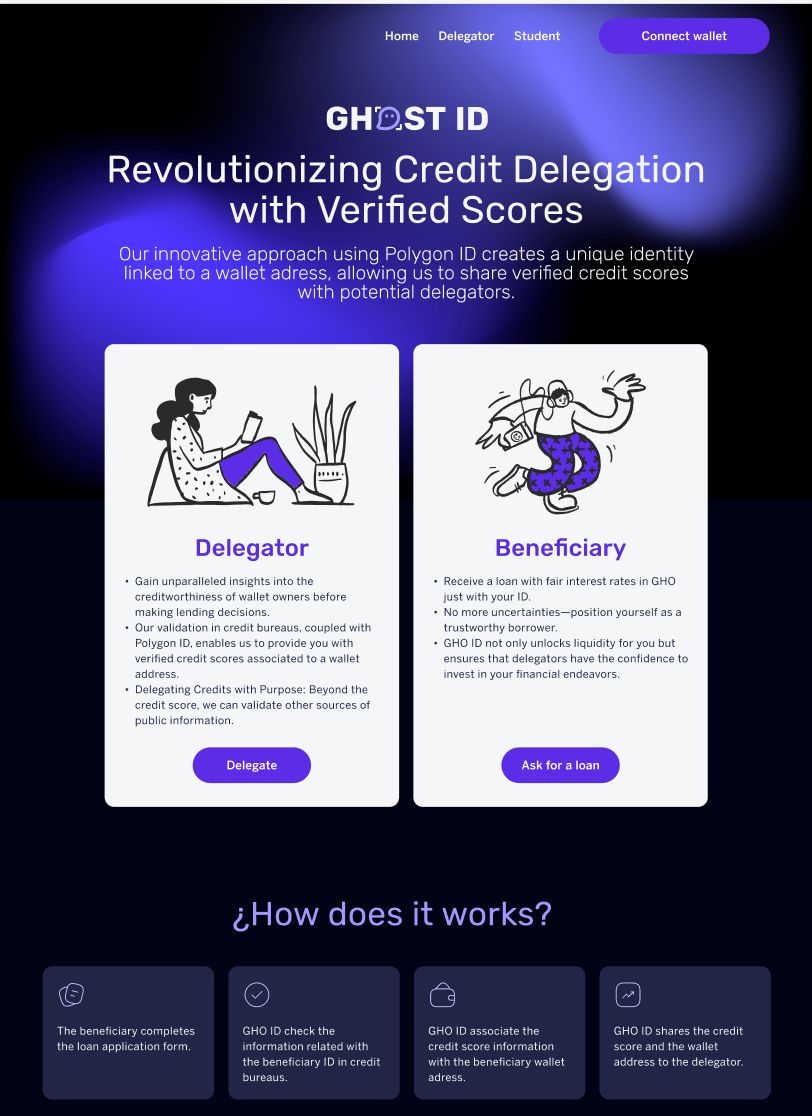

LFGHO - Verified ID

GHOID unlocks liquidity for everyday people and empowers credit delegators by providing insights into the creditworthiness of wallet owners. We examine information associated with credit bureaus and other financial sources to create a unique identity linked to a wallet address.

Project Description

Imagine a world where lending isn't bound by traditional norms but is a dynamic force for good! Enter GHO ID, the game-changer in DeFi credit delegation. We're not just unlocking liquidity; we're handing you the keys to a future where every decision is informed empowering, and potentially revolutionary.

Picture this: you want to support a student's dreams or back a small business that want to grow, but the challenge for delegators lies in knowing their creditworthiness related with a wallet adress. ENS might link identities, but we're taking it a step further. GHO ID is the superhero cape for credit delegators, arming you with comprehensive insights into wallet owners' credit profiles, without knowing the loan beneficiary personal data.

Importance of Liquidity in Education and Regional Development: In regions like Latin America, access to liquidity is often a crucial factor in the educational pursuits of students and the development of entrepreneurial productive projects. We're not just talking about loans; we're talking about a pathway for students to thrive and entrepreneurs to turn dreams into reality.

Use Case 1: Education in Latin America: • GHO ID isn't just about numbers; it's about supporting the dreams of students in Latin America. We're shaking up the system by incorporating academic prowess due to national exams results into credit assessments, making education accessible and fostering a wave of knowledge across the region.

Use Case 2: Productive Projects and Entrepreneurs • Calling all visionaries! GHO ID isn't a bystander; it's a partner in your entrepreneurial journey. With verified business certifications from different sources such as chambers of commerce, we're unlocking liquidity for projects that define the future of Latin America.

Barriers and High-Interest Rates: Now, let's talk about the elephant in the room: barriers and jaw-dropping interest rates. GHO ID acknowledges the struggles—limited credit history, stringent criteria, and those eye-watering interest rates.

The Ecuadorian case Microloans and Consumer Loans: • Ecuador is a dolarized economy and microloans often come with staggering interest rates, reaching 20% in microloans. Consumer loans, according to the Ecuadorian National Bank rates, are around 16% in 2024. GHO ID aims to challenge these barriers and high rates by providing a more inclusive and reasonably priced credit delegation platform.

Utilizing Stablecoins for Responsible Borrowing: GHO ID recognizes the potential of stablecoins, specifically those pegged to USD such as GHO, in offering a more sustainable borrowing alternative with fair interest rates.

In this moment the borrow rate in GHO is around 4 and 6% APY.

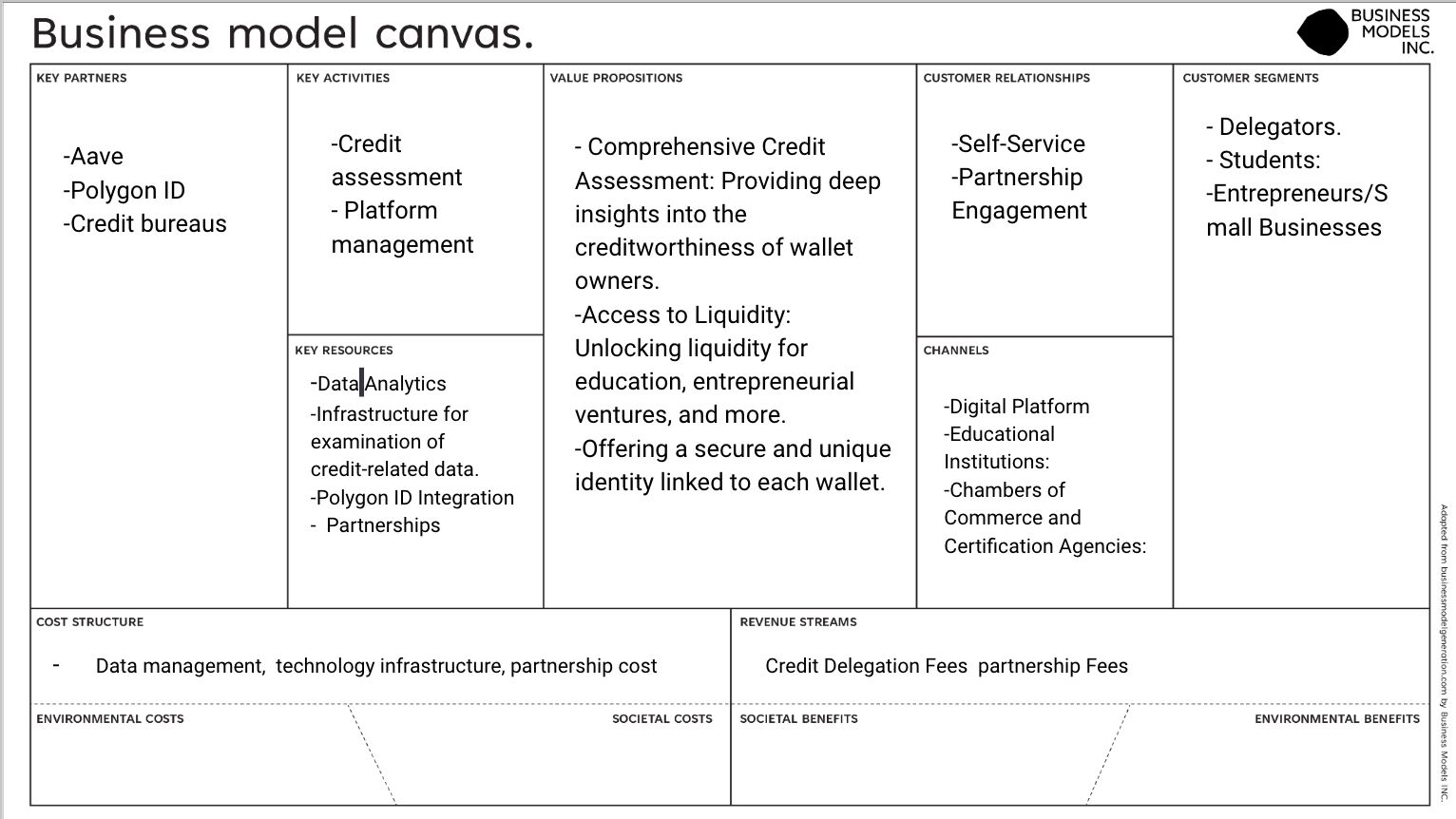

Revenue Streams:

- Credit Delegation Fees: Charges for delegators accessing GHO ID services.

- Partnership Fees: Revenue from educational institutions, chambers of commerce, and certification agencies.

Key Resources:

1.Data Analytics: Infrastructure for meticulous examination of credit-related data from credit bureaus. 2.Polygon ID Integration: Technology to create unique and secure identities linked to wallets. Partnerships: Collaborations with educational institutions, chambers of commerce, and certification agencies. 3. Aave integration for delegators.

Future Roadmap: Creators, join the revolution! GHO ID's future is as bold as its present. We're expanding partnerships, brainstorming new use cases, and waving the flag for fair lending practices across Latin America.

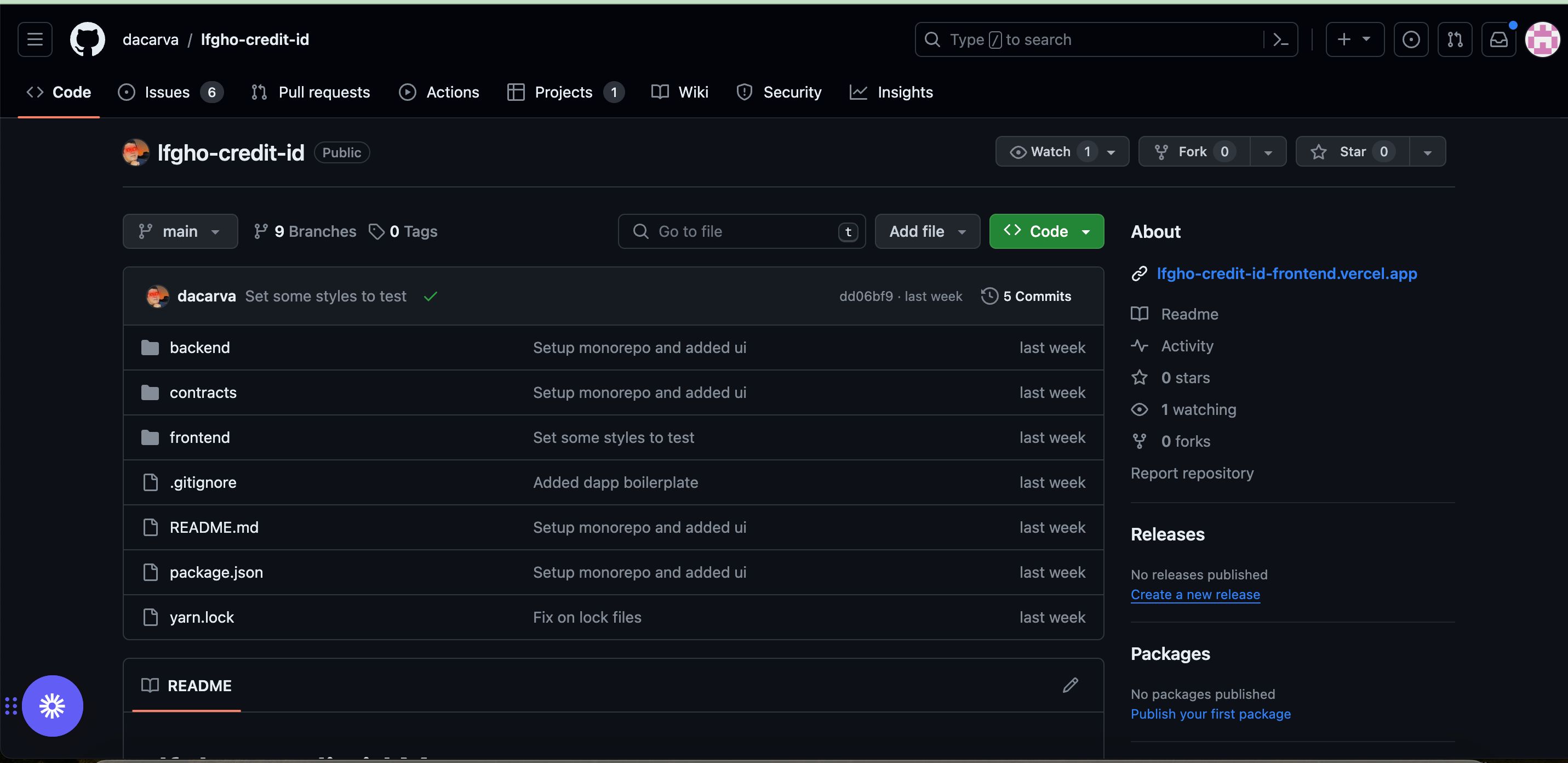

How it's Made

In terms of technology, we utilize the following technological stack: Polygon ID, Supabase, Alchemy, JavaScript, React, and Figma.

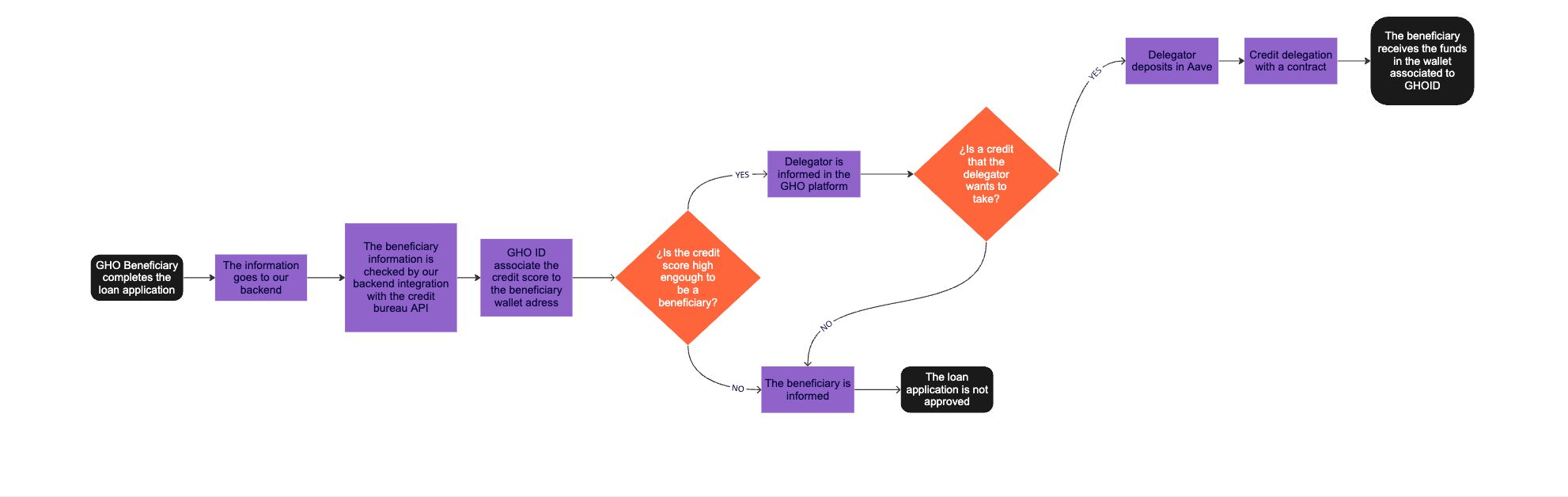

Our project receives personal information from the loan beneficiary, and we validate this information through our integration with credit bureaus' APIs. This information is associated with Polygon ID. We then share with potential delegators the credit scores linked to the wallet addresses of the loan beneficiaries.

In our project, we employ the three components of the trust triangle: issuer (issues credentials related to a credit score), verifier (delegator), and identity holder (loan beneficiary).