VARQNet

Protocol that allows for stablecoin creation for fiat that is pegged to USD

Project Description

Stable Coins in Cryptocurrency:

Overview: Stable coins, such as USDC (termed UsdStable), have revolutionized DeFi and remittances by being pegged to fiat currency. Challenges in Developing Nations:

Limited access to USD leads to a "black market" rate for UsdStable, creating a premium for USD access. The Problem:

Swapping local currency (DevFiat) for a local stable coin (DevStable) results in a price premium between DevStable and UsdStable. Solution: Vault Access Reserved Quota Network (VARQN):

Purpose: VARQN, a network of DApps, issues, stabilizes, and ensures liquidity for DevStable and UsdStable, separating official from black market rates.

Operation:

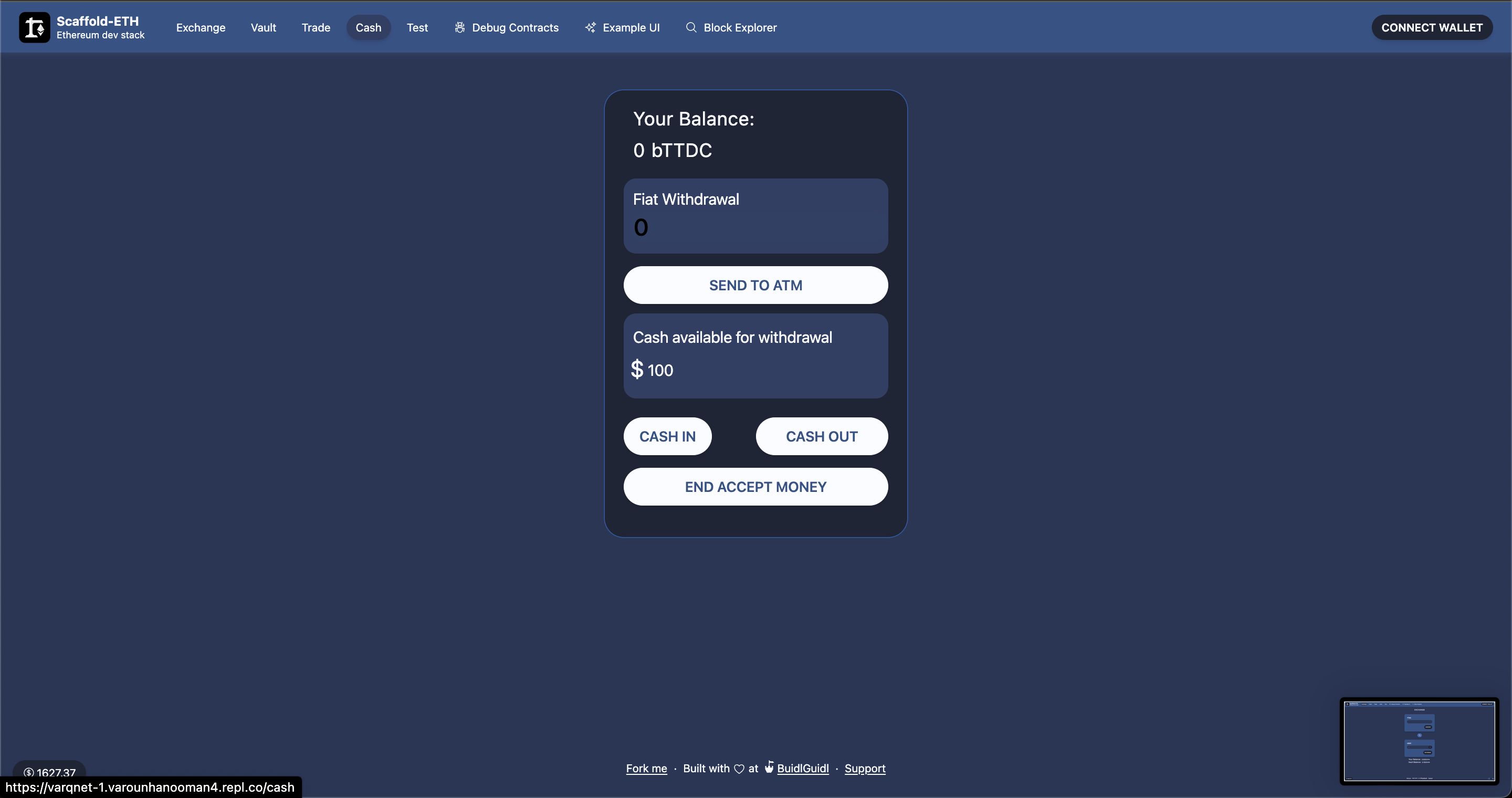

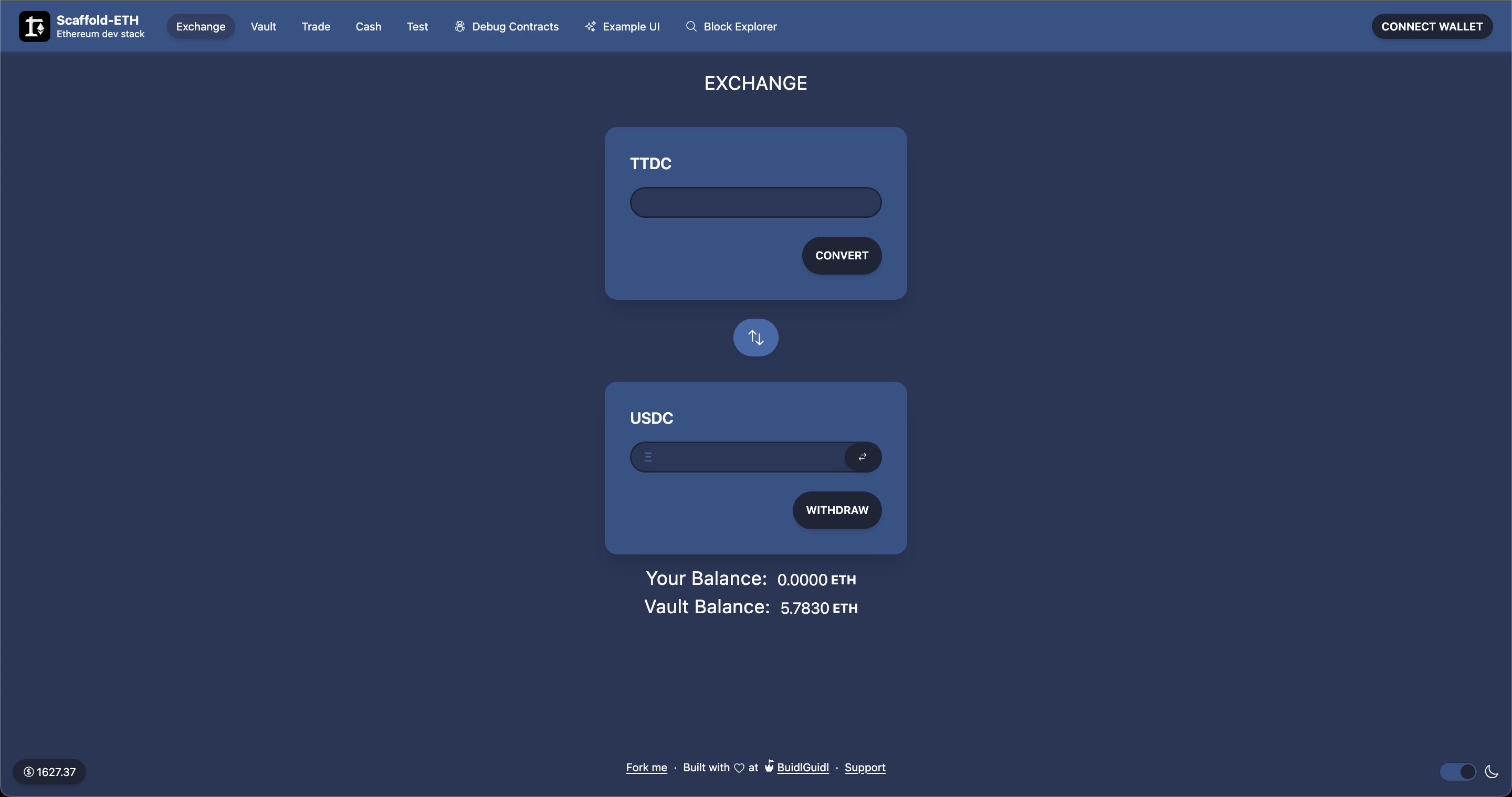

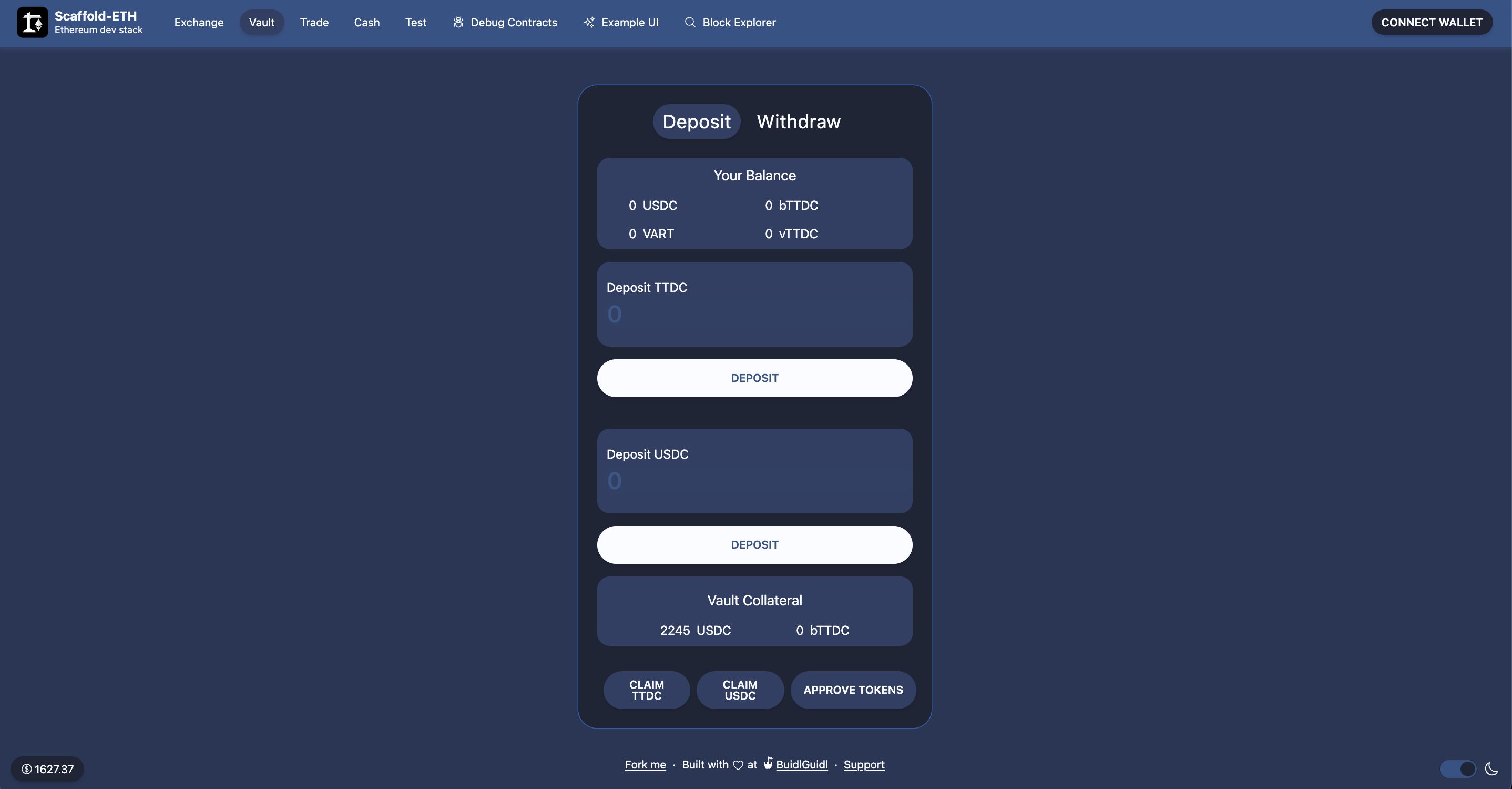

VARP: Users deposit UsdStable (like USDC or DAI), minting DevStable and VART (a 1:1 USD pegged token). AMM (e.g., Uniswap): VART and DevStable are paired for "price premium" discovery. It also supports KYC/AML vetted stables or CBDCs.

How it's Made

- Architecture:

Distributed Ledger: VARQNet operates on an EVM blockchain, ensuring transparency, immutability, and decentralization.

Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. They govern the minting of DevStable and VART, the deposit of UsdStable, and the interactions within the AMM.

- Vault Access Reserve Protocol (VARP):

Deposit Mechanism: Users send UsdStable (like USDC or DAI) to a specific smart contract address. This contract verifies the deposit and mints the corresponding DevStable and VART tokens.

Minting Algorithm: Ensures that for every UsdStable deposited, an equivalent amount of DevStable and VART is minted, maintaining the 1:1 peg.

Withdrawal Mechanism: Users can redeem their UsdStable by sending VART to the smart contract, which then burns the VART and sends back the corresponding UsdStable.

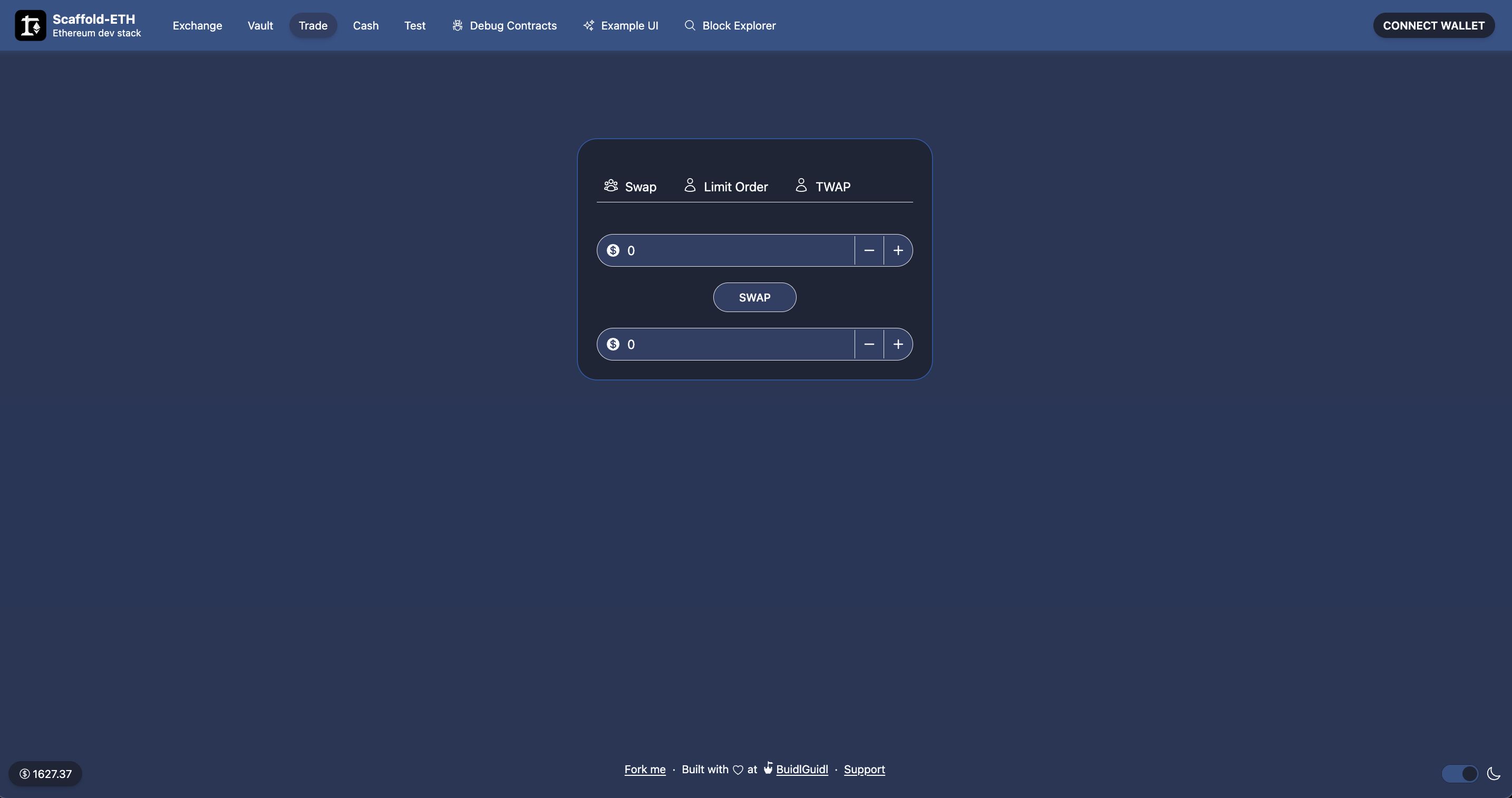

- Automated Market Maker (AMM):

Liquidity Pools: These are smart contracts that hold pairs of tokens, in this case, VART and DevStable. Users can trade between these pairs or provide liquidity to earn fees.

Price Discovery: The ratio of VART to DevStable in the liquidity pool, combined with the trading activity, determines the "price premium". The constant product formula used in platforms like Uniswap ensures that the product of the two reserves remains constant, which in turn affects the price.

Integration: The AMM would be integrated with the VARP to ensure seamless liquidity provision and withdrawal, as well as accurate minting and burning of tokens.