L3ND

A NFT–backed lending solution for the majority of the retail collections, where users obtain instant liquidity from its NFTs by using them as collateral.

Project Description

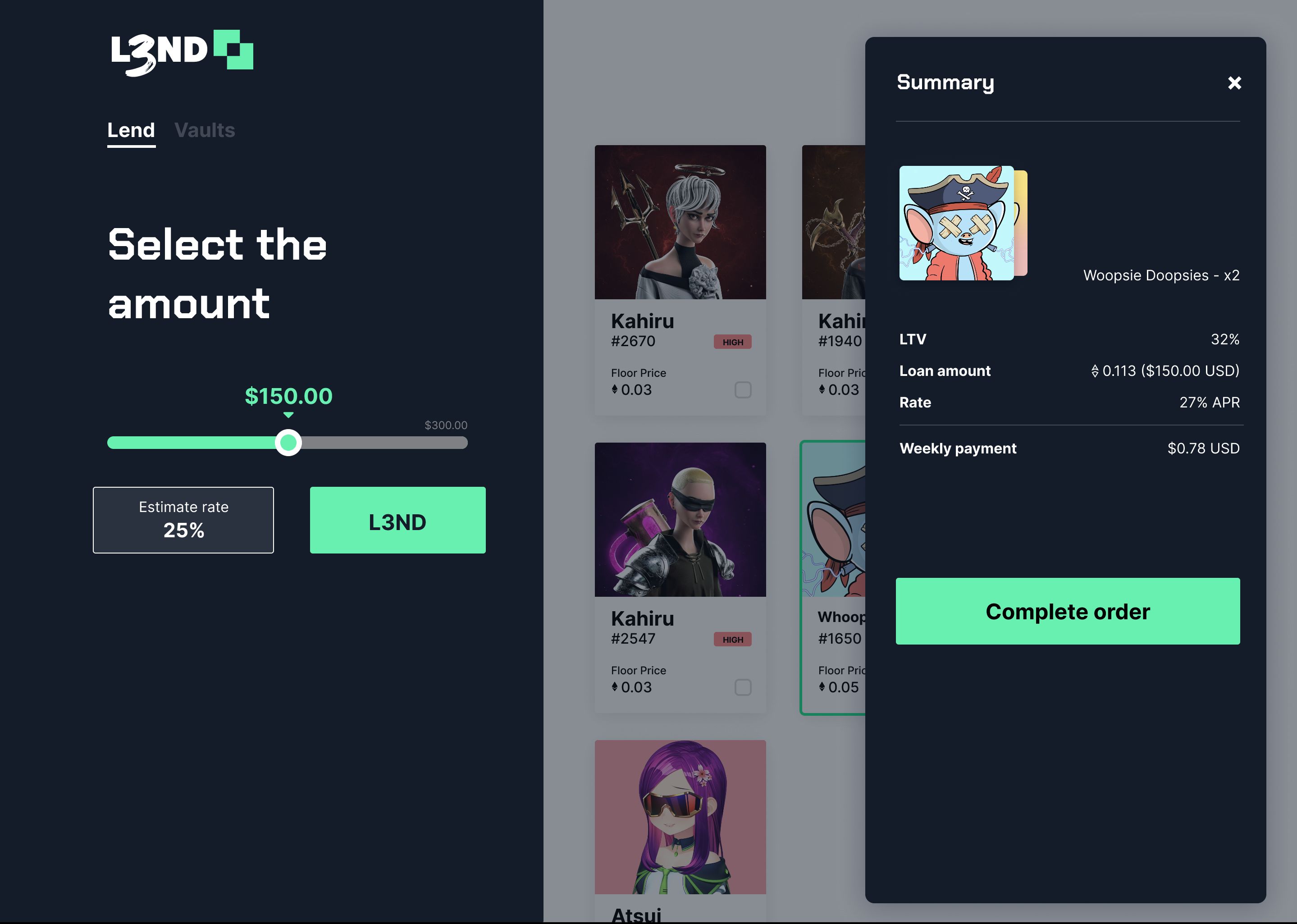

We’re building a P2Pool micro credit platform, where users can use most of retail NFTs as collateral. On the user’s side, they access our web-app and login with their wallet using MetaMask. We’ll display all the NFTs on the user’s wallet (allowed for credit) so they can choose which NFTs they’d like to use as collateral. Once they choose the NFTs they want to use we present the LTV, rate and max credit amount, calculated in real time. This is based on a collection’s credit score and a user’s credit score that we establish. For the collection’s credit score we take into account floor price, total volume, 24h volume, % listed, and unique owners, our algorithm gives a score to each category and calculates a final score. To get this information up to date when the user request the loan, we plan to use The Graph, and create a new Graph to validate the collections we accept. On the other hand, for the user’s credit score, we only take into account the credit history in our platform at the moment, we plan to analyze the user’s activity in marketplaces and more to give a more accurate score in the future. At the moment we take into account number of loans in our platform, payment history, and early payments. Our algorithm computes both scores and gives the final loan’s parameters for the user to accept or decline the deal.

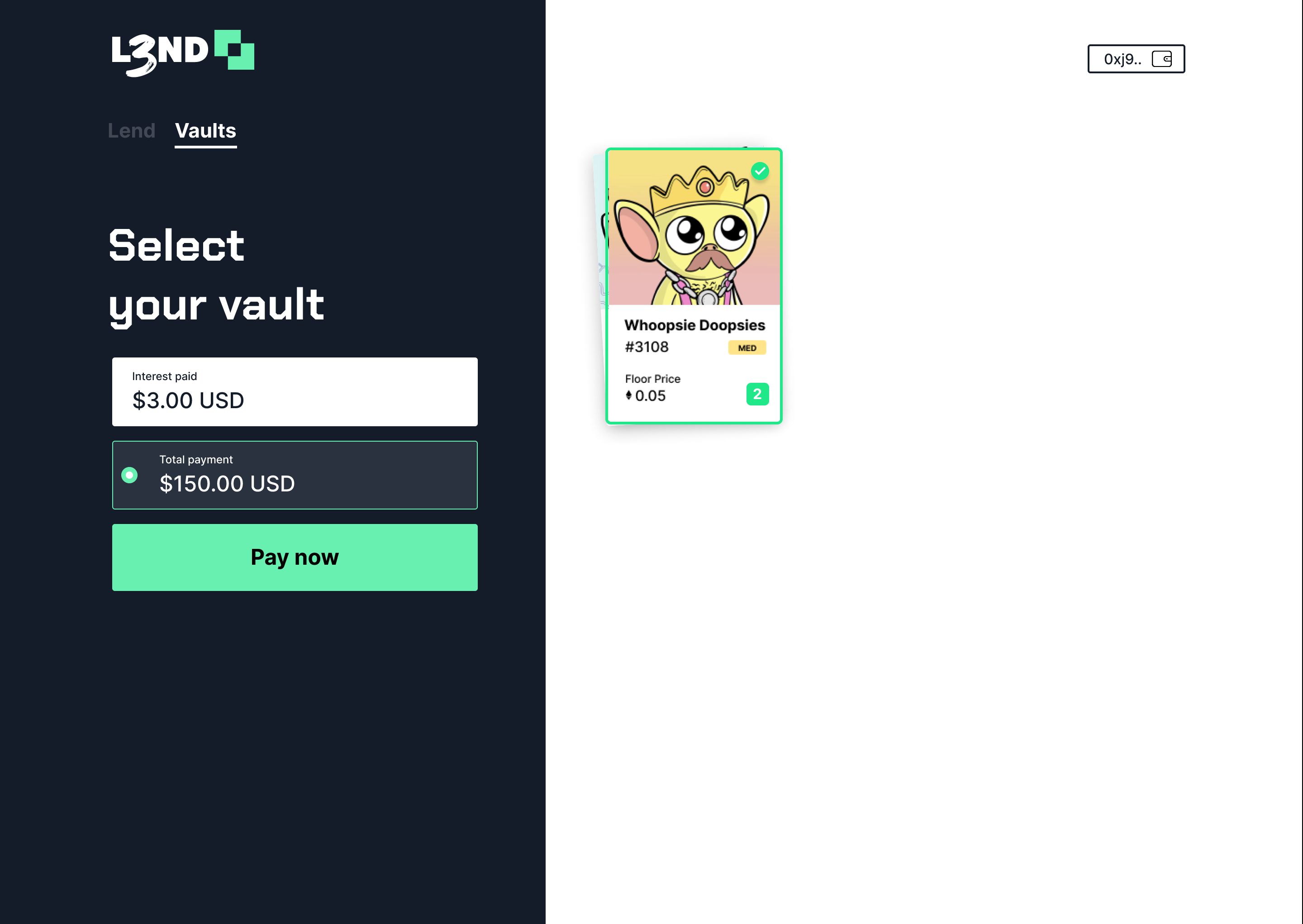

If the user accepts the deal, he’ll sign the transfer of the NFT, which will remain on an escrow contract during the duration of the loan. The loan doesn’t have a fixed period of time, we use Superfluid to create a stream where user’s will be paying the interests constantly. When the user pays back the principal, the escrow contract will release back the NFT, the user only pays interest for the duration of the loan. If the user defaults to pay the interest, the escrow contract will release the NFT to our platform, which will list it on sale automatically 5% below floor price. 5% of the interests will go to the platform and the rest will go to the liquidity pool. If the user defaults, when the NFT is sold the complete amount will go to the liquidity pool. We also monitor the collections in real time, if the floor price drops more than 20% from the starting value when the credit was created, the NFT will also be liquidated and will go to the liquidity pool.

On the lender’s side, we’ll open a liquidity pool where lenders can deposit ETH / USDC / Matic to get a quite stable yield in return. This funds will be used to originate and underwrite loans.

As a platform we charge a 5% fee over the interest earned by the lender, with 0 costs to the borrower.

The main structure of our platform is built on Polygon, we plan tu use Hyperlane to allow Ethereum and other networks NFTs. With Push we are going to notify our users if they’re getting close on being liquidated.

How it's Made

The project is built using web2 and web3 code, utilizing HTML, CSS, JS as well as Solidity.

Furthermore, we have used sponsor technology as following:

- Polygon as main chain.

- Superfluid to help us provide in real time transmission of interest payments.

- Chainlink & The Graph to allows us capture and utilizing data already in the blockchain.

- Push, selected to help us build an alert notification systems .