SET OFF

P2P Micro lending and borrowing platform with settlement clearing mechanism

Project Description

Traditional Lending Challenges:

Inefficiencies: Traditional lending systems often involve complex and time-consuming processes with intermediaries, leading to delays and high costs. Lack of Transparency: Limited visibility into the terms, conditions, and real-time status of loans can lead to distrust among participants. Obligation Settlement Issues: Settling obligations between multiple parties can be cumbersome and prone to errors, especially in closed clearing clubs. Lender and Borrower Pain Points:

Limited Access: Small-scale lenders and borrowers often face difficulties accessing favorable loan terms or capital. Unfair Terms: Conventional platforms may offer less favorable terms due to lack of competition or opaque pricing mechanisms. Risk Management: Managing and assessing credit risk can be challenging and inefficient. Solution:

Our platform offers a decentralized P2P lending and borrowing ecosystem with an integrated obligation settlement mechanism, leveraging advanced technologies to address the aforementioned problems.

Decentralized Lending and Borrowing:

Smart Contracts on Linea: Utilizes Linea's blockchain to enable transparent, secure, and efficient transactions between lenders and borrowers. Smart contracts automate the creation, management, and settlement of loans, reducing the need for intermediaries and minimizing errors. Dynamic Loan Terms: Lenders can define interest rates and loan terms, while borrowers can select from a range of available loans that meet their needs. This fosters a competitive environment, allowing for more favorable terms. Efficient Obligation Settlement:

On-Chain Clearing Mechanism: Implements an obligation settlement mechanism similar to closed clearing clubs but on-chain. This ensures that obligations among multiple parties are settled in a streamlined, automated manner, reducing the risk of disputes and errors. Graph Protocol Integration: Leverages the Graph Protocol to index and query blockchain data efficiently, providing real-time insights into loan statuses, obligations, and settlement processes. Enhanced Security and Privacy:

Phala TEE Integration: Utilizes Phala's Trusted Execution Environment (TEE) to ensure that sensitive data and computations are handled securely and privately. This enhances trust and security for all participants in the lending and borrowing process. Use Cases:

For Lenders:

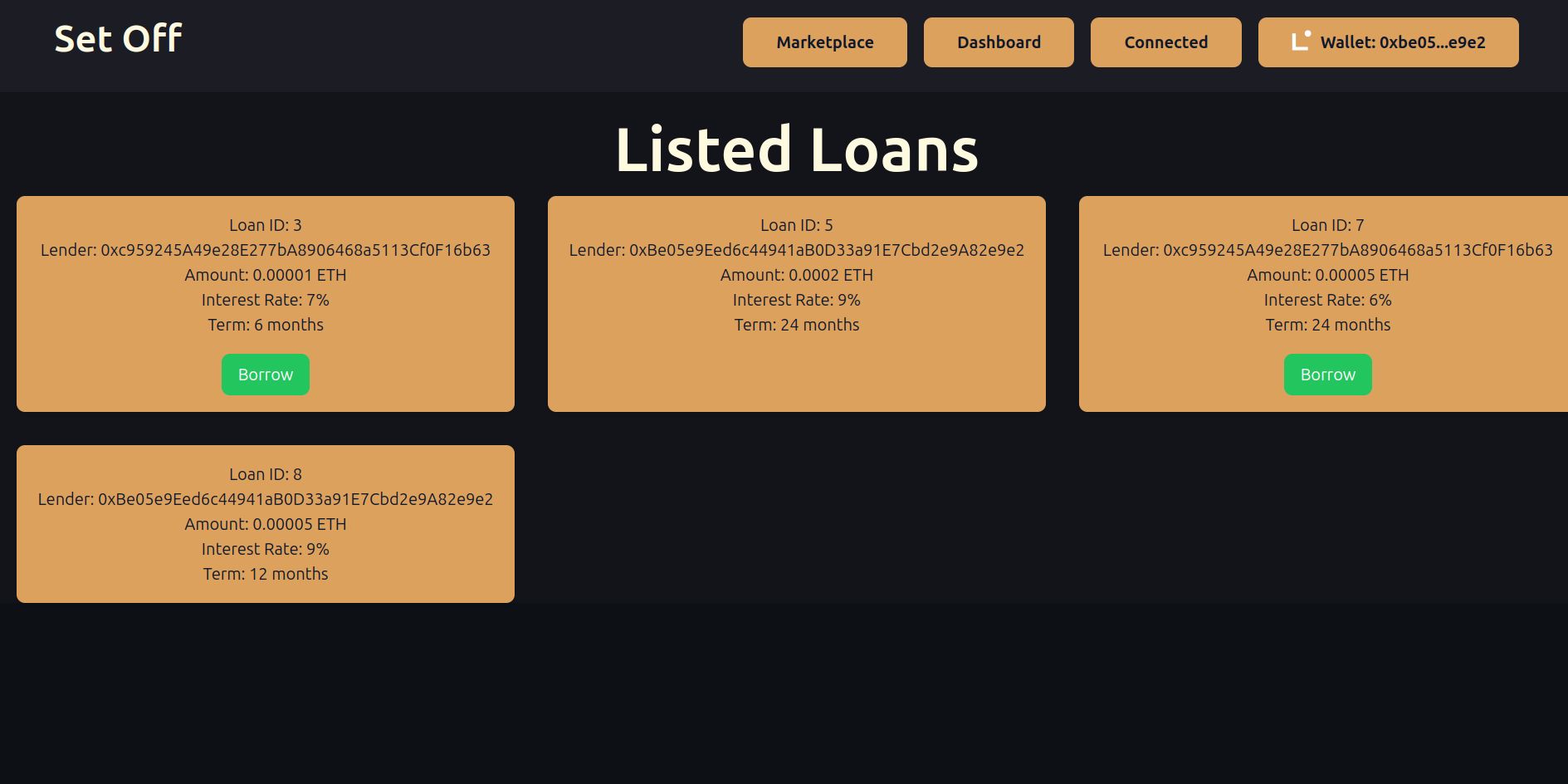

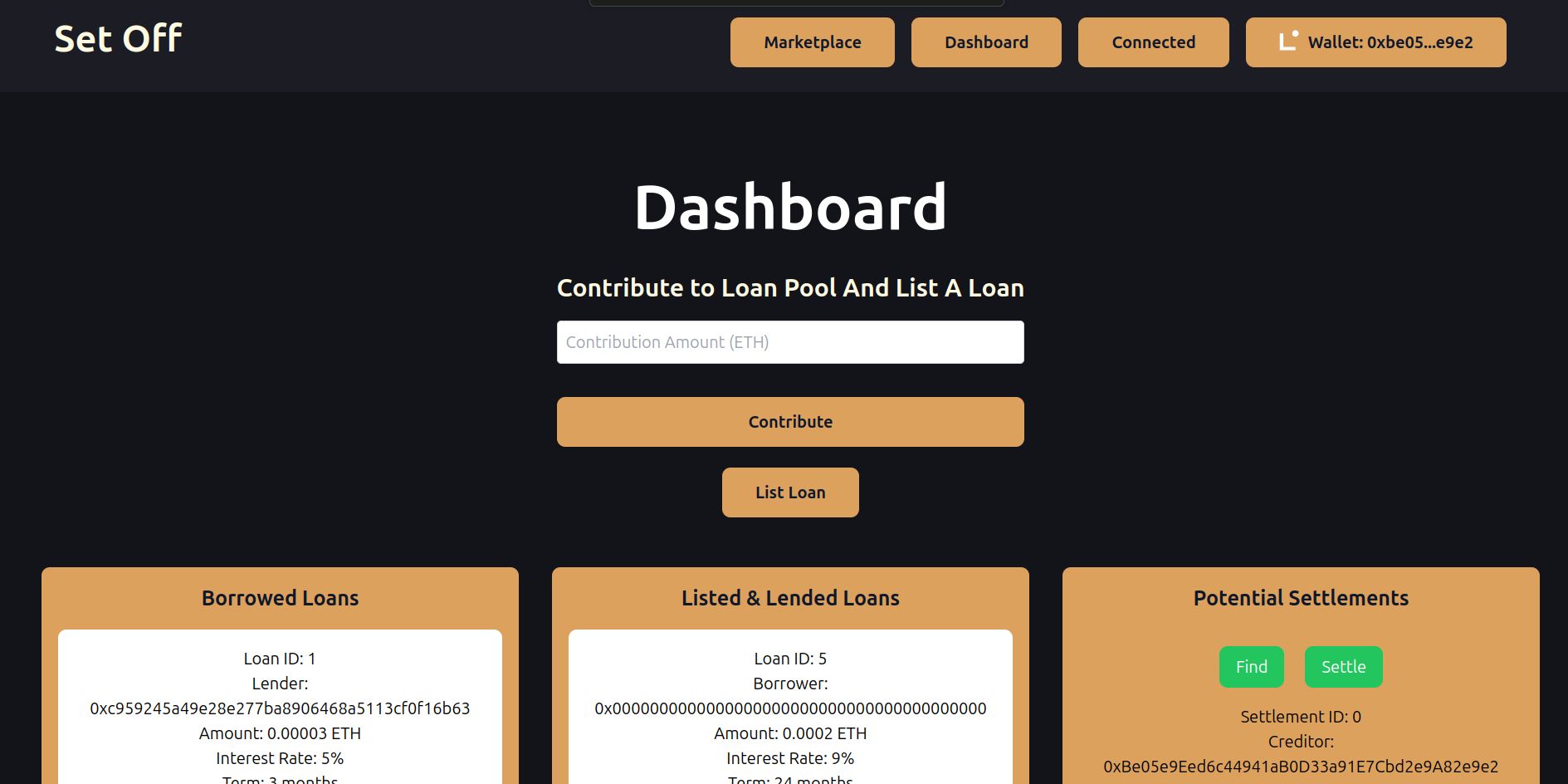

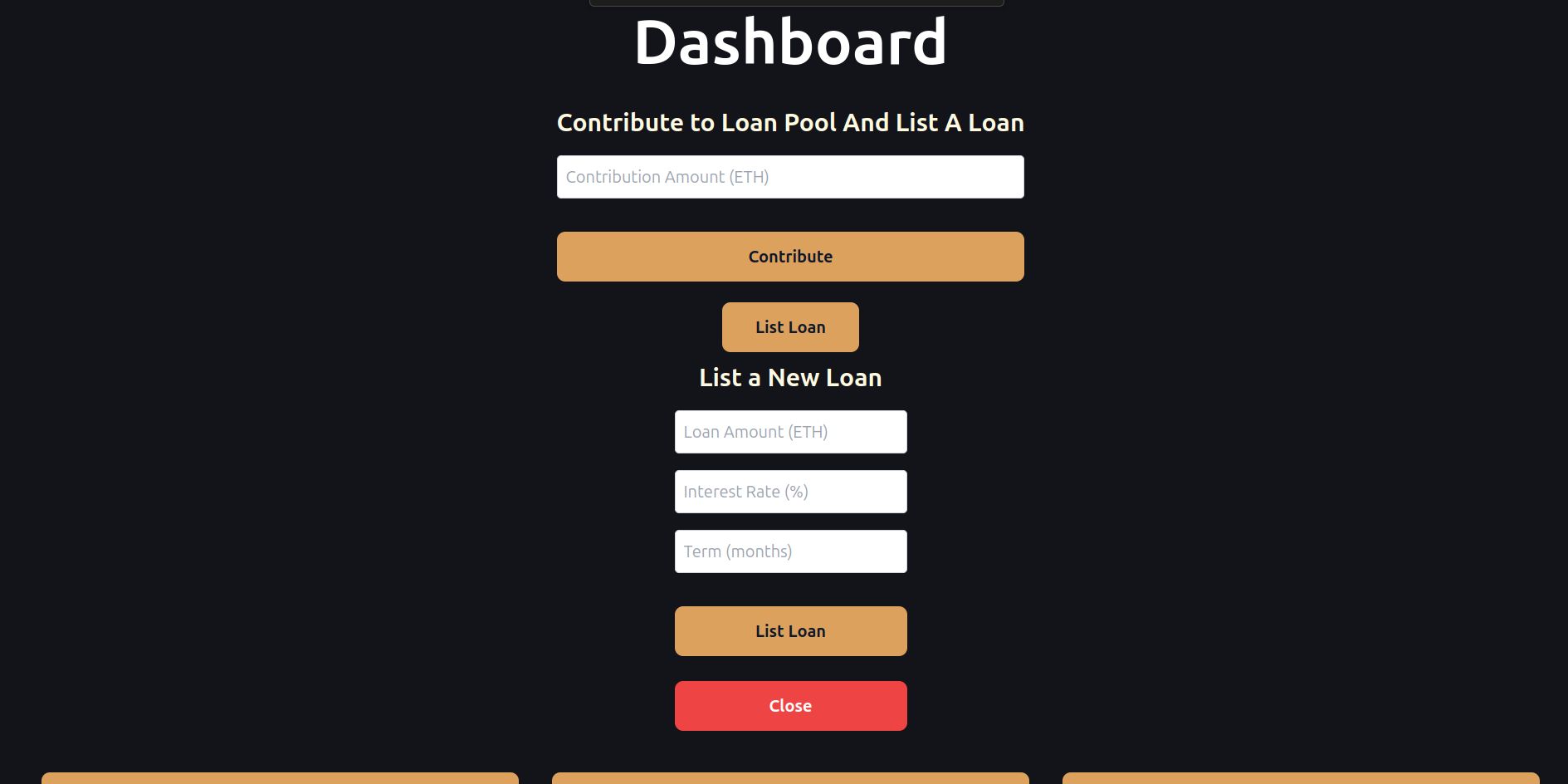

Create and List Loans: Lenders can contribute to the pool of available loans, set their own terms, and list them on the platform. Monitor and Manage Investments: Track loan performance, view detailed reports, and manage investments efficiently through the decentralized interface. For Borrowers:

Access Competitive Loans: Browse through various loan offerings, select terms that suit their needs, and apply for loans directly. Track Loan Status: Monitor the status of their loans and obligations in real-time, with transparent and fair processes. For Both Parties:

Automated Obligation Settlement: Experience seamless and automated settlement of obligations, reducing the administrative burden and ensuring accurate results. Conclusion:

Our platform revolutionizes P2P lending and borrowing by addressing traditional challenges through decentralization and advanced technology integration. By leveraging Linea, Phala TEE, and the Graph Protocol, we provide a secure, transparent, and efficient solution for modern lending and borrowing needs, transforming the financial landscape for both lenders and borrowers.

How it's Made

- Core Technologies Used:

Linea Blockchain:

Role: Linea provides the foundation for our decentralized platform. We use Linea’s smart contract capabilities to manage the creation, execution, and settlement of loans. Integration: Smart contracts are written in Solidity and deployed on Linea, ensuring secure and transparent transactions. The blockchain’s scalability and efficiency support our platform’s real-time operations. Phala TEE:

Role: Phala’s Trusted Execution Environment (TEE) is used to handle sensitive data and computations securely. This ensures that borrower and lender data, as well as the details of loan transactions, are protected from unauthorized access. Integration: Phala TEE is integrated into our smart contracts and off-chain components to secure the processing of confidential information, such as personal financial data and loan terms. The Graph Protocol:

Role: The Graph Protocol is employed to index and query blockchain data efficiently. It helps us provide real-time data on loan statuses, obligations, and settlement processes to users. Integration: We use subgraphs to create custom data indexing for our platform, enabling fast and reliable access to data required for the platform’s operations and user interfaces. 2. Architecture and Integration:

Smart Contracts:

Lending/Borrowing Logic: Deployed on Linea, these contracts handle the core functionalities, including loan creation, terms setting, application, and repayments. Obligation Settlement: A custom smart contract manages the settlement of obligations between multiple parties. This contract ensures that all parties meet their commitments efficiently and fairly. User Interface (UI):

Frontend Framework: Built using React, our UI interacts with the Linea blockchain via ethers.js. The UI allows users to create loans, apply for loans, and monitor their statuses. Data Display: Utilizes The Graph Protocol for efficient querying and displaying real-time data on loan statuses and obligations. Backend Services:

Data Handling: Backend services integrate with Phala TEE to handle sensitive computations securely. These services process off-chain data and interact with our smart contracts as needed. APIs: Custom APIs are built to facilitate communication between the frontend and backend, as well as between the backend and the blockchain. 3. Partner Technologies:

Phala TEE: Provides a secure environment for processing sensitive information. This partnership enhances user trust and compliance by safeguarding personal and financial data. The Graph Protocol: Enables efficient data indexing and querying, significantly improving the platform’s responsiveness and user experience. 4. Notable Hacks and Innovations:

Custom Obligation Settlement Mechanism:

Hacky Element: To address the challenge of multi-party obligation settlement, we designed a novel smart contract mechanism that automates and optimizes the settlement process. This approach is inspired by closed clearing clubs but tailored to the decentralized nature of our platform. Hybrid On-Chain/Off-Chain Data Processing:

Hacky Element: We implemented a hybrid data processing model where sensitive data is processed off-chain using Phala TEE, while critical transactional logic remains on-chain. This approach minimizes on-chain computation while ensuring security and efficiency. Dynamic Loan Term Adjustment:

Hacky Element: Our platform includes a feature allowing lenders to adjust loan terms dynamically based on market conditions. This adaptability is achieved through a combination of smart contract logic and real-time data analysis facilitated by The Graph Protocol. In summary, our project leverages a combination of Linea for blockchain operations, Phala TEE for secure data processing, and The Graph Protocol for efficient data handling. Through innovative integrations and a hybrid approach to data processing, we’ve created a robust and scalable P2P lending and borrowing platform with a cutting-edge obligation settlement mechanism.