SoFiLend

SoFiLend is a DeFi over collateralized lending protocol using on-chain social profiles (Lens, ENS, etc.) as collateral for borrowing assets and leveraging an advanced social graph system..

SoFiLend

Created At

Winner of

Chiliz - Pool Prize

Prize Pool

Arbitrum - Pool Prize

Prize Pool

Scroll - Deploy on Scroll

Prize Pool

Polygon - Best use of Polygon zkEVM

Mask Network - Best Use of Next.ID Most Creative Project

Project Description

SoFiLend is a DeFi over collateralized lending protocol using on-chain social profiles (Lens, ENS, etc.) as collateral for borrowing assets. Our application uses smart analytics to monitor blockchain activity, generating a reputation score for each user with an advanced social graph system. Depending on the reputation score obtained by the user, he is eligible to borrow an amount of assets.

What is the difference with an under collateralized protocol?

The under collateralized lending protocols don't really work because people have no incentive to pay back their loans. We wanted to create a virtuous system that puts a person's social reputation as collateral. These profiles have significant value in terms of reputation in the ecosystem and are a greater incentive to pay vack your loan than an under collateralized protocol.

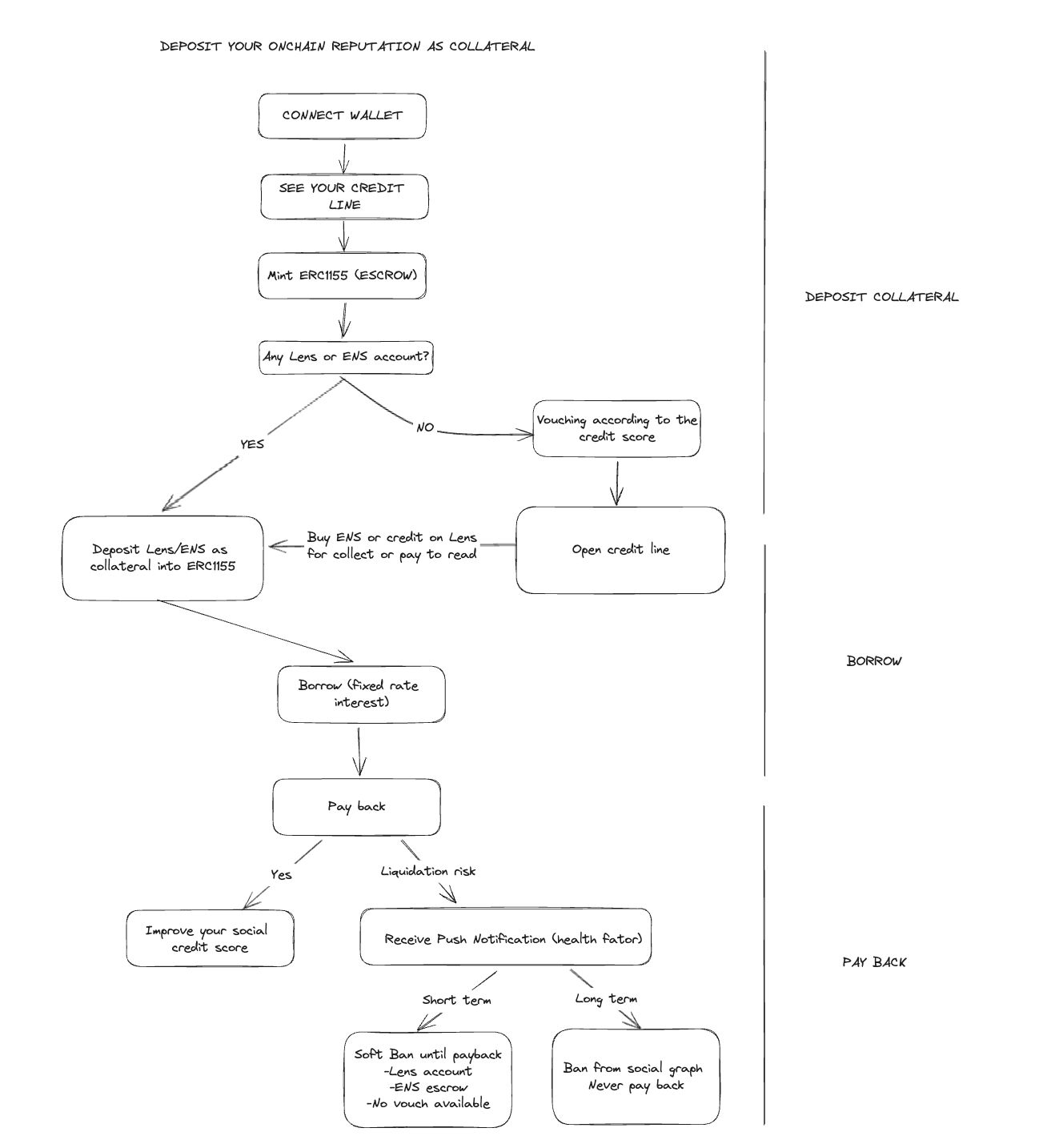

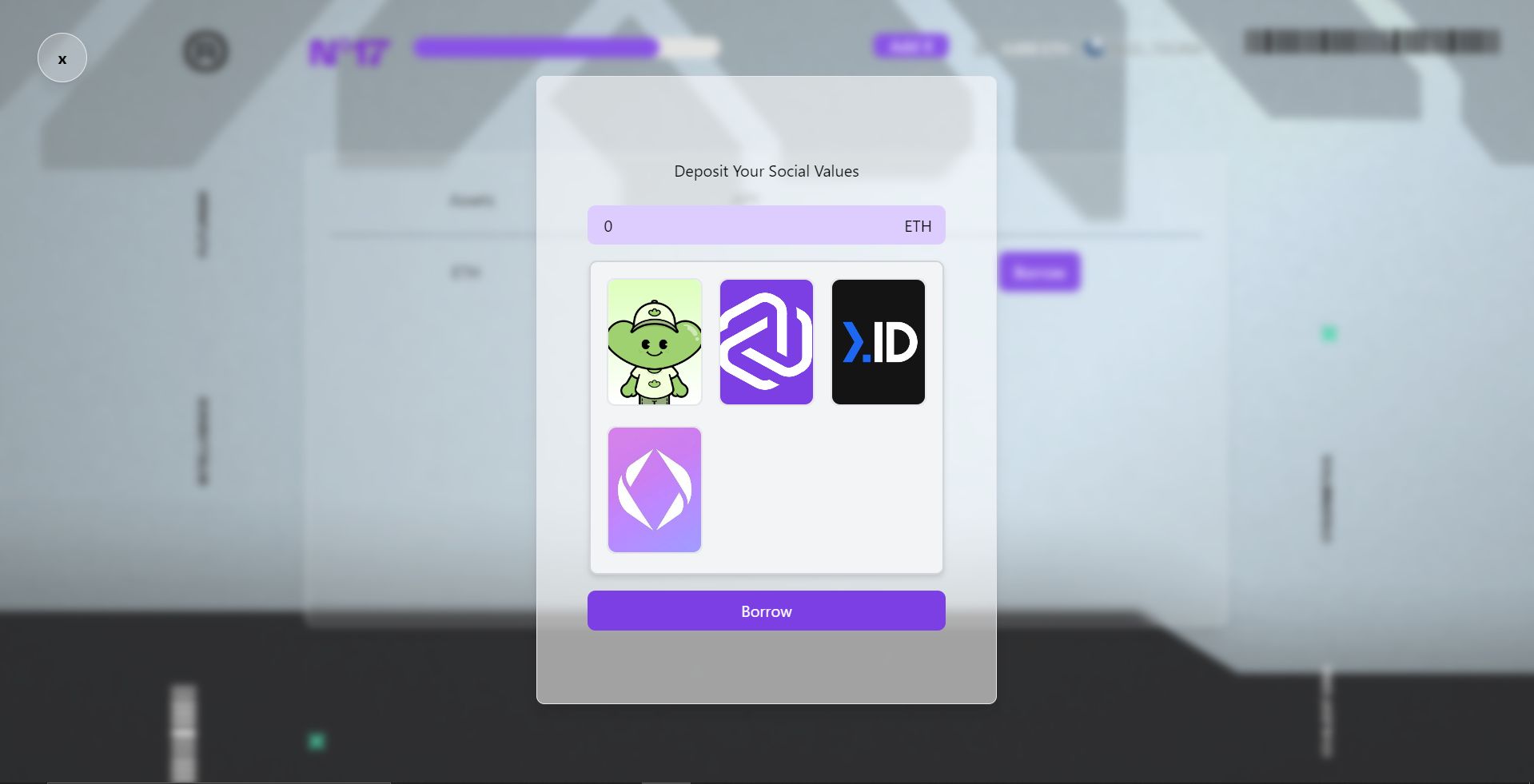

Deposit your on chain reputation as collateral

You deposit your social profiles (Lens and/or ENS domain) as collateral on the protocol. These profiles have significant value in terms of reputation in the ecosystem and are a greater incentive to repay your loan than an under collateralized protocol. When you deposit them, you are still able to use your social profile, but when the risk of liquidation approaches, your wallet receives a notification via Push Notifications indicating its health factor in order to warn you of the risk of liquidation. Once the debt is repaid, you are able to recover your collateral. However, if you do not pay back your loan, a soft ban will apply until you pay:

- For Lens: the funds collected through pay to read or collected posts are locked in an escrow

- For ENS: the funds you are supposed to receive are locked in an escrow

- Vouching system not available (2 maximum per wallet)

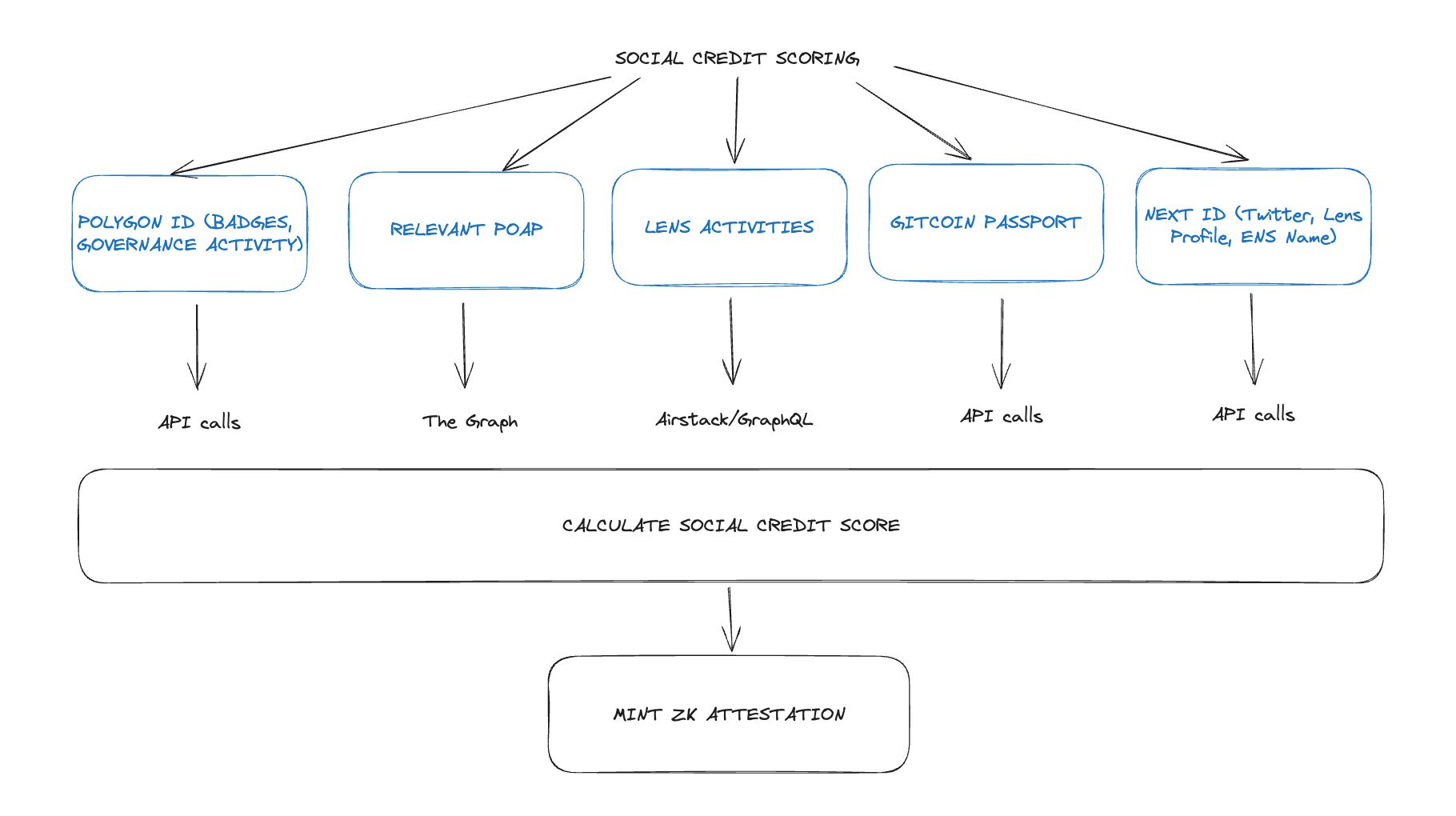

Social Credit Scoring

When you connect your wallet, you can calculate your social credit score and this will scan all the relevant data about your involvement in the ecosystem (Polygon ID VCs, Gitcoin Passport, Lens activities, Twitter Activity, relevant POAP, etc.) to create your onchain reputation. You can then certify your score with the Ethereum Attestation Service to obtain a proof of onchain reputation that can be used on other protocols. The social credit score changes (positively or negatively) depending on three factors: the ability to pay back a line of credit (creditworthiness), vouching quality and the addition of new social proofs as a community involvement.

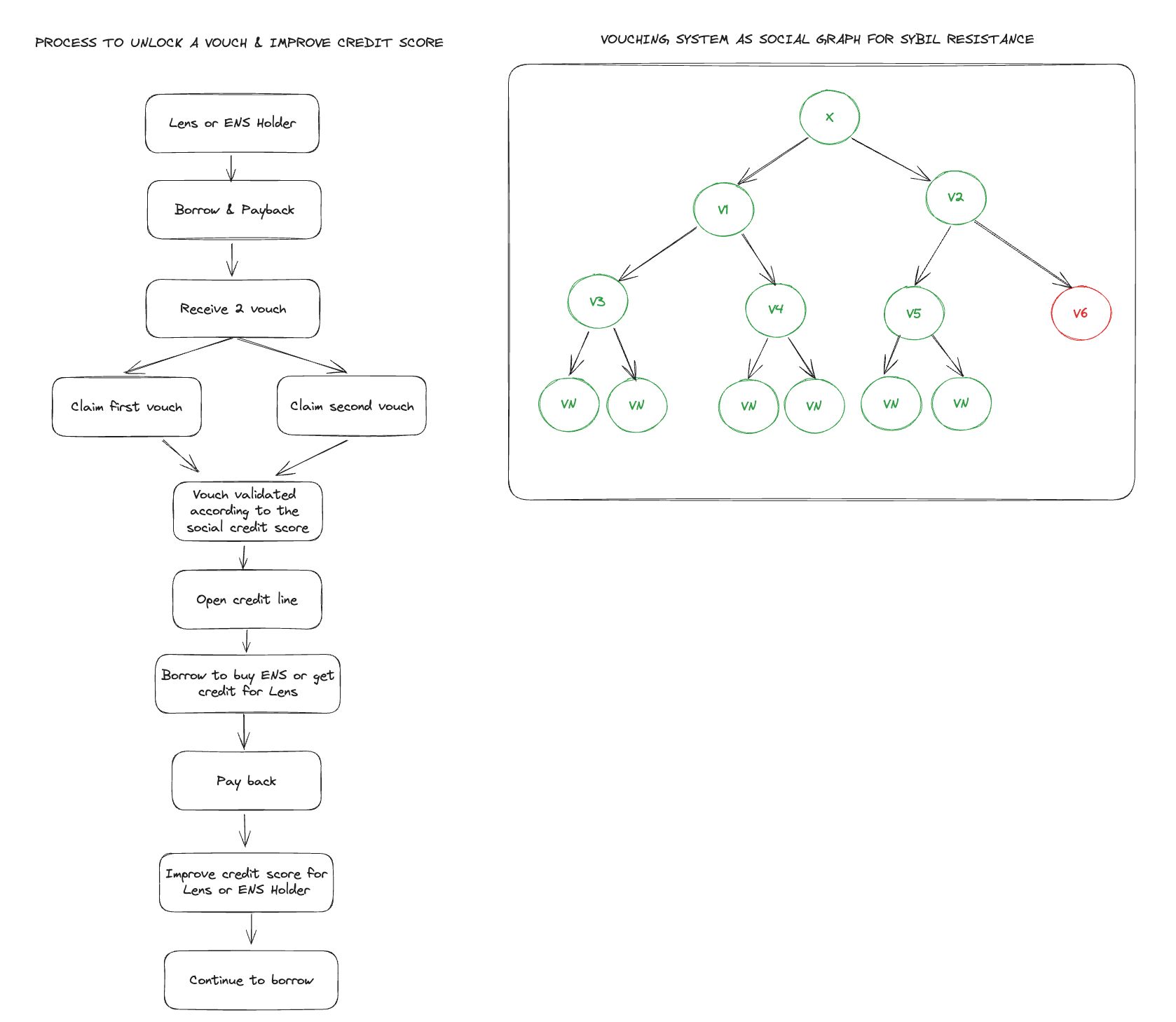

Sybil resistant Social Graph by using a vouching system

We integrate a social graph where the first ENS/Lens holders the people they recommend by using a vouch system. In order to be sybil resistant and to combat the use of fake wallets, wallets must have a credit score => a certain amount in order to get a credit line and be able to borrow. Thanks to this loan, people (vouchers) are able to obtain an ENS or credits on Lens enabling them to collect posts or use the pay to read function. In this way, they are able to deposit these elements as collateral. This system creates a virtuous circle.

ETHGlobal Registering Staking Use Case

- Staking is often a drag for students or local community members. For instance, we could imagine that hackers, instead of directly staking could directly put in collateral their social profile (Lens, ENS) in order to get registered for the hackathon.

- This is a particularly rewarding incentive for active but precarious passionate community members.

Roadmap

- Tips for improving your credit scoring

- Improve credit scoring with an algorithm

- Partnerships with different loan protocols to alert malicious behaviors (people who do not pay back)

How it's Made

For smart contract development, we implemented ERC1155. For the backend, we used nodejs/express and The Graph. Then, for the frontend, we used React, node.js and Spline. For more details, see the sponsors' integration section. We have deployed the application on several networks.