ParkedUp

Short and Long term P2P car park lending and renting, long-term means User A can use User B's parking spot at no cost. In return, User A allows User B to use their equity as security for a loan.

ParkedUp

Created At

Winner of

WalletConnect - Innovation Pool Prize

Prize Pool

Arbitrum - Pool Prize

Prize Pool

Scroll - Deploy on Scroll

Prize Pool

Project Description

It is not uncommon for property owners to rent out car parking spaces especially in densely population urban areas, there exist applications which connect the 'landlords' of these parking spaces to the 'tenants'. Usually these agreements last a couple hours or days, intermediary applications take their commission, starting from 10%. Our is the same except decentralised, meaning little to no commission, but the real benefit comes when extending the timeframe of the agreement. Whereby we allow Mrs.'Tenant' of the car parking space to authorise the Mr.'landlord' to use Mrs. Tenants' equity for collateral for a loan Mr.Landlord wants to take out, in exchange, Mrs.Tenant doesn't pay for the use of the car parking space since Mr.Landlord can utilise this loan to generate returns. Obviously there are many caveats in this system, such as trustability and conflict resolution, but the main problem we are solving is the mismatch between users who wish to utilise a real world asset without purchasing it by selling their current holdings and those who hold illquid assets that have revenue generating potential but due to poor reach have variable returns.

This concept allows the landlord to create a uniform revenue stream by staking the loan taken out against their 'tenants' collateral. Whilst allowing holders of collateral-able equity to benefit from RWA usage for 'free'. (Forgoing the APR of their equity).

How it's Made

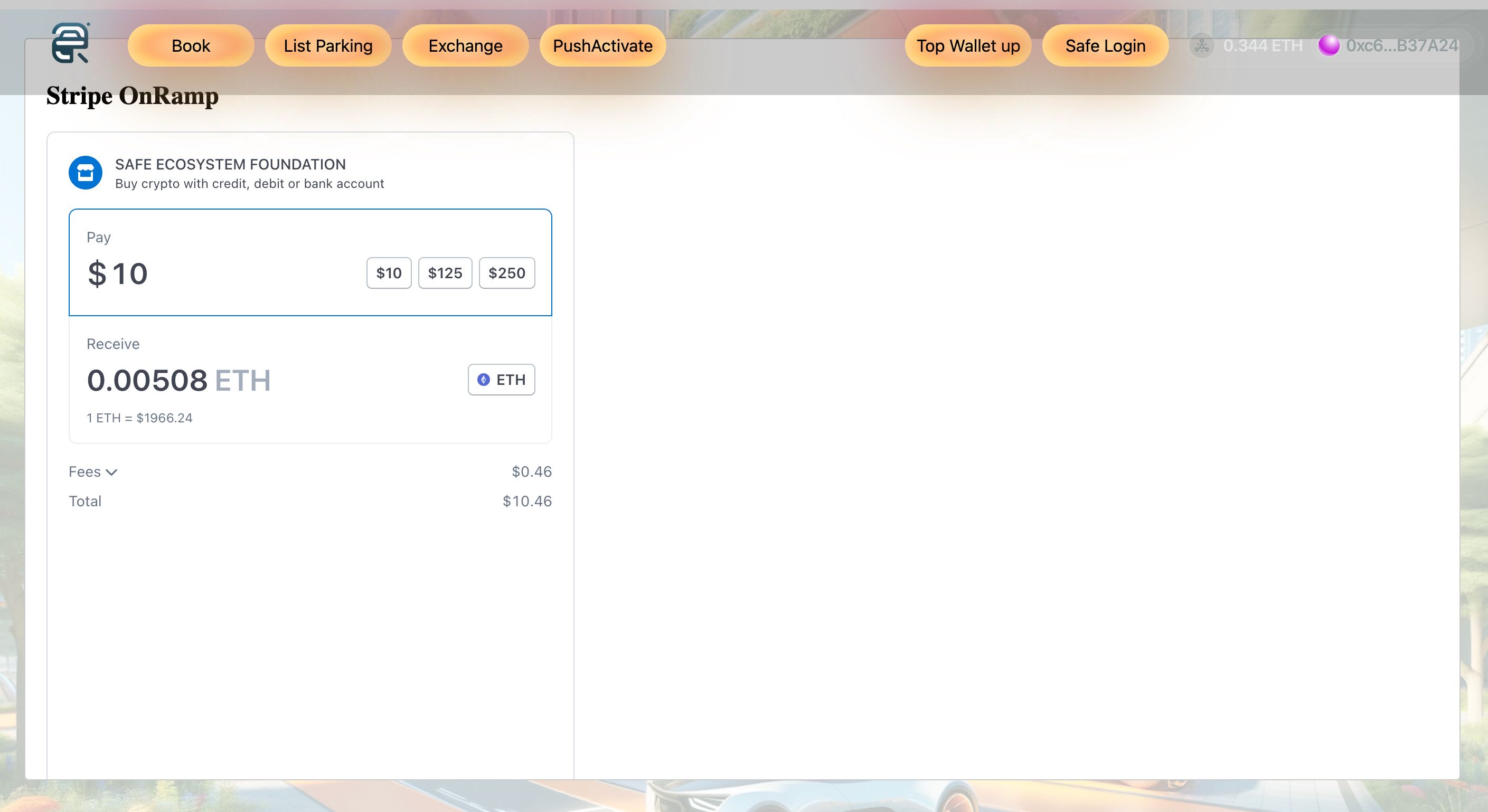

We fiat on-ramp using the safe SDK allowing for the simpler P2P book and list car park spacing aspect of our application, before they book they can connect their wallet with connect wallet or more intuitively login with an email as we've utilised safe account abstraction. Users are notified of updates with push integration, our smart contracts locks the money until the service has been offered. Then with respect to the longer-term renting, we tried utilising Spark and Aaves' credit delegation functions (spark lend) to lock the tenants equity, ready for the landlord to take a loan against it. This would then be automatically staked for the Landlord to earn APR.