SoSH

User-operated Social Layer AVS Unlocking Staked Liquidity, releasing the liquidity of Staking and Restaking Assets for Dapps

Project Description

We are developing an AVS App chain leveraging Eigenlayer DA technology, characterized by a content-centric social layer. Our framework enables decentralized applications (dApps) to be constructed on the SoSH platform, enhancing their content through our robust application API. This integration extends to staking and restaking mechanisms, thereby unlocking the staking and restaking asset liquidity and attracting a broad user within the existing DeFi ecosystem.

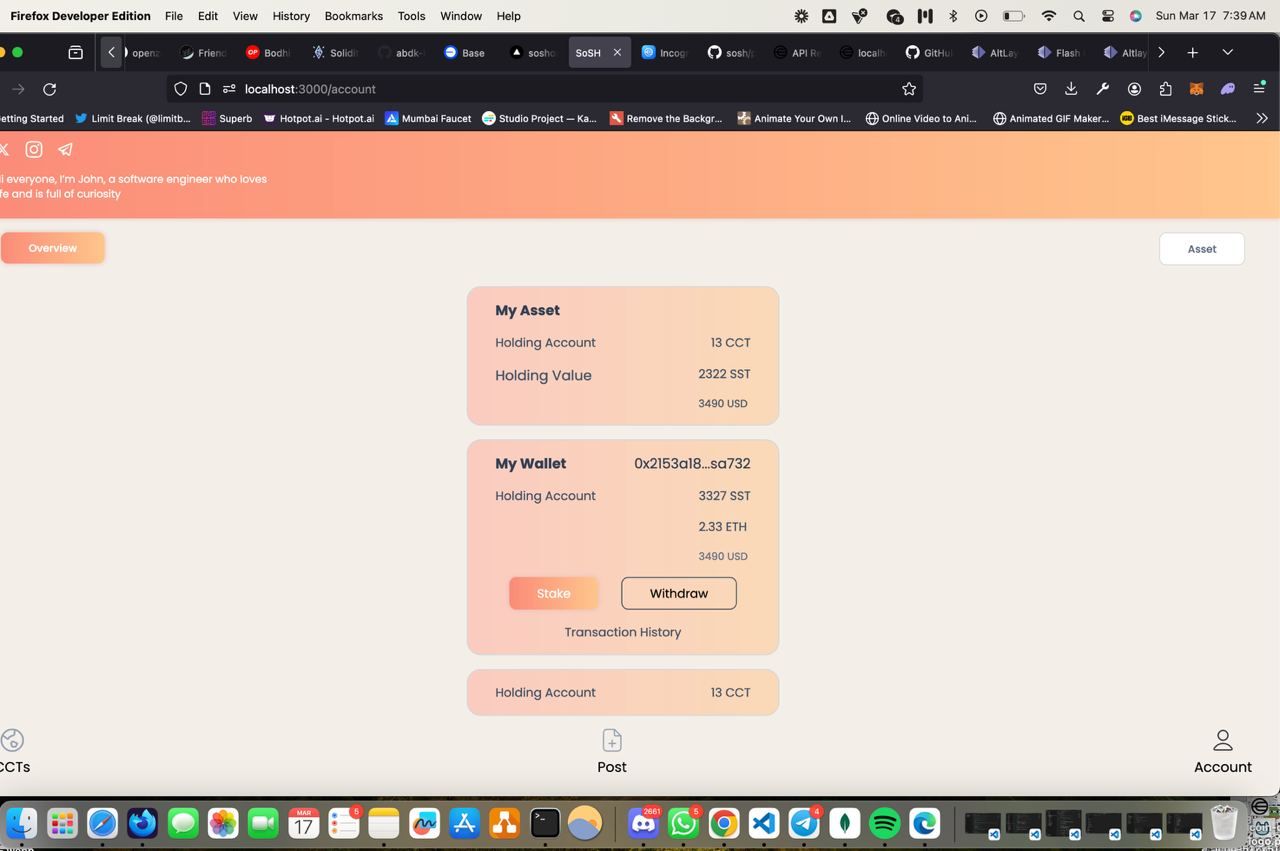

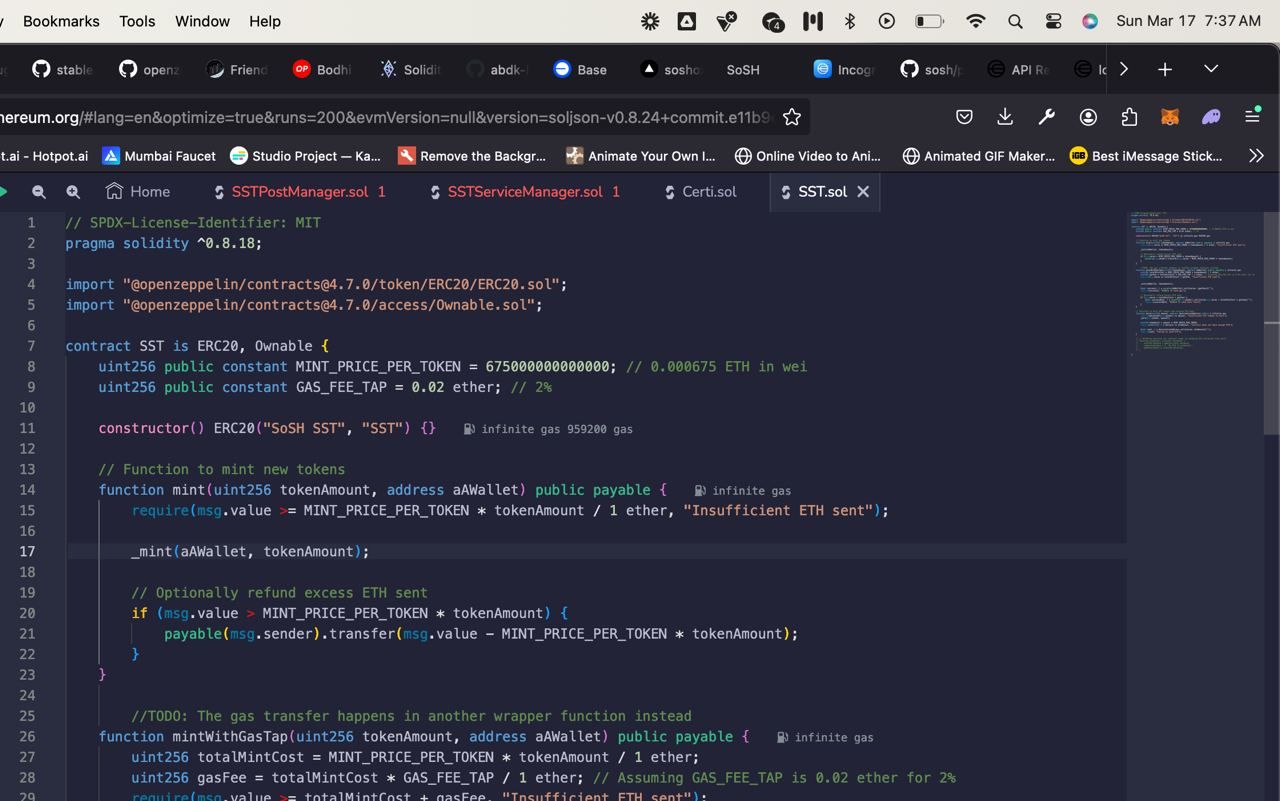

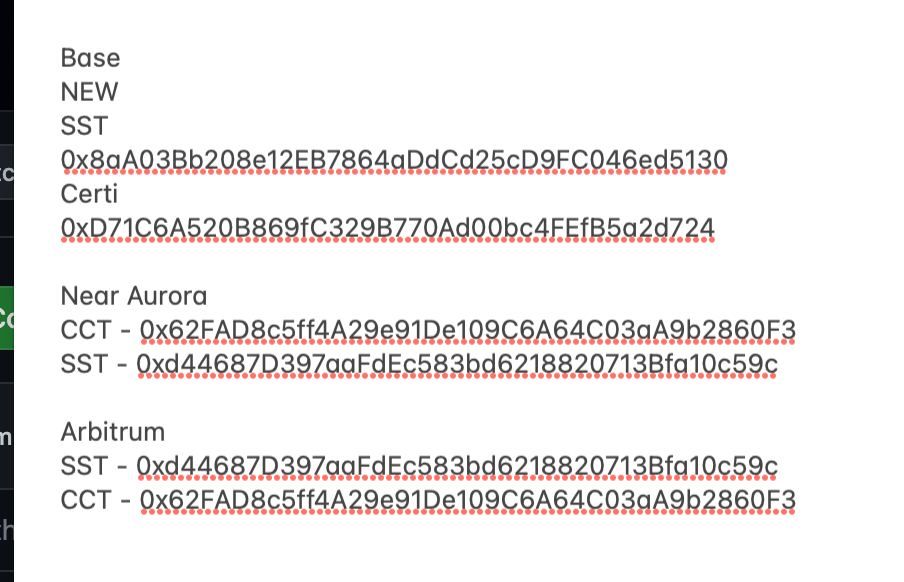

Central to our strategy is the introduction of the SoSH Stable Token (SST), a stablecoin tethered to a basket of staking assets, primarily ETH, stETH and other restaking assets. Within the SoSH ecosystem, SST facilitates transactions, allowing users to trade content via a bonding curve mechanism.

Users can stake staking asset certificates, like weETH and eETH, to acquire SST. This enables them to engage with the ecosystem and access high-quality content through dApps built on SoSH. Content trading may result in SST earnings or losses for the users, who have the flexibility to unstake SST at any time. Upon unstaking, users can reclaim their original staked assets in full, provided they return all acquired SST, or a portion thereof, proportional to the SST returned. And they can also get the points of the original staked assets according to how much they reclaim.

SoSH meticulously records each staked asset in its respective SST pool within our backend. Assets can be reclaimed only by exchanging the corresponding amount of SST previously staked.

Should users gain additional SST through arbitrage, they can leverage their surplus to obtain more of the staked assets from the pool with higher reserves.

Staking within SoSH grants points to the platform. We commit to redistributing these points to users who successfully redeem their staked assets with SST. However, a loss of SST results in the forfeiture of both the staked assets and the accrued points. Winners who capitalize on extra SST for additional assets will only receive the assets, as SoSH retains the points.

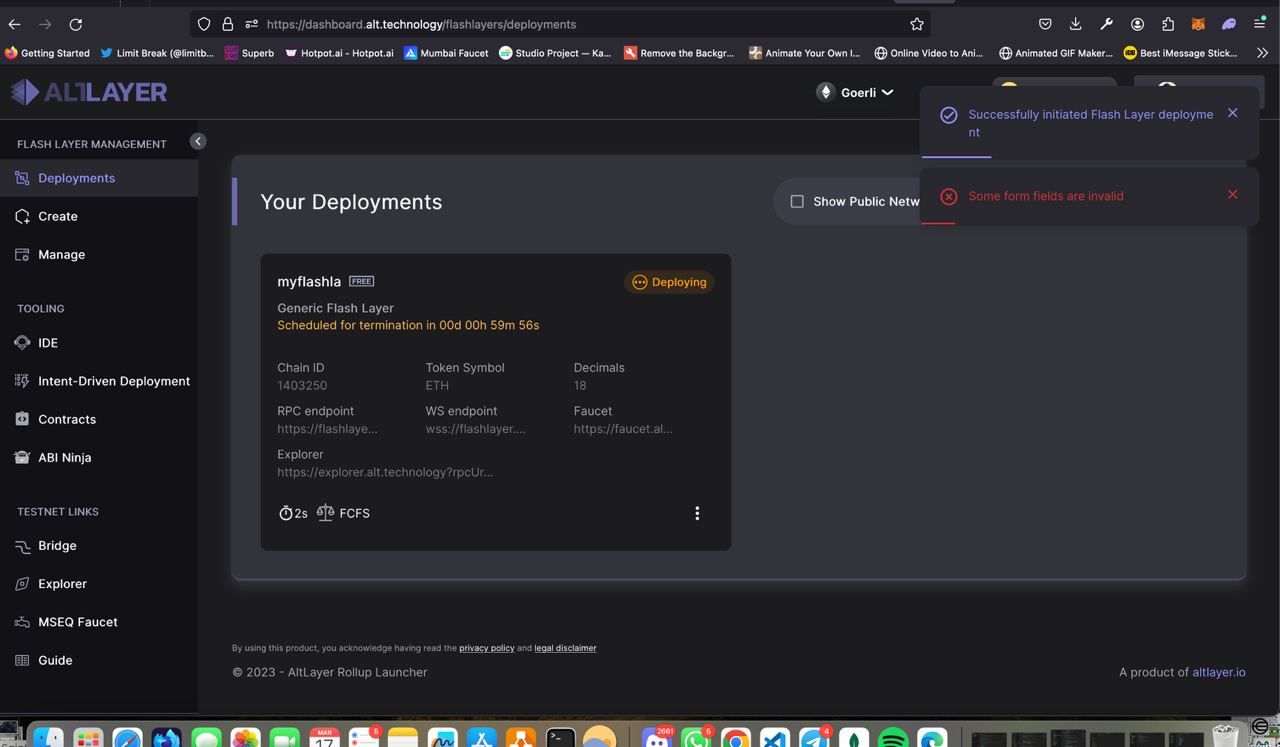

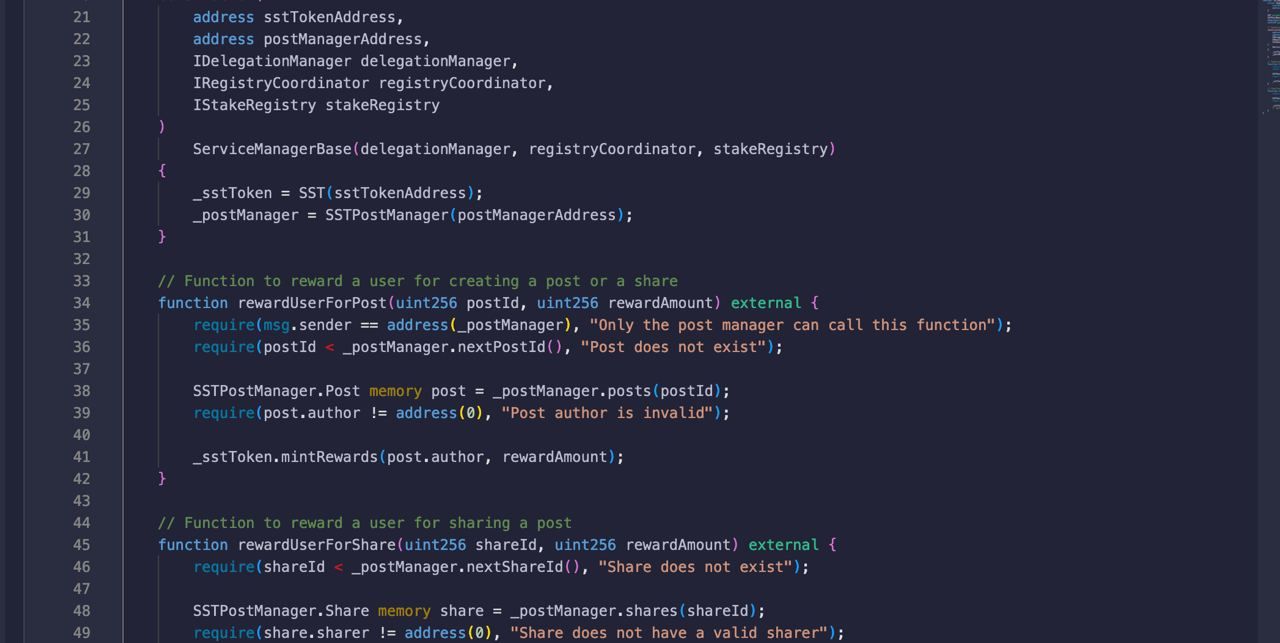

How it's Made

We intend to employ the Eigenlayer Staking Mechanism and Avail DA to develop a social layer conducive to decentralized application (Dapp) creation on our platform. This strategy aims to enhance Dapps by focusing on user interaction and the exchange of content. By integrating SST, our proprietary stablecoin, we will facilitate the staking and restaking processes, thus streamlining transactions within our ecosystem and unlocking previously inaccessible liquidity. This move is designed to increase the attractiveness of our platform by directing this liquidity to meaningful Dapps, thereby expanding our user base. As a practical demonstration of our concept, we are developing a Dapp centered around content trading, with a special emphasis on minority communities. This Dapp will utilize an Automated Market Maker (AMM) bonding curve in collaboration with Pancake to enable users to share and exchange diverse content forms, such as stories, images, and videos. This platform will not only facilitate content promotion and trading but also allow for arbitrage opportunities. All transactions within this Dapp will be conducted using SST. SST is our stablecoin available on SoSH, backed by a variety of staking and restaking assets. Users can stake their assets to obtain SST, which then allows them to engage with SoShow and use SST to buy and sell content. This process unlocks the liquidity of staked assets, facilitating actual cash flow within Dapps. If users decide to leave the ecosystem, they can redeem their staked assets by returning SST. The amount of assets and points they receive back will depend on the proportion of SST they return.