Shared liquidity dex

A brand new decentralized exchange with a shared liquidity vault powered by PYTH oracles, enabling LPs to deposit into an index fund of assets with dynamic fees and integration for swap functionality

Project Description

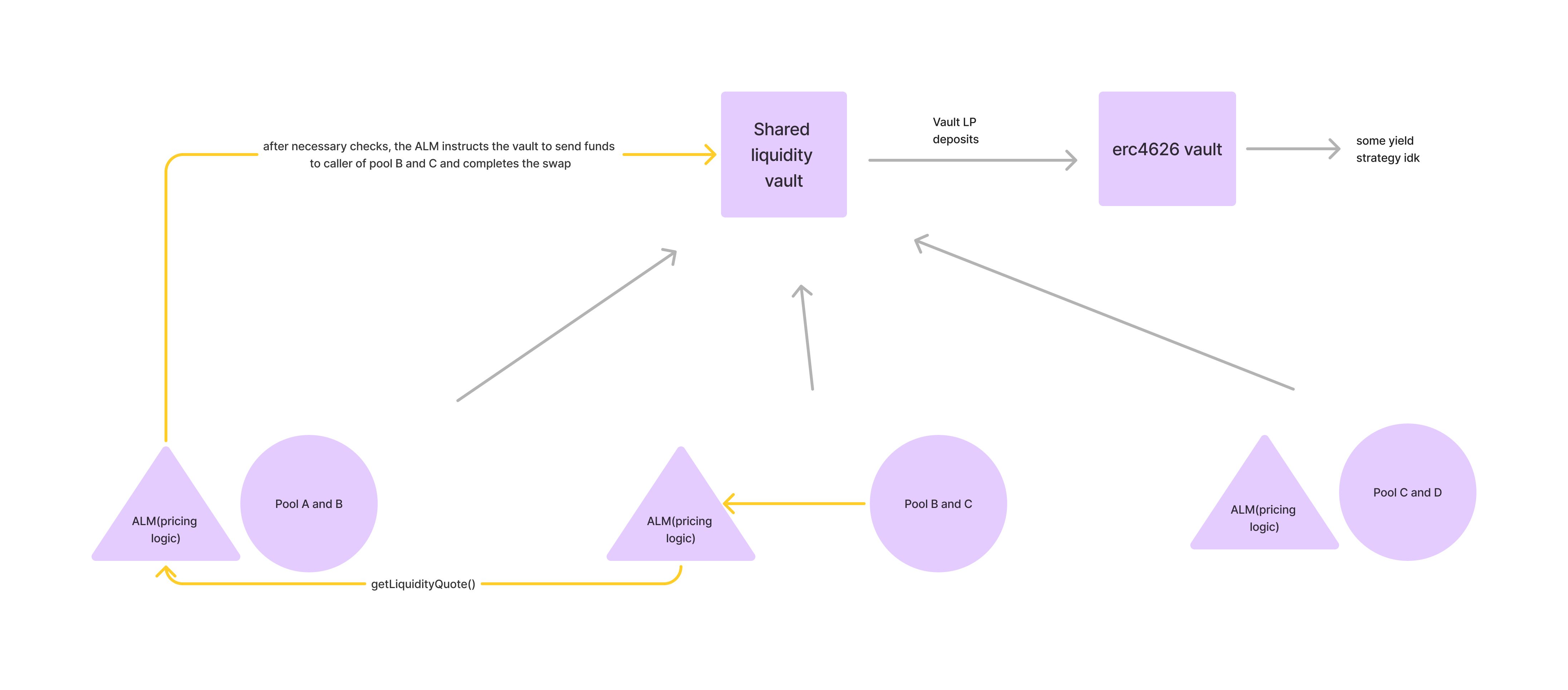

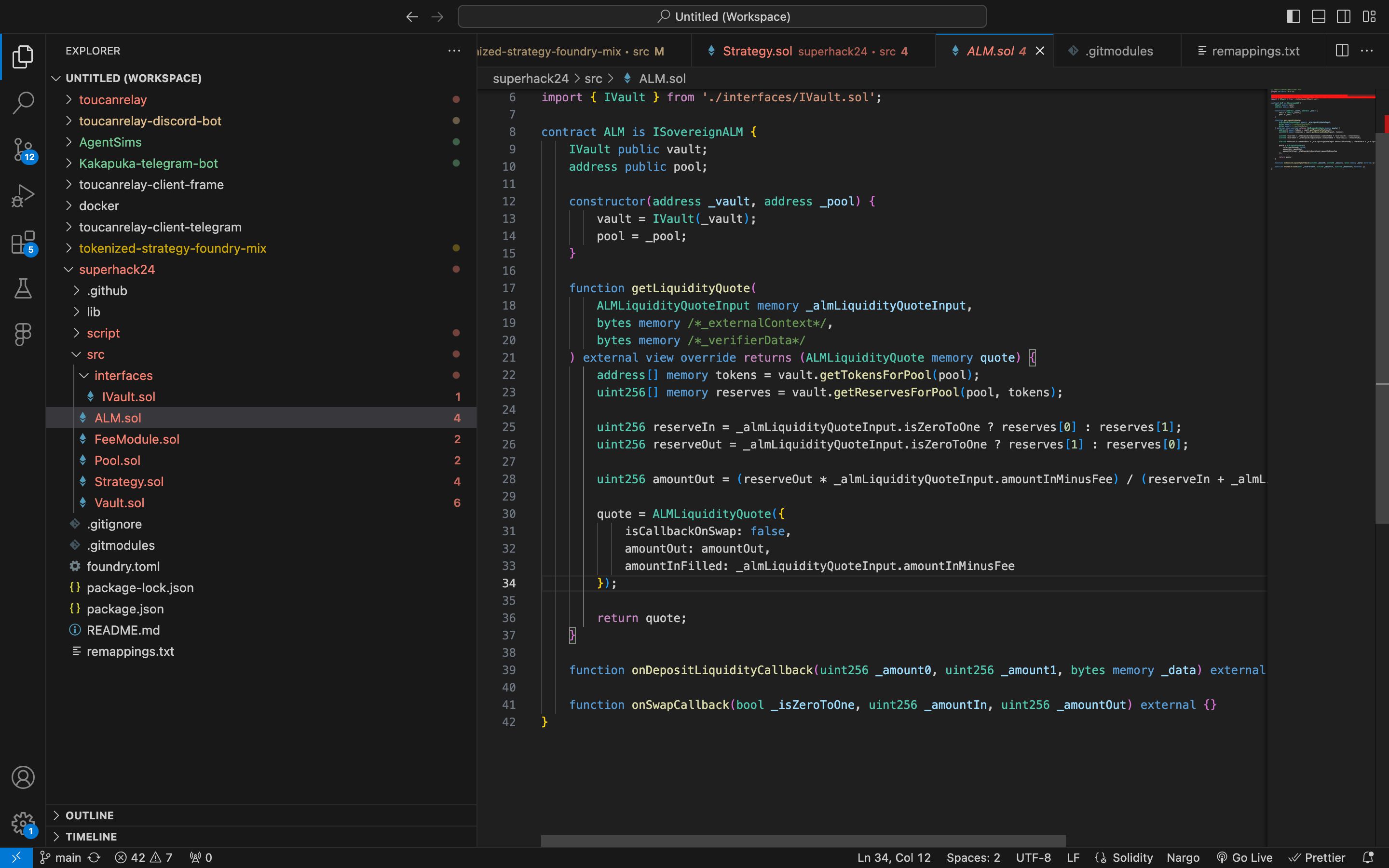

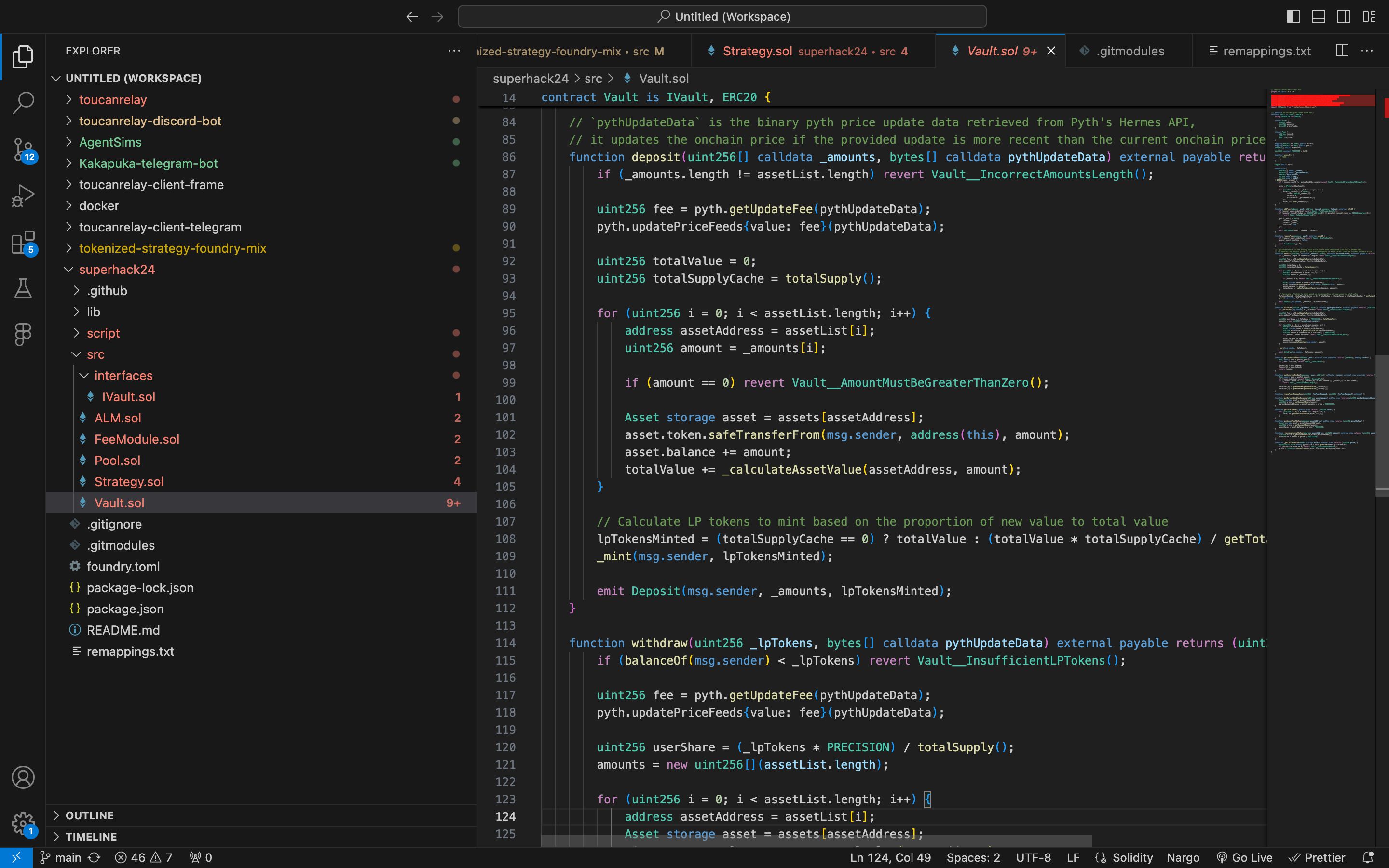

This project is a decentralized exchange built on a DEX modular stack, featuring a shared liquidity vault that acts as a market-weighted index fund. Liquidity providers deposit into a collection of assets, spreading risk and rewards across the entire vault. The system integrates with PYTH oracles for pricing and value determination and includes a dynamic fee structure that adjusts based on asset balances. Additionally, the DEX features an ERC-4626 vault integration, where fees are converted into LP tokens and used to generate additional yield.

How it's Made

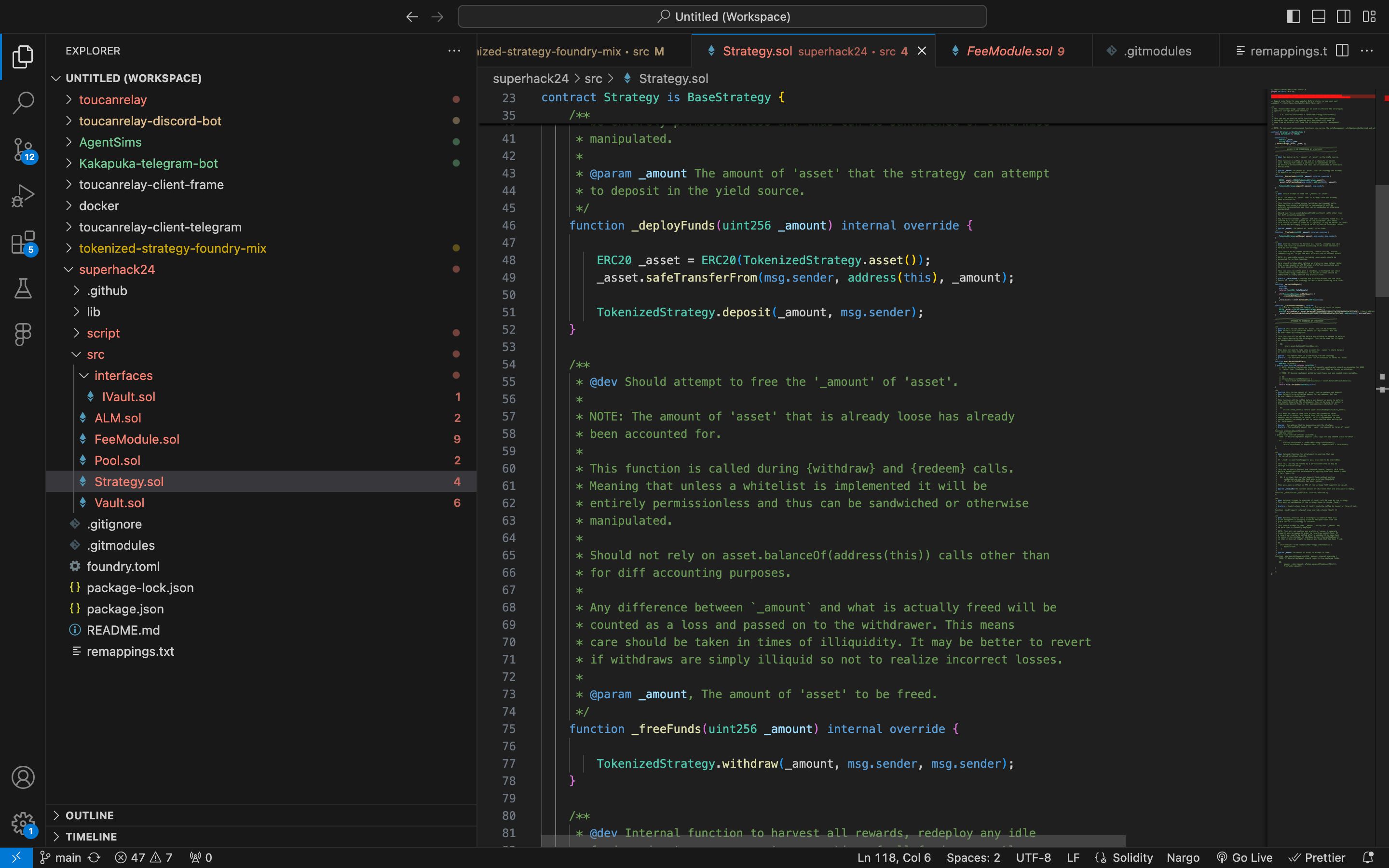

The DEX utilizes a modular architecture (Valantis), allowing different components like fee modules and pricing logic to be easily integrated or swapped out. The core of the system is a custom vault contract that holds a collection of assets, functioning like an index fund. PYTH oracles handle the pricing of deposits and withdrawals, removing the need for internal price calculations. The dynamic fee module incentivizes liquidity by adjusting fees based on asset levels. The project also includes an ERC-4626 vault for a yield strategy, where DEX-generated fees are converted into LP tokens and deposited to earn additional returns, enhancing the overall yield for users.