LendGuard

LendGuard: Your personal guardian for lending protocols! Set your desired health factor, notification & rebalance thresholds, deploy custom guards for security. Manage approvals & configurations hassle-free. #DeFi #Lending #Security

Project Description

Problems.

- More than 50% users had enough liquid tokens in their wallets while they had been liquidated.

- More than 80% users had enough liquid DeFi positions in their wallets while they had been liquidated.

- It is challenging to react to rapid market changes and be liquidated because you can just sleep at this time.

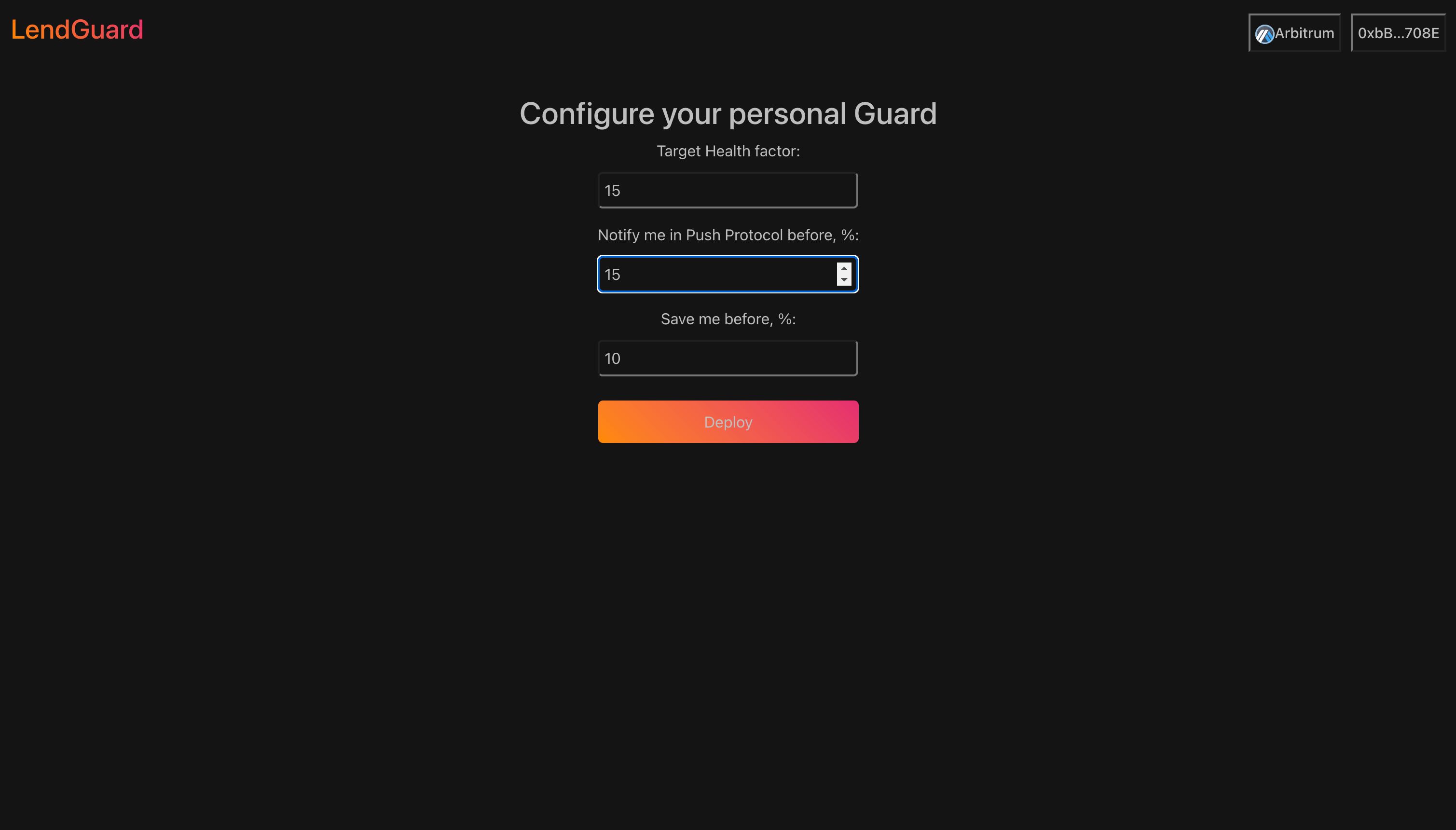

Solutions. "LendGuard" is a safety vault designed to solve these problems an dto enhance the security and control of lending protocols within the decentralized finance (DeFi) space. Users can configure and deploy their custom Guards. In general, Guard is an extension of a lending's pool (in demo version only Aave V3) with base depositing & borrowing functions and additional settings. By using Guard, any user may pre-approve collateral tokens from lending and our keepes (or you can deploy your own) will notify you via Push Metamask Snap and will smartly adjust your debt position.

Key Features.

- Configurable Health Factors Users have the flexibility to set their desired target health factor for their vault. The health factor serves as a crucial indicator of the vault's financial health within the lending protocol. This setting enables users to maintain a certain level of safety in their vault.

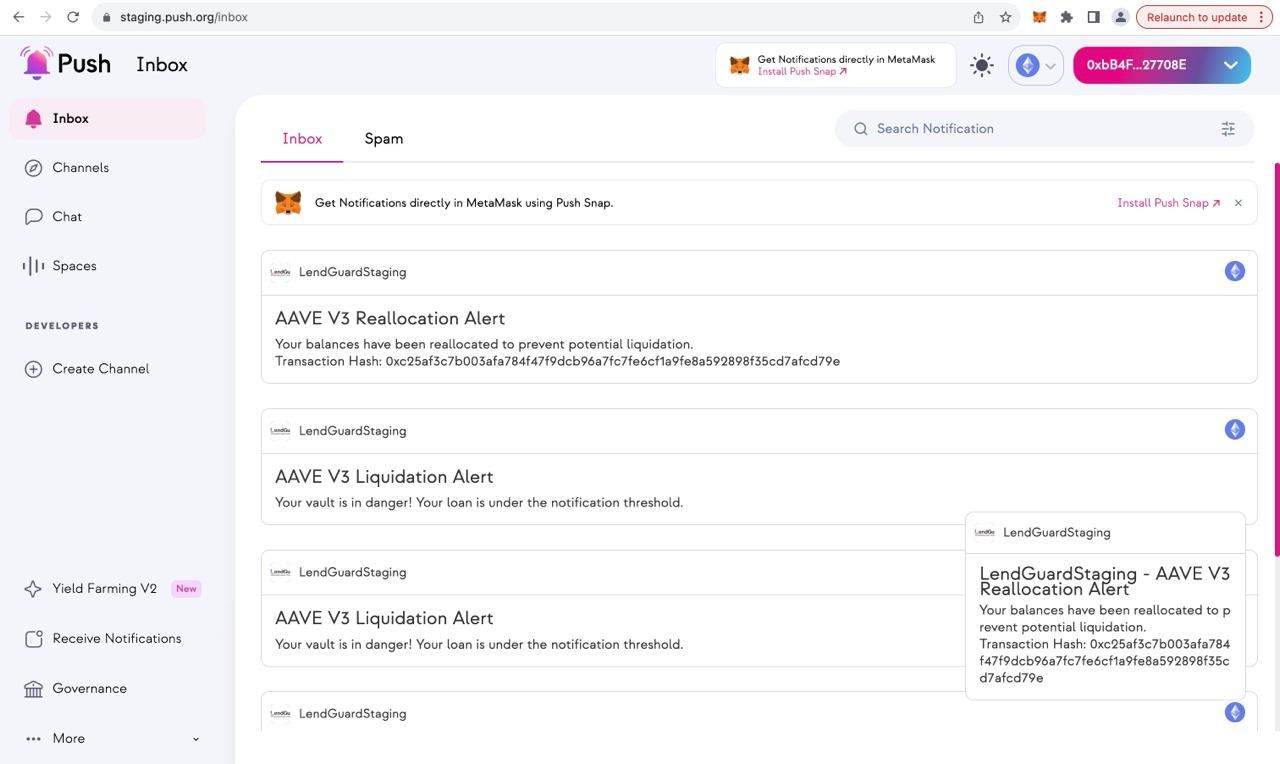

- Notification Thresholds LendGuard allows users to set notification thresholds. These thresholds act as early warning triggers, notifying users via Push Protocol when their vault's health factor approaches a specified percentage below the target level. This feature enables proactive monitoring and timely intervention.

- Rebalance Thresholds Users can define rebalance thresholds, which trigger an automated rebalancing action by the keeper when the vault's health factor drops to a specific percentage before reaching the target level. This automation ensures the vault stays within the user's defined safety parameters without requiring manual intervention.

- Customized Vaults Users have control over configuring their vaults according to their risk appetite and preferences. They can adjust thresholds and health factor settings based on their risk tolerance and market conditions.

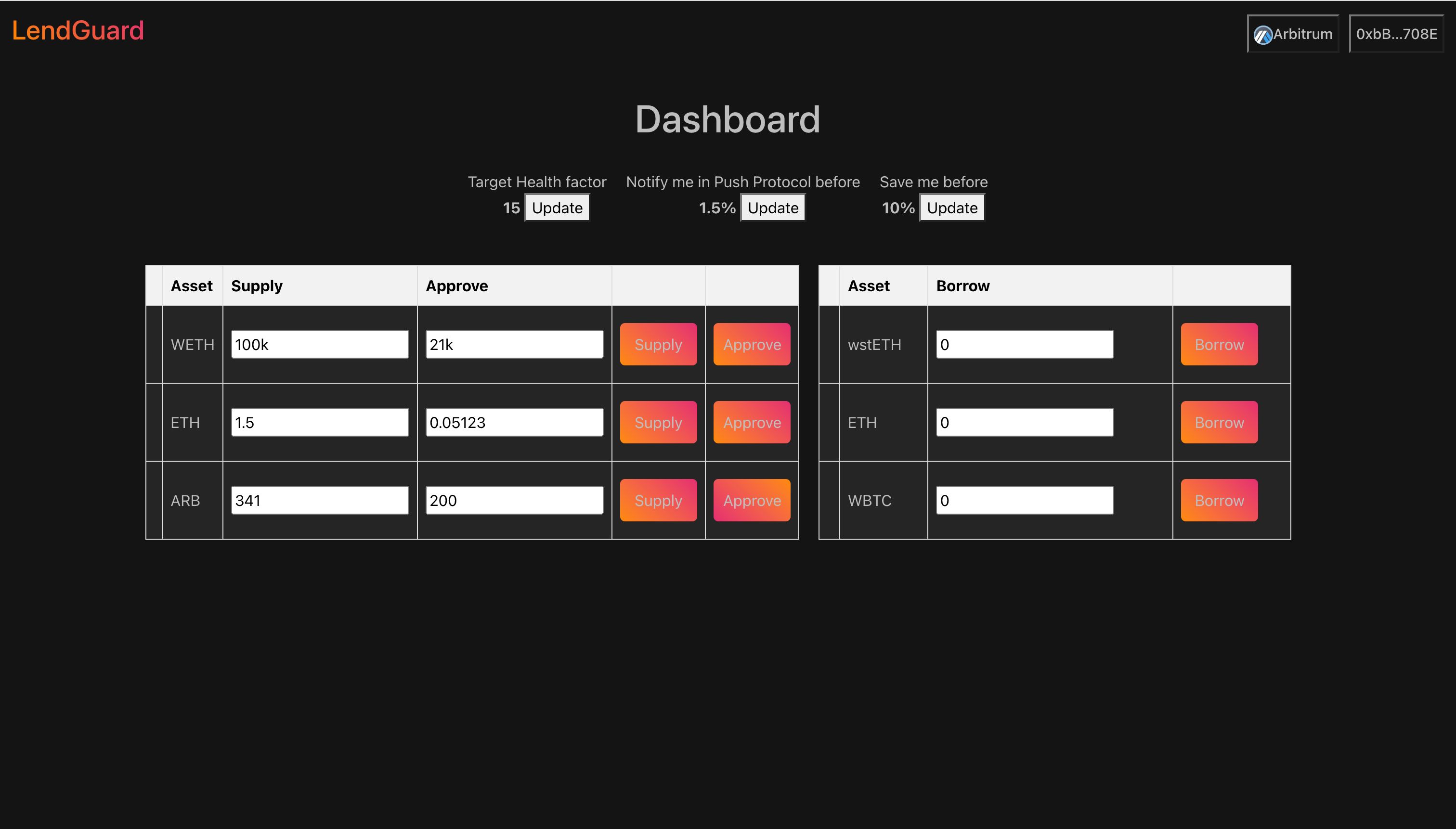

- Token Approvals Through the main dashboard, users can select and approve specific tokens they deem "safe" to be utilized within their vault. This functionality provides users with granular control over the assets used in their lending activities.

- Vault Reconfiguration The dashboard allows users the flexibility to revisit and adjust their configured settings, such as modifying thresholds or resetting the automated keeper functionalities as needed. This feature ensures adaptability to changing market dynamics and risk profiles.

Overview. LendGuard's primary goal is to offer users a secure, personalized, and proactive approach to managing their lending protocol activities. By enabling users to tailor their vault configurations and automate actions based on predefined thresholds.

Future improvements.

- To broaden available tokens to pre-use by using 1inch Fusion that will allow you to send any tokens to collateral and repay at pre-liquidation moments.

- To create DeFi protocols allowance option. For instance, user can approve Uniswap's position to unwrap and to adjust debt position. This mechanics can greatly improve the capital efficiency of your loan position.

- To decentralize keeper network, to integrate keeper's algortihms on chain.

- To broaden lendings' connectors.

Economics.

- Users should buy and stake GUARD token to deploy and be maintained by LendGuard's keeper network.

- The keeper that prevent liquidation will get a part of this stake. It may replace liquidator's market in future.

How it's Made

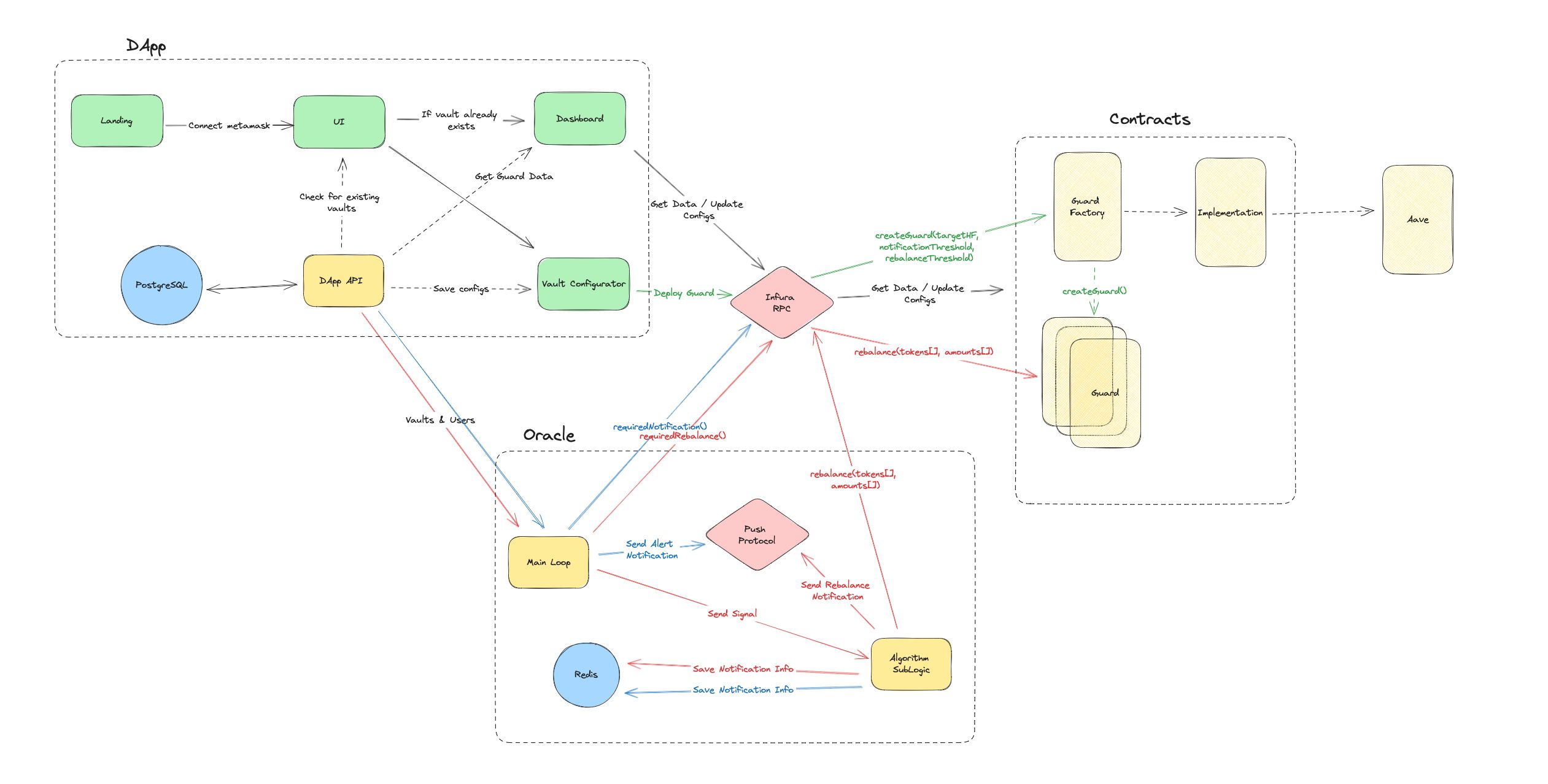

The architecture of LendGuard comprises three integral components, each serving a distinct function in ensuring the security and functionality of the platform.

- Contracts:

-

Implementation as Aave V3 Wrapper: LendGuard's contracts are structured as a wrapper around Aave V3, offering functionalities for depositing, withdrawing, repaying, and borrowing assets similar to those on Aave. However, LendGuard stores collaterals and debts within its contract for enhanced security and control. The utilization of Aave V3 as a prototype allows for quick development and testing, leveraging the existing functionalities while extending them to suit the specific requirements of LendGuard.

-

Clone OpenZeppelin Proxy Pattern: To efficiently deploy new vaults (referred to as Guards), LendGuard utilizes the Clone OpenZeppelin proxy pattern. This pattern facilitates cost-effective and secure deployment of new Guards by cloning existing contracts, significantly reducing deployment costs while maintaining safety standards.

-

Additional Methods and Thresholds: Guards include additional methods beyond Aave's functions to check thresholds and execute rebalancing actions triggered by the keeper module.

-

Keeper / Operator Module: The Keeper module tracks all users' vaults (Guards) and continuously monitors their defined thresholds. When thresholds are breached, the Keeper sends notifications via the specified Push Protocol to alert users of potential risks. Additionally, it executes deposits when necessary to maintain the vault's health within the user-defined parameters.

-

DApp:

- LendGuard's DApp serves as a user-friendly interface enabling users to deploy their vaults (Guards) and manage their configurations.

- It provides an intuitive dashboard where users can set their target health factors, notification thresholds, and rebalance thresholds. Additionally, users can approve specific tokens to be used within their vaults and adjust configurations as needed.

Notable Aspects:

- Cost Efficiency: The use of the Clone OpenZeppelin proxy pattern significantly reduces deployment costs, making the platform more accessible to users. Example (arbitrum deploy 0.0000591417 ETH ($0.12) https://arbiscan.io/tx/0x77c245a36d2b8cc299428c44ca4c925905405d7487afce306115a5c508cf16c0)

- Security and Control: Storing collaterals and debts within LendGuard's contract enhances security and control over users' assets.

- Automated Threshold Monitoring: The Keeper module's automated monitoring and execution of actions based on user-defined thresholds offer a proactive approach to risk management within DeFi lending.

More docs: https://github.com/Lend-Guard/LendGuardHello