Sassy - ZK Data NFTs

Automatic ZK claim generator that can be trade across chains and marketplaces as an NFT

Project Description

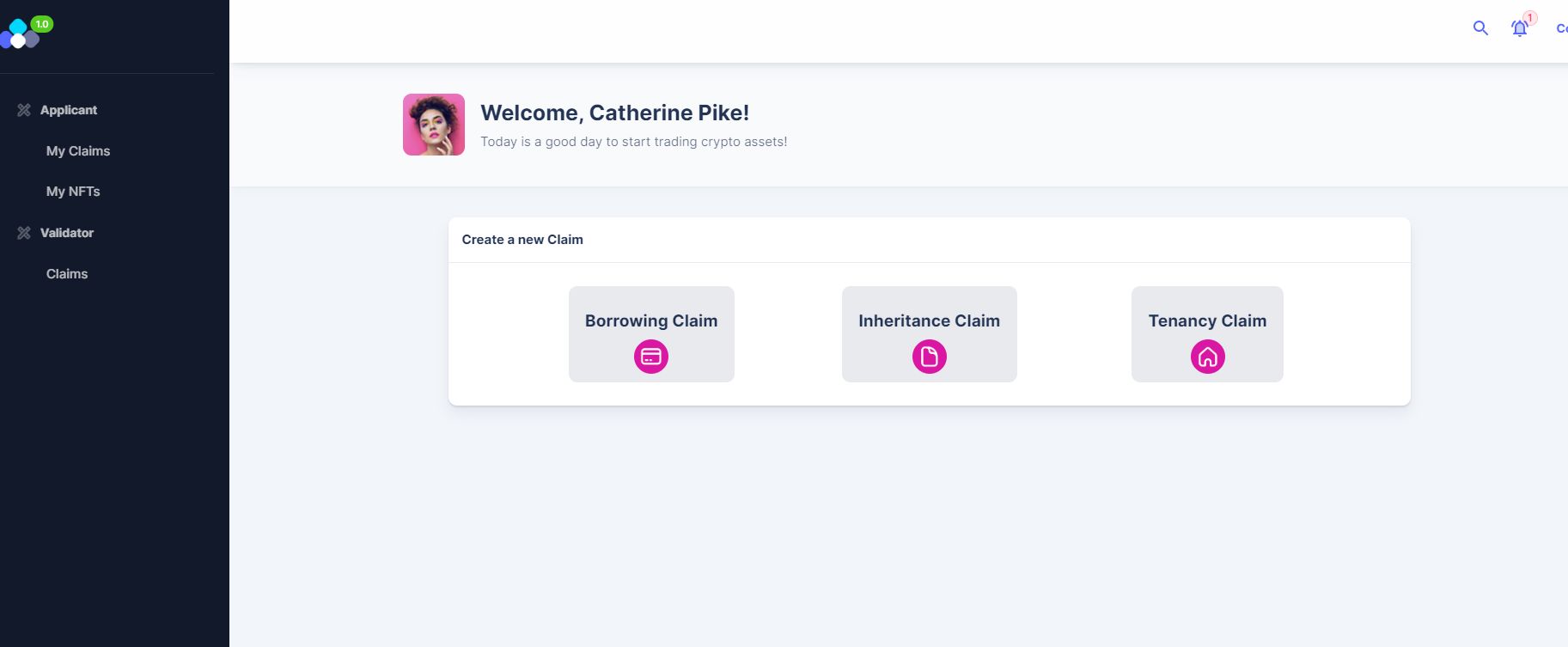

Sassy is a Dapp that provides a user-friendly, secure, and efficient claim solution that tackles the issues of the traditional borrowing process. Sassy addresses issues such as lack of privacy, silo credit assessment, and fraud. To achieve this, Sassy allows the issuing of automatic zero-knowledge credit claims from verified Web2 sources of data (such as a user's bank account) that can be turned into transferable NFTs. This allows users to access credit opportunities in other chains or marketplaces, making borrowing much more simple, reliable and private.

Sassy's architecture is designed to ensure privacy, security, and transparency. The use of zero-knowledge protocol and compute to data, ensures that users can prove they have access to certain credit criteria without revealing the information itself. The Dapp also ensures that the user's data is anonymized and securely stored in a private vault.

Sassy also enables the creation of credit NFTs form these ZK claims which allows the user explore every credit lending option across different chains and marketplaces.

Sassy empowers users to take control of their data and financial decisions while allowing lending processes to become much more efficient and collaborative.

How it's Made

- The user loads their transactional data from their bank account into the app through a direct API.

- The transactional data is then uploaded into a private vault on Filecoin, where nobody has access to it.

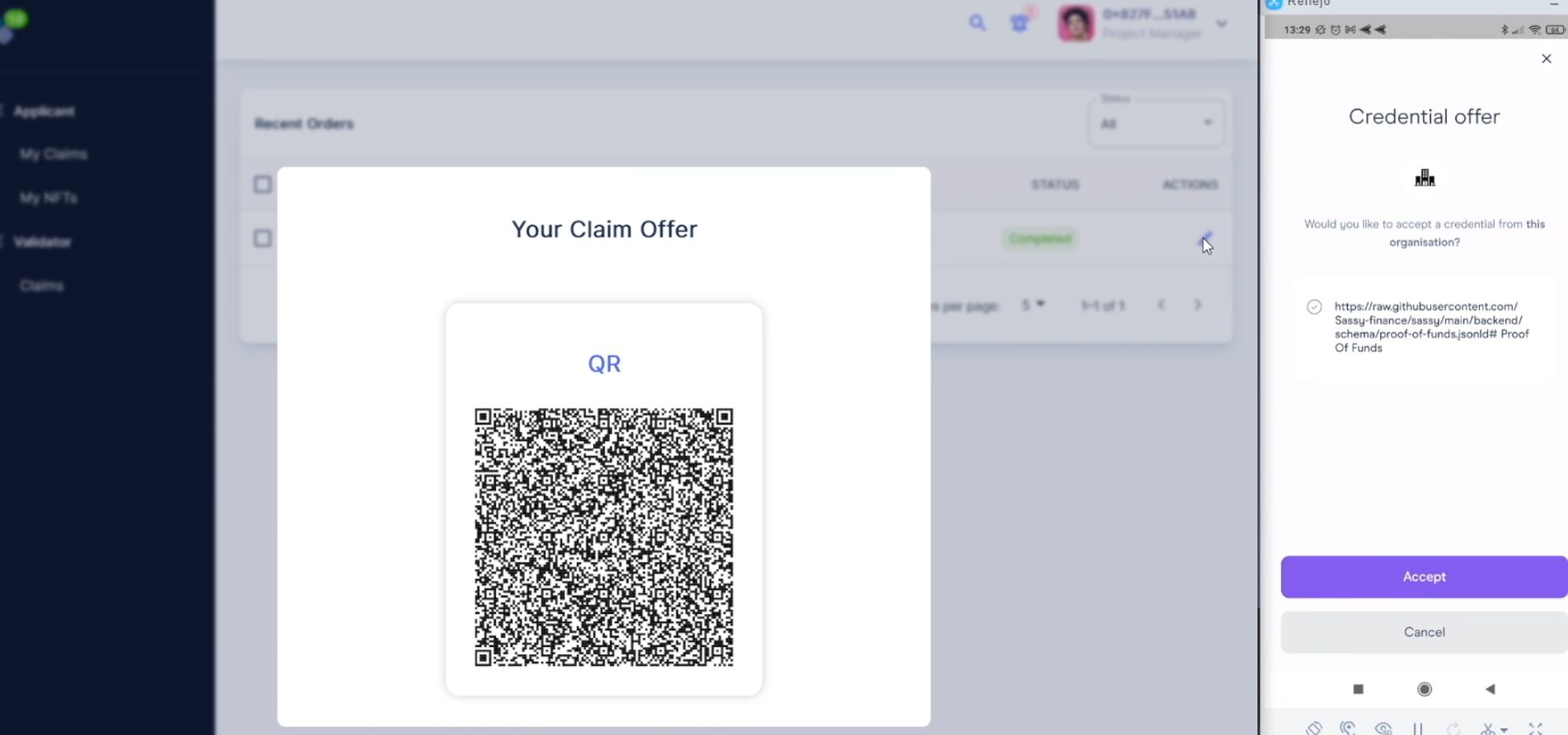

- A credit validator can then execute their credit algorithms without accessing the actual data, using BaKalhau, issuing a credit claim.

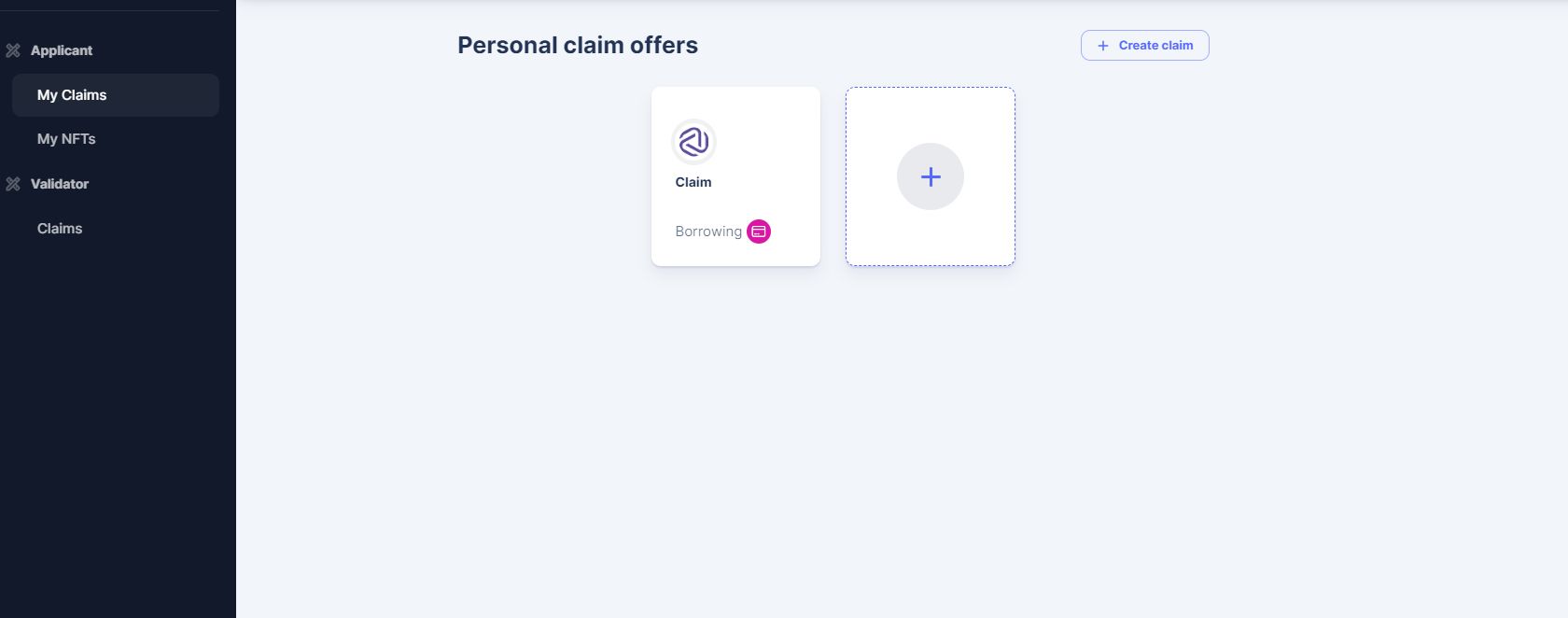

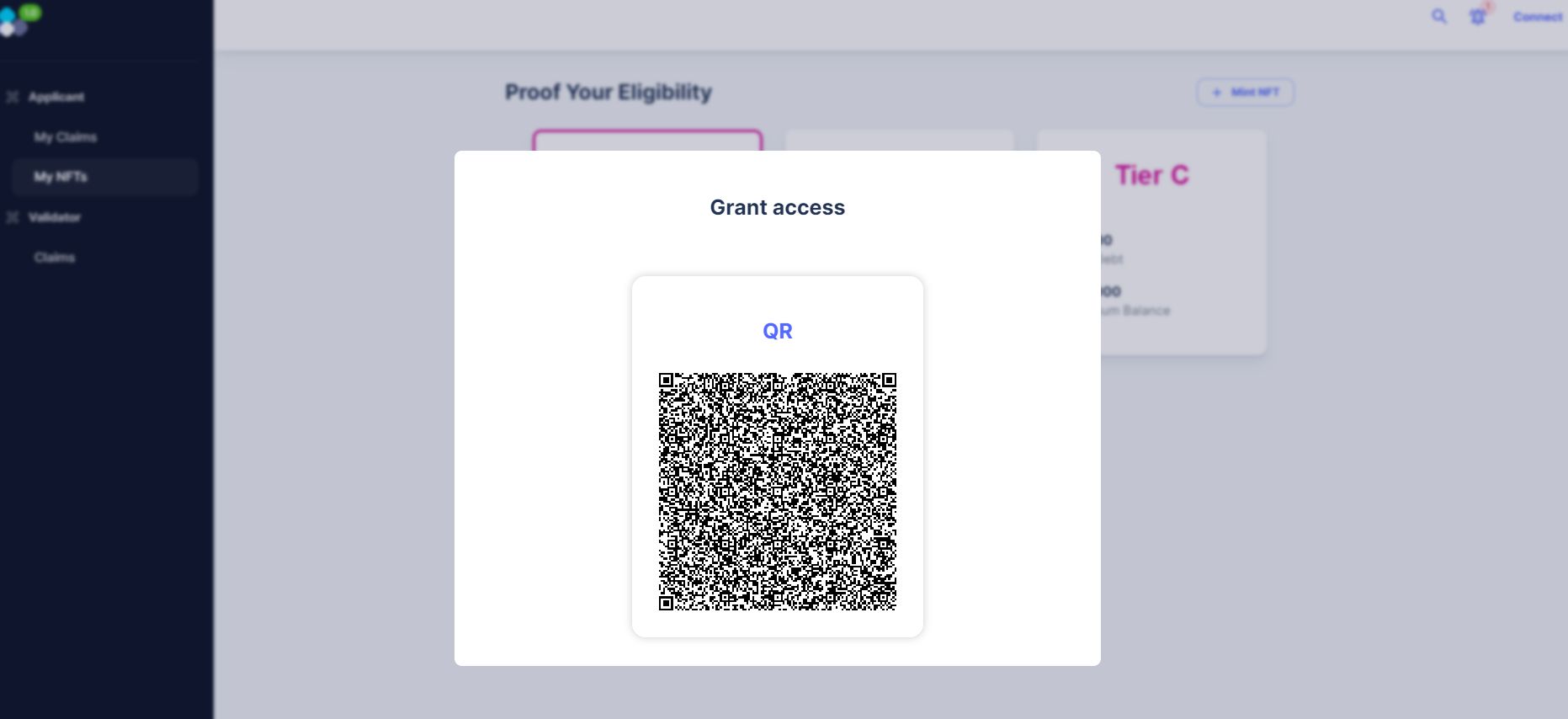

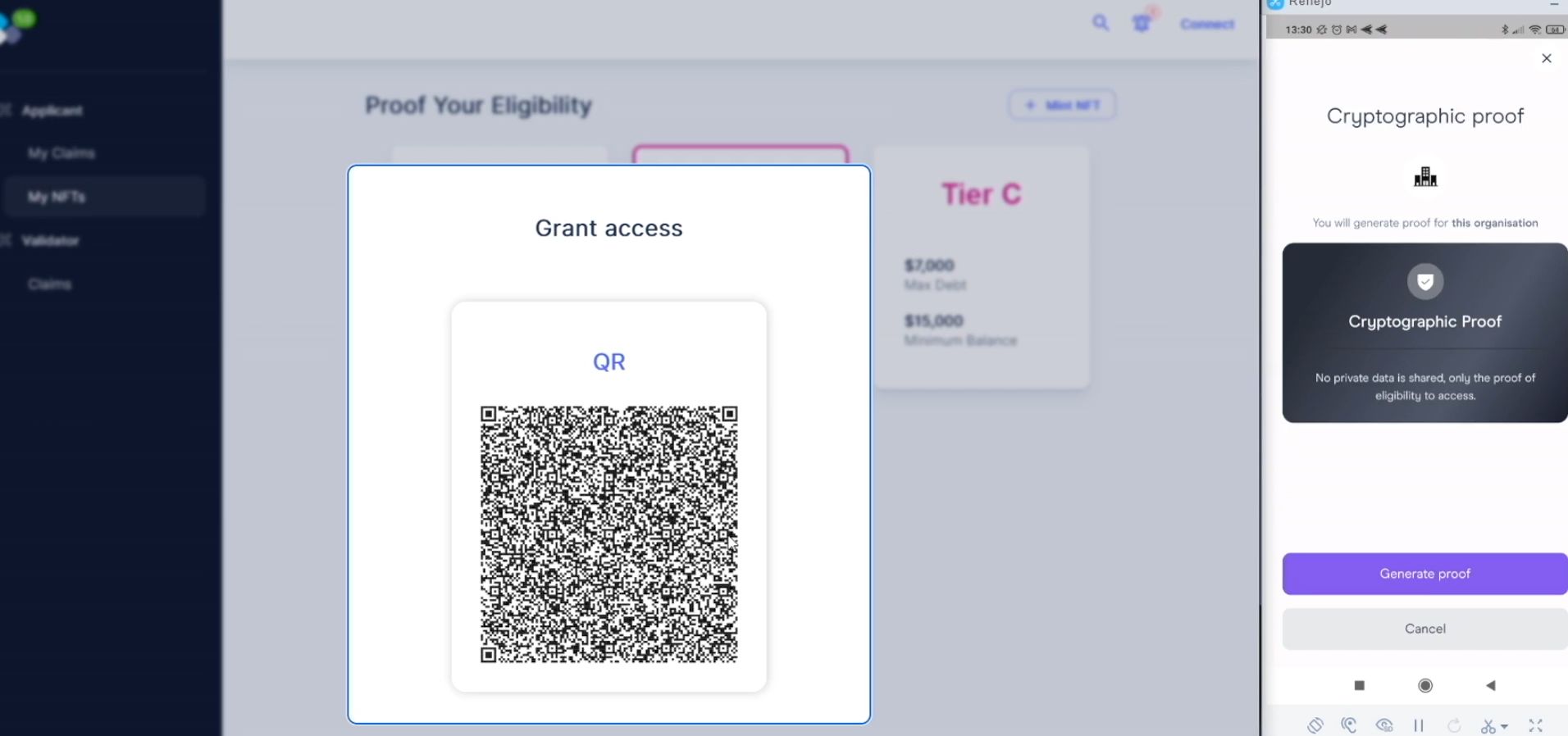

- Then the user can add this claim to their Polygon ID and verify their eligibility for a certain type of credit criteria.

- Lastly, the user can then request access to specific lending tiers by presenting the generated claim, confirming that they meet the parameters of that specific tier.