USTC+

$USTC+ is a Defi model that aims to utilize "SUPPLY REGULATORS" to lock excess token supply and give confidence to market participants with the aim to achieve a re-peg of the algo stable coin USTC back to 1$

Project Description

The well-known Terra collapse brought a new era of distrust into the blockchain industry and its so-called experts. However, if we want Web3 to be successful, we need to get back people's trust by helping to recover assets that people lost. Terra still active by consumers who lost millions of dollars yet with the hope to return it back. The strong community got support from the major exchanges. Binance and Kucoin are actively burning trading fees (https://www.luncmetrics.com/) for LUNC since they still hold the majority of the supply and attract the humongous community of Terra Labs that was built over the years. Their deed might seem noble to some but in our opinion, they act for their benefit since there are still large perpetual market trades even with these collapsed prices (https://coinalyze.net/terra-classic-usd/liquidations/) and the MM can manipulate the LUNC, USTC prices however they need. (https://www.luncmetrics.com/price/ustc) There were many attempts to re-peg (MintCash and Terra assets burning) the 2 infamous coins but they are failing from our viewpoint.

A better alternative would be to use USTC as it is a multichain asset since its power is in adoption and community behind. The plan is to try to lock up the majority of available supply with good incentives for the liquidity providers/ SUPPLY REGULATORS until we reach the levels of USTC available in circulation, for an attempt to utilize it as a stable coin again.

How it's Made

For a successful re-peg of USTC, we'd need to achieve a self-custody protocol that is verifiable, incentivized, and has a slashing mechanism where supply regulators will benefit from market activities and hold the excessive supply so it can be introduced back to markets in a slow and controlled manner.

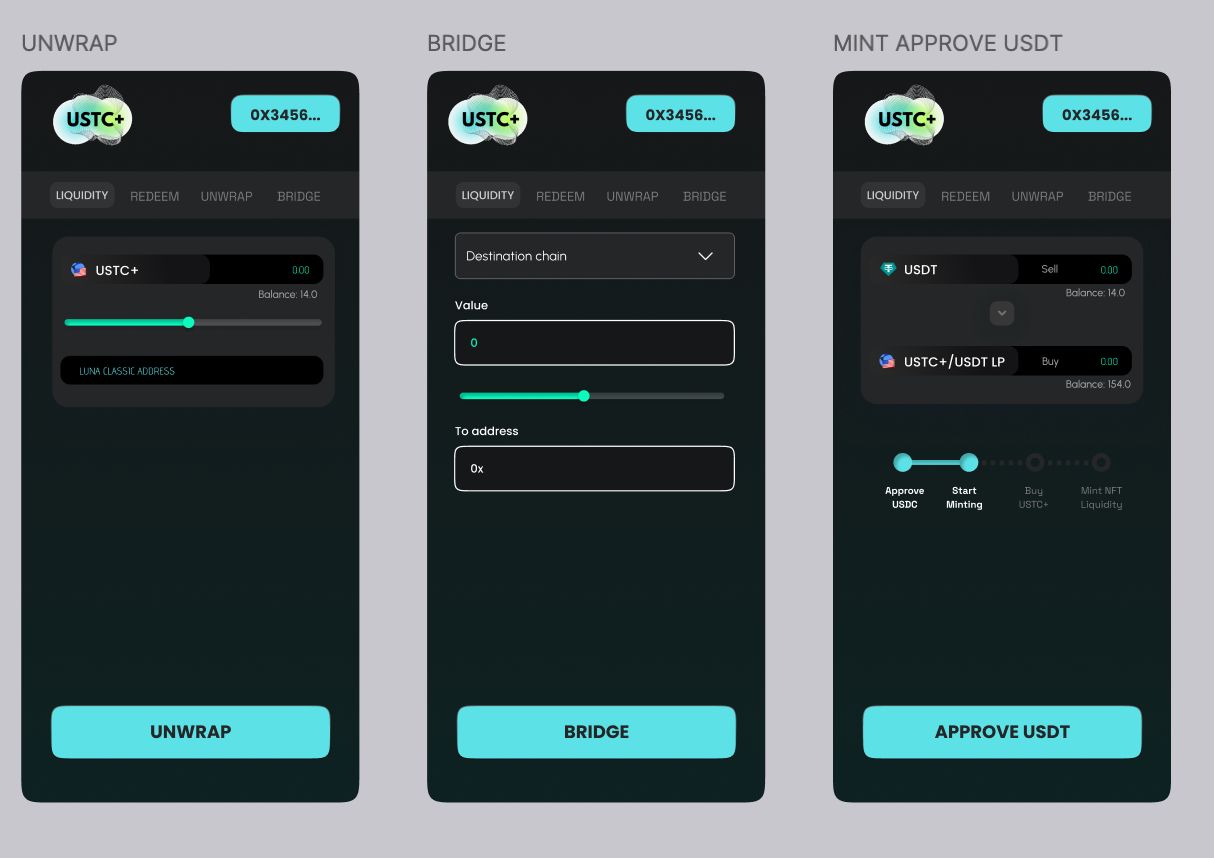

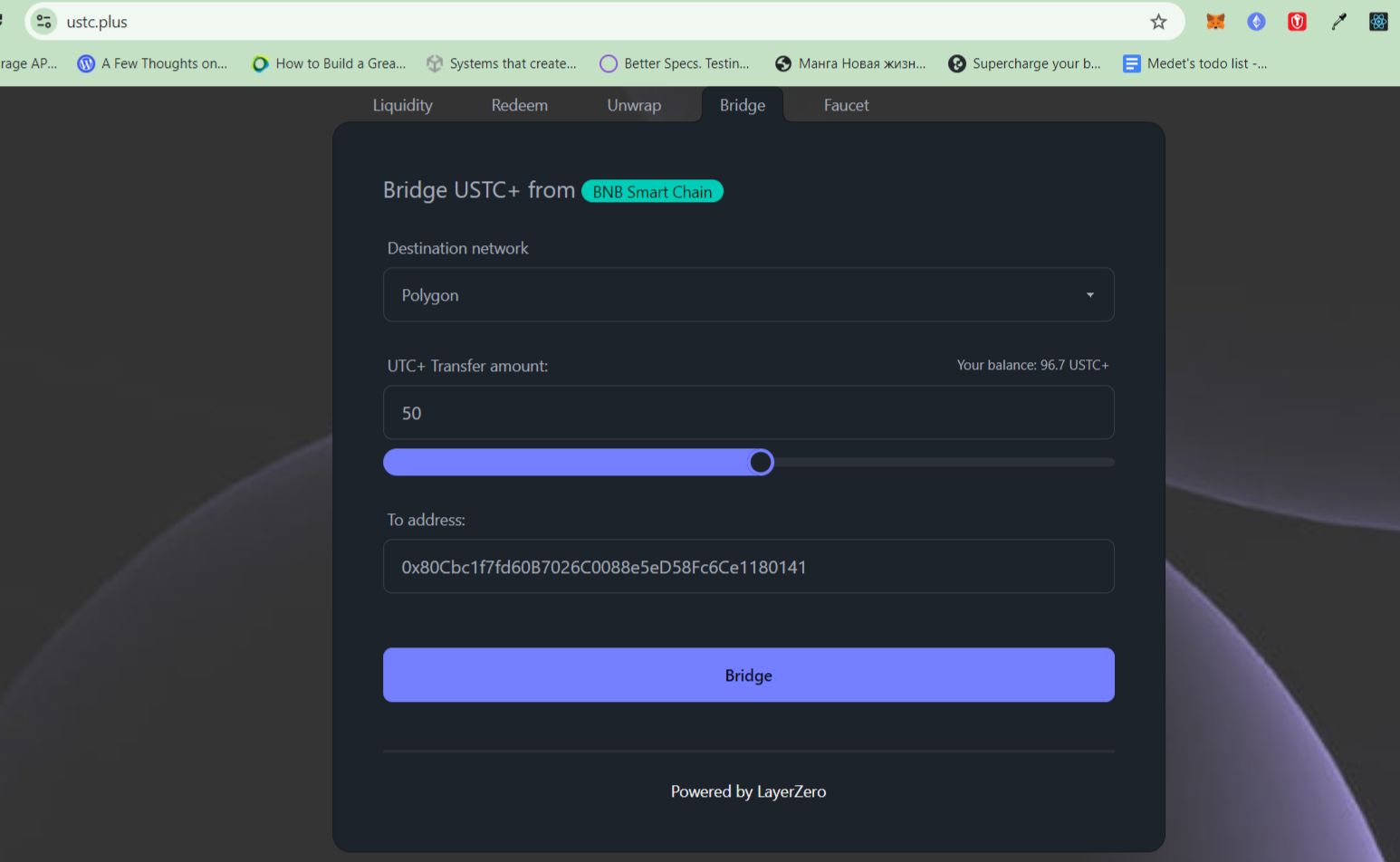

USTC+ is a multi-chain fungible token that is 1-to-1 pegged to USTC. To turn it into a multi-chain asset we utilized the LayerZero's OFT technology. There is no owners of USTC+ except LayerZero network itself.

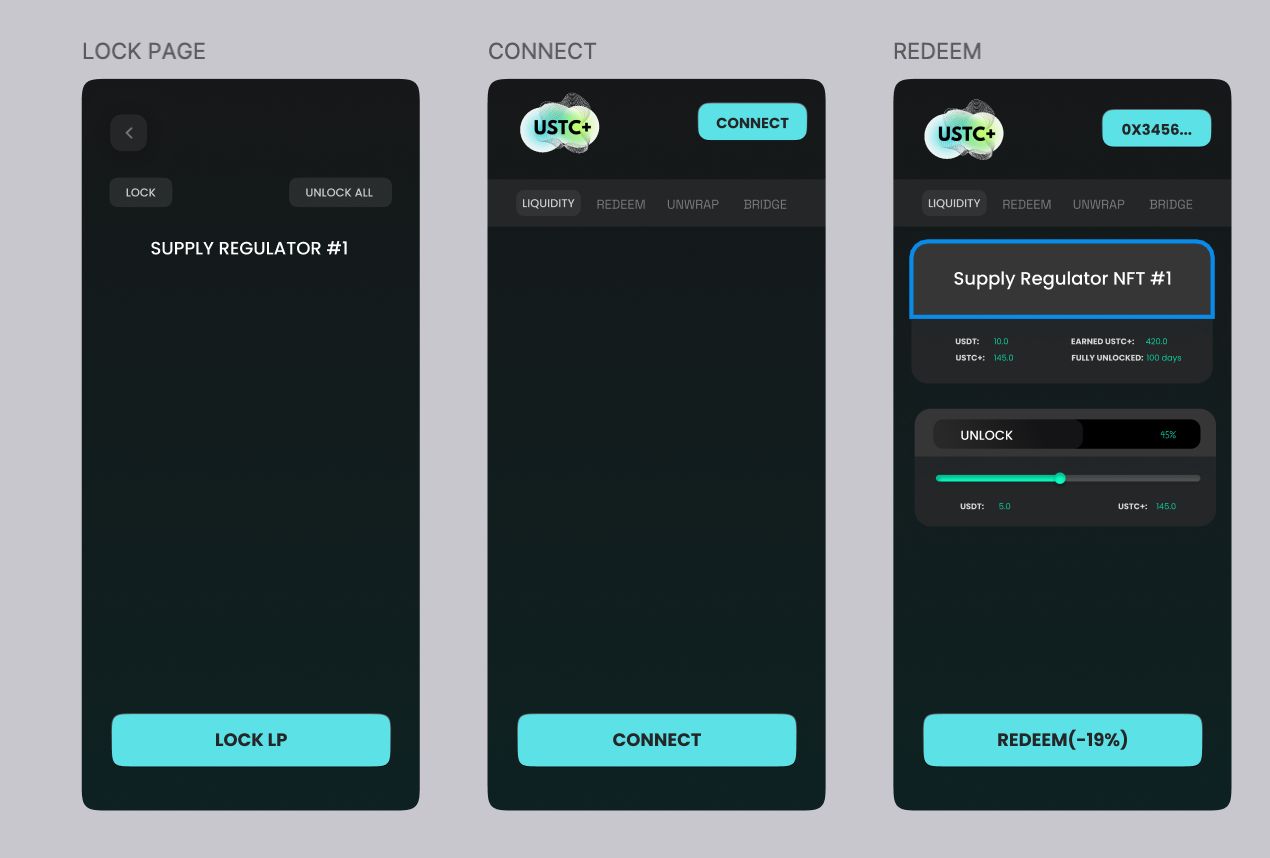

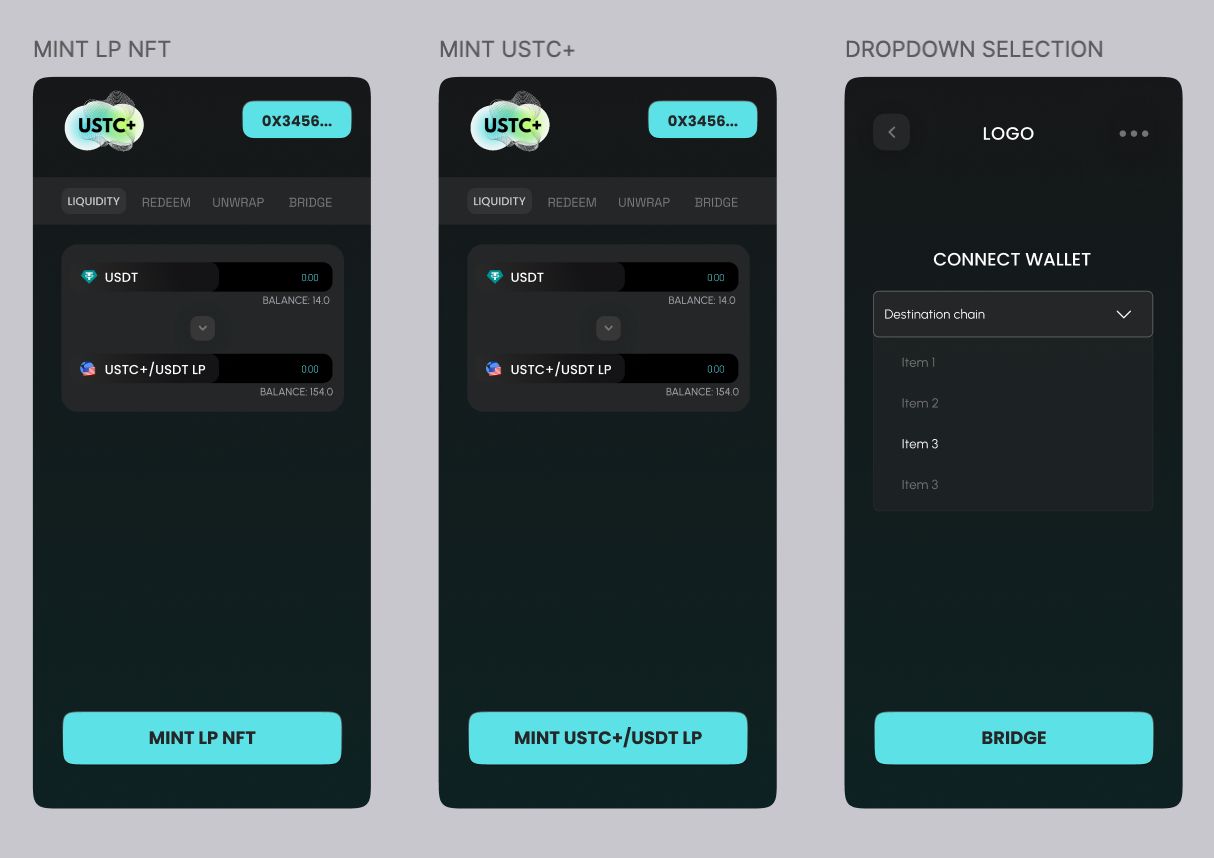

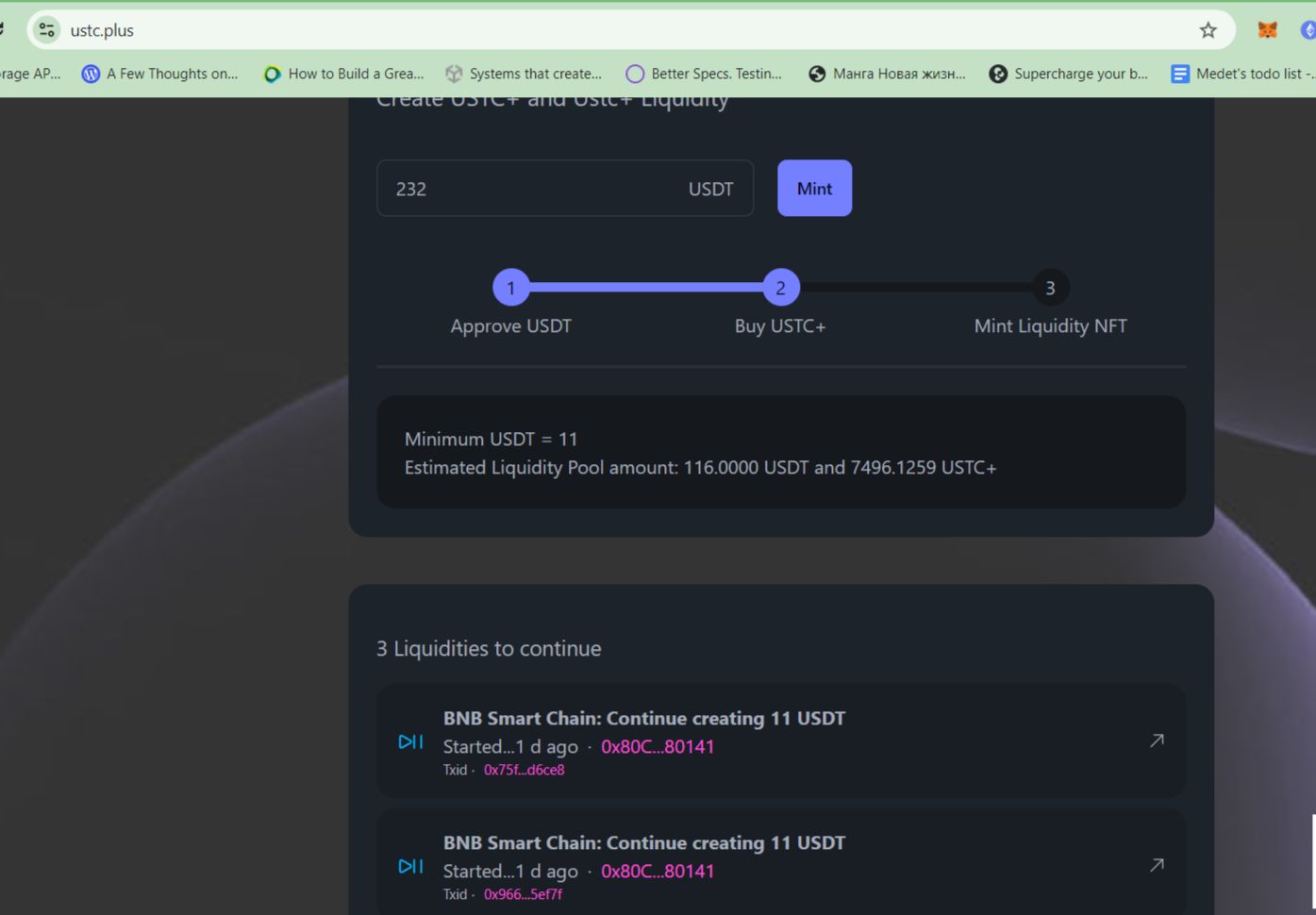

To incentivize people to mint USTC+ and hold it, we created a Dex that mints the USTC+ and immediately converts it into an Liquidity NFTs. The holders of NFT gets the network reward from the USTC+ transaction fee. People can buy the USTC+ by the providing stable coin such as USDT. In the beginning of the minting process the dex smartcontract transfers 50% of the stable coin to the binance bot. Sine binance is the most active platform with the largest USTC liquidity, our backend keeps the binance bot that upone the deposit automatically buys the USTC and issues an approval signature for the user. The approval signature is then used by a user to mint Liquidity tokens where 50% is his stable coins, while the other 50% is USTC+. Later, he can burn his USTC+ to get USTC in the Terra classic network.

Our binance bot that pegs the USTC+ to USTC in the exchanges achieves the transparency through the Envio and Tableland.

Envio is the decentralized smartcontract event indexer which provides a public hosted service. The ustc+ dex smartcontracts are indexed only through the Envio, so that users can track the syncing state of the binance bot. If they started a minting process, by checking Envio public url, they can see did binance bot trades his assets or not. No one except the Envio network provides the binance bot with the information.

Our backend upon receiving the event logs from Envio submits them to the Tableland - a decentralized database service. The minting statuses are tracked on the Tableland database that people can verify. The binance bot uses only the public tableland tables to determine minting process.

Using theout of our control data storage providers, our project achieves the 50% transparency, and self custody. In the next update of Ustc+ project we aim to migrate the binance bot itself to the decentralized cloud service that provides a Multi Party Computations to store the bot keys. We emitted it intentionally for this hackathon period intentionally as researching the security aspect takes more time and we want to carefully evaluate all the options.

Here is the USTC+ minting process:

- The user provides a stable coin in a major blockchains supported by LayerZero (for now its Polygon and BNB Smart Chain).

- The dex smartcontract automatically transfers 50% OF USDT to the binance bot address.

- The dex backend receives the notification about user's transaction from Envio indexers.

- Then, dex backend submits the code to the tableland database with the initial status as "received".

- The binance bot thread in the dex backend updates the tableland database about the status of the USTC - USTC+ peg with the binance metadata parameters. Then creates a signature for a user to submit.

- User can see the result of the tableland database and the binance metadata and if its valid they confirm the minting of the Liquidity.

- Dex smartcontract mints a Liquidity NFT with 50% stable coin and 50% Ustc+.

Incentives.

The Liquidity NFTs have the hardcoded slashing mechanism at 24%. Every month this slashing fee reduced by 1%. In case of the macro-economic anomaly, where USTC+ price changes for 24%, then user may withdraw the tokens. After all he gets the more tokens that covers his slashing fees.

Users who wants to exchange (either buy more USTC+ or sell their bag) automatically invokes the 1% transaction fee. This transaction fee that applied to any USTC+ transaction. The fee is automatically distributed to all Liquidity Token holders. We assume that at least 50% of the people will keep the their Liquidity tokens during the macro-economic anomaly to collect the fees from the intensive trading.

The 1% trading fee distribution to all Liquidity holders is achieved through the Reflect mechanism introduced by Reflect.finance that we use for Ustc+ fee distribution as well.

The slashed fees from early redeem of the coins from Liquidity NFTs go to the multi-sig wallet that is governed by the USTC+ community core members. For the multi-sig we use the Gnosis Safe technology.

Our frontend uses the Nexth and smartcontracts for the dex are implemented using the hardhat framework along with Reflect finance, Openzeppelin and Layerzero libraries.