SLiP

SLiP is Short Liquidity Pool, the first protocol to short DEX LP tokens, changing Impermanent Loss in Impermanent Gain and allowing to build new unique products (depeg protection, antifragile stablecoin, …), making it a new primitive for volatility-based solutions.

Project Description

After witnessing DeFi’s massive success, we have realized there is missing a core piece of infrastructure: natively convex payoff strategies. The current strategies in DeFi are generally characterized by concave payoffs. Such strategies are negatively impacted by shocks in volatility making the overall DeFi ecosystem fragile, as shown by recent market crashes (e.g., UST depeg). Furthermore, the lack of convex strategies makes it difficult for traders to balance the overall market betting against / in favor of the volatility implied in asset prices as they would do in TradFi. This results in slow price adjustments and, at the end of the day, a DeFi ecosystem less adapt to sophisticated players such as institutional investors and investment banks. One of the most peculiar issues related to concave payoffs is “Impermanent Loss” which has an impact on the +$40bn TVL in DEXs. Around 50% of liquidity pool token holders lose money due to Impermanent Loss.

SLiP aims to take DeFi to the next level by offering a new set of instruments to leverage opportunities from market fragility. It is the first protocol allowing to short liquidity pool tokens (LP tokens), expanding the utilities for LP token holders and allowing traders to profit from market volatility (changing “Impermanent Loss” into “Impermanent Gain”). In addition, SLiP can be used to build new unique features and products, such as depeg protection, new derivatives and antifragile stablecoins, making it a primitive for a new ecosystem of solutions.

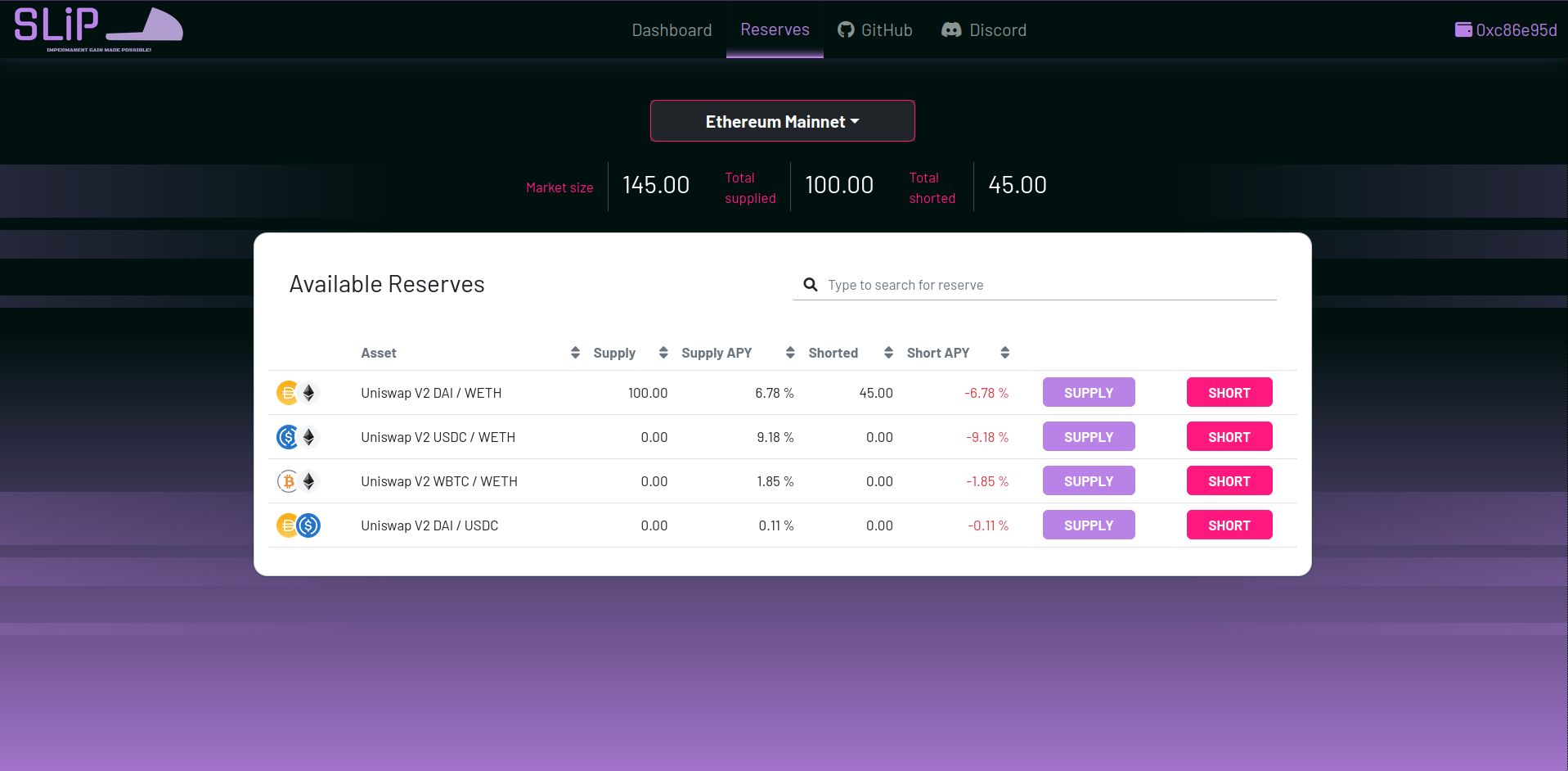

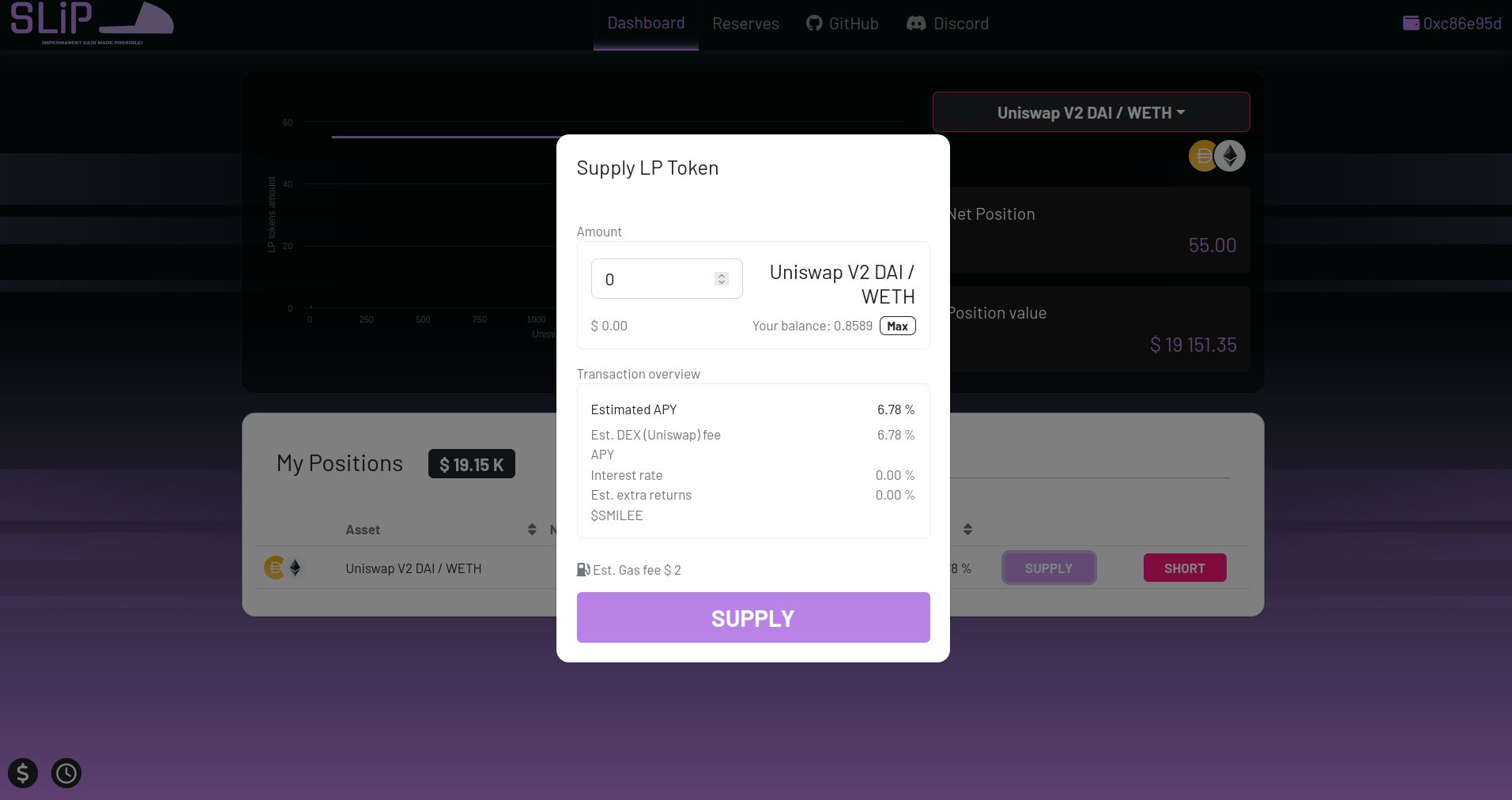

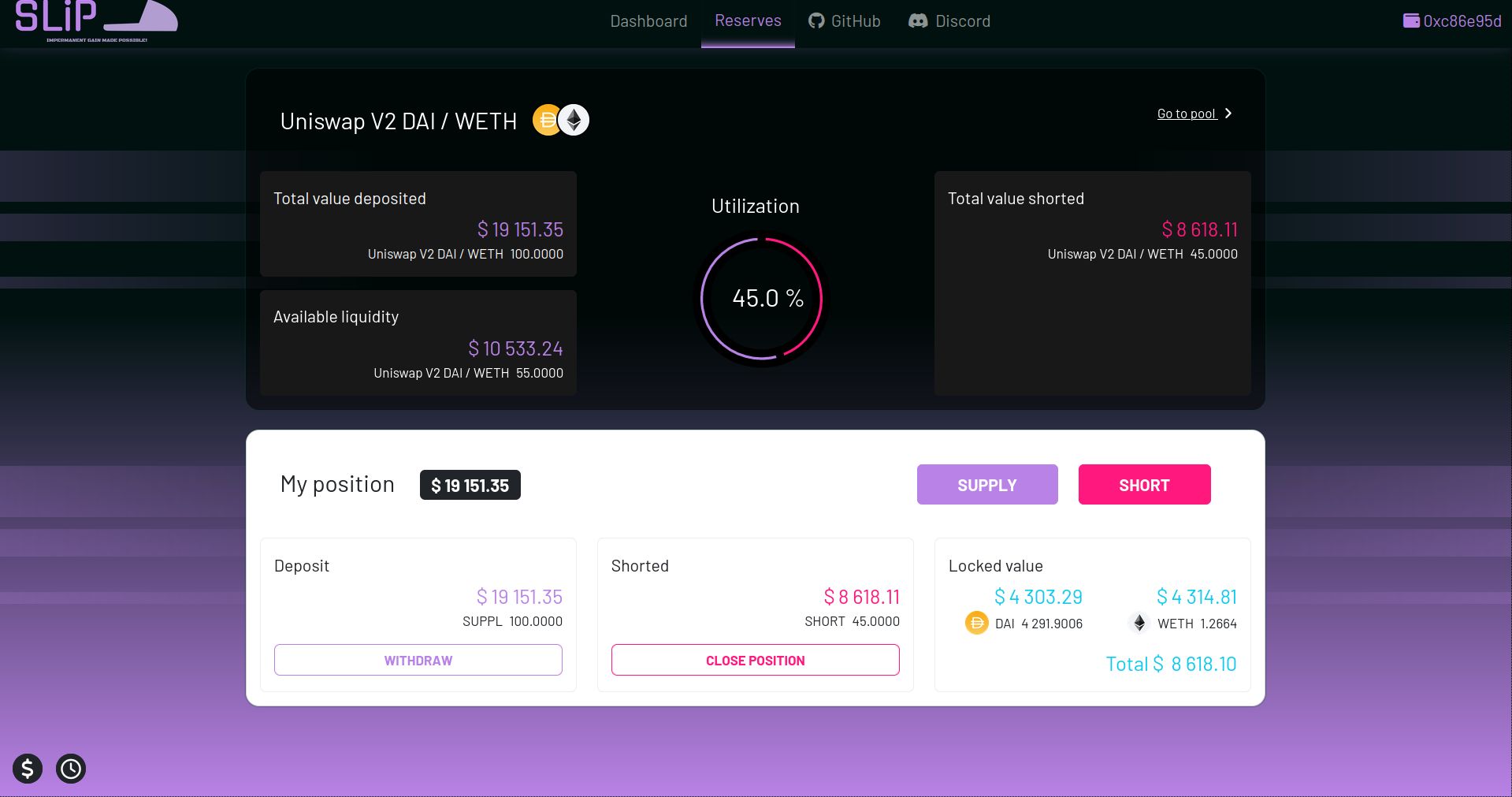

In details, SLiP has two types of users: liquidity providers and liquidity takers. SLiP liquidity providers are investors that hold LP tokens and deposit them in SLiP to earn extra rewards. The process to start/end the deposit is as follows: liquidity providers deposit LP tokens and receive a certain amount of SLiP LP tokens, which are designed as AAVE A-tokens, earning an interest rate. The process is reverted by burning the SLiP LP tokens and receiving back LP tokens.

The return and reward scheme for liquidity providers is as follows:

- Standard returns from DEX LP token holding (eg., PancakeSwap fees)

- Fixed interest rate depending on utilization rate in SLiP protocol

- Extra reward in SLiP tokens as additional loss mitigation mechanism

Therefore, using SLiP, liquidity providers reduce their exposure to Impermanent Loss by adding extra interest rates and rewards while not changing their payoff structure or exposing themselves to additional risks. On the other hand, SLiP liquidity takers are traders and investors that want to short LP tokens (ie., borrow and redeem), obtaining a convex payoff that changes “Impermanent Loss” into “Impermanent Gain”. The process to activate/end the strategy is as follows: -Collateral placement: a liquidity taker deposits the initial collateral to activate the strategy -Strategy activation: a liquidity taker activates the strategy resulting in a single-block transaction where: o LP tokens deposited in SLiP are borrowed and redeemed on the DEX obtaining the underlying tokens of the pair o the tokens obtained are locked in the SLiP Collateral Vault o The liquidity taker obtains SLiP Strategy tokens, which are designed as AAVE debt tokens paying an interest rate, and represent the position -Strategy conclusion: the liquidity taker closes the strategy reverting all the previous steps, returning the LP tokens borrowed and keeping potential extra LP tokens generated by the strategy

The return structure for liquidity takers is as follows:

- Extra LP Tokens generated by the strategy

- Fixed interest rate depending on utilization rate

- Extra rewards in SLiP tokens as additional loss mitigation mechanism As a result, using SLiP, liquidity takers can bet against Impermanent Loss by paying an interest rate.

How it's Made

From a technical perspective we took as a reference AAVE core (we are actually leveraging its v2 source code for some of the primitives in the prototype) and built on top of Uniswap V2. The technological stack comprises several EVM smart-contracts (written in Solidity). We expect to develop the frontend in Svelte. The test suite and other scripts (from deployment to management and other utilities) will be written in Python with the Brownie framework.