ve8020GHO

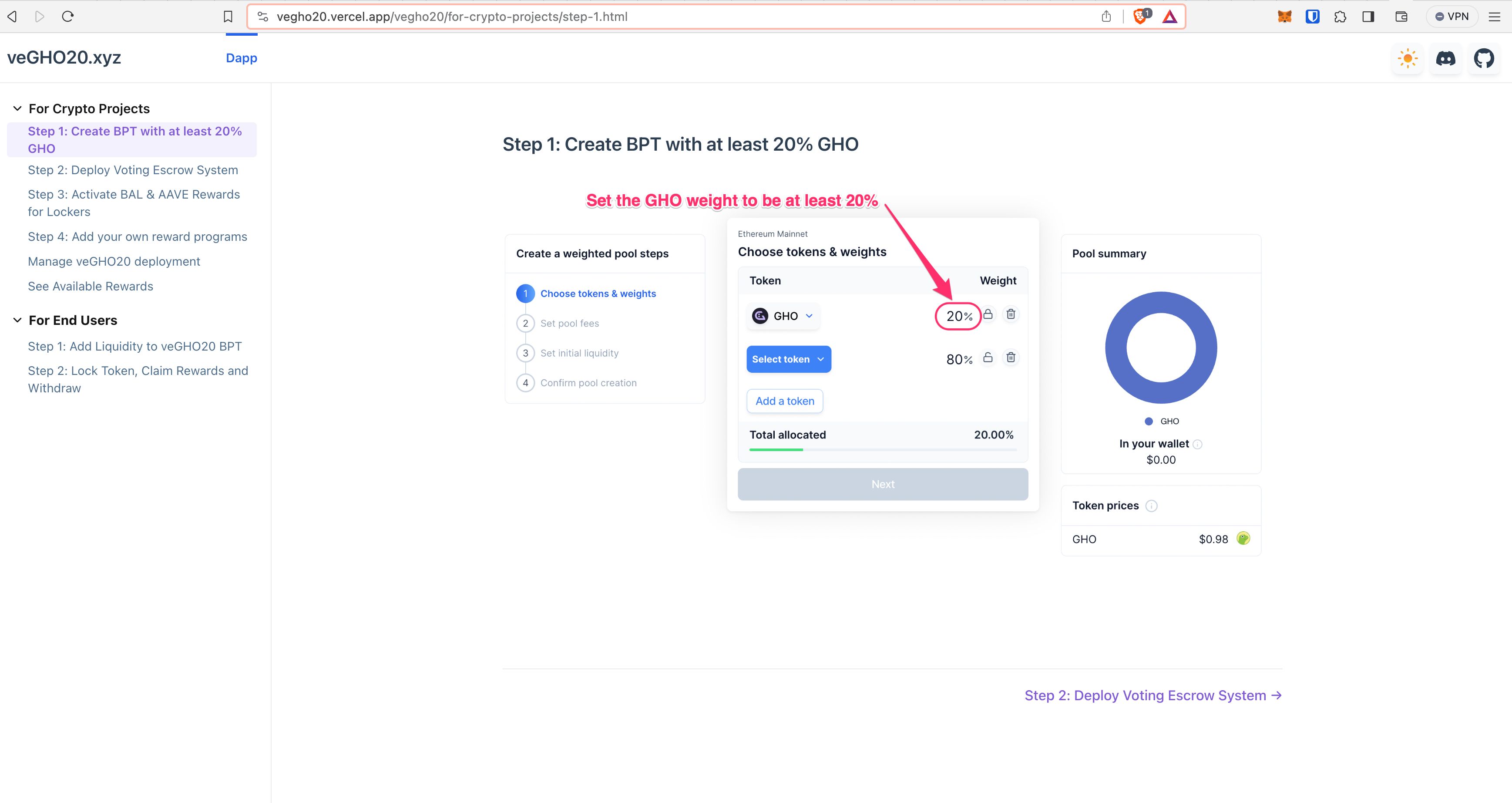

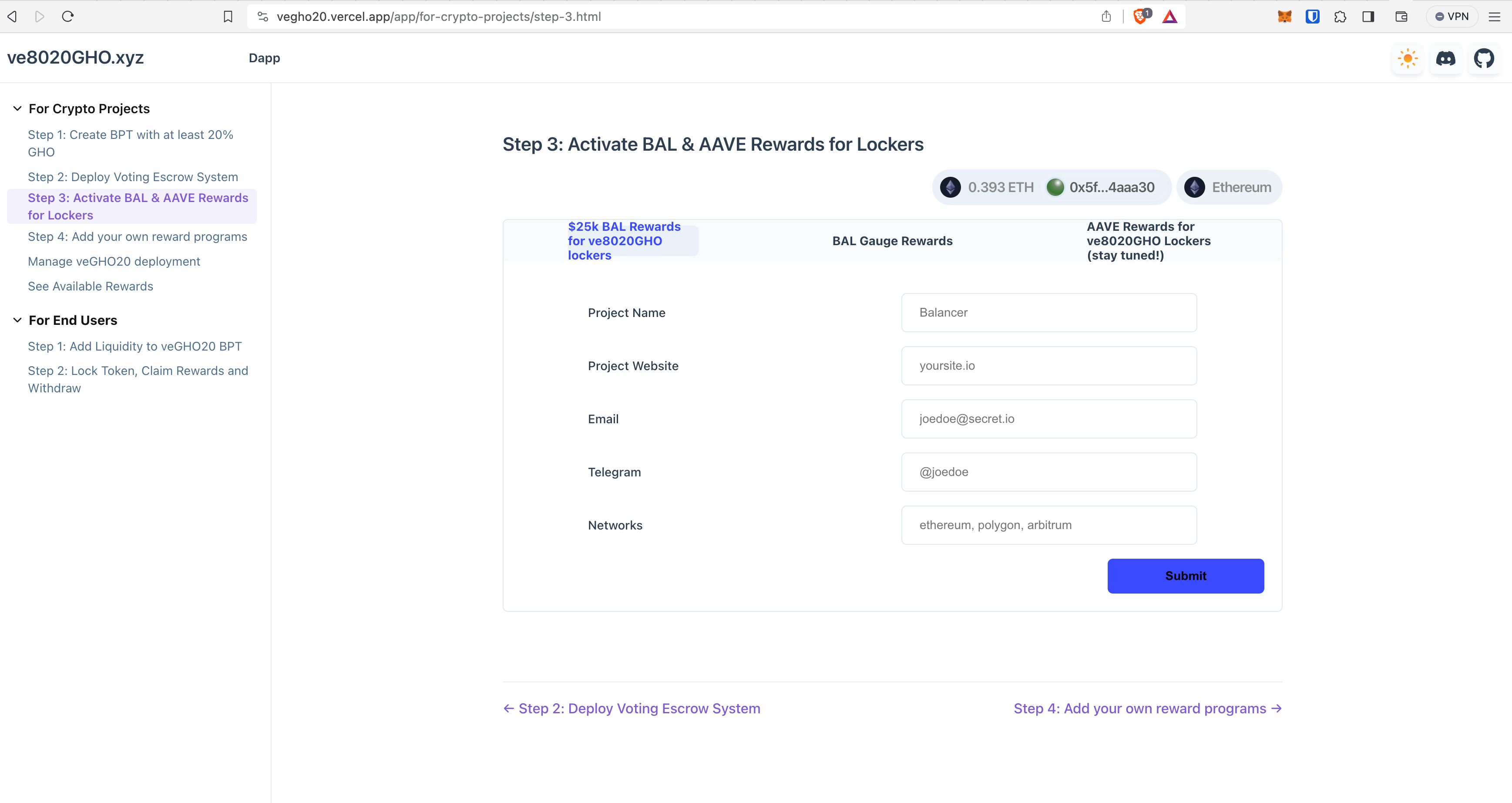

veGHO20 provides projects with long-term, time-locked GHO-based AMM liquidity, replacing mercenary yield farmers and market makers. Protocols that adopt ve8020 are eligible for a 25k BAL grant (~$105k) distributed to lockers of veGHO20 BPTs that contain at least 20% GHO weight.

Project Description

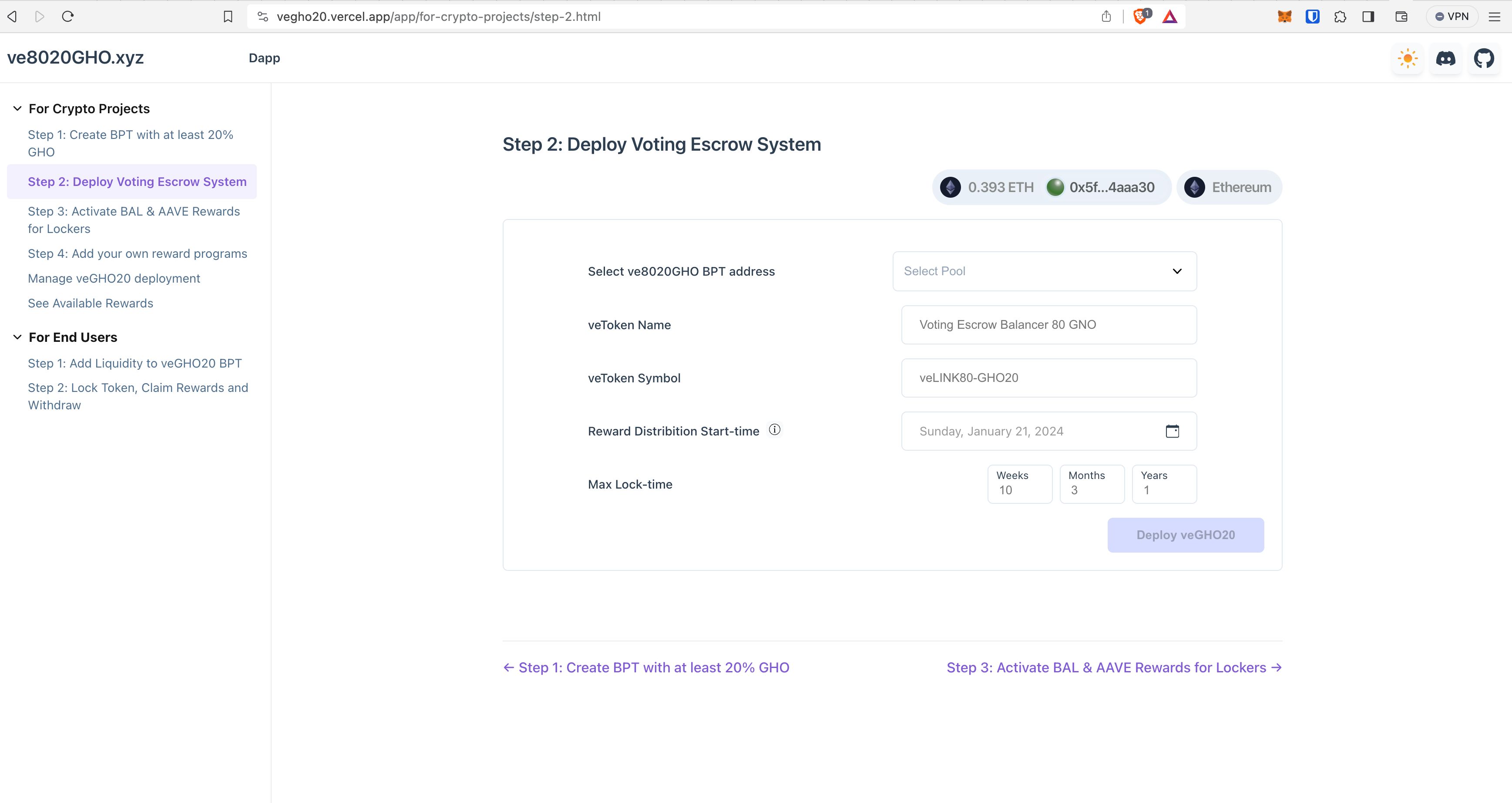

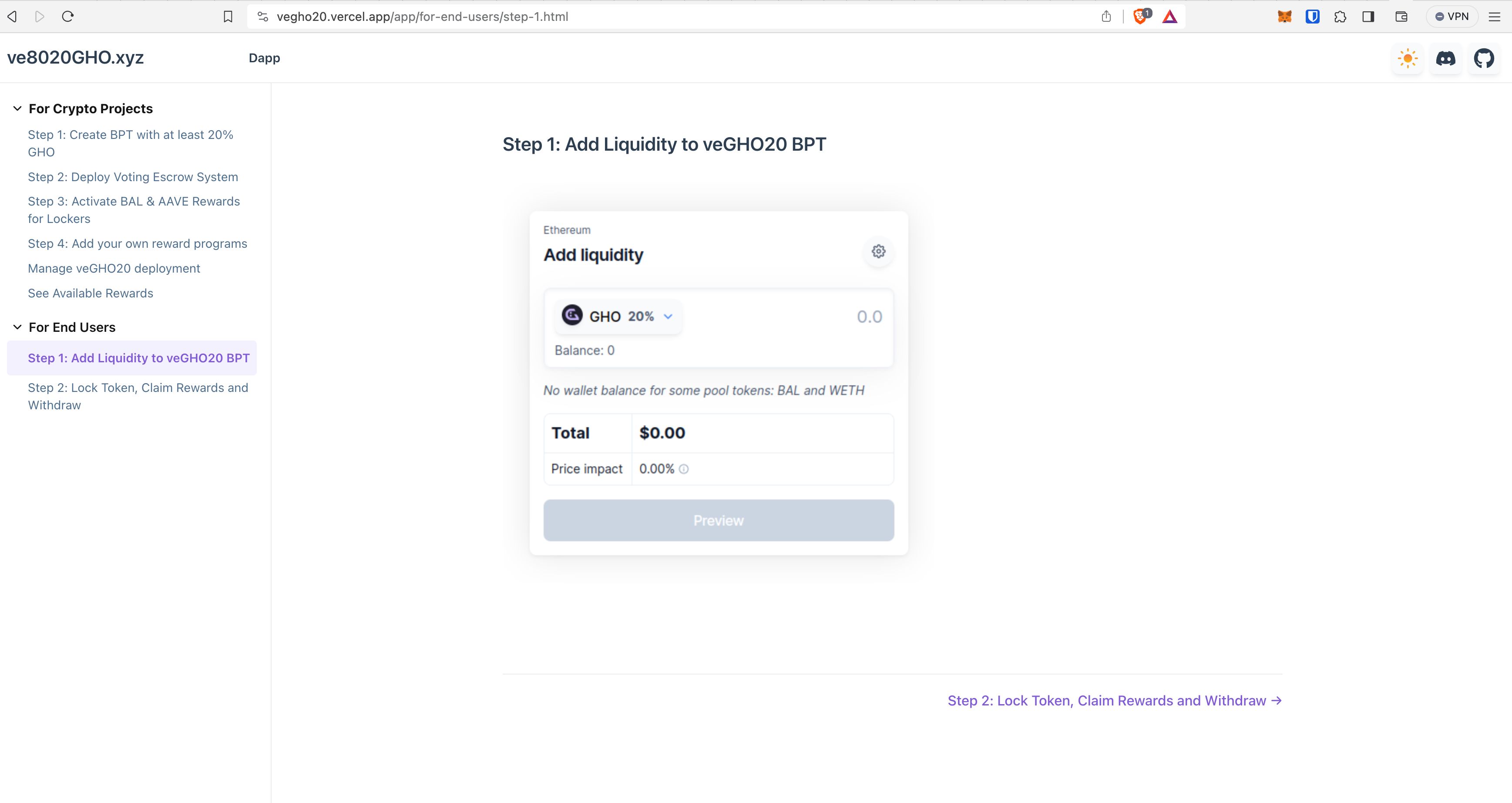

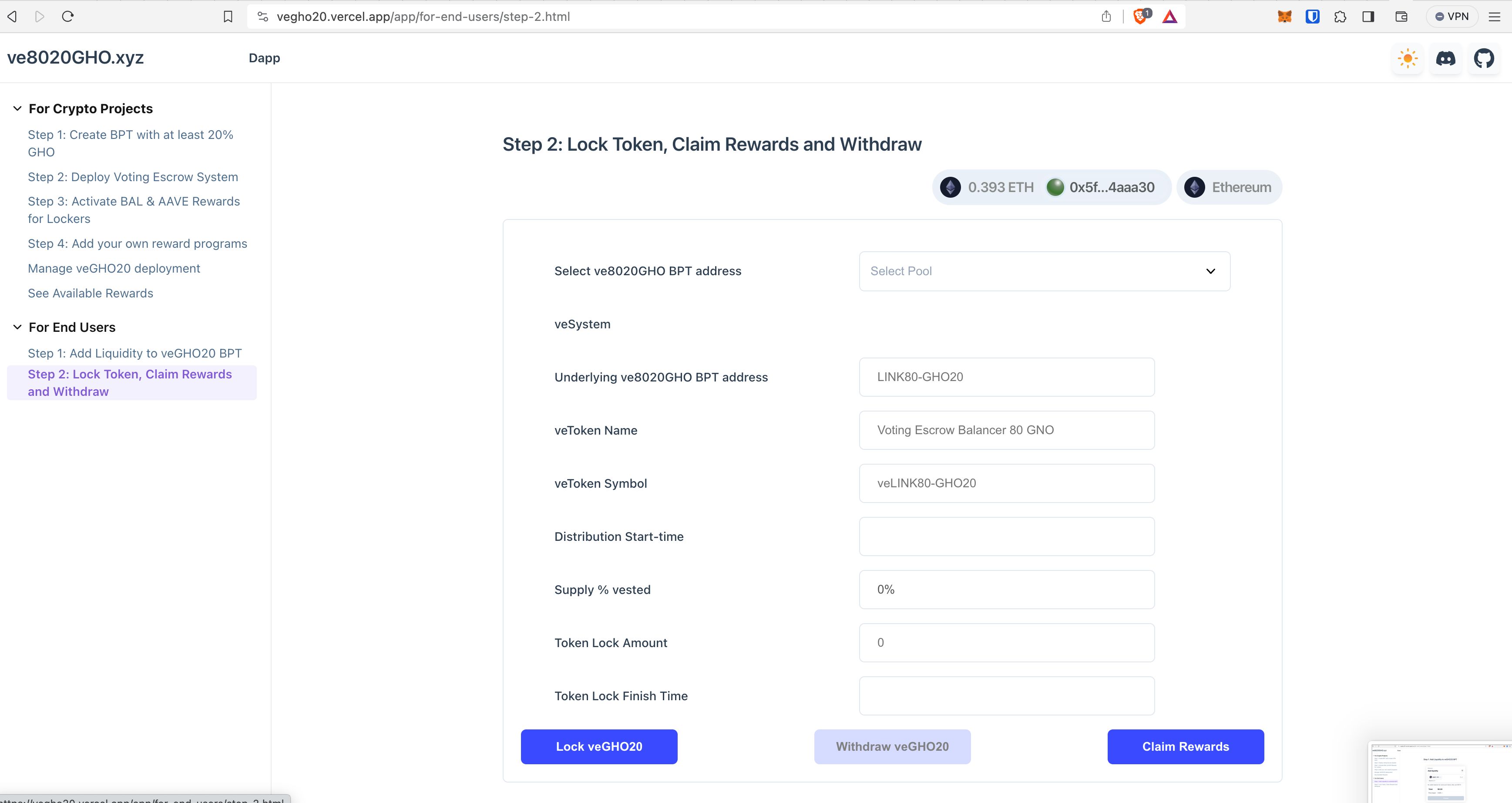

On a mission to create long-term sources of real yield for long-term GHO holders 6 months after GHO launch, DeFiLlama shows only 8 destinations in DeFi which provide yield for GHO holders. As compared to DAI which has 340 destinations with yield, in addition to sDAI. How did we arrive at the idea? Instead of seeking for yield, we researched various problems of Web3 projects, scoring them against each other for the unique ability of GHO to provide a natural solution. Solution: ve8020GHO provides projects with long-term, time-locked GHO-based AMM liquidity, replacing mercenary yield farmers and opaque market makers. Protocol teams that adopt ve8020GHO receive audited Voting Escrow governance, reward and gauge contracts, enjoy rapid accumulation of Protocol Owned Liquidity (POL) and Protocol Controlled Liquidity (PCL). Protocols that use GHO20 or equivalent are eligible for an initial grant of 25k BAL (~$105k at the time of writing) to be distributed to lockers of ve8020GHO BPTs that contain at least 20% GHO weight. Call to action: Web3 projects that need deep Protocol-controlled liquidity can request Apply for 1st cohort, incentivized by Balancer DAO with possible Aave participation Missionary token holders of such ve8020GHO-powered projects, receive:

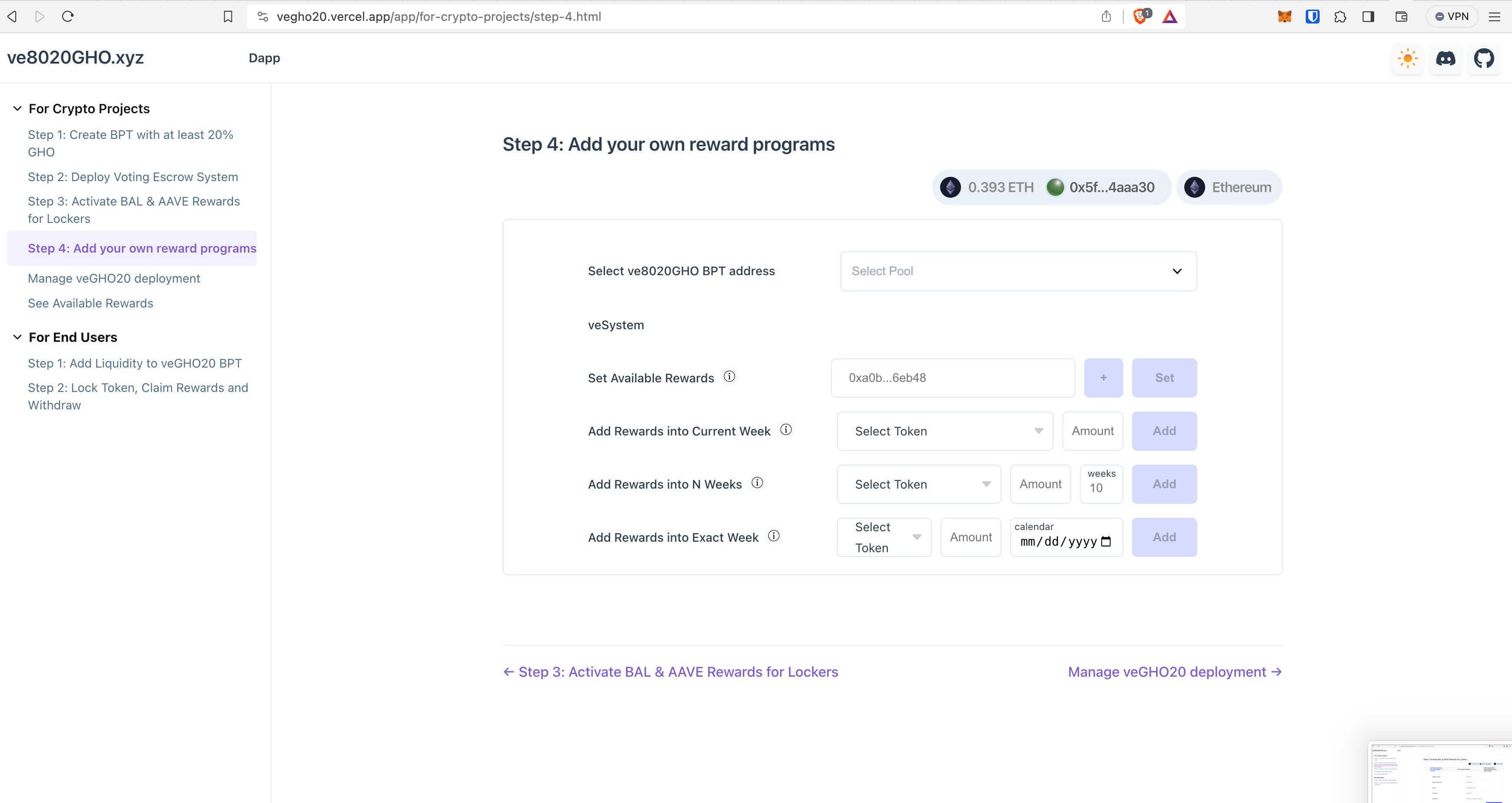

- BAL emissions through BAL Gauges (as voted by veBAL token holders who allocate emissions)

- 25K BAL incentives worth $105k+ and up to 250k BAL (worth $1.05M), - more volume and size of the ve8020GHO pool - the greater amount of BAL. Possibility of receiving matching AAVE incentives, and self-service add-on incentive mechanisms (fixed reward per period, or gauge-based).

How it's Made

- Voting Escrow Solidity smart contracts based on Curve and Balancer’s ve system.

- Integration with Gauge-based reward distribution of Balance Gauges

- Subgraph from The Graph

- Vue.js front-end, deployed to Vercel

- GHO used in Balancer Pool Tokens, UI requiring BPT to contain at least 20% weight in GHO, although smart contracts do not impose such limitations