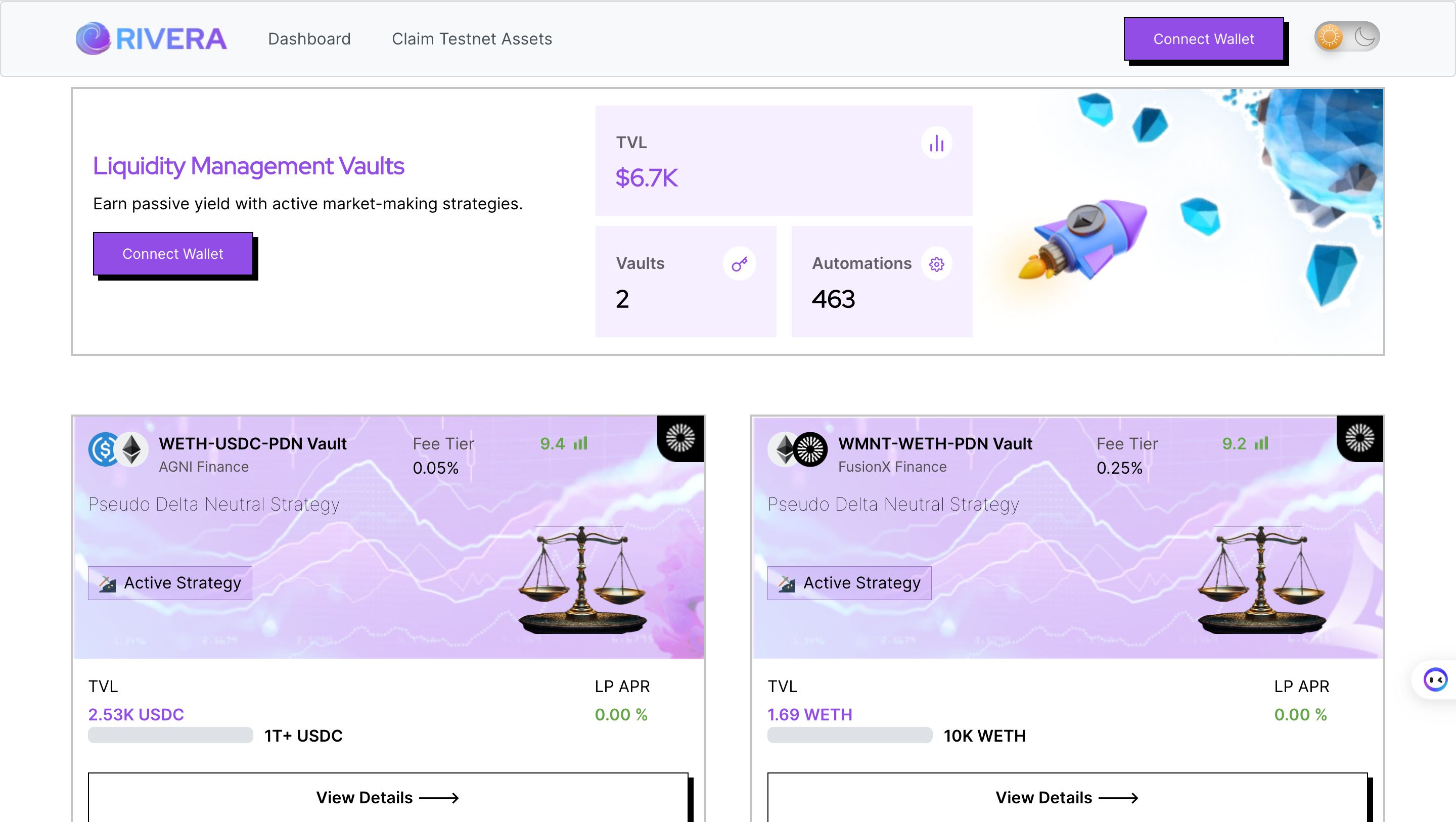

Rivera Money

Earn risk-free returns on $GHO. ERC-4626 vault for delta-neutral farming.

Project Description

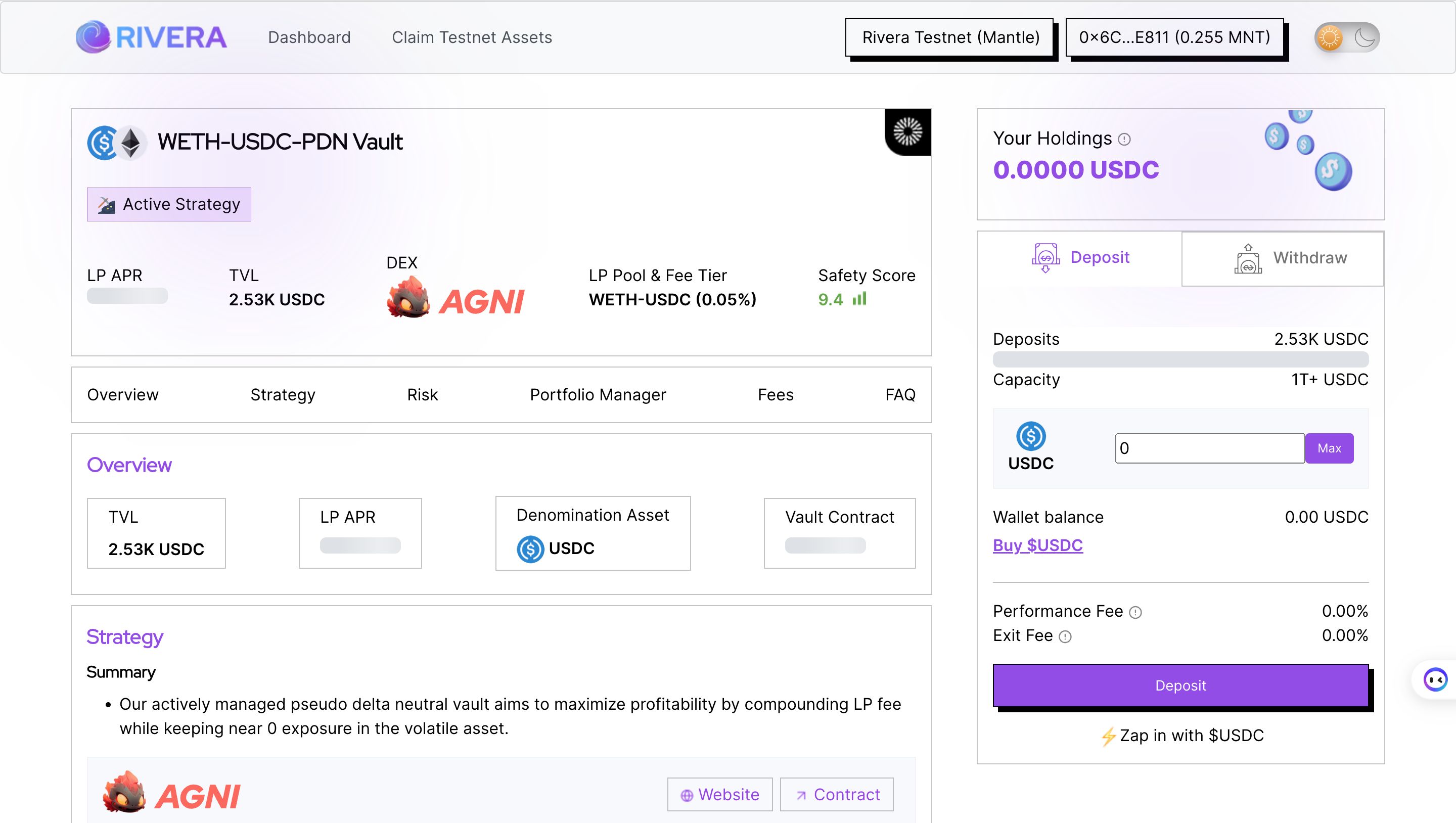

We have built ERC-4626 vaults running a delta-neutral strategy on $GHO. $GHO holders can deposit their assets in the vault and earn yield by providing liquidity on the ETH-GHO-like LP pools on Uniswap or other AMMs. Our delta-neutral strategy hedge. strategy exposure in $ETH or another volatile asset so that users can enjoy a high yield of AMM LP farming without taking any market risks.

How it's Made

We have employed a delta-neutral strategy to farm an AMM pool without taking volatility exposure of a secondary asset. The strategy takes a long and short position on the volatile asset. The long position is used for DeFi farming while the short position will hedge user exposure in the volatile asset. Shorting is done by borrowing volatile assets from the Aave pool.

The user deposits funds in an ERC-4626-based vault contract. The funds are then employed in a delta-neutral strategy by a secondary smart contract called a strategy contract. Say, the user deposits 100 $GHO into the vault contract, 60 $GHO will be transferred to the Aave lending contract, and using this position as collateral, 40 $GHO worth of $ETH is borrowed at a 150% collateral ratio. Now using the borrowed $ETH and the remaining 40 $GHO in the vault, a farming position worth 80 $GHO is opened. Overall user deposited funds are earning farming rewards at an efficiency of 80%. So if the farming reward for the pool being employed is providing 25% APY (which is not uncommon on Uniswap) then the users will be generating a 20% APY on their vault deposits without taking any market or volatility risks.

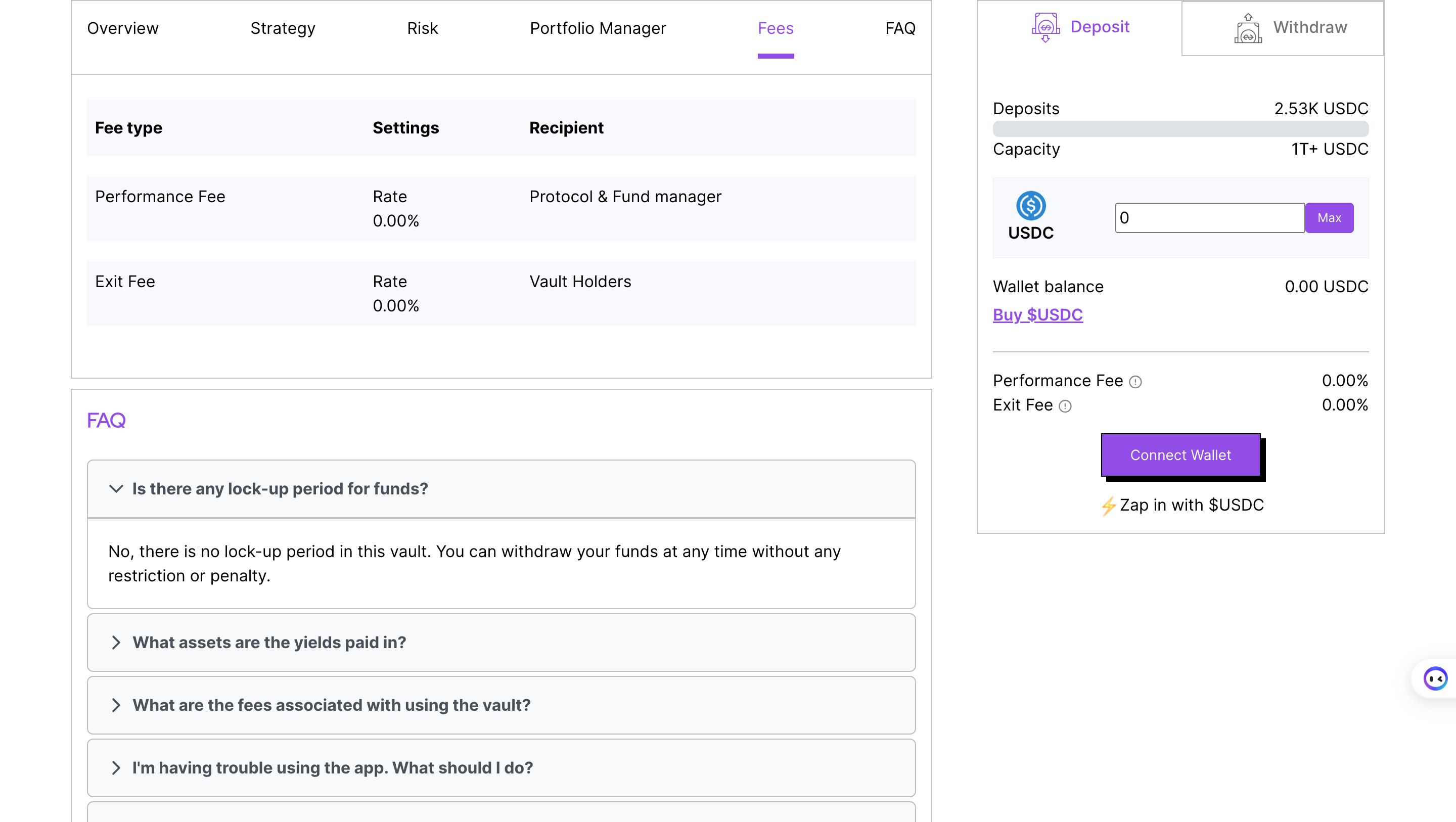

We have employed automation using Gelato. The keeper automatically rebalances the strategy's hedging exposure as the market price volatile asset changes. The keepers ensure that user risk exposure is evenly distributed by calling the rebalance function of the strategy contract. This also ensures that a 150% collateral ratio is maintained on Aave to avoid liquidation. Keepers also run an algorithmic harvester that maximizes compounding efficiency.