Solara

Solara enables under-collateralized microfinance by leveraging historical blockchain transactions and social reputation. It helps users access loans by assessing their trustworthiness through transaction history and social attestations from DAOs, bridging the gap in DeFi lending.

Project Description

The problem of not having access to finance with onchain social reputation leads to no advantage of your transaction history and belonging to a community.

Problem Statement • Lack of Undercollateralized Access to Microfinance On-chain: In DeFi, most loans require over-collateralization, limiting access to capital for individuals or small businesses who don’t have sufficient assets to pledge. • Lack of enforcement by law: Traditional microfinance systems benefit from legal frameworks that enforce repayment, but on-chain lending lacks this type of enforcement. This creates higher risks for lenders, as there are limited mechanisms to ensure that borrowers repay their loans in the absence of formal legal consequences. • Trust and Creditworthiness Gaps: On-chain microfinance is struggling to scale due to the difficulty in assessing risk without requiring excessive collateral.

Solution Overview • Social Reputation: Allowing your social circle to vouch for your borrowing where their risk is of damaging their credit score. • Leveraging Historical Transactions: Borrowers’ transaction history on the blockchain can serve as a transparent credit score, improving trust and access to finance. • Incorporating On-chain social Reputation: Social reputation from DAOs, attestations, and participation in decentralized communities(ETHGlobal) can be used to assess borrower trustworthiness.

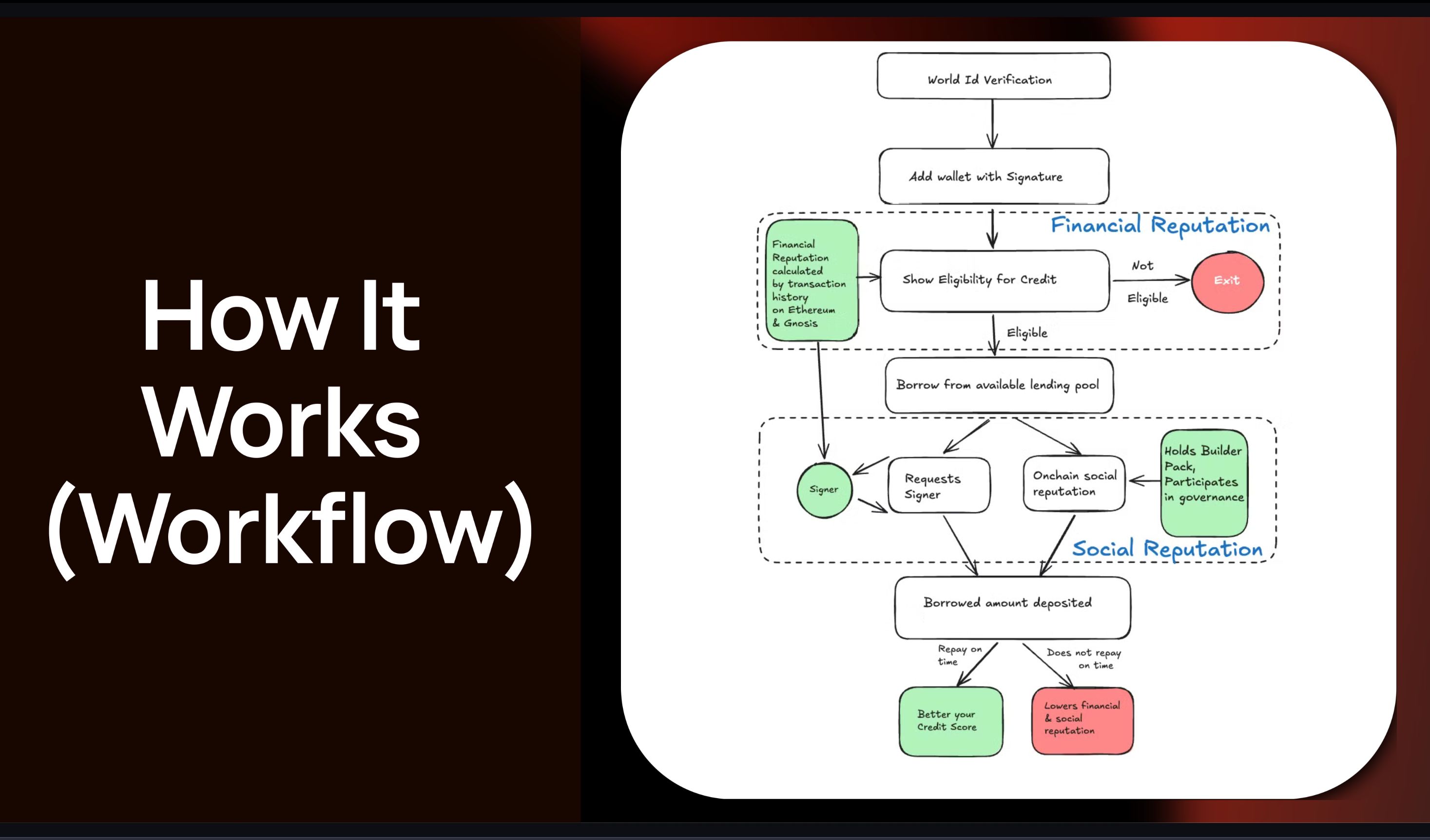

How It Works (Workflow) • User Onboarding: Individuals connect their wallets, and the system accesses their on-chain transaction history on Gnosis Chain & Ethereum. • Credit Scoring Mechanism: The credit score is built using a combination of historical transaction data (frequency, volume) and previous microfinances. • Loan Issuance: Lending pool smart contract allows borrowing for anyone who satisfies the required criteria. • Repayment Tracking: Loan repayments are recorded on-chain, contributing to the borrower’s ongoing reputation and creditworthiness.

Use Case Example • Scenario: A builder who has participated in several online hackathon wants to participate at ETHBangkok & is short of few hundred dollars. • Onboarding Process: The borrower connects their wallet, the smart contract evaluates their historical transactions, and the reputation at ETHGlobal. • Loan Issuance: The borrower receives a microloan based on their on-chain trust score and reputation, and the loan is automatically tracked for repayment.

How it's Made

We verify Proof of Humans using Worldcoin to avoid the same person using multiple wallets to take advantage of under-collateralized loans. We also use to check whether the signer is different.

We use Sign Protocol to attest for borrowers that, they will pay back the loan. We use this attestation to release the borrowed amount from the Lending pool.

Reown Notifications help in informing the signer about the pending request. The borrower also received notification for repaying the loan on time.

We have deployed our contracts on Gnosis Chain.