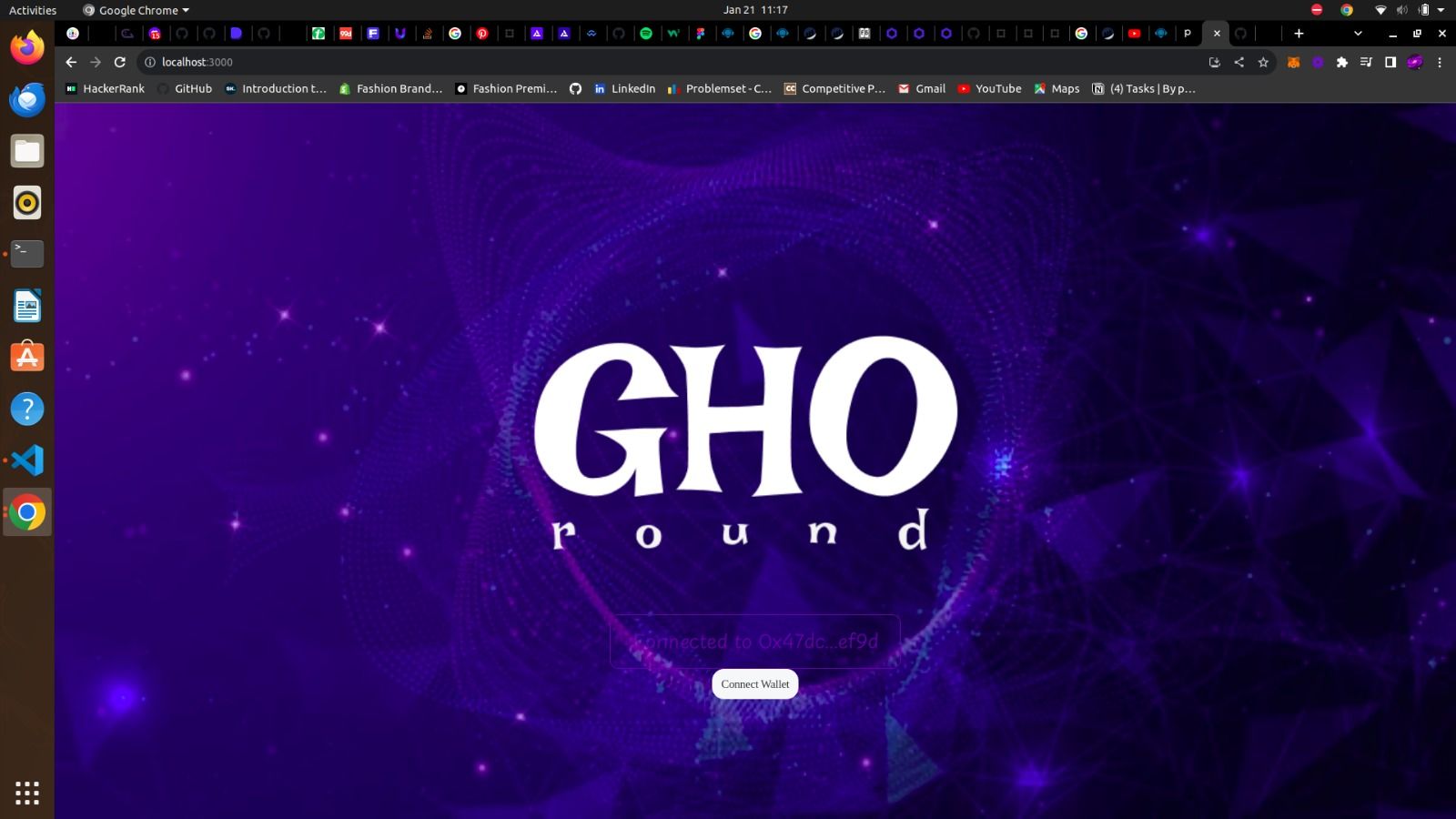

GHOround

An ecosystem for Lending & Borrowing AI Models using ProofOfStake & P2P to mint GHO stablecoin.

Project Description

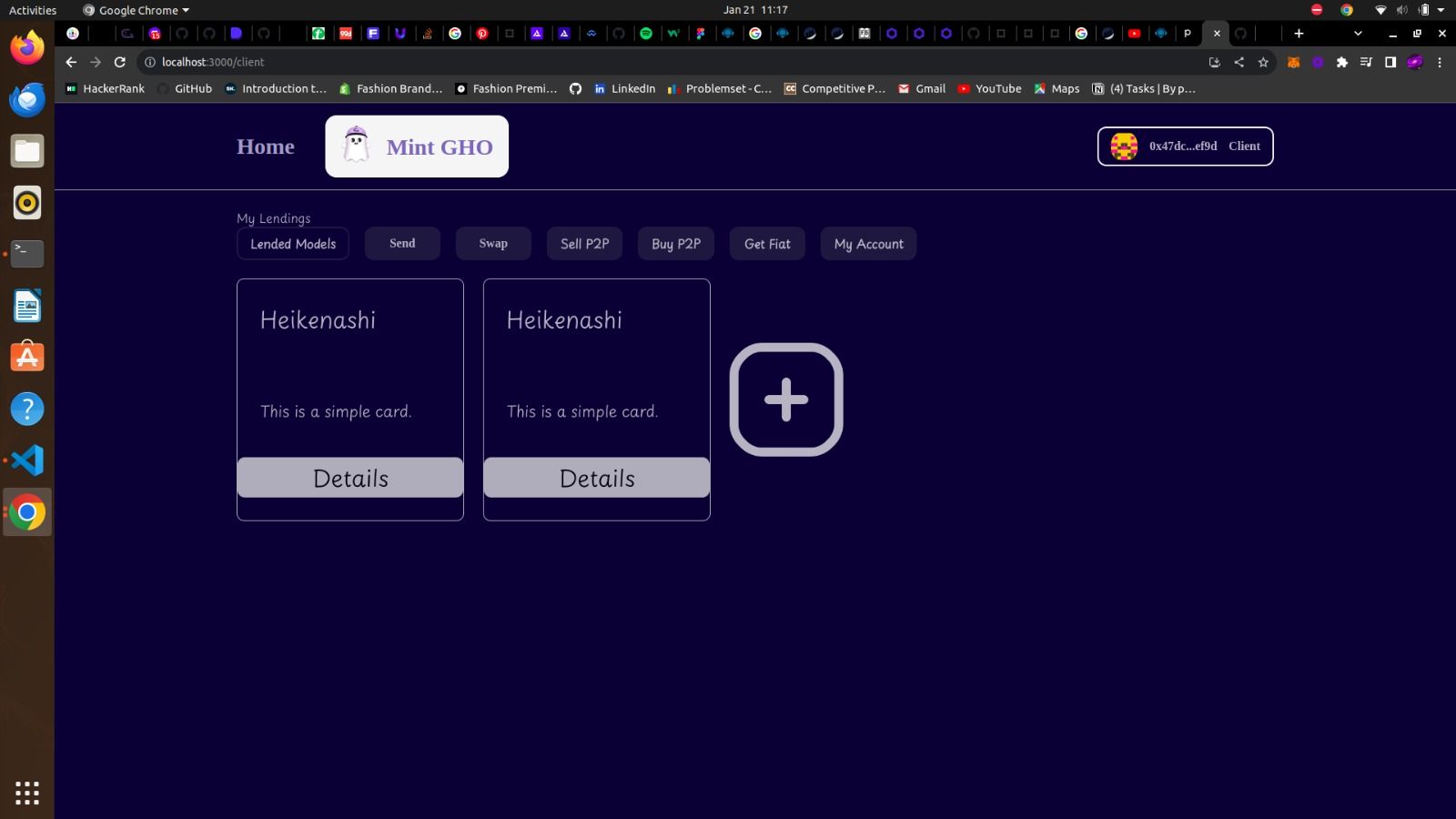

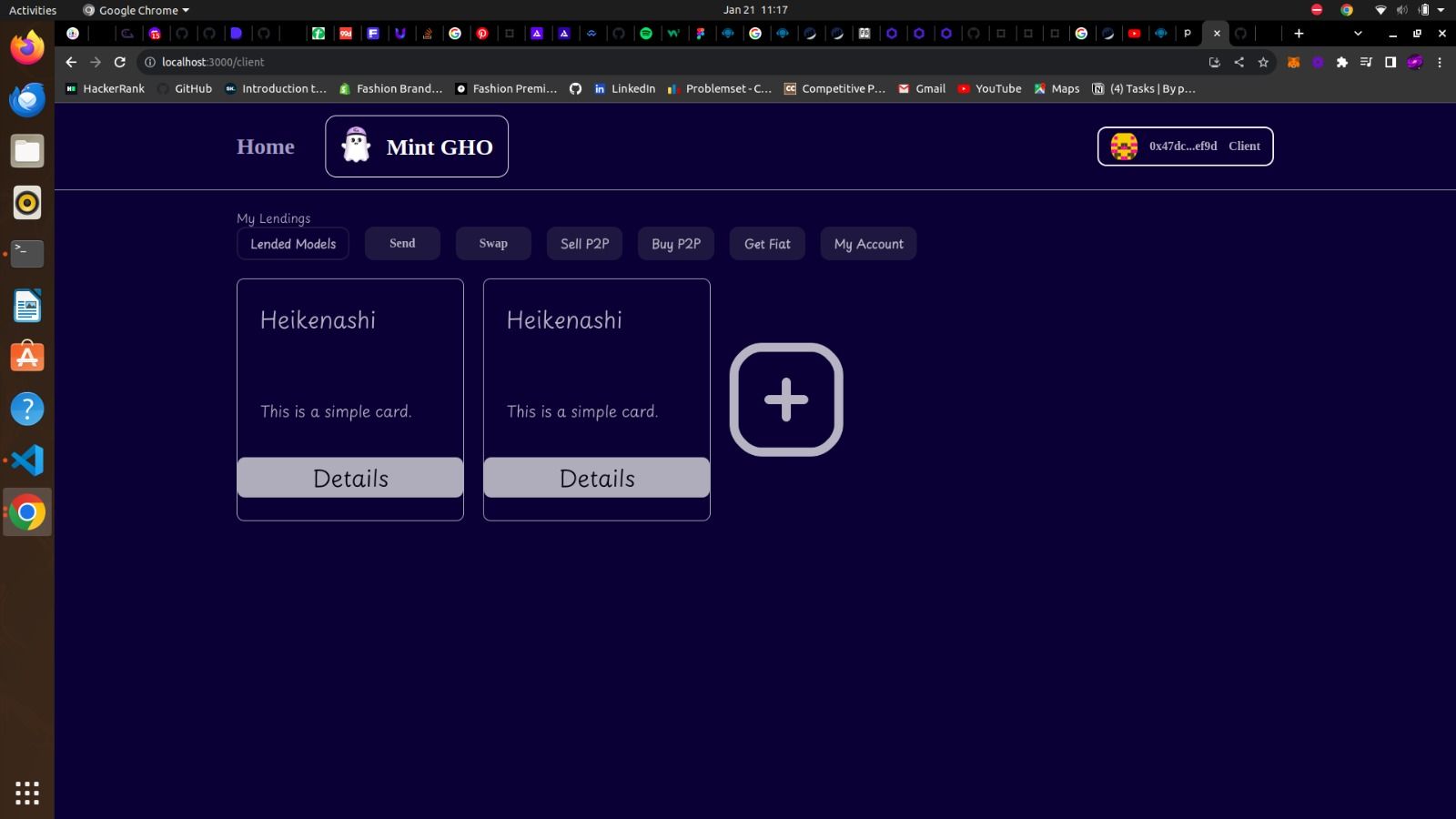

GHOround is the state-of-the-art platform where anyone round the globe can become a part of a new emerging ecosystem of lending & borrowing AI models that has GHO - AaVE's stablecoin as it's backbone.

The project GHOround is a proof-of-concept of the original idea of building a generalisable platform for lending & borrowing AI models while keeping them safe, secure & robust. The objective was to create a general framework that would enable any kind of AI model to be lended on the platform for some other borrower to be used by. ALl transactions on the platform happen in GHO coin

Users can come & build their trading strategies for various tokens of different DEXs & chains & then create models for them.

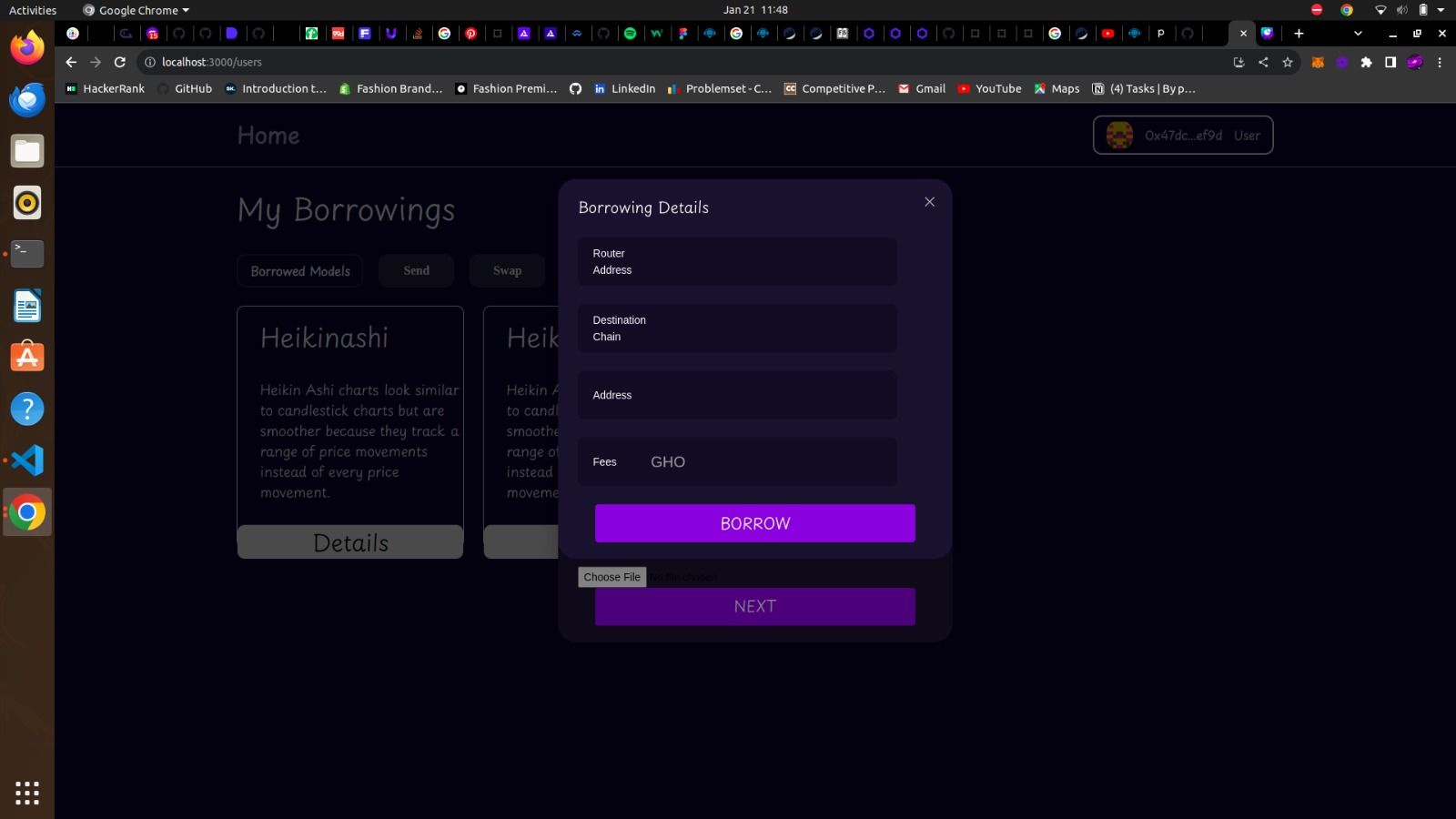

They can lend those models to borrowers & get a upfront fees in GHO tokens. The transactions on cross chains/DEXs will be done securely through CCIP.

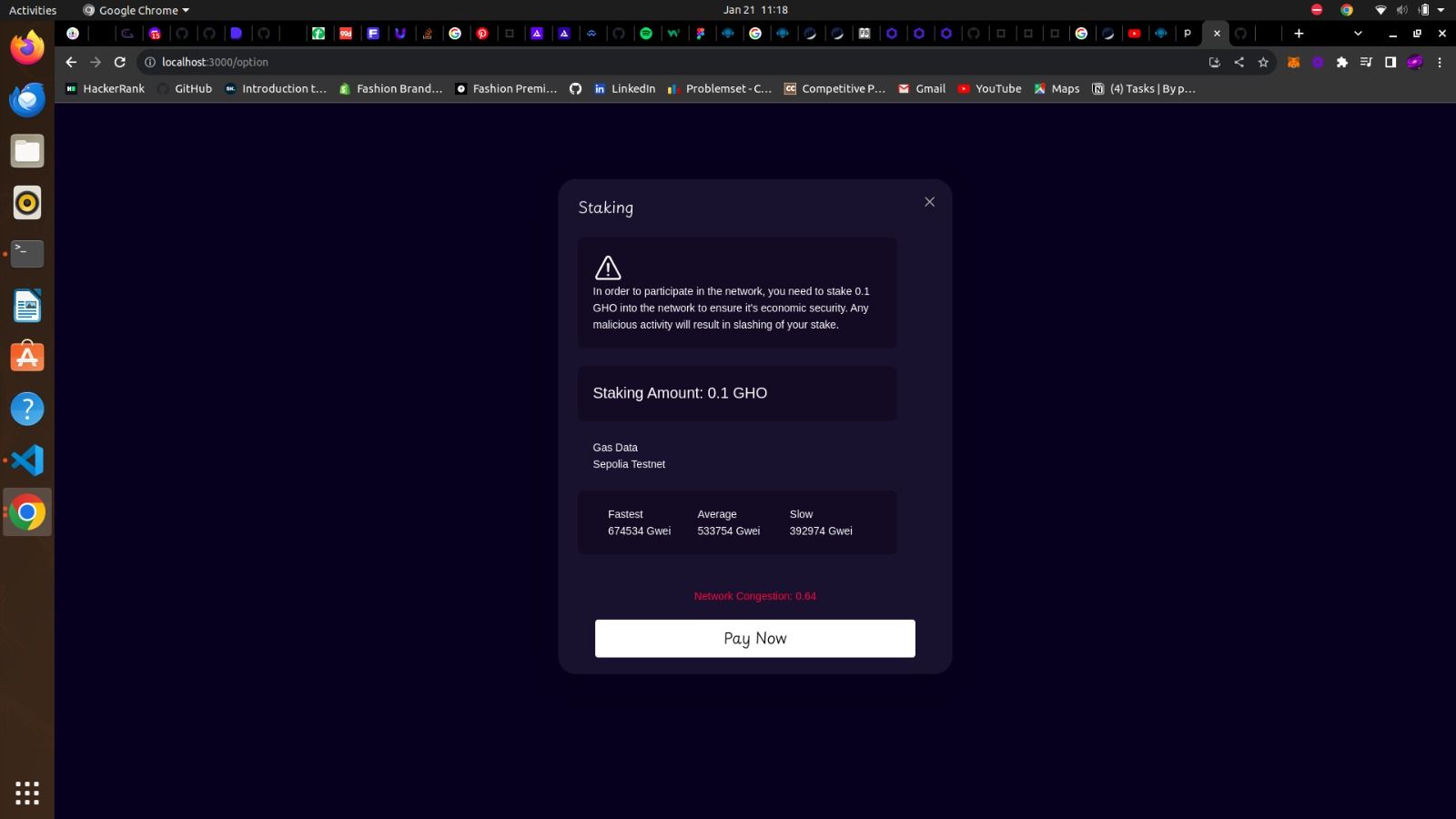

For making those models available for lending, they'll have to follow a Proof-of-Stake mechanism where they will stake a certain amount of GHO which then goes to the Aave DAO Treasury.

The creditDelegationVault.sol will be signed between model lender & borrower which will have a fixed deadline when the model has to be returned & also the interest that the user will have to pay throughout the period on a regular basis.

Borrowers can trade using those models the way they want & all the payments to lenders happens in GHO since it's 1:1 pegged as well.

The lenders after gaining a good record of lending can use the future payments ( interests they will regularly receive from borrowers) as collateral & after crossing a limit they can become a GHO facilitator.

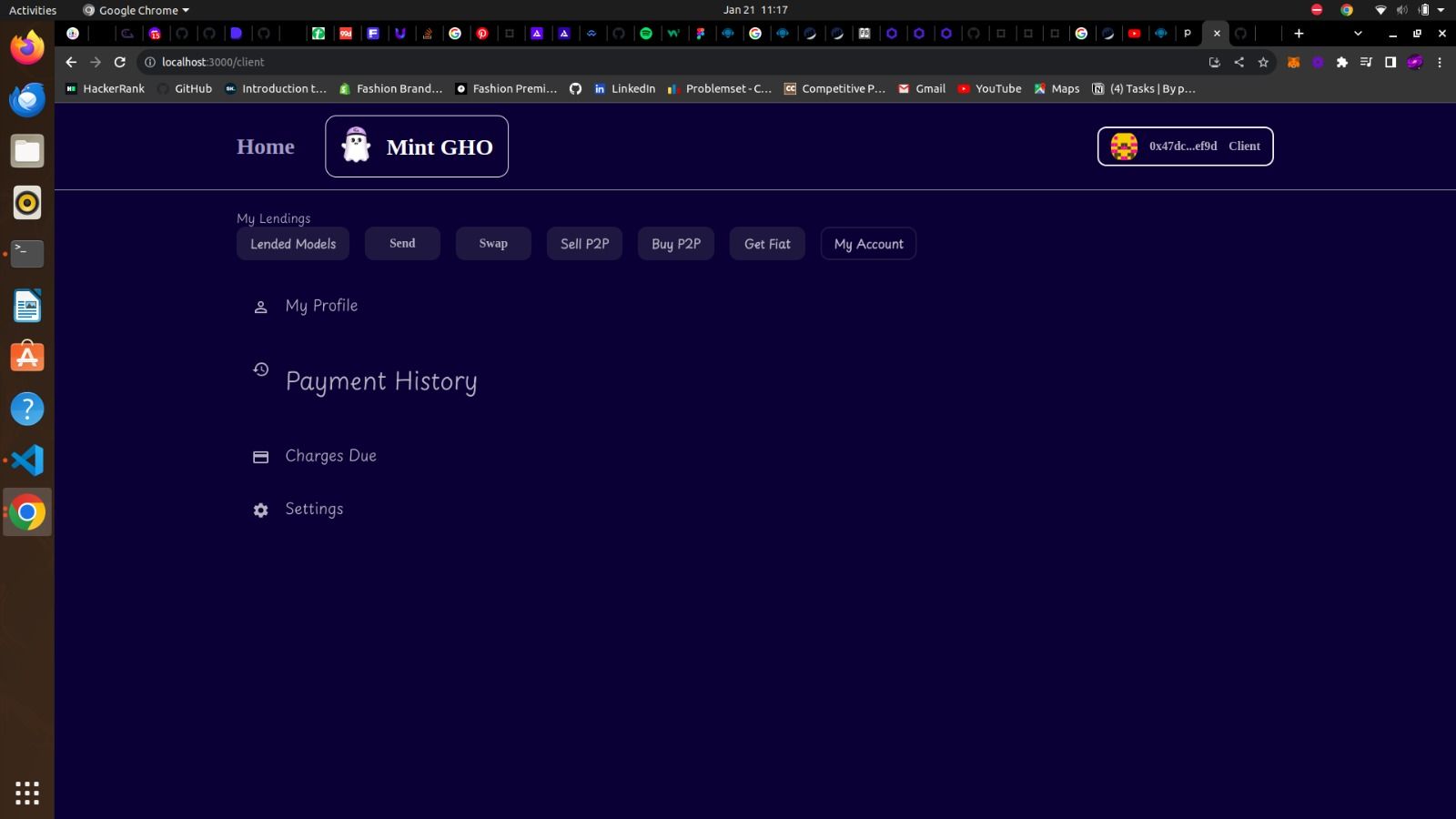

The platform for convenience of users will also have a wallet integrated into the platform where they can buy or sell tokens.

The UI will be very fluid & they can see all their interactions with GHO coin. This data fetched is visualised through various charts & users can smartly lookup at their transactio histories & other details.

Web2-Web3 integration also happens since GET FIAT CURRENCY option is also available for for users to liquidate their tokens to FIAT currency. We're using Monerium's SDK for this.

The models borrowed & lended will be kept secure using IPFS encryption and only the CID will be shared with the borrower .

This will create a positive feedback loop where more the number of models borrowed more GHO tokens will be transacted & this more lenders will be there on the platform who can act as Facilitators & thus mint more GHO for more trading.

A win-win for both Aave Community & GHO token traders as it will increase the use of GHO for daily trading while also incentivising users for it.

All of this process described above is smoothly iluustrated in the following diagram:

Contract Addresses 0x39F1d105446E32942318F63c1363a835F9BD8dCF -- lender_ccip 0x1F2E135F5a90EDcAEf32Bae4804eb894418645Cc -- borrower_ccip 0x0BF3dE8c5D3e8A2B34D2BEeB17ABfCeBaf363A59 -- sendGHO_ccip 0x147F6d5B83166043C0784cD688AFE5C54f4f295a -- creditDelegationVault 0x494e65506Bf2a0d0650aE789bD7299a41EAFf1Cb -- mockGHOToken 0x502726A056D32Fc3362Eb21095401dd93Fa47fC3 -- mockAToken 0x0f55c1C9250fC77f5261B9773cACB6d6b455fB1C -- Facilitator 0xF0138ef0b7D6Ed38A5091a2B4AcEa2A05072Ea51 -- UIGhoDataProvider

FAQs QN: How does the facilitator aspect works ?

ANSWER: Well, the concept is such that whenever the AvailableCapacity() of the lender is greater than the BucketThreshold() while simultaneously being less than the BucketCapacity(), the lender is elgible to act as a Facilitator.

QN: What is the collateral that the GHO is being minted against in this case, is it the expectation of profit from the strategies?

ANSWER : Every borrower who has borrowed a model signs an agreement with the lender, pays the upfront fees in GHO tokens. Now he'll have to also pay a certain fixed amount of fees predefined in the contract every month to the lender as interest. The interest that this lender gets every month + also the number of borrower count acts as a collateral for the lender.

Ofcourse, We can't keep expectations of profit from strategies as collateral since that's not a guaranteed or a very reliable form of payment.

What's Next?

Well, why just limit to models for trading!?. We plan to expand to building the customised model framework in the next couple of months to enable lenders to lend any kind of AI model which will bring generalisability & wide adoption of the ecosystem thus bringing in even more use cases for GHO token.

How it's Made

We used Chainlink CCIP for every crosschain Transaction. Model lending & borrowing happens through CCIP & is paid in GHO Tokens. After the bucketThreshold being crossed, the lender is eligible to act as a facilitator. A creditDelegationwithSignature Vault contract is signed as an agreement between lender & borrower. EIP2612 & EIP 4337 are implemented from scratch & used . MOnerium's SDK was used to convert from crypto to FIAT currency. Payments contracts for sending & receiving GHO from & to any address, swapping GHO & also selling & buying P2P on Aave are added & deployed successfully.