Sneed

Automatic hedging against impermanent loss using V4 hooks and options

Project Description

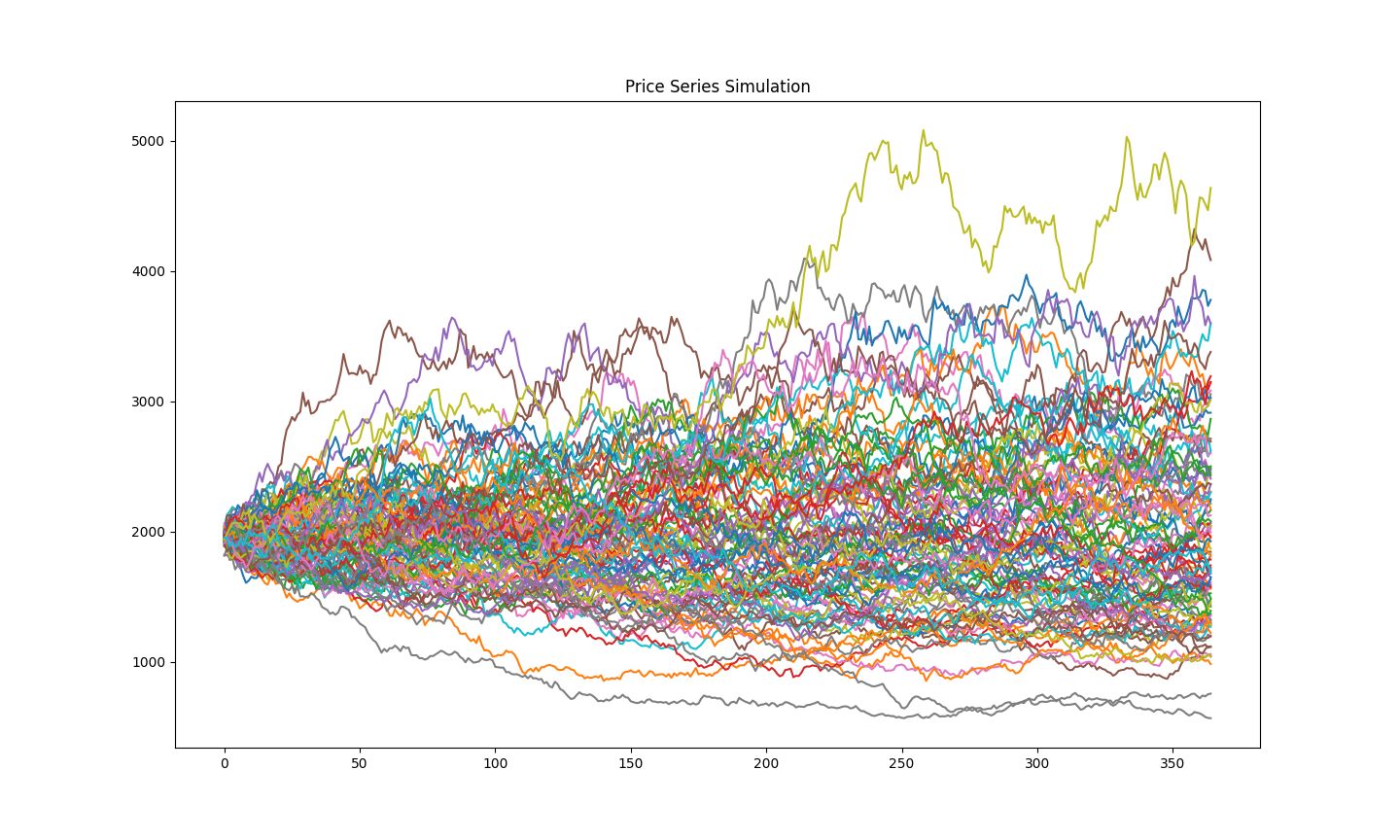

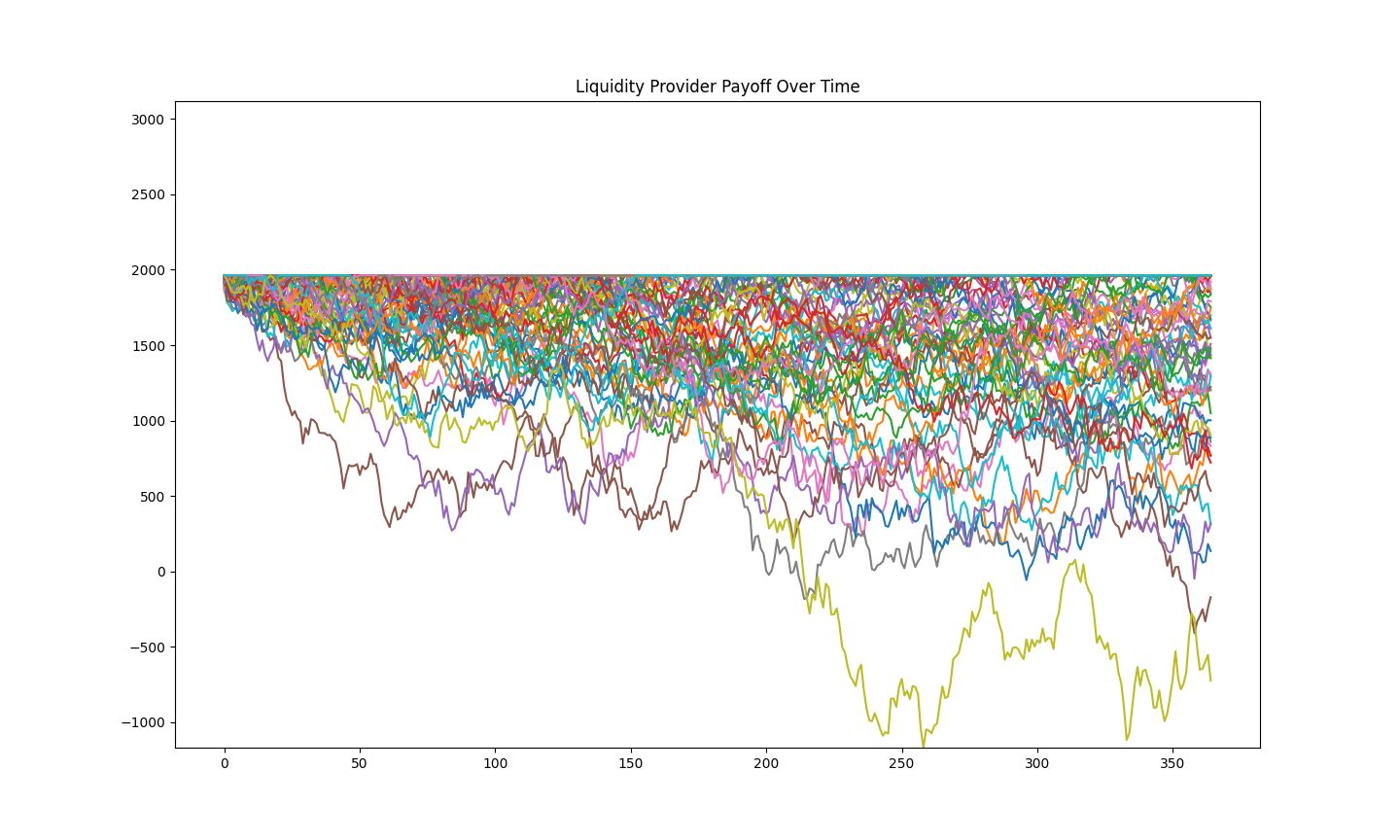

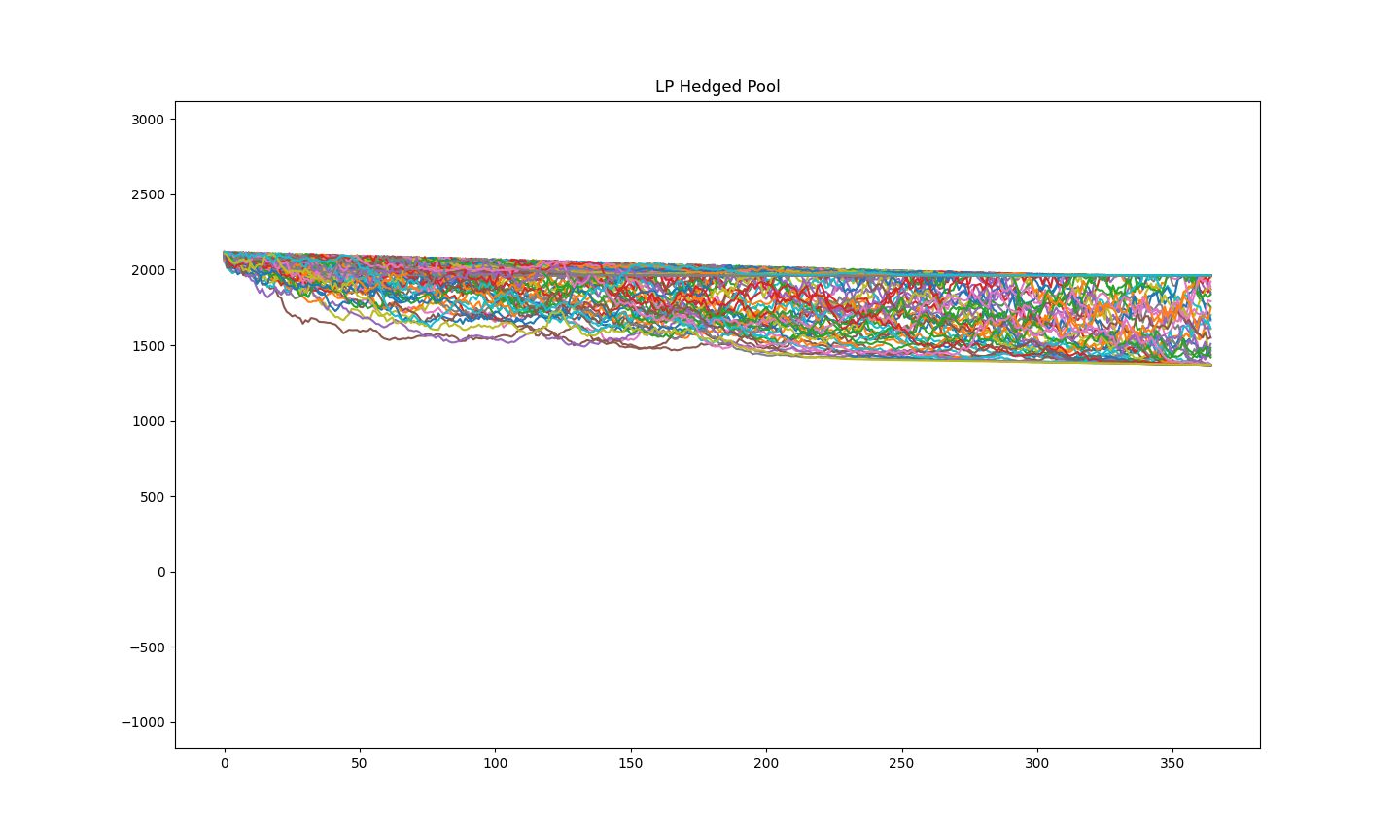

This project is a Uniswap V4 hook used to limit the impact of impermanent loss. Uniswap LP positions are the equivalent of selling an option. In essence, we are long vol, short spread. Our IL comes from the increase in spread. To mitigate this, we automatically buy options to cover this increase. So, the only way the LPs lose money is if the premiums for the options aren't covered by the LP fees.

How it's Made

We built this project using the foundry Uniswap V4 hook template by saucepoint. The hook uses a generic adapter for buying options and can be switched out to support multiple protocols. The main one we support is Lyra, but for the tests we use a generic mock one. Simulations of this strategy have been written in python using numpy, scipy, and matplotlib.