Konoha

Omni-Chain Yield Aggregator. Bridge, swap and deposit all automatically.We constantly compare the highest APYs across multiple chains and optimally invest in them.

Project Description

Existing yield aggregators have two problems.

- Only a single chain is supported.It is not possible to compare across the chain. 2.Lots of actions required. If you want to move assets to another chain、 you need to withdrawing, bridging, and depositing.... and so on.

Konoha is an omnichain yield aggregator that solves these problems. Konoha is unique in 2 ways.

First, Konoha Always continue to invest in the highest APY. We now support Moonbeam, Ethreum , and polygon, and invest in the best lending protocol among these.

Second, is All of this is done automatically. Once deposited, all asset management is handled by Konoha. The user then only needs to withdraw.

Let me explain the architecture in a little more detail.

First of all, we determined the "operative chain". In this hackathon, we chose Moonbeam.

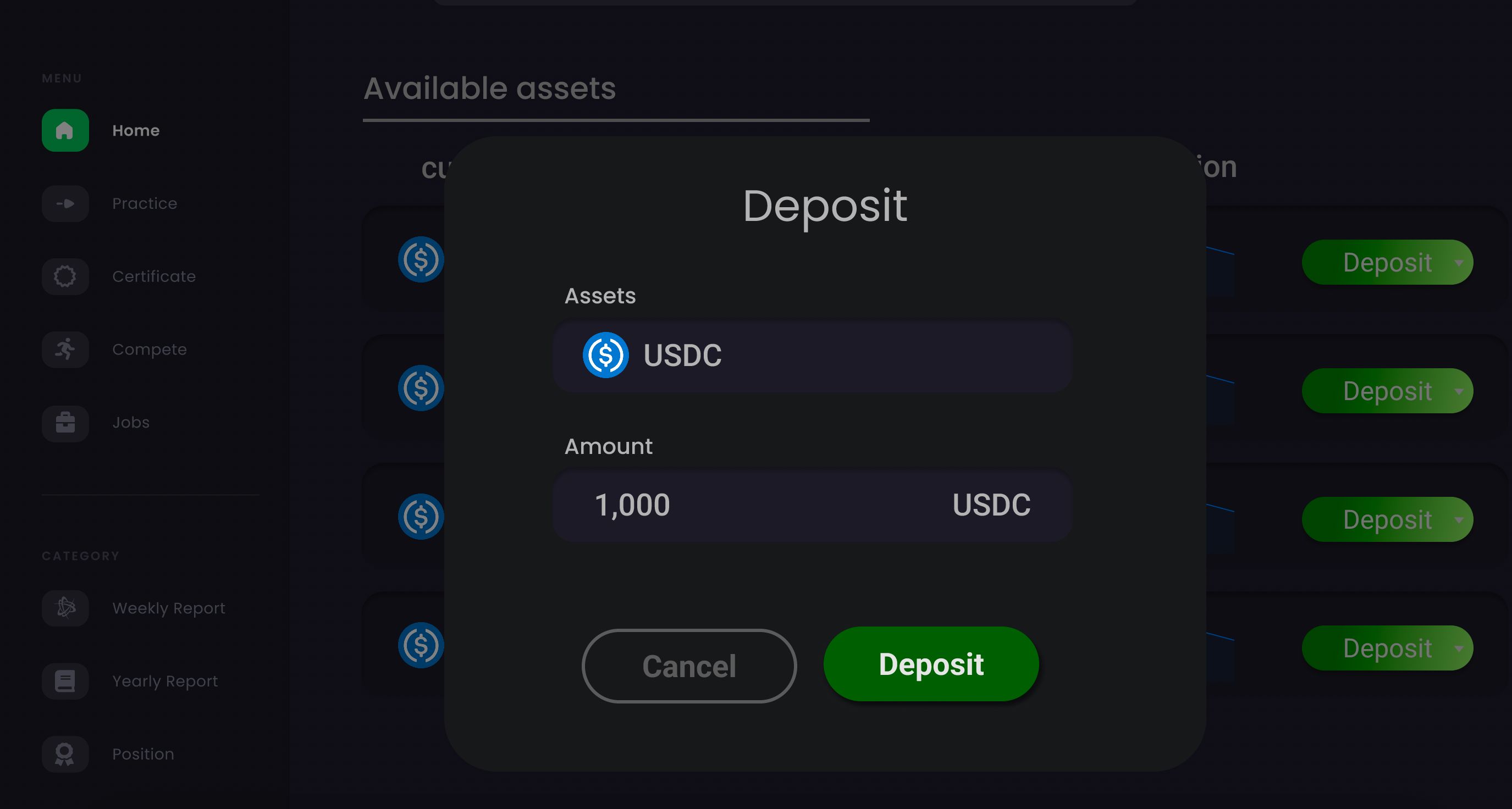

Next, the user makes a deposit on Moonbeam.

We created a server that gets the APY for DeFi s, validates it and sends it to Moonbeam so rebalance by comparing which DeFi has the highest APY every 2 hours.

If necessary, bridge and staking is executed using a messaging protocol.

How it's Made

@Uniswap We hacked the bridge and the lending to make a smart connection.Normally, bridged currency cannot be deposited directly into a lending protocol, which is very unusable.Therefore, we used Uniswap to swap the bridged currencies to enable seamless linkage.

@ChainLink We used Chainlink Clone. This is essential for yield aggregators, and we use it to compare the APYs of multiple chains acquired by Konoha every two hours.

@Moonbeam We chose Moonbeam for our chain of operations. Users deposit assets on Moonbeam and smart contracts determine the best lending protocol. As a result, we are able to connect Moonbeam with other chains' lending protocols and efficiently manage assets.

@Polygon To take advantage of the omni-chain's yield aggregator strengths, we set two requirements for chain selection: 1. the presence of a DeFi with a large number of users; and 2. relatively low gas costs.In this hackathon, we are making it possible to link Aave on polygons for more efficient asset management.

@Sygma In an omni-chain yield aggregator, it is important to send information about each chain efficiently. We used Sygma to efficiently let other chains know which APY is the highest right now.