SwiftYield

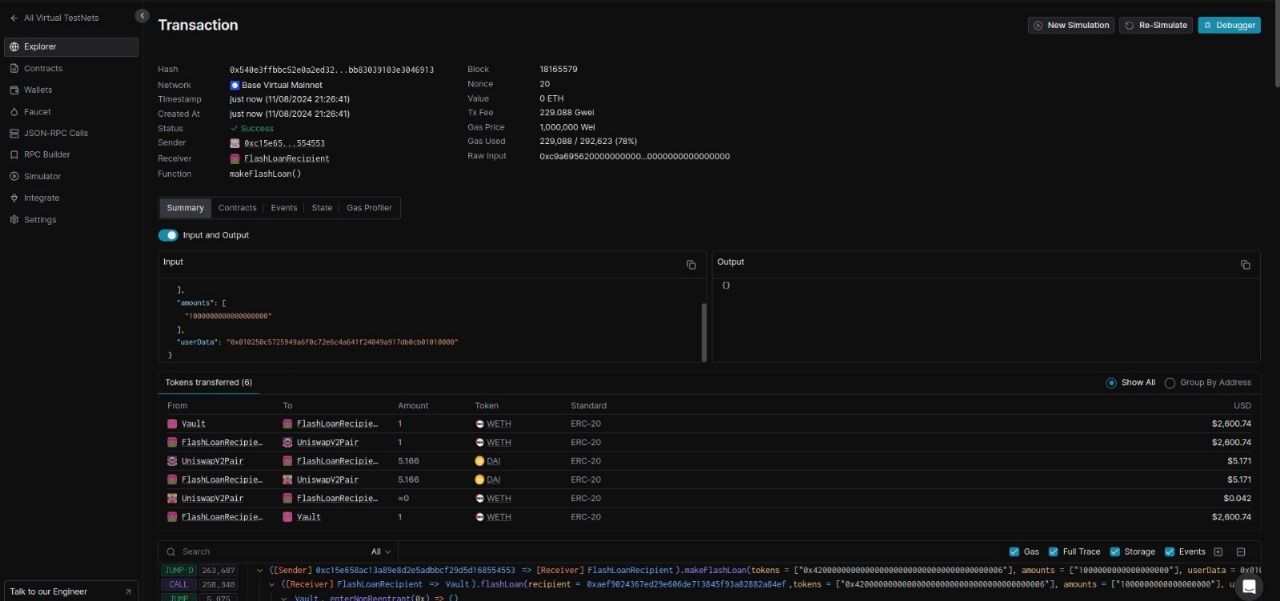

We deploy our bot on Tenderly for real-time monitoring and management of smart contracts, ensuring accurate and efficient arbitrage trading.

SwiftYield

Created At

Winner of

Tenderly - Build a dapp with Virtual TestNets

Worldcoin - Pool Prize

Prize Pool

Project Description

Our project is developing an advanced trading bot that harnesses the power of flash loans from Balancer to perform arbitrage trading across various decentralized exchanges (DEXs). Here’s a detailed look at how blockchain technology, decentralized applications (dApps), and decentralized finance (DeFi) authentication come into play:

-

Flash Loans from Balancer: Flash loans are a revolutionary financial instrument in DeFi that allows users to borrow large amounts of capital without collateral, provided the loan is repaid within the same transaction block. Our bot utilizes Balancer's flash loans to execute arbitrage opportunities across different DEXs. The bot takes advantage of price discrepancies between tokens on platforms like Uniswap and others. By borrowing funds temporarily, the bot can perform high-frequency trades, making profitable transactions without needing upfront capital.

-

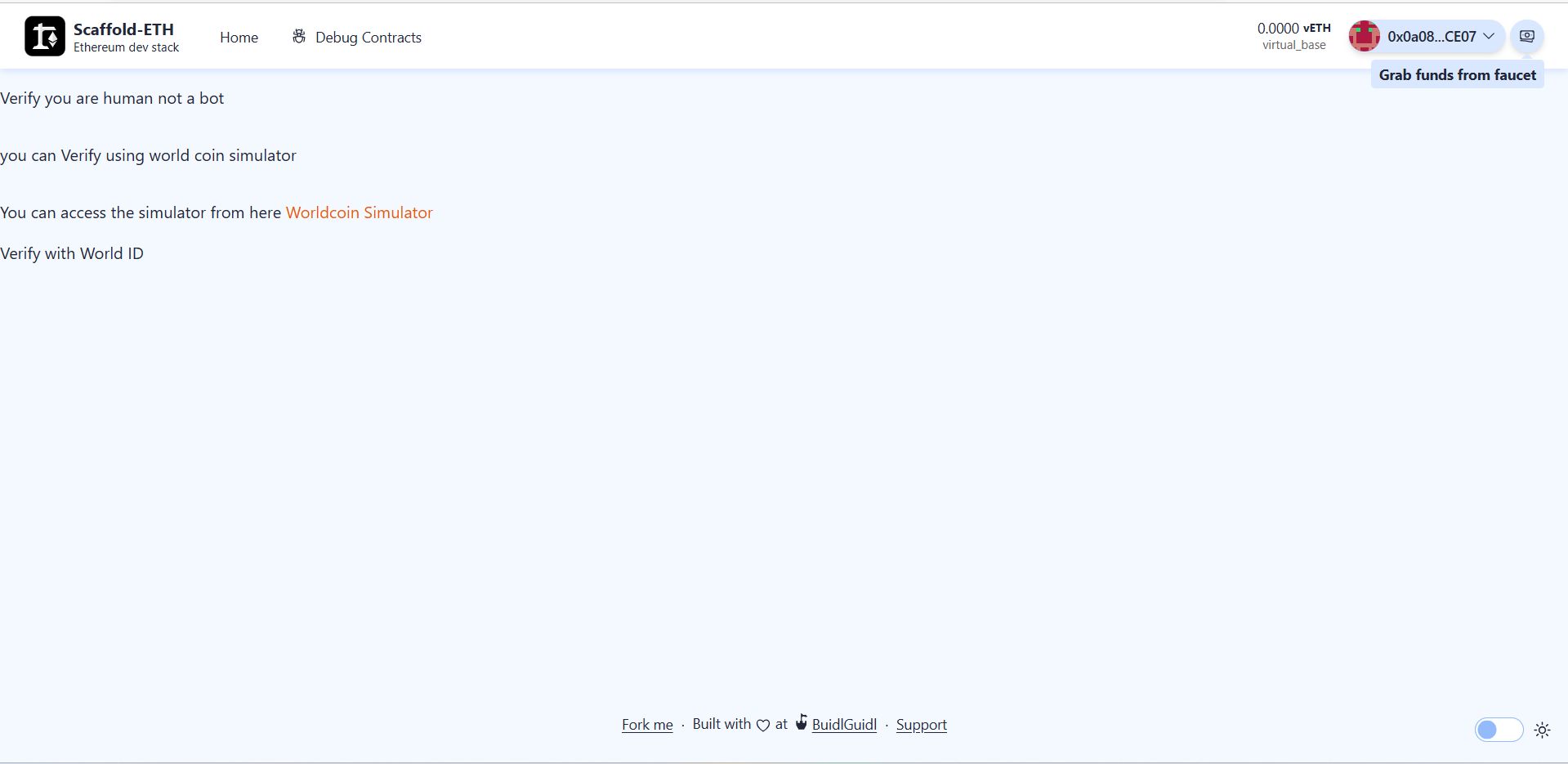

Worldcoin's World ID for Decentralized Authentication: Worldcoin's World ID is a cutting-edge privacy-preserving proof of personhood protocol. It provides a secure and decentralized way to authenticate users without compromising their privacy. By integrating World ID, our bot ensures that user interactions are authentic and secure, preventing fraud and ensuring that only legitimate users are engaged in trading activities. This protocol maintains the integrity of user identification while safeguarding personal data.

-

Monitoring Token Prices and Executing Trades: The bot continuously monitors token prices across various DEXs. By analyzing price movements and discrepancies, it identifies potential arbitrage opportunities—where the price of a token differs between exchanges. Using the flash loans, the bot executes trades to exploit these price differences, buying low on one exchange and selling high on another.

-

Transaction Management and Monitoring with Tenderly: Tenderly is a comprehensive platform that provides robust tools for managing and monitoring smart contract interactions on the Ethereum network. Our bot's transactions are deployed and tracked using Tenderly, allowing for real-time oversight of every operation. This integration helps ensure that all trades are executed correctly, transactions are recorded accurately, and any issues are addressed promptly.

-

Interoperability with Ethereum and Base Networks: Our bot operates on both the Ethereum network and Base network, two key blockchain platforms. By leveraging both networks, the bot enhances its trading capabilities, utilizing Ethereum’s extensive DeFi ecosystem and Base's innovative features. This interoperability allows the bot to access a broader range of trading opportunities and integrate seamlessly with various DeFi applications.

-

Innovative DeFi Applications: Our project focuses on creating an innovative trading experience by integrating novel DeFi applications. This includes leveraging advanced trading strategies, optimizing the use of flash loans, and exploring new financial products and services in the DeFi space. The combination of these elements aims to enhance profitability and efficiency within the decentralized finance ecosystem.

In summary, our bot combines the latest advancements in blockchain technology, dApp functionality, and DeFi authentication to create a sophisticated arbitrage trading solution. By utilizing flash loans, secure decentralized authentication, and comprehensive transaction management, the project offers a unique and efficient approach to trading in the DeFi landscape.

How it's Made

Architecture Design:

Components: The trading bot consists of several key components: a flash loan provider (Balancer), a price monitoring system, a trading engine, and a transaction manager. These components interact to perform high-frequency arbitrage trading. Integration: The bot integrates with the Ethereum network and Base network to access and execute trades across various decentralized exchanges (DEXs). It uses APIs and smart contracts to interact with these platforms. Flash Loan Utilization:

Borrowing Mechanism: The bot utilizes flash loans from Balancer to borrow capital without requiring collateral. This is done through Balancer’s smart contracts that facilitate the loan, provided it is repaid within the same transaction block. Execution: The bot performs trading operations with the borrowed funds, exploiting price discrepancies between different DEXs. After executing trades, the bot repays the flash loan within the same transaction. World ID Integration:

Authentication: The bot integrates Worldcoin’s World ID to authenticate users securely and privately. This integration ensures that all trading activities are conducted by verified and legitimate users while protecting their personal information. Monitoring and Trading:

Price Monitoring: The bot continuously monitors token prices on various DEXs using data feeds and APIs. It identifies arbitrage opportunities based on price differences. Trading Execution: Once an opportunity is identified, the bot executes trades by interacting with smart contracts on the DEXs. It buys tokens on exchanges where prices are lower and sells them where prices are higher. Transaction Management with Tenderly:

Deployment: The bot’s smart contracts are deployed on the Ethereum network. Tenderly is used for managing and monitoring these contracts. Monitoring: Tenderly provides real-time insights into contract interactions, helping ensure that trades are executed correctly and transactions are tracked accurately. How Smart Contracts are Written Contract Definition:

Smart Contracts: Smart contracts are written in Solidity (for Ethereum) and define the rules and logic for flash loans, trading operations, and transaction management. Functionality: These contracts include functions for borrowing funds, executing trades, repaying loans, and recording transactions. Flash Loan Contract:

Borrow Function: A function within the contract allows the bot to request a flash loan. This function specifies the amount to be borrowed and ensures the funds are returned within the same transaction. Execute Function: After receiving the loan, another function is called to execute the trading operations. This function interacts with other DEX contracts to perform buy and sell transactions. Arbitrage Logic:

Price Check: Smart contracts include logic to check token prices on multiple DEXs. This involves querying price data and calculating potential profits from arbitrage. Trade Execution: Contracts facilitate the actual buying and selling of tokens based on the identified arbitrage opportunities. Repayment Function:

Repayment: The contract includes a function to repay the flash loan. This ensures that the borrowed amount, plus any fees, is returned to the lender before the transaction block ends. How Transactions Occur in Flash Loan Trading Initiation:

Request: The bot initiates a transaction by requesting a flash loan from Balancer. This is done through a smart contract that specifies the amount of capital needed. Execution Block:

Borrow and Trade: Once the loan is granted, the bot uses the borrowed funds to execute trades across different DEXs. This is done in a single transaction block, ensuring that all operations are completed before the block is finalized. Arbitrage: The bot buys tokens at a lower price on one exchange and sells them at a higher price on another. The profit is realized within the same transaction block. Repayment:

Return Funds: At the end of the transaction block, the bot’s smart contract repays the flash loan, including any fees. If the loan is not repaid, the entire transaction is reverted, ensuring no risk to the lender. Confirmation:

Transaction Finalization: The transaction is confirmed by the network, and the results (profits, loan repayment) are recorded on the blockchain. Tenderly helps monitor and validate these transactions to ensure accuracy. In summary, the trading bot is built using a combination of advanced blockchain technologies, including smart contracts for flash loans and trading operations, secure authentication via Worldcoin’s World ID, and transaction management through Tenderly. This approach enables efficient and profitable arbitrage trading within the decentralized finance ecosystem.