OmniForward

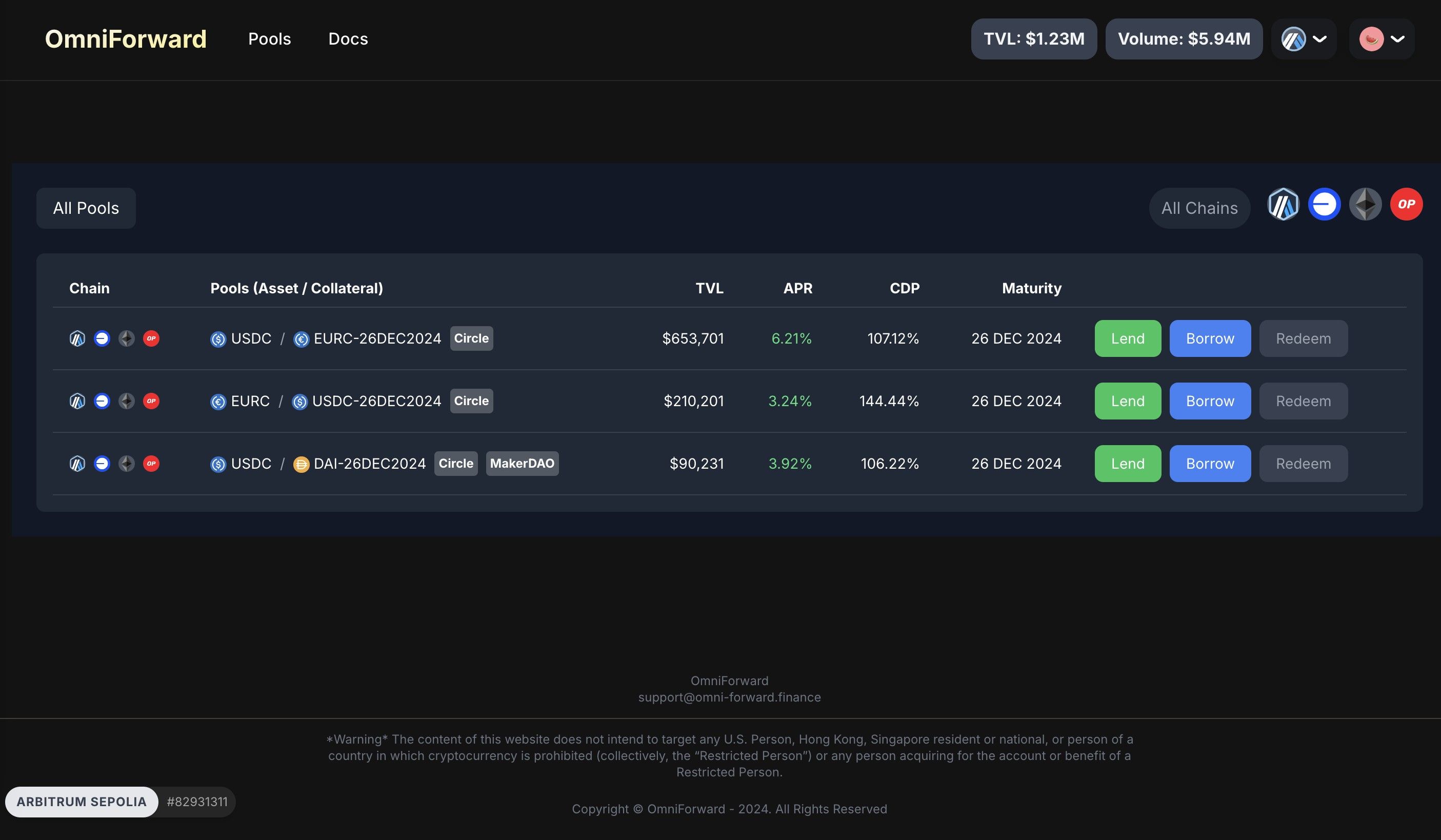

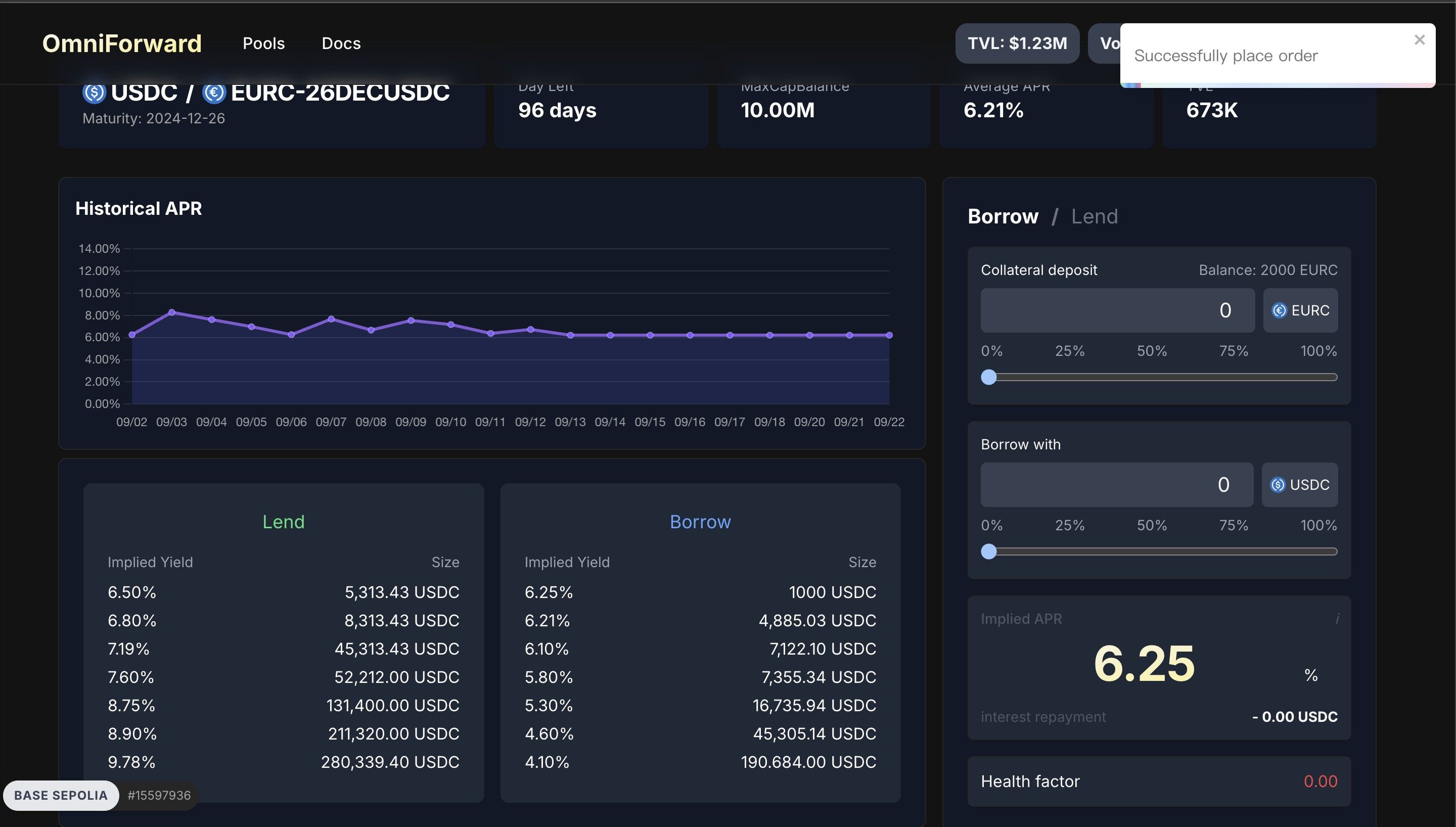

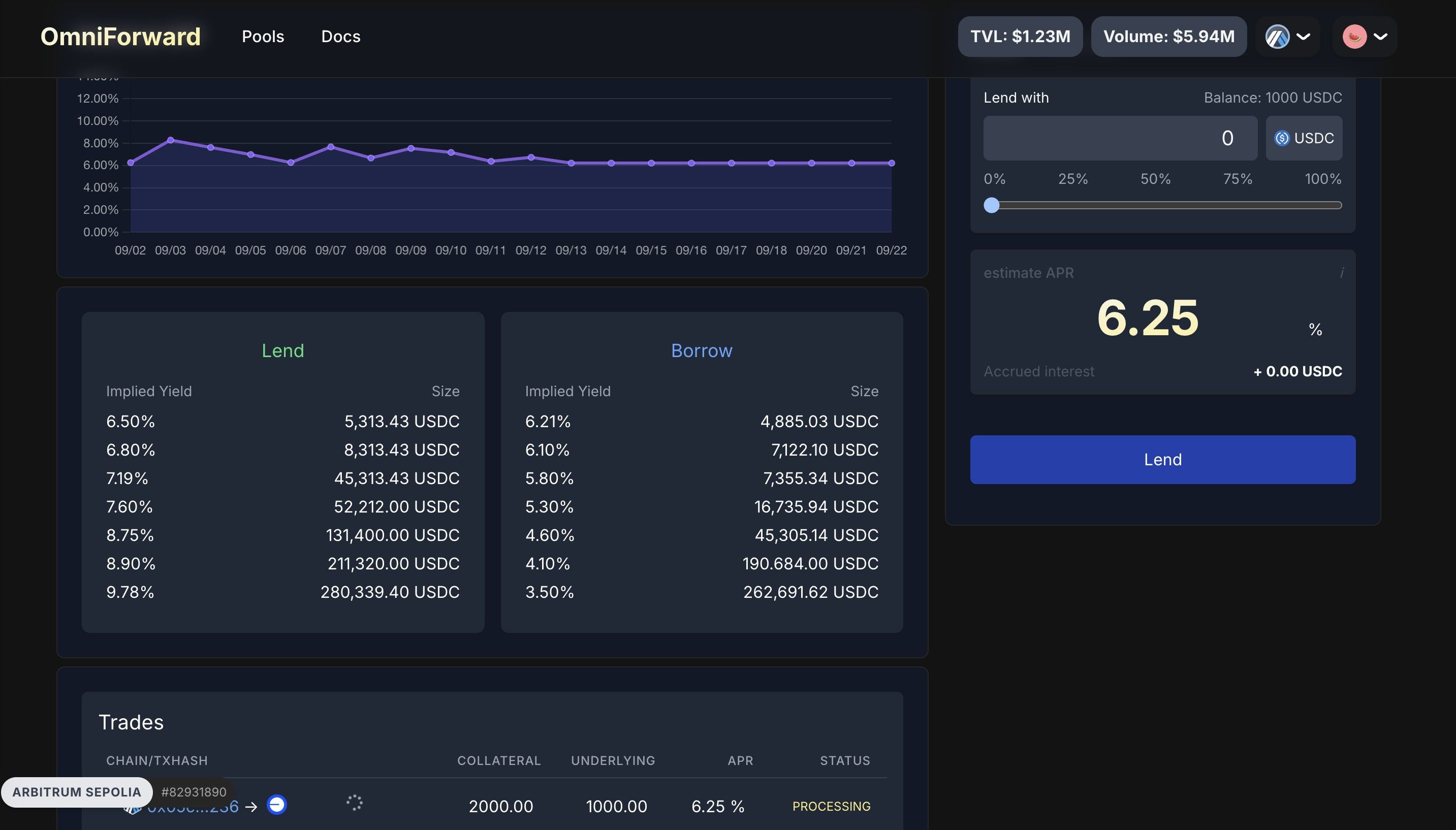

cross chain lend/borrow by fixed rate and term bring arbitrage, looping, aggregating and much more opportunity, and as long as much asset pick fixed rate and term, the market would growth much faster than it used to.

OmniForward

Created At

Winner of

Circle - Build with Circle's Web3 Services 2nd place

Project Description

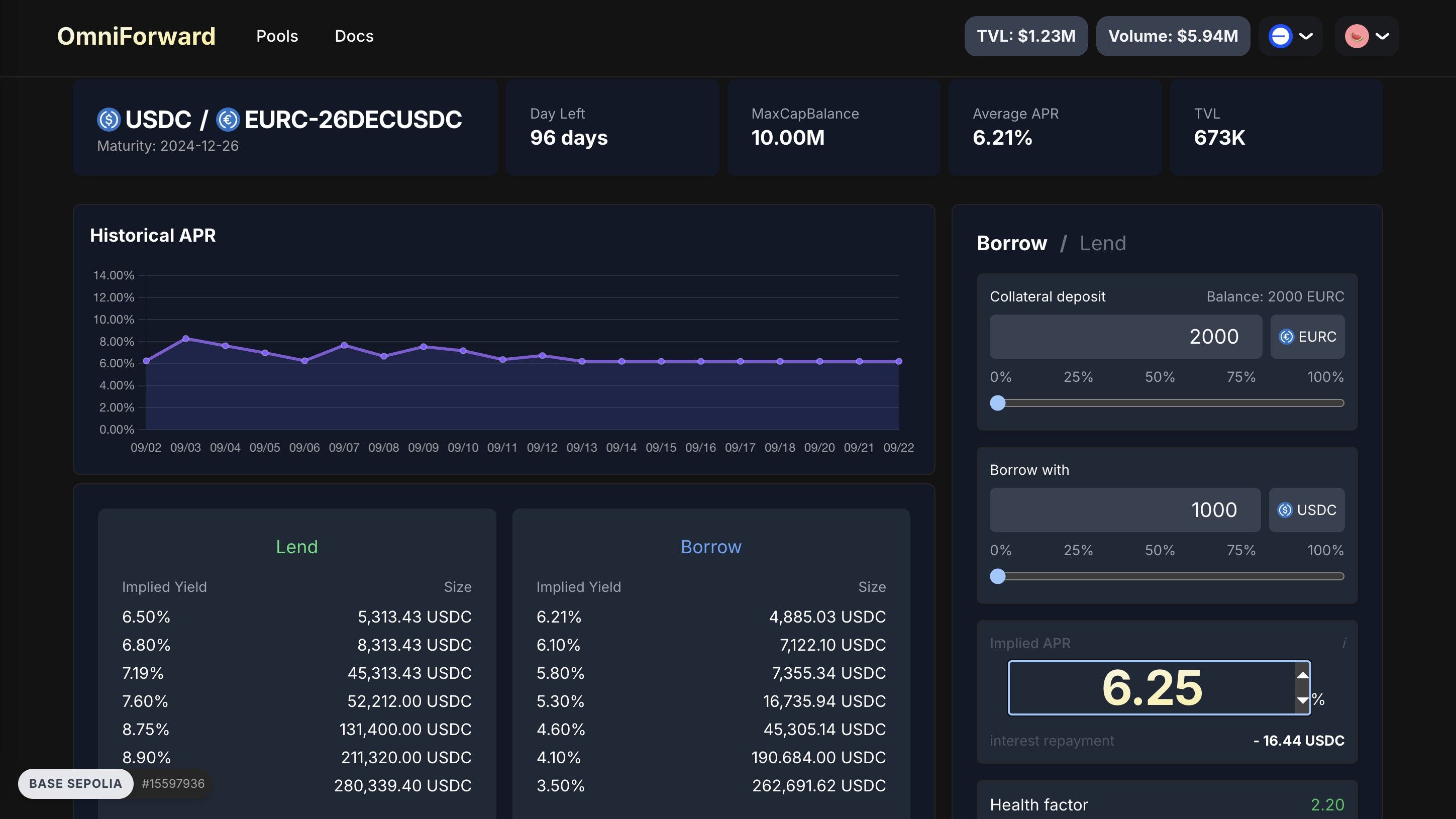

By cross chain fixed rate lending borrowing, users could able to comparing different rate crossing multiple chains, and given by fixed rate and tenors, the risk and profit is expectable, which make users or insitutions much preffering for longer term lend or borrow. Which bring more advantages:

- Price/Rate discoverying around Defi world instead of one chain.

- The more assets locked in terms, less the depeg occured.

- Longer term makes credit, yield-bearing token even mortgage are easier to get in.

- Too much stable coin make liquidity seperate into all around the world, once aggregate them, the outstanding projects will standout eventually.

How it's Made

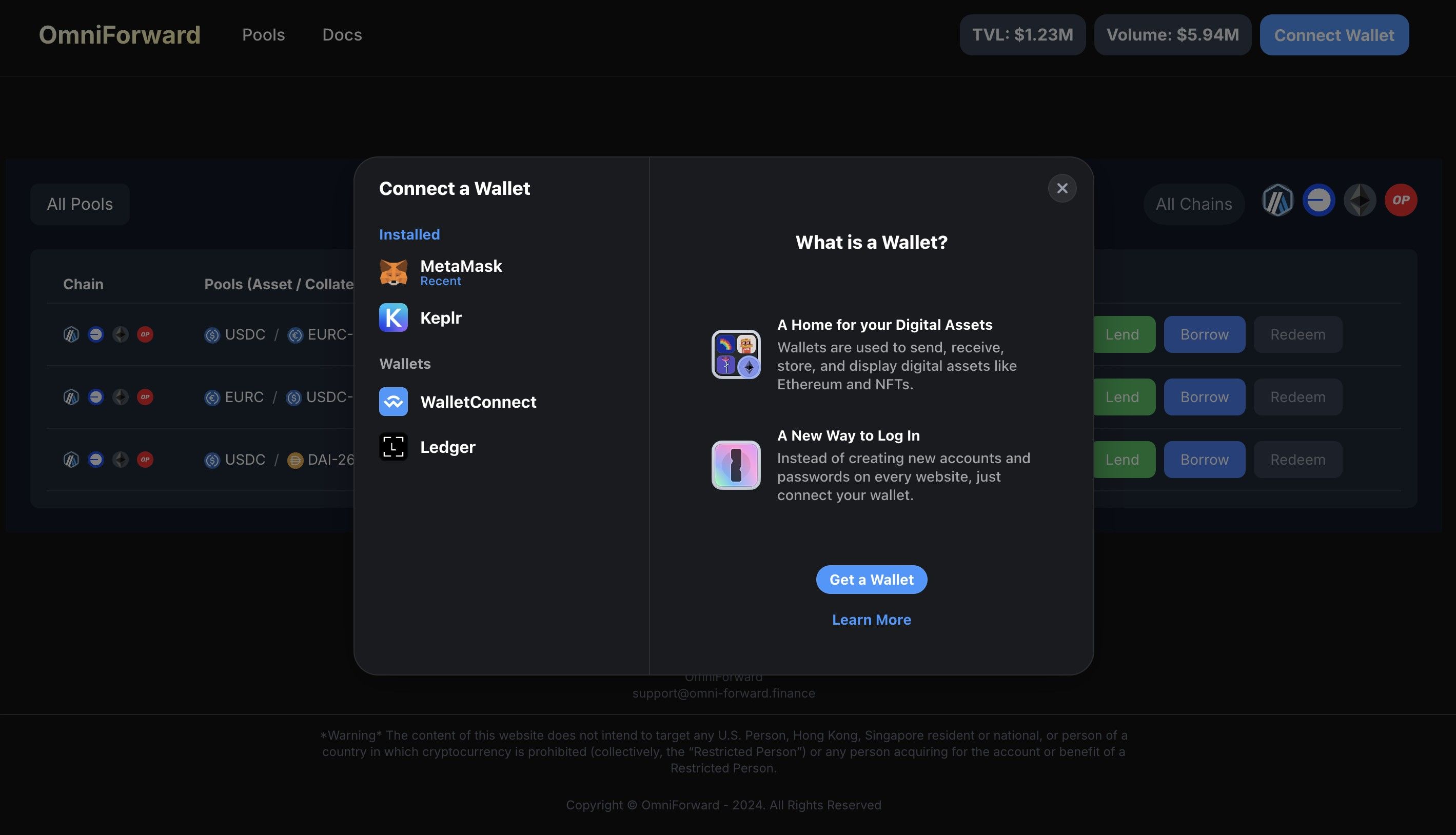

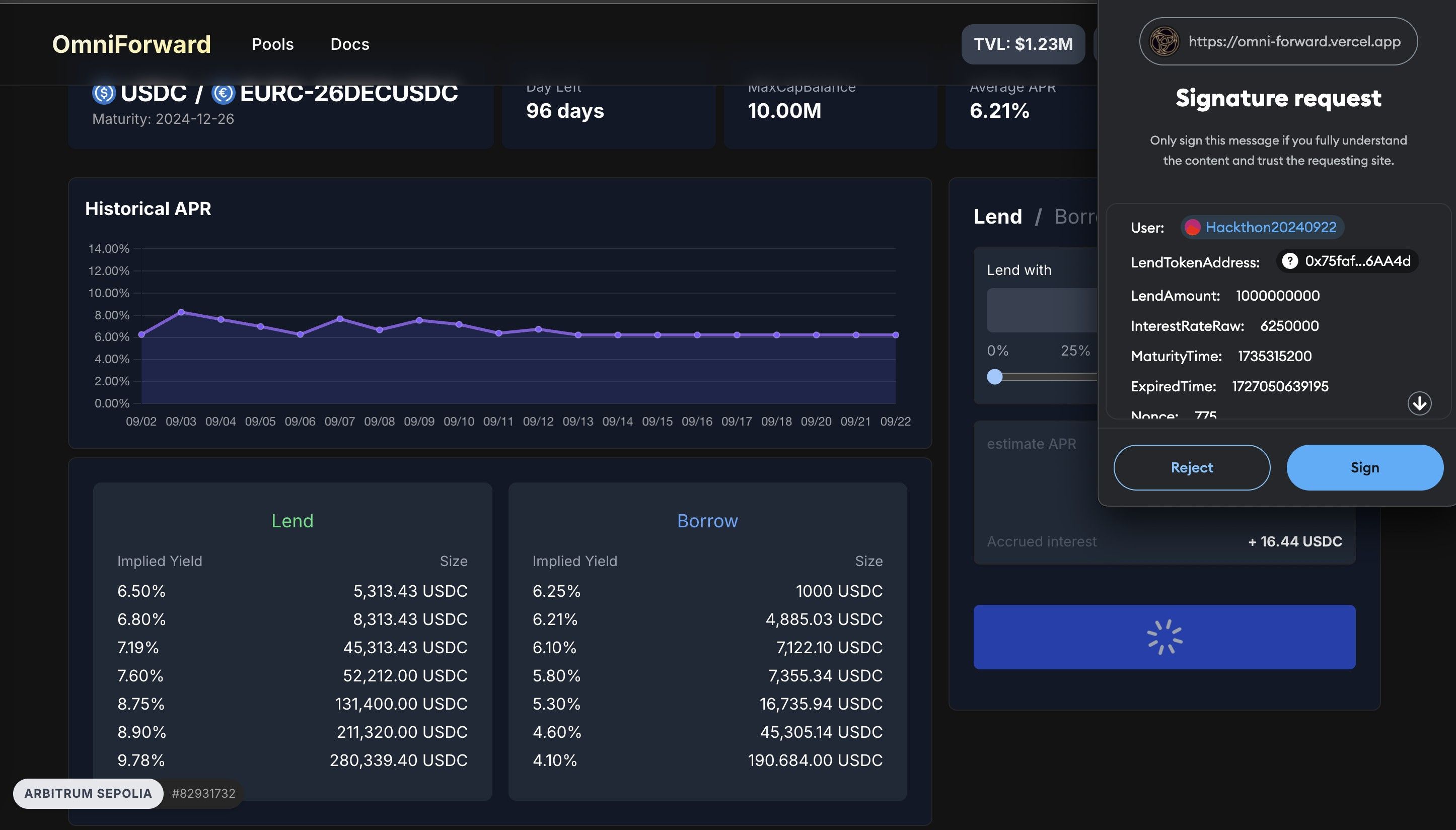

This project is built using Circle CCTP and ChainLink CCIP for cross-chain capabilities, leveraging WalletConnect and Ledger for wallet management. The frontend is developed with React, while the backend, written in Python, operates as the order-matching engine. It assists users by interacting with smart contracts to match orders based on zero coupon bond, ensuring fairness and automating the process of managing zero-coupon bonds and fixed-rate calculations