proto

Protocol connecting strategists, node runners and LPs to enable decentralised market making.

proto

Created At

Winner of

🌍 Uniswap Foundation — Best Ecosystem Hack

🏊 The Graph — Pool Prize

Project Description

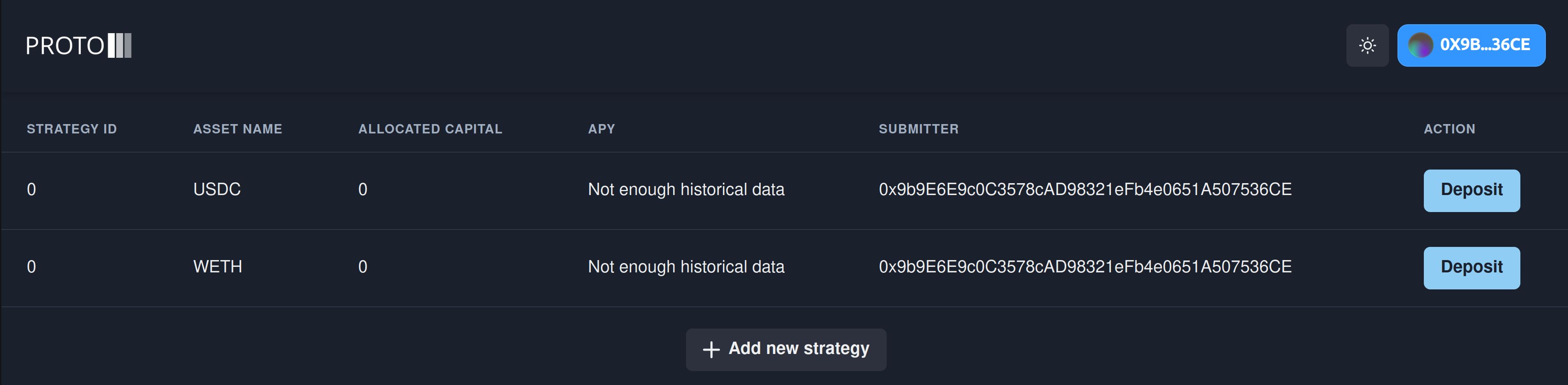

We built a protocol that enables liquidity providers to deposit funds in pools which can be used for market making activities. When funds are not used for market making purposes, they are put into Aave to earn passive yield.

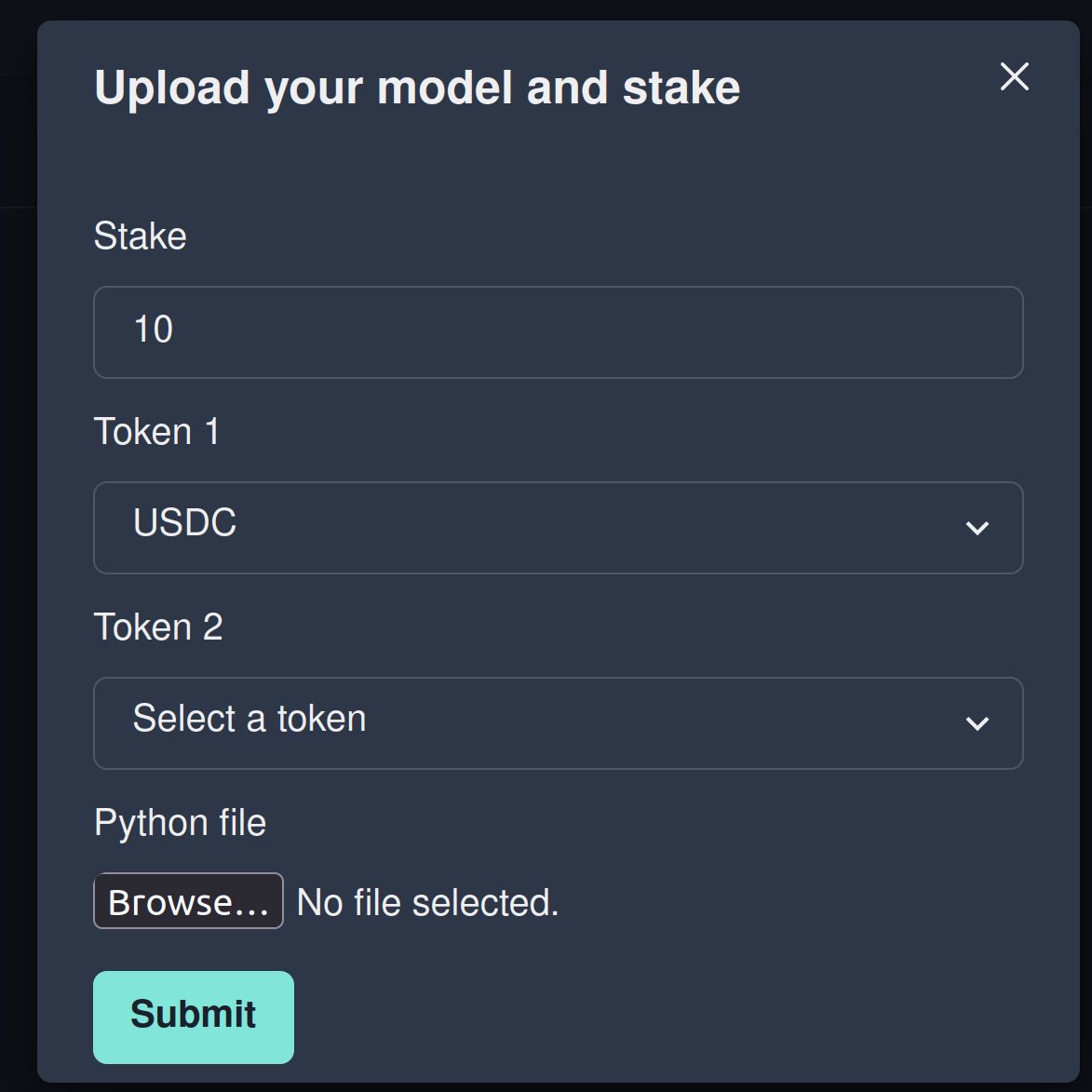

Strategists can register strategies onchain and push an encrypted Docker file to IPFS which can only be executed in a trusted environment e.g. Intel SGX. This protects their strategy from being leaked. They also have to put up a stake to insure potential losses. As their strategies are expected to be delta neutral, their PnL is checked after each epoch and settled with the stake. If their stake is below a certain safety threshold, they have to put up more funds as otherwise their model won't be allowed to manage funds.

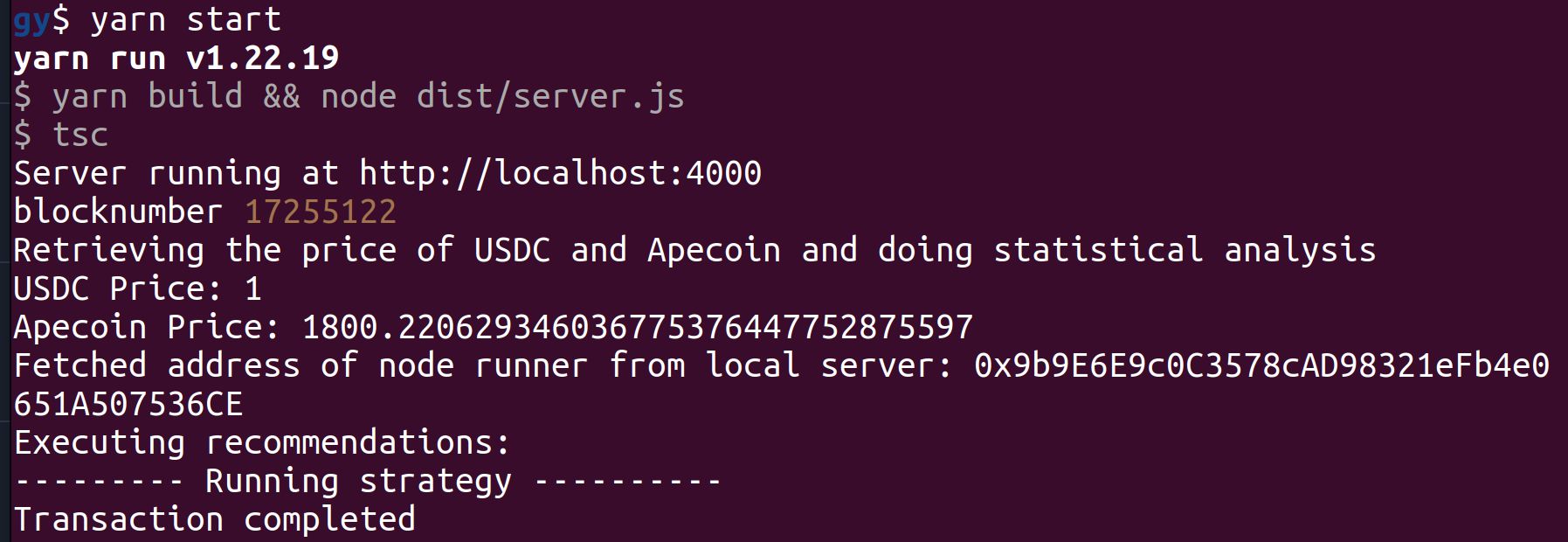

A node runner can pick up the models over Filecoin and register using a secret that is stored in the enclave. Node runners have to execute the code stored in the secret enclave. In the provided market making strategy, we update Uniswapv3 range orders. However, in the future onchain orderbooks could be supported.

How it's Made

We built the smart contracts with Solidity and integrated them using Foundry/Anvil with Aavev3 and Uniswapv3. Eventually, we deployed the smart contracts on GnosisChain as we think their cheap fees would be ideal for active market making strategies. Also, we see strong strategic alignment as Uniswapv3 is planning to launch on Gnosis soon. Using our market making, we can provide sufficient liquidity in the initial rather illiquid market.

In order to derive the best strategy, we integrated TheGraph to get accurate price information. Further, we decided to make the market for ApeCoin to enable a more liquid market for their token. While ApeCoin is currently only available on UniswapV2, our market making could enable a V3 pool. To ensure decentralised distribution of market making models, Filecoin/IPFS was used.