TOKENLEASE

The project is to develop an NFT renting and lending platform using blockchain technology. The platform will allow users to lend and rent NFTs, create smart contracts to manage transactions, and integrate with wallets to enable secure payments.

Project Description

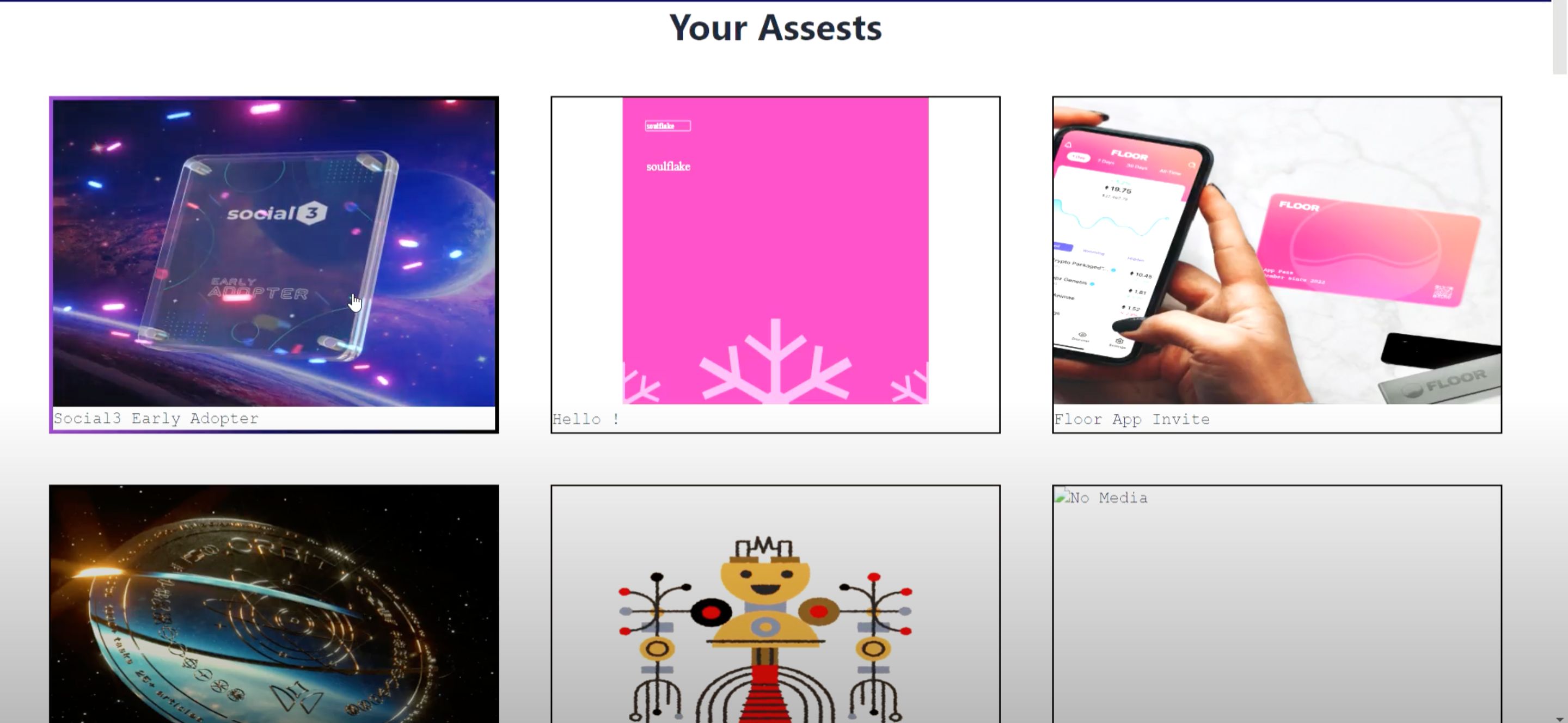

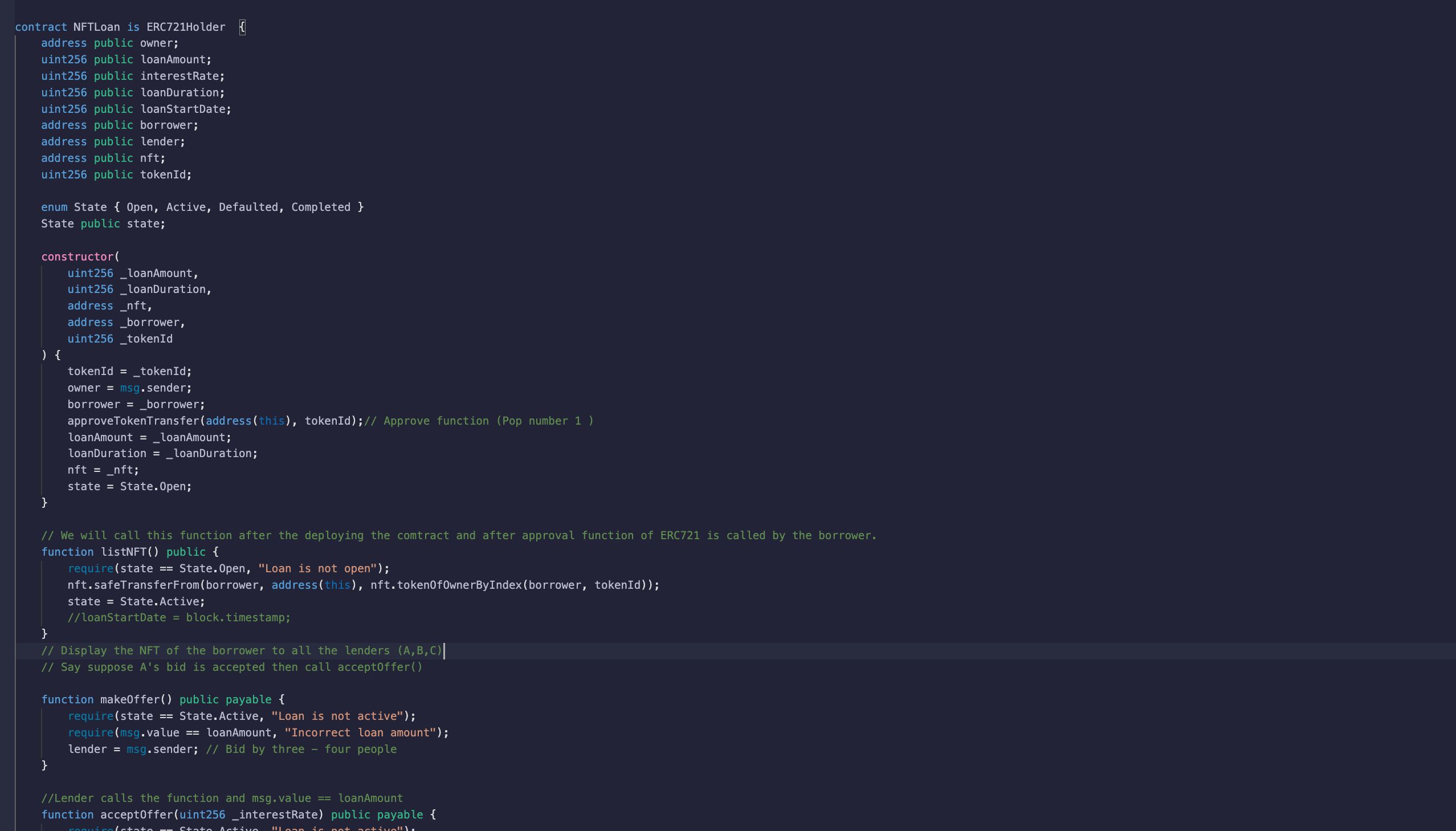

The platform could work by allowing NFT owners to use their non-fungible tokens as collateral for a loan. The borrower would deposit their NFT into the smart contract which acts as an escrow , and in return, the contract would disburse the agreed amount of Ethereum to the borrower's wallet.

The borrower would be required to repay the loan plus interest within a specified period. If the borrower is unable to repay the loan, the smart contract would automatically transfer ownership of the NFT to the lender as a form of repayment.

This kind of lending platform would allow NFT owners to leverage the value of their assets to access liquidity without having to sell their NFT. It would also provide an opportunity for Ethereum holders to earn interest on their assets by lending them out to NFT owners in need of liquidity.

How it's Made

Front End - Wagami , Chakra UI and React Solidity dependencies - Open Zeppelin Set up the development environment: To create the NFT lending platform, you need to set up a development environment that includes all the necessary tools and software. This includes a text editor, a command-line interface, and a blockchain development framework such as Truffle.

Define the requirements: You need to define the requirements of the NFT lending platform. This includes identifying the key features such as the ability to deposit NFTs as collateral, disbursing Ethereum loans, and managing loan repayments.

Smart contract development: Develop the smart contract that will manage the lending process. This contract should include functions for depositing NFTs as collateral, disbursing Ethereum loans, and managing loan repayments. You should also include an oracle to verify the value of the NFT collateral.

Frontend development: Develop the frontend interface to allow users to interact with the smart contract on the blockchain. The frontend should include a form for borrowers to input their NFTs as collateral, specify the amount of Ethereum they wish to borrow, and agree to the terms of the loan. The frontend should also include a dashboard for lenders to view their loans and manage repayments.

NFT evaluation: Evaluate the value of the NFT collateral to ensure that it meets the collateral requirements. This can be done using an oracle that pulls data from various NFT marketplaces to determine the current value of the NFT.

Collateral deposit: Allow borrowers to deposit their NFTs as collateral by calling the corresponding function on the smart contract. The smart contract should then hold the NFT until the loan has been repaid or the collateral has been liquidated.

Ethereum disbursement: Disburse the agreed amount of Ethereum to the borrower's wallet after the collateral has been deposited.

Loan repayments: Allow borrowers to make repayments through a function on the smart contract. The smart contract should hold the repayment in escrow until the loan is repaid in full.

Collateral liquidation: Automatically liquidate the collateral by transferring ownership of the NFT to the lender if the borrower is unable to repay the loan. The smart contract should also return any remaining Ethereum to the borrower's wallet.

Testing and auditing: Test and audit the NFT lending platform to ensure that it is secure and functions as intended. Additionally, the platform should comply with any relevant regulations, such as KYC