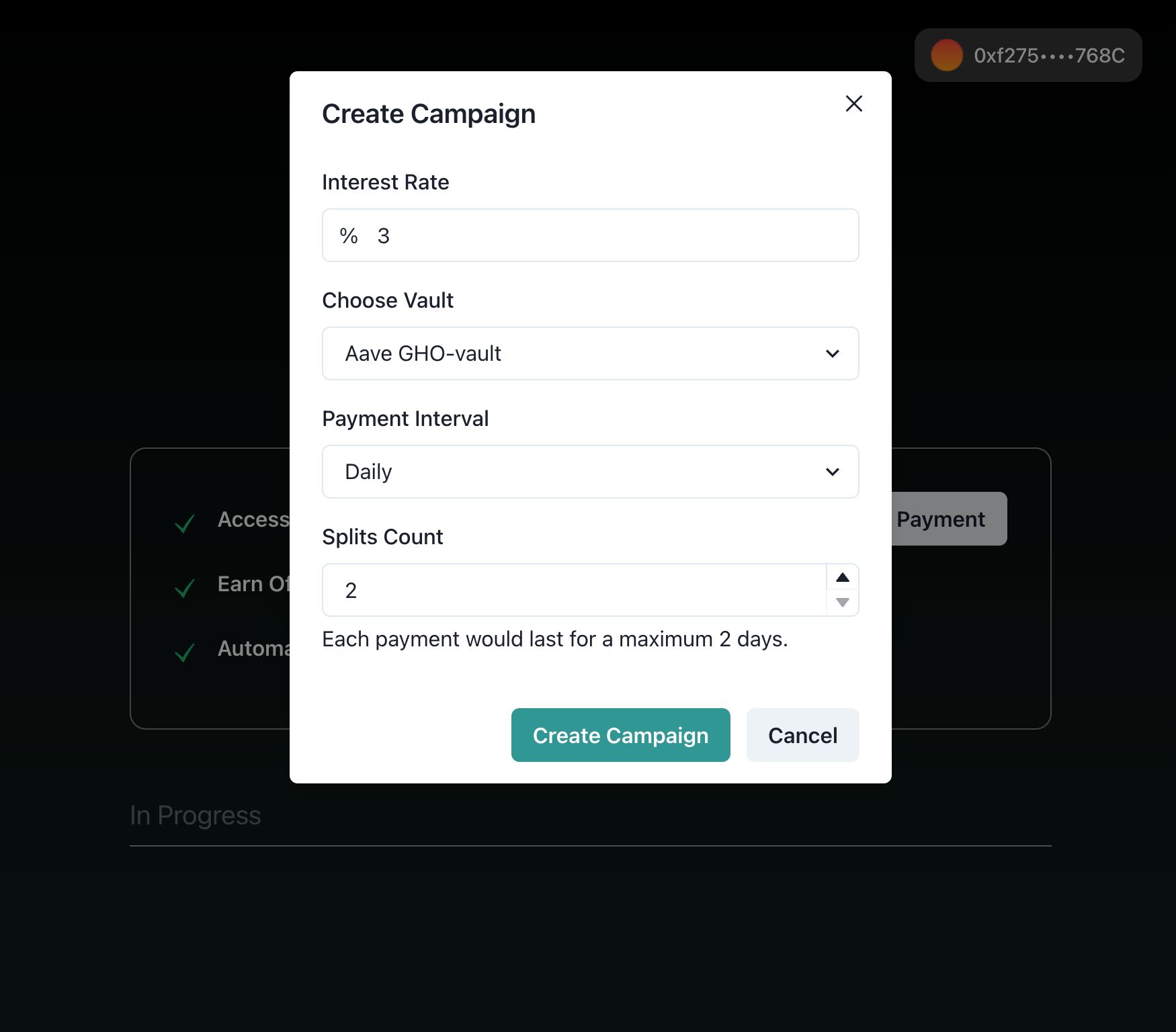

Individual Merchants, Teams, and DeFi projects can offer customers the option to pay in Kite installments over a set period by creating New Campaigns on-chain, where the terms and conditions of a payment plan are defined.

How it's Made

The Kite Core contract holds ownership of the vault and uses the GHO within the total supply to liquidate unhealthy loans on the lending markets.

Kite Core has Chainlink's AutomationCompatibleInterface. This allows off-chain liquidation bots, which monitor the health factors on Aave, to trigger a liquidation process when they detect an undercollateralized loan and confirm sufficient liquidity in Kite's vault.

Interoperability with CCIP While Kite's core is deployed on the Sepolia Testnet, Campaigns can be initiated from other Layer 2 networks like Avalanche, using Chainlink's CCIP and LINK as a universal gas token to pay for transactions.

On Mainnet launch, where the USDC token is supported on CCIP, merchants could receive payments from Sepolia to other destinations.