TARS

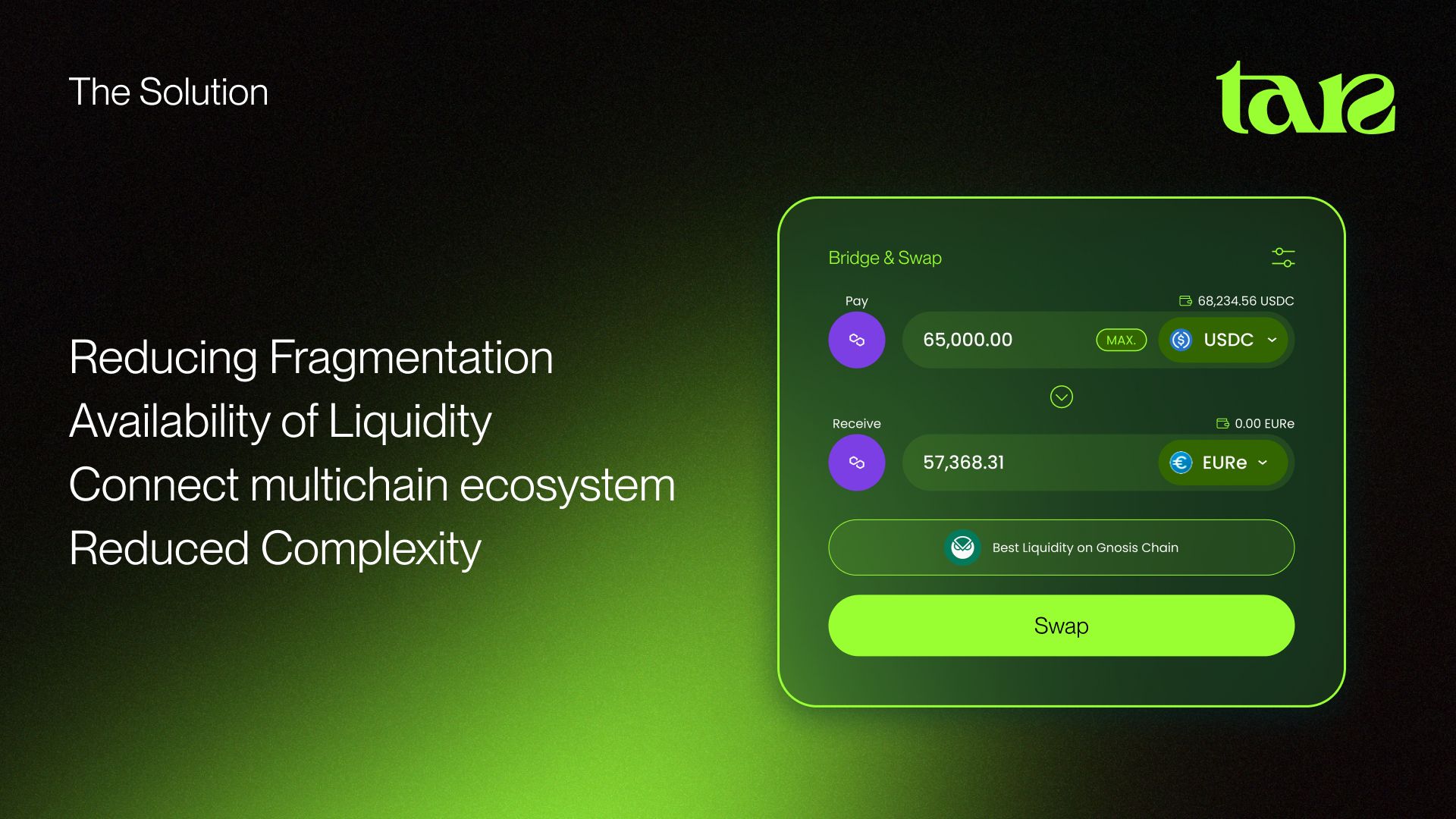

TARS enables swaps via indirect routes (2+ swaps) on single-chain DEX, increasing liquidity depth, reducing slippage, and concentrating liquidity on a single chain.

Project Description

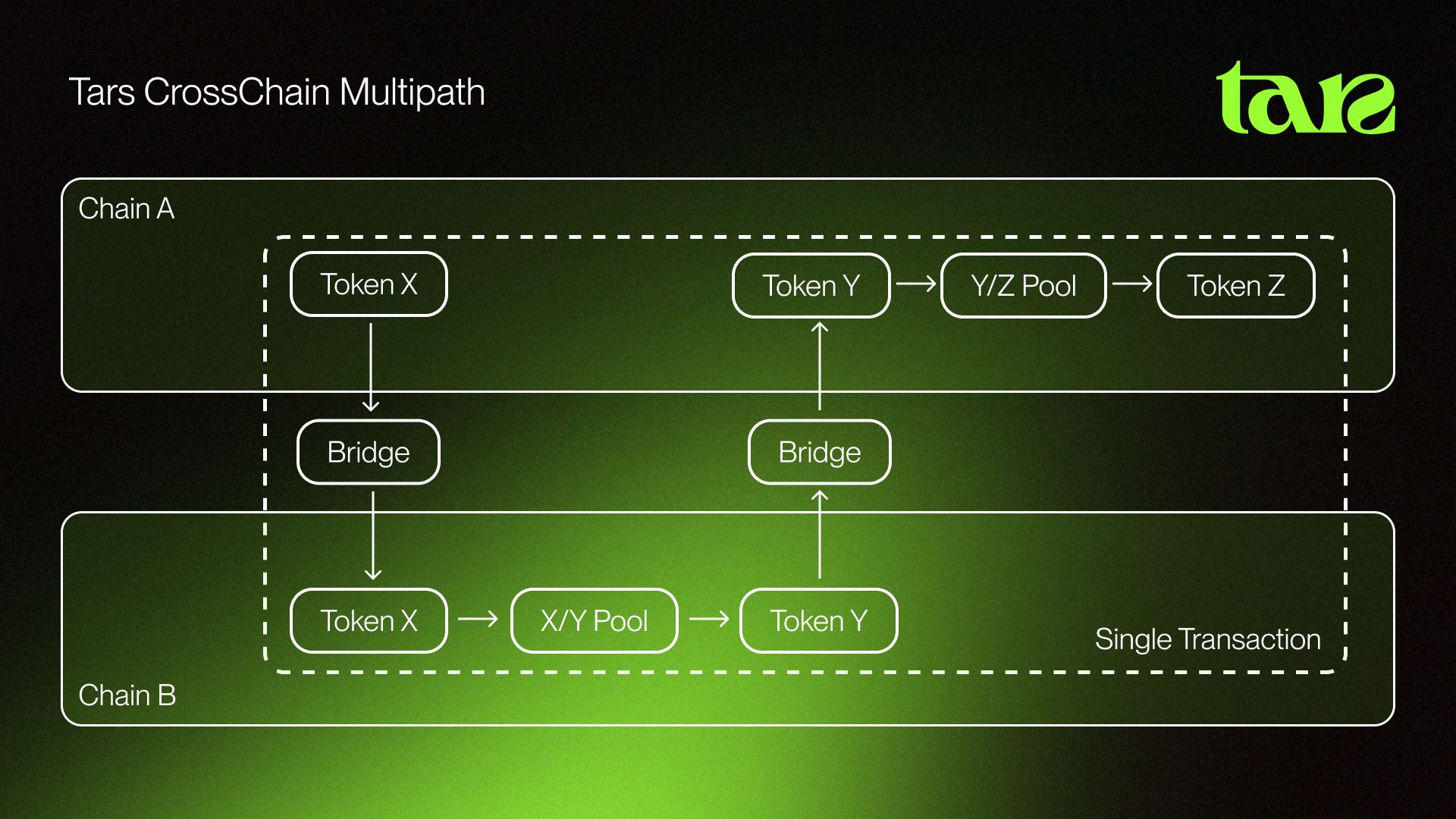

TARS enable swaps via indirect routes (2+ swaps) to be carried out in a single transaction, transparently for the user. Let's consider that we have 3 different tokens named X, Y and Z and that all 3 are available on a chain A and a chain B.

We also know that token X only has liquidity on chain B, token Y only on chain A and token Z on both chains A and B.

Alice would like to swap token X for token Y on chain A, but X has no liquidity available at the time of the swap. However, there is plenty of liquidity on chain B, and token X is bridgeable to chain B. So we'd like to be able to carry out this swap by bridging token X from chain A to chain B, then exchanging X for Z, and finally bridging token Z to chain A and exchanging it for token Y.

This is a huge advantage for protocols with tokens deployed and bridgeable on several chains, even stablecoins.

TARS Crosschain multipath would enable liquidity to be concentrated on a single chain, limiting fragmentation and providing greater liquidity depth, while reducing slippage.

How it's Made

This architecture is the fruit of a reflexion to solve problems like fragmented liquidity, high slippage due to low liquidity and bad user experience. By using bridge aggregator like LiFi and dex aggregator like 1inch, TARS manages to execute swap with the best conditions for the user when there is a flagrant lack of liquidity on one chain. Better than unifying liquidity, TARS bring to the table liquidity abstraction.