LetsGHO

LetsGHO is an on-chain payment processor which supports both Credit and Debit payment powered by GHO

Project Description

"LetsGHO, a Blockchain Payment Processing Platform: A Web3.0 Version of VISA and Mastercard" LetsGHO inspired by the current challenges of existing blockchain payment systems, our team has developed a solution that tackles critical issues like poor user experience, inefficiencies of on-chain payment system, low capital efficiency, and integration difficulties. LetsGHO aims to be the Web3.0 equivalent of VISA and Stripe together.

Current Challenges in Blockchain Payments: Poor Payment UX: The current on-chain payment pain points of high gas fees and the numerous steps to make a single purchase payment. Inefficiencies in Fully On-Chain Systems: Issues like irreversible payments and immediate settlement which does not allow any failure. Low Capital Efficiency: In every payment on blockchain, you are immediately make sell your token to make a payment. Your asset will immediately transferred out of your wallet. Integration Difficulties: There is no payment validation on-chain. Business need to directly integrate to blockchain with their on cap.

Innovative Features of LetsGHO: From Poor UX of High Gas Fee to Gasless Payments: Utilizing the permit function of the GHO token, we offer gasless transactions for both credit and debit payments. Overcoming On-Chain Inefficiencies: With off-chain payment validation and a 28-day billing cycle settlement, similar to traditional credit systems, we introduce a zero-interest period for users leveraging assets for payments. Enhancing Capital Efficiency: Our credit payment support allows users to maximize the use of their assets without the need to sell immediately. User can have a chance to earn yield from AAVE on their deposit. Repayments are structured flexibly every 28 days. Ease of Integration: Merchants can easily integrate with our platform using our API, and both merchants and users benefit from our dashboard for managing revenues and debts.

How it's Made

For Let’s GHO to have a good UX, gasless, capital efficient, easy to integrate, and reasonably decentralized we have 4 main components namely smart contract, front end, backend, and services. We’ll go into each component in detail here.

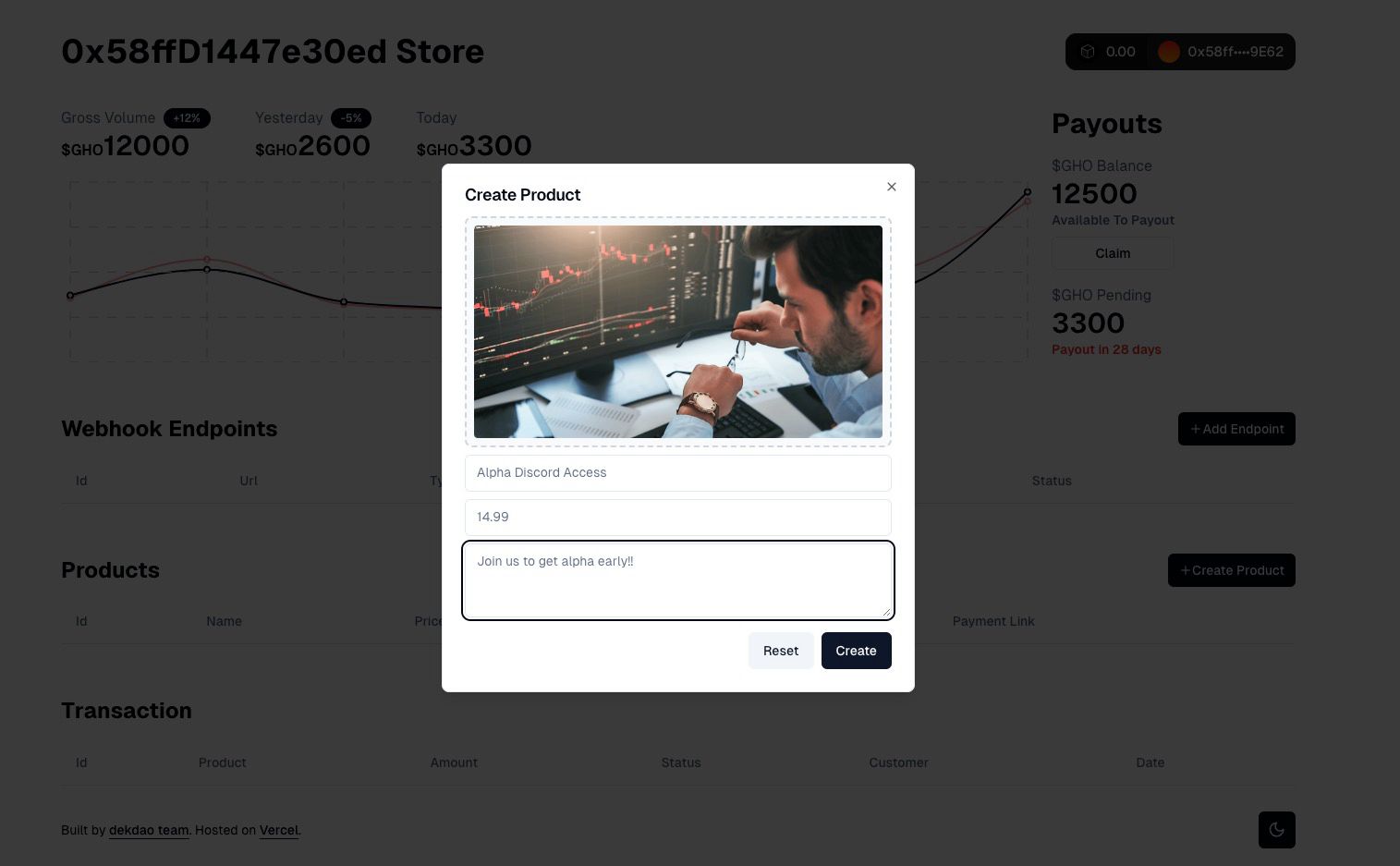

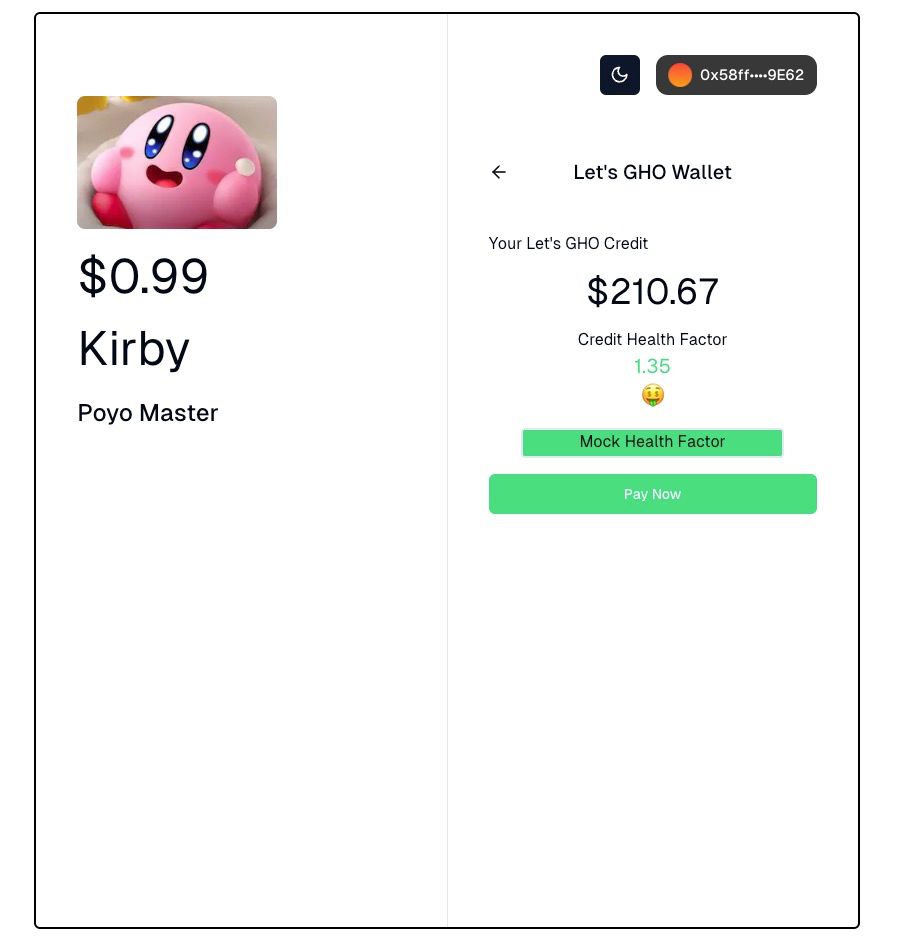

Smart contract - 2 main contract Letsghogateway handle all payment operation and accounting. There are 3 main way to pay Instant with GHO - we use erc20 permits to allow gasless payment from users. While our relayer call in via function settle Instant pay with debt (GHO) - if a user has an asset in aave we also allow the user to pay by borrowing against their asset. This also gasless with delegationWithSig to delegate credit then gateway will borrow on behalf of the user to complete payment. Pay with credit - user can open account (an application specific AA, letsghowallet) with let’s gho which allow user to hodl asset, lending in aave and pay with credit which will be settle every 28 days. This relies on custom AA logic and our accounting system. At the end of 28 days users can pay with GHO or GHO debt will be borrowed against assets in the wallet. letsGHOWallet - an application specific smart contract wallet that works with gateway to handle user’s assets. Namely it locks up user assets for a period to ensure their ability to pay at the end of an epoch. While users can still earn yield by lending to aave. User can also close accounts to make it behave like a normal AA. Normal exit - user can initiate exit procedure and will be able to control the wallet after the settlement date. (28 days) This process does not require any involvement from letsGHO systems that ensure that users still have control over their assets. Fast exit - user can request letsGHO to settle all outstanding balances by either pay with GHO or with debt. After everything settles, the user can control the wallet. This requires the letsGHO backend. dispute and refund - let’s gho contract to keep track of finalized and settling data. User can create dispute and get refund with in the same period + some grace period Backend - Our backend is built on Next.js API utilizing firebase firestore as a database. Using Vercel cron job for scheduling tasks. The backend is inspired by Stripe API where you can create your product, generate payment links and even set up a webhook. Aim to make the DX as good as possible. Our settlement engine settles the transaction from the database into the smart contract every 7 days.

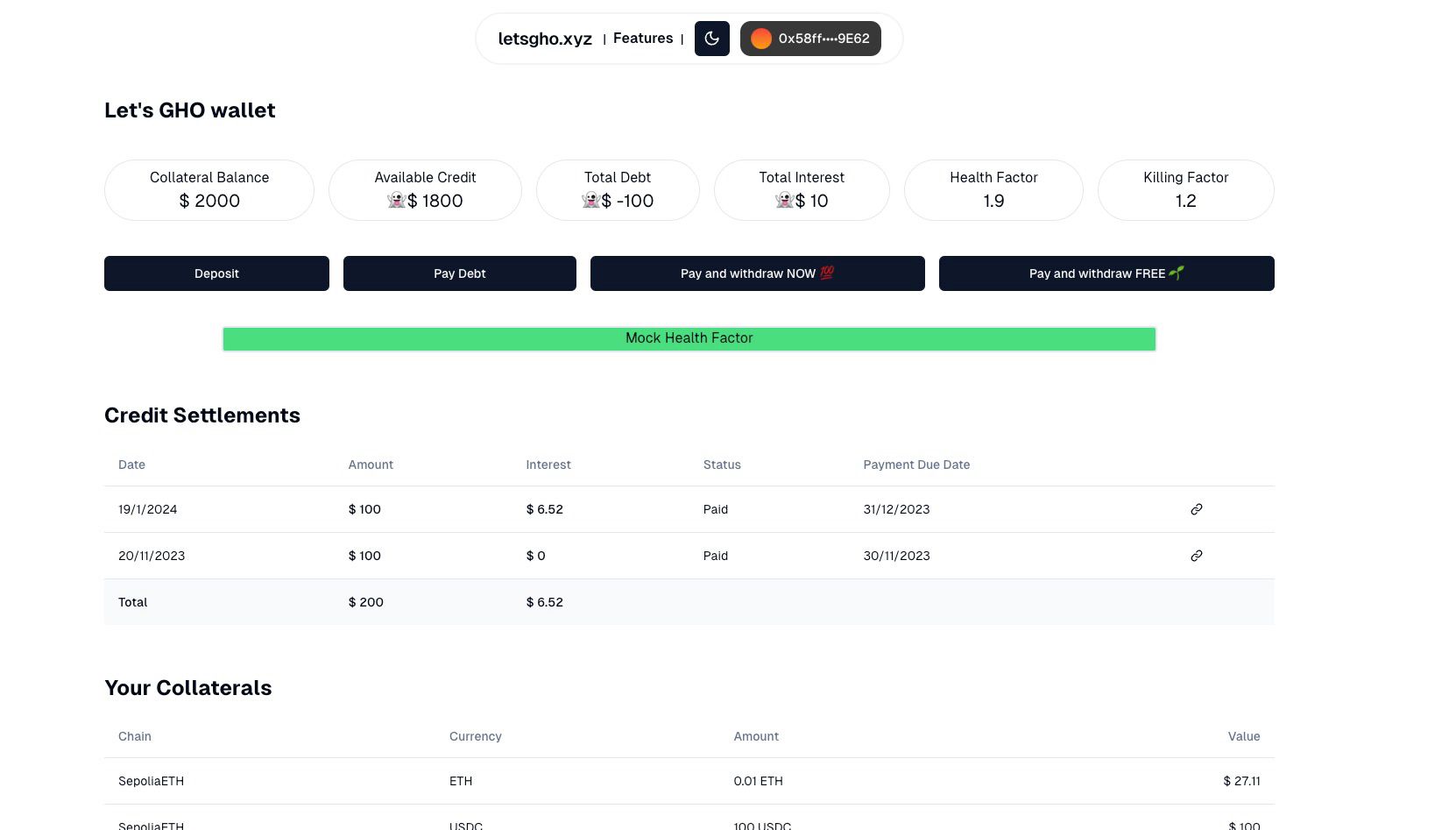

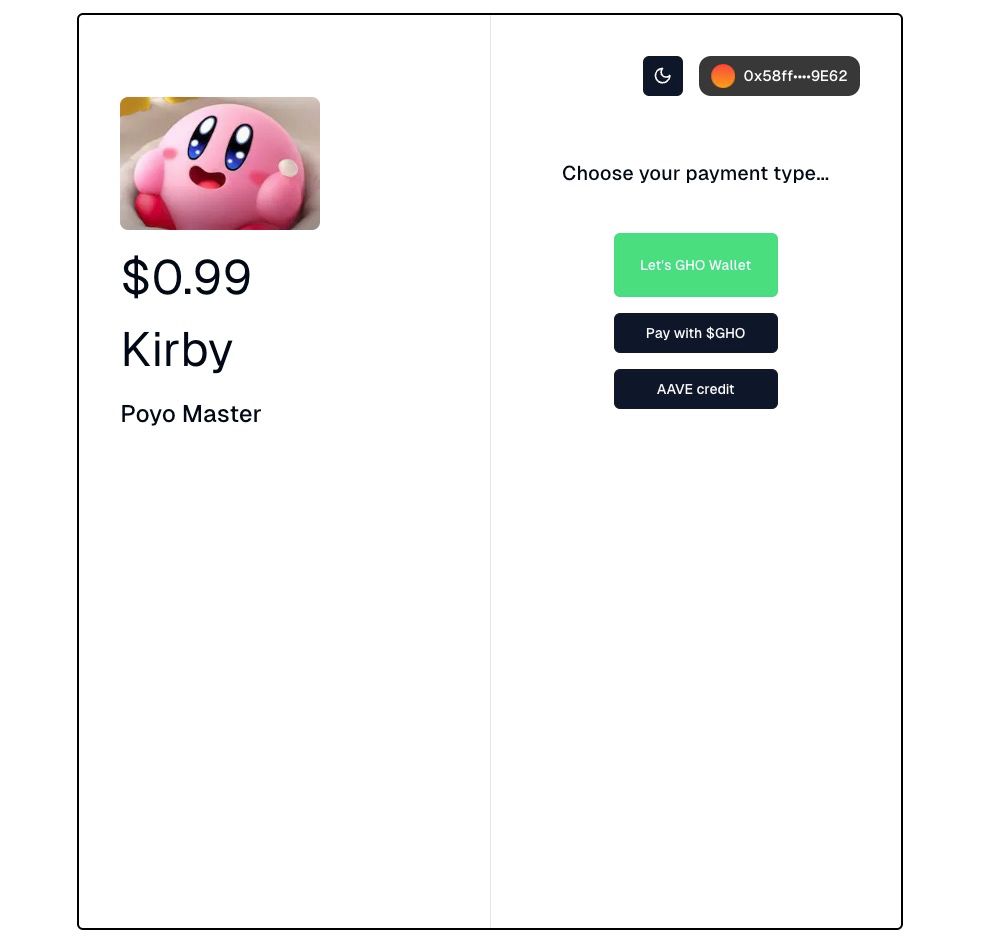

Frontend - Our frontend is built on Next.js with shadcn-ui, tailwindcss. Family’s ConnectKit and wagmi library to handle all web3 interactions. The frontend has 3 main section, for merchant, payment, and credit user. Merchant Dashboard Merchants can see all transactions history (+graphs), add products, and add webhook endpoints for transaction notification. Payment Page Customers will see the details of the product and they can choose to pay in 3 ways (all gas free): with our Let’s GHO Wallet, directly with GHO, or with their collateral in AAVE. User Dashboard Inspired by dashboard for credit card user in TradFi Our Let’s GHO Wallet User can see their collaterals within the wallet, available credit, debt, interest, and the health factor. They can Deposit collateral, pay the debt, or request to withdraw. Services - Family’s ConnectKit and wagmi library to handle all web3 interactions.