Quotation Station

A peer-to-peer trading system integrating both DEXes and CEXes, powered by agent-based services. With atomic swaps across EVM chains and smart orchestration of agents, we deliver seamless, decentralized arbitrage opportunities for institutional and retail users alike.

Project Description

Quotation Station is a peer-to-peer decentralized trading system, integrating both centralized exchanges (CEXes) and decentralized exchanges (DEXes) through robust connectivity using CCXT and DCTX libraries. Our innovative framework allows users to engage in arbitrage and trading opportunities by leveraging a network of agents, each with distinct roles in an agent-based economy.

Key to our system are atomic swaps across EVM-compatible chains, secured by smart contracts that ensure trustless, instant trade execution across multiple blockchain environments.

At the heart of the ecosystem is the Orchestrator agent, which manages the lifecycle and health of the various agent services (Solver, Executor, Price Feed). The orchestrator also dynamically incentivizes participation, balancing the number of solvers and executors to ensure smooth, continuous operations, even in cases of participant shortages.

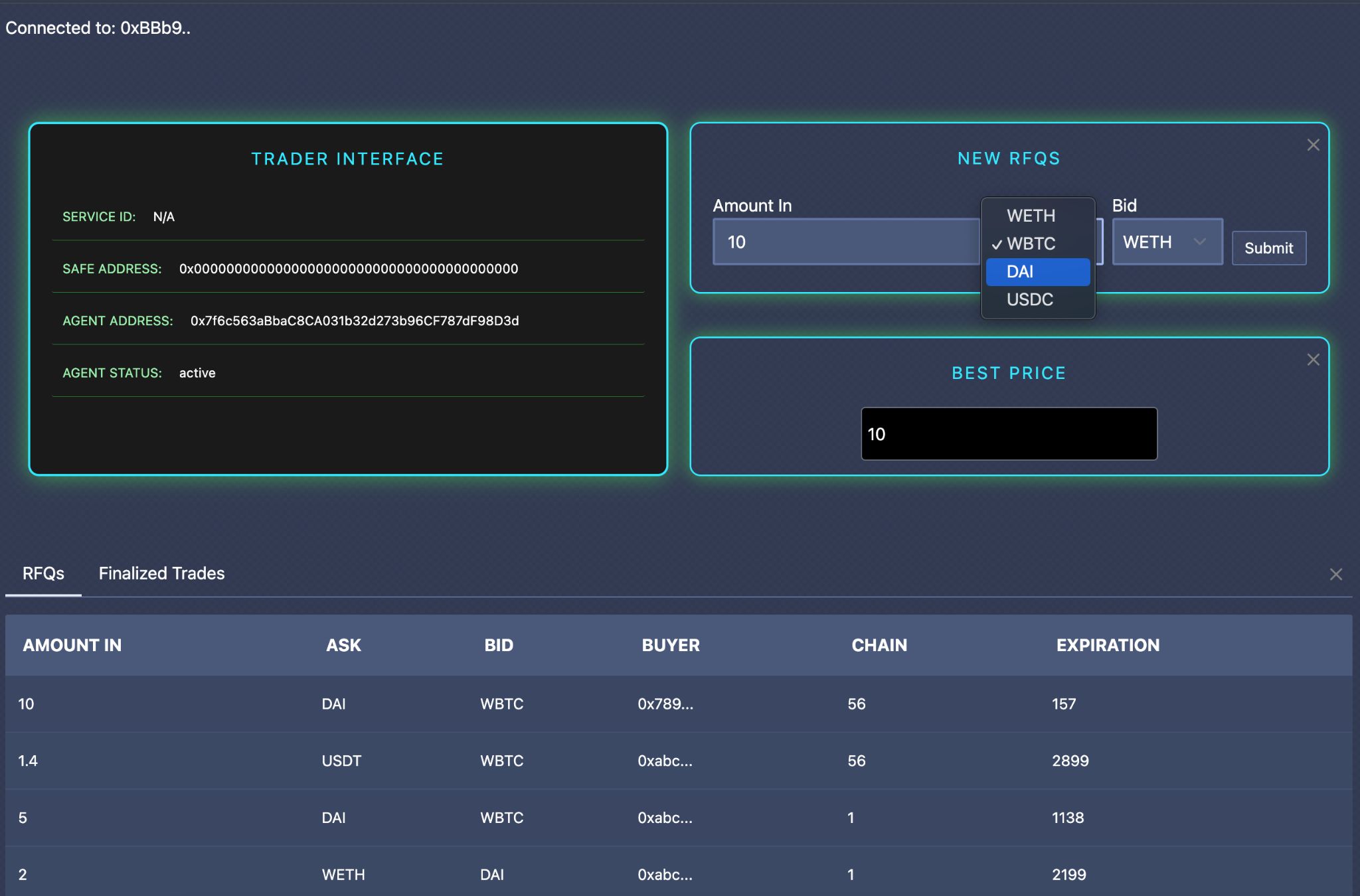

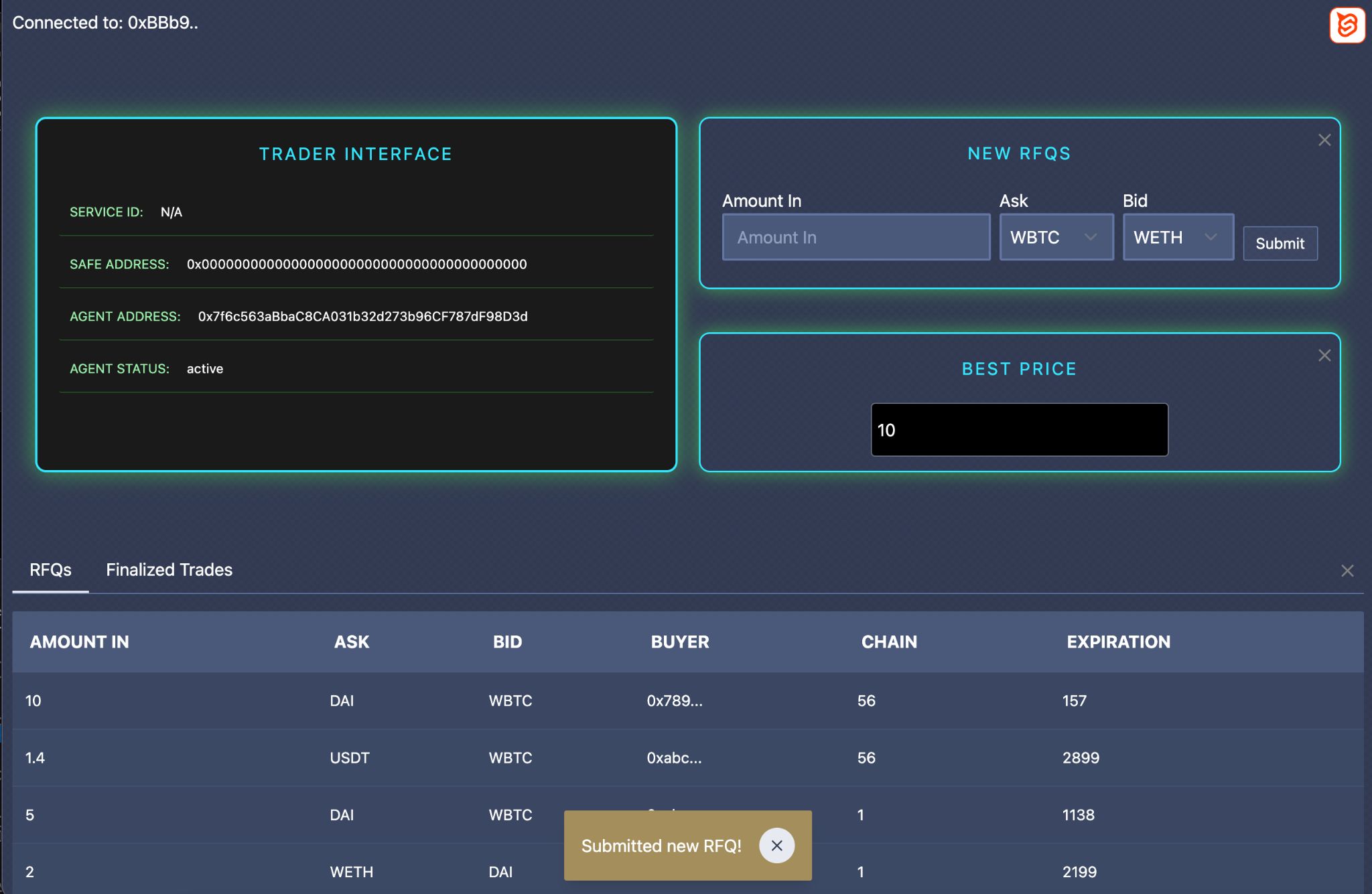

Our platform supports both institutional and retail users through a user-friendly, intuitive frontend, simplifying access to powerful decentralized financial tools. The multi-agent architecture allows each agent (Solver, Executor, Price Streamer) to operate individually or in concert with others, creating efficient and scalable agent economies.

This modular design fosters a resilient and decentralized peer-to-peer trading system, bringing together liquidity from both centralized and decentralized markets, optimizing arbitrage opportunities and executing trades with maximum efficiency.

How it's Made

How It's Made:

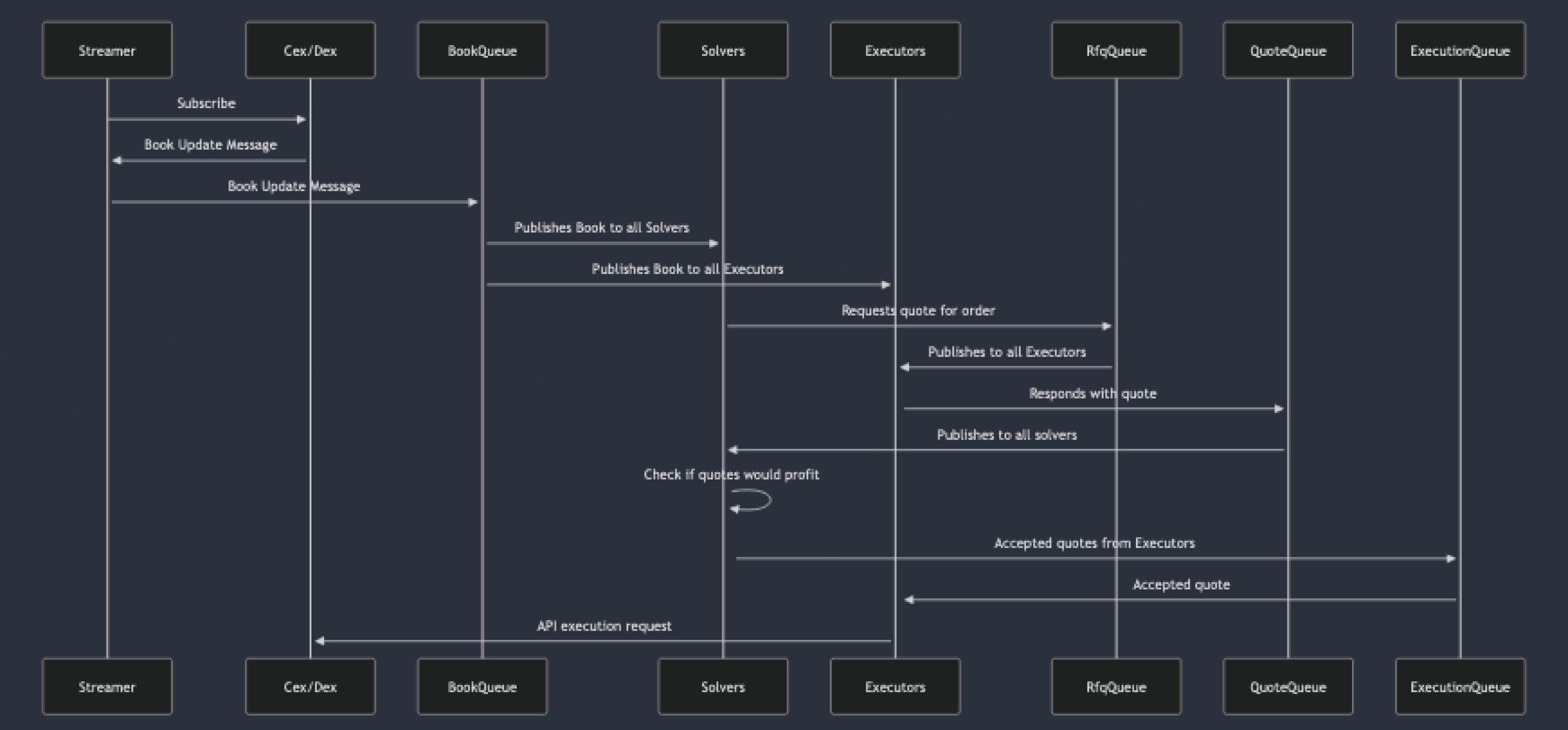

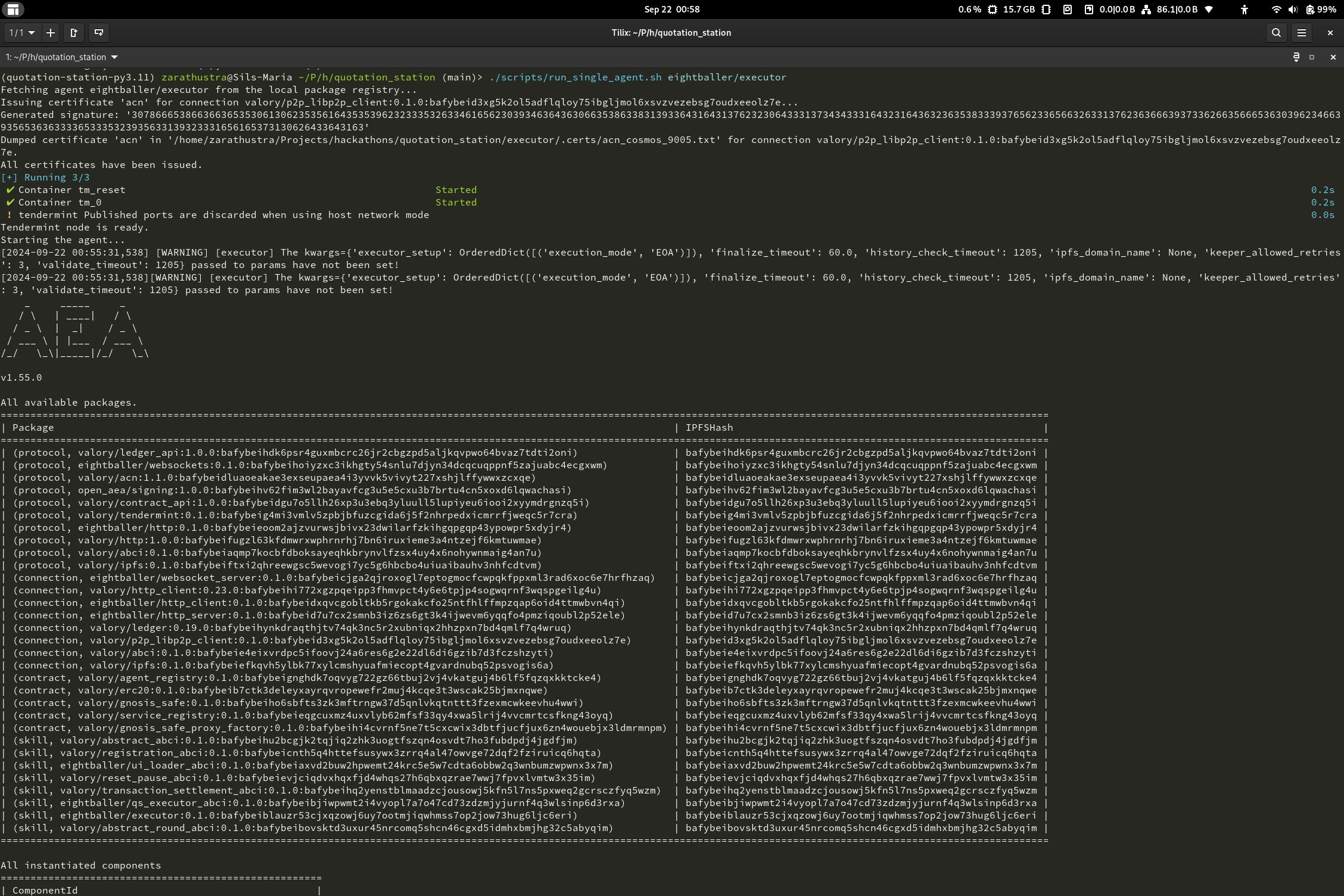

We built this project using the Autonolas framework, which provided the foundation for our agent-based services. The architecture revolves around a set of core agents—Orchestrator, Solver, Executor, and Price Streamer—each running as individual or multi-agent services that communicate and interact within an agent-economy.

The trading system integrates both DEXes and CEXes via two critical libraries: CCXT for centralized exchange (CEX) integration and DCTX for decentralized exchange (DEX) access. This allows us to bring together liquidity and trading functionality from diverse platforms into a unified peer-to-peer system.

EVM-based smart contracts are employed to enable atomic swaps across various chains, ensuring secure, trustless trades without intermediary risks. These smart contracts act as the backbone for executing cross-chain arbitrage opportunities.

Agent Breakdown:

- Orchestrator: The orchestrator agent is responsible for managing the deployment, lifecycle, and health of the other agents. It spins them up via Docker containers, monitors their states, and ensures smooth operations by incentivizing participation where needed (e.g., adjusting rewards to attract solvers/executors during shortages).

- Price Streamer: Constantly fetches live price data from various DEXes and CEXes to inform both the solver and executor agents about optimal trade opportunities.

- Solver: This agent matches Request for Quote (RFQ) orders between buyers and sellers and optimizes the best trades.

- Executor: The executor responds to RFQ requests, acting as the supplier and executing matched orders once they are confirmed.

Technologies Used:

- Autonolas framework: The core framework for building, customizing, and deploying the agents.

- Docker: Used to containerize each agent for independent deployment, making the ecosystem highly modular and scalable.

- CCXT & DCTX: Libraries for integrating with both centralized and decentralized exchanges.

- Tendermint: For coordinating synchronized state-transitions within each of the multi-agent services.

- Libp2p: For peer-to-peer dialogue between the agents.

- IPFS: For storing all the code of the agents and their components.

- Solidity: For writing smart contracts enabling atomic swaps across multiple EVM chains.

- Python: Primarily used for scripting the agents and managing their interactions.

Hacky and Notable Aspects:

-

Cross-chain Atomic Swaps: We hacked together a flexible, EVM-compatible smart contract architecture that allows for atomic swaps across multiple blockchains. This reduces the need for traditional intermediaries and allows users to move assets quickly between chains with zero trust required.

-

Incentivized Orchestration: The Orchestrator isn’t just a passive controller—it actively monitors the health of the agent economy and incentivizes more participants by tweaking reward schemes in real-time to balance demand across solvers and executors. This creates a dynamic, self-regulating system.

-

Agent Economies: Each agent can run independently or in a group as a multi-agent service. This modular approach allows for the creation of self-sufficient agent economies that adapt to real-world demand.

By combining these technologies and concepts, we’ve built a resilient, decentralized p2p trading system that bridges liquidity between CEXes and DEXes, while automating arbitrage and trade execution in a trustless and scalable manner.